Wolff's Sharp Rebuttal To Russell's "Underrated" Remark: A Lucky Acquisition?

Table of Contents

Wolff's Critique of Russell's Valuation Methodology

Wolff's primary criticism centers around the flaws he perceives in Russell's valuation methodology. He argues that the analysis significantly overestimates potential benefits and underestimates inherent risks, leading to an overly optimistic conclusion.

Overestimation of Synergies

Russell's analysis seemingly overestimated potential synergies between Acme Corp and Beta Industries. Wolff contends that several crucial factors were overlooked.

- Failure to account for integration challenges: Merging two distinct corporate cultures and IT systems is notoriously complex and costly. Russell's model appears to have underestimated these integration hurdles significantly.

- Unrealistic projections regarding market penetration: The projected market share gains post-acquisition seem overly ambitious, failing to consider the competitive responses from established players in the market. Wolff suggests a more conservative approach to market penetration projections would be warranted.

- Lack of consideration for the competitive landscape: The analysis insufficiently addresses the potential for intensified competition following the merger, potentially eroding the anticipated synergy benefits. Competitor reactions were not adequately factored into Russell's valuation.

Underestimation of Risks

Wolff highlights significant risks overlooked in Russell's analysis, potentially jeopardizing the acquisition's success.

- Regulatory hurdles: The merger faces potential regulatory scrutiny, with the possibility of lengthy delays or even outright rejection. This crucial risk element appears largely absent from Russell's assessment.

- Potential for legal challenges: Wolff suggests a realistic appraisal should account for potential legal challenges related to antitrust concerns or intellectual property rights. Such litigation could significantly impact the deal's profitability.

- Dependence on volatile market conditions: The projected returns are heavily dependent on stable and even improving market conditions. Wolff argues that the inherent volatility in the market was underestimated, making the rosy forecast less reliable.

Data Discrepancies

Wolff points out inconsistencies and potential inaccuracies in the data used by Russell to support his valuation, further undermining its credibility.

- Questionable sourcing of key figures: Wolff questions the reliability of some of the key financial figures used in Russell's analysis, raising concerns about their accuracy and provenance.

- Lack of transparency in data methodology: The lack of transparency regarding the data collection and processing methods raises concerns about potential biases and errors in the analysis. A more rigorous and transparent approach is needed, according to Wolff.

- Potential for bias in data selection: Wolff suggests that the data used might have been selectively chosen to support a predetermined conclusion, biasing the results and undermining the objectivity of the analysis.

Alternative Perspectives on the Acquisition

Beyond the purely financial valuation, Wolff suggests exploring alternative strategic motivations for the acquisition.

Strategic Rationale

The acquisition may have been driven by factors beyond simple financial gain, impacting its long-term value.

- Market share consolidation: The merger might aim to significantly consolidate market share, potentially leading to increased pricing power and reduced competition.

- Access to key technologies or intellectual property: Acme Corp might possess valuable technologies or patents that Beta Industries seeks to acquire, justifying the deal beyond immediate financial returns.

- Talent acquisition: The acquisition could be strategically focused on acquiring Acme Corp's highly skilled workforce, representing a significant long-term asset for Beta Industries.

Long-Term Implications

The long-term effects of the acquisition remain uncertain, prompting a careful assessment of both potential benefits and drawbacks.

- Impact on future revenue streams: The long-term impact on revenue streams needs careful consideration, factoring in market dynamics and the successful integration of the two entities.

- Effect on brand reputation: The acquisition's effect on both companies’ brand reputations requires evaluation; potential synergies and risks must be weighed carefully.

- Long-term sustainability of the business: The long-term sustainability and profitability of the merged entity need rigorous examination, considering various internal and external factors.

Analyzing the "Lucky Acquisition" Argument

The question of whether this acquisition was simply a lucky break or a carefully calculated move remains open.

Element of Chance

Unforeseen circumstances can significantly impact an acquisition's success.

- Unpredictable market shifts: Unforeseen changes in market conditions could significantly impact the deal's outcome. This uncertainty was likely not fully accounted for in initial projections.

- Impact of external factors (e.g., geopolitical events): External events like geopolitical instability or regulatory changes could severely impact the acquisition's profitability and long-term viability.

- Influence of management decisions: The effectiveness of management decisions post-merger will be crucial. Poor integration or strategic missteps could negate any initial gains.

Skill vs. Luck

The relative importance of skillful planning and execution versus mere chance in determining the acquisition's success remains debatable.

