Women & Finances: 3 Costly Errors To Avoid

Table of Contents

Underestimating the Power of Saving & Investing

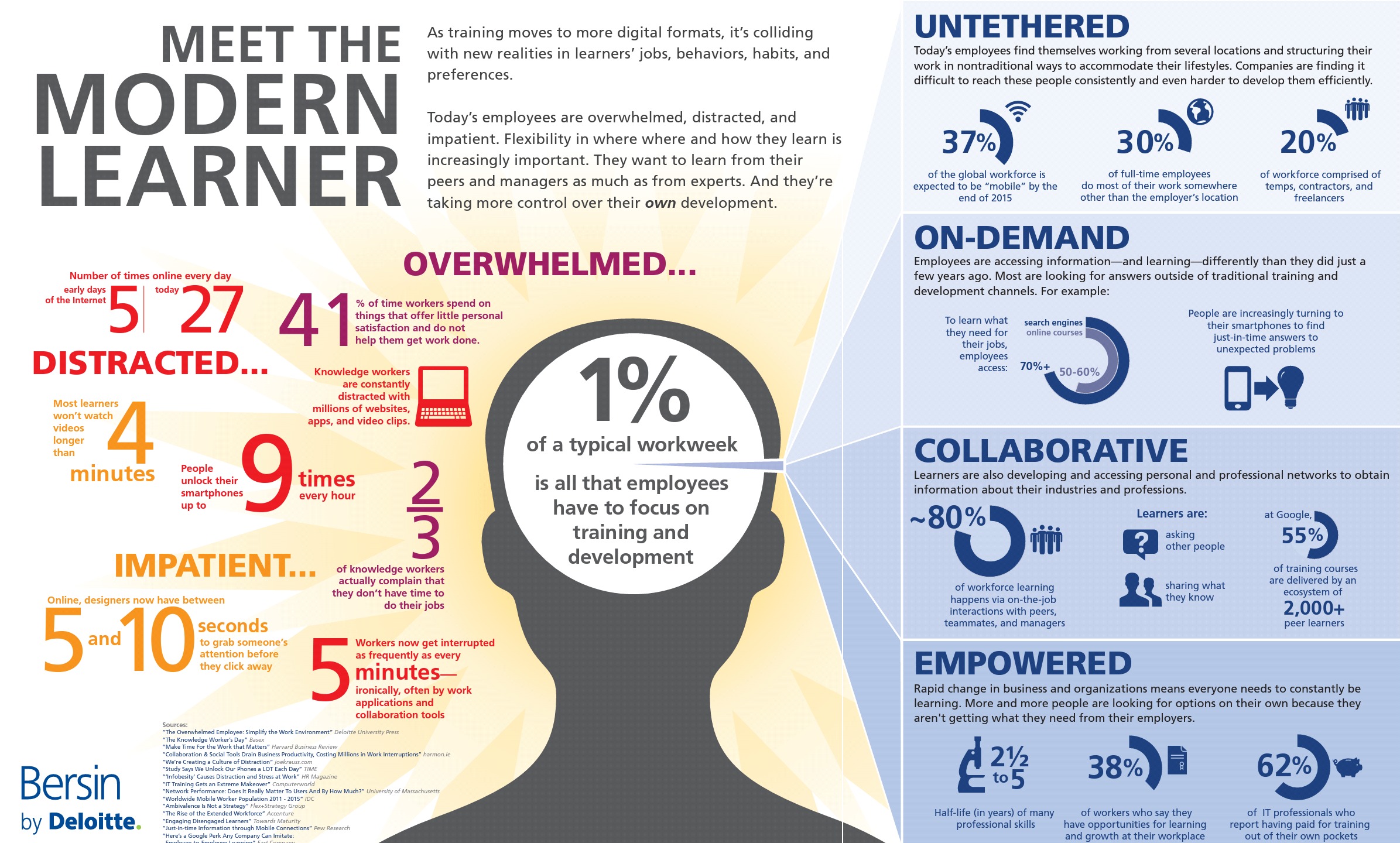

One of the most significant financial mistakes women make is underestimating the transformative power of saving and investing. Many women delay starting their savings and investment journey, missing out on the incredible benefits of compound interest. Compound interest, the interest earned on both the principal and accumulated interest, is a powerful wealth-building tool that works best over the long term. The earlier you start, the more time your money has to grow exponentially.