- Evidence supporting strategic decision-making: Arguments can be made that the acquisition was a strategic move based on sound business logic, despite the challenges highlighted by Wolff.

- Examples of successful risk mitigation: If Beta Industries has successfully mitigated some of the risks identified by Wolff, this weakens the argument that the acquisition was solely based on luck.

- Counterarguments to the "lucky acquisition" claim: Several counterarguments exist, suggesting that even with the flaws in the initial valuation, the acquisition holds long-term strategic value.

Conclusion

Wolff's rebuttal of Russell's "underrated" assessment of the Acme Corp acquisition presents a compelling counter-narrative. By highlighting flaws in the valuation methodology and offering alternative perspectives, Wolff challenges the notion that this was a purely lucky acquisition. The long-term success will ultimately depend on a multitude of factors, including skillful execution and adaptation to market dynamics. Further analysis is needed to fully determine the impact of this acquisition. To stay updated on this developing story and other crucial market analyses, follow our blog for more insightful commentary on Wolff's Rebuttal and other key business events. Understanding Wolff's critique is crucial for informed investment decisions in similar future acquisitions.

Featured Posts

-

Real Madrid Florentino Perez Elnoeksegenek Elemzese

May 26, 2025

Real Madrid Florentino Perez Elnoeksegenek Elemzese

May 26, 2025 -

Canada Post Strike Will Customer Exodus Follow

May 26, 2025

Canada Post Strike Will Customer Exodus Follow

May 26, 2025 -

Le Frere D Albert Luthers Thierry Fait Face A Un Deuil Difficile

May 26, 2025

Le Frere D Albert Luthers Thierry Fait Face A Un Deuil Difficile

May 26, 2025 -

Jeu De Management Cycliste Rtbf Lancez Vous Pour Le Tour De France

May 26, 2025

Jeu De Management Cycliste Rtbf Lancez Vous Pour Le Tour De France

May 26, 2025 -

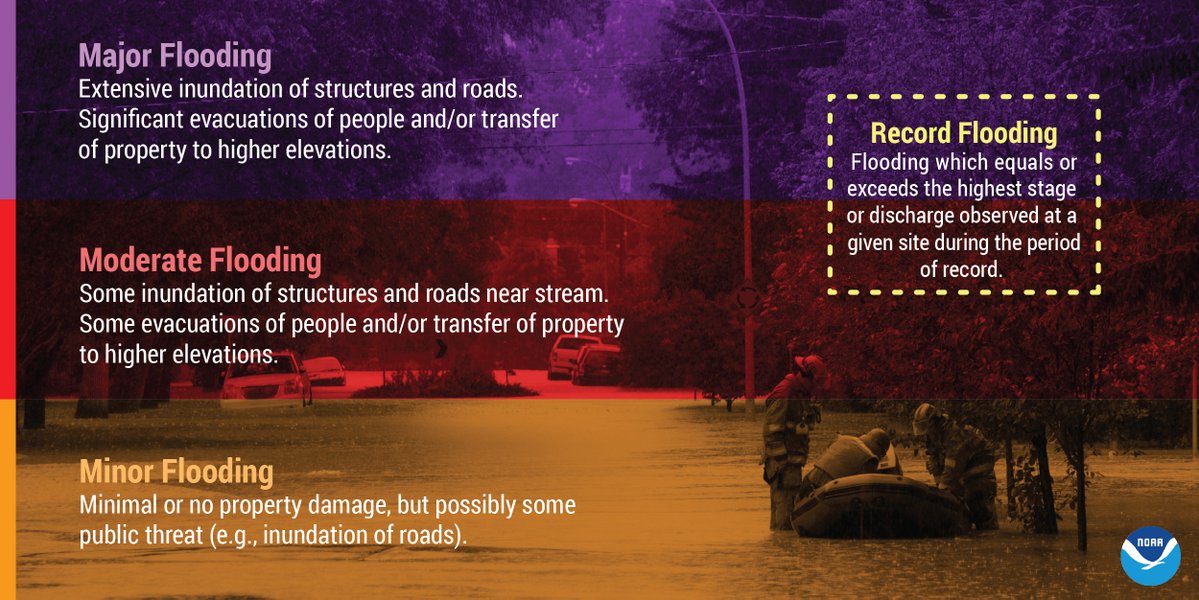

How To Respond To A Flash Flood Emergency A Life Saving Guide

May 26, 2025

How To Respond To A Flash Flood Emergency A Life Saving Guide

May 26, 2025