-

The Impact of Starting Early: Imagine investing a small amount consistently from a young age. Over decades, even modest contributions can accumulate into a substantial sum thanks to the magic of compounding.

-

Investment Options for Women: Don't be intimidated by the world of investing! There are many options suitable for different risk tolerances and financial goals. Consider:

- Low-risk, high-yield savings accounts: Ideal for emergency funds and short-term goals.

- Index funds: Offer diversified exposure to a broad market segment at a low cost.

- ETFs (Exchange-Traded Funds): Similar to index funds but trade like stocks, offering flexibility.

-

The Importance of an Emergency Fund: Life throws curveballs. An emergency fund, typically 3-6 months of living expenses, provides a safety net to handle unexpected events without derailing your financial progress.

-

Debunking Investing Myths: Many women hold misconceptions about investing, believing it's too risky or complicated. With proper research and potentially professional guidance, investing can be manageable and rewarding.

-

Practical Budgeting and Saving Tips: Creating a realistic budget and tracking your expenses are crucial steps. Identify areas where you can cut back and allocate those funds towards savings and investments.

Setting Realistic Financial Goals

Setting SMART financial goals (Specific, Measurable, Achievable, Relevant, Time-bound) is paramount. Instead of vaguely aiming to "save more," define specific goals like: "Save $5,000 for a down payment on a house within two years." This clarity makes your goals more attainable and motivates you to stay on track.

Ignoring Debt Management and its Long-Term Impact

High-interest debt, such as credit card debt or payday loans, can significantly hinder your financial progress. Ignoring debt management can lead to a vicious cycle of accumulating interest and delaying your financial goals.

-

The Negative Impact of High-Interest Debt: High-interest debt eats away at your financial resources, diverting money that could be used for savings, investments, or other priorities.

-

Strategies for Debt Reduction: Explore effective debt management strategies like:

- Debt snowball method: Pay off the smallest debt first for motivation, then roll that payment amount into the next smallest debt.

- Debt avalanche method: Prioritize paying off the debt with the highest interest rate first to minimize overall interest paid.

-

The Importance of a Good Credit Score: A good credit score is essential for securing loans, mortgages, and even insurance at favorable rates. Managing debt effectively is crucial for building and maintaining a strong credit score.

-

Student Loan Debt Management: Student loan debt can be a significant burden. Explore repayment options, such as income-driven repayment plans, and consider refinancing if feasible.

-

Available Resources: Numerous resources can assist women in managing debt, including credit counseling agencies and financial literacy programs.

The Importance of Credit Score

Your credit score is a crucial factor in your overall financial health. A good credit score opens doors to better interest rates on loans, mortgages, and credit cards, saving you substantial amounts of money over time. Conversely, a poor credit score can limit your financial opportunities and lead to higher borrowing costs.

Lack of Financial Planning and Protection

Failing to develop a comprehensive financial plan is another costly mistake. This includes neglecting essential insurance coverage and estate planning.

-

The Importance of a Financial Plan: A solid financial plan provides a roadmap for your financial future, encompassing goals, strategies, and risk management.

-

Essential Insurance Coverage: Consider the following types of insurance:

- Life insurance: Protects your loved ones in case of your death.

- Health insurance: Covers medical expenses.

- Disability insurance: Provides income replacement if you become disabled.

- Long-term care insurance: Helps cover the costs of long-term care.

-

Estate Planning and Wills: Creating a will ensures your assets are distributed according to your wishes and protects your loved ones from potential legal battles.

-

Available Resources for Financial Planning: Numerous resources can assist you in creating a financial plan, including financial advisors, online tools, and workshops.

-

Unique Considerations: Single mothers, widows, and women in diverse situations may have unique financial considerations that require tailored planning.

Securing Your Future with a Solid Plan

Developing a robust financial plan involves several key steps:

- Assess your current financial situation: Track income, expenses, and assets.

- Define your short-term and long-term financial goals.

- Create a budget and stick to it.

- Develop a savings and investment strategy.

- Manage your debt effectively.

- Secure adequate insurance coverage.

- Plan for your estate.

Conclusion

Ignoring these three costly financial errors—underestimating saving and investing, neglecting debt management, and lacking financial planning and protection—can have severe long-term consequences for women's financial well-being. By taking proactive steps to improve your financial literacy and create a comprehensive financial plan, you can secure your financial future and achieve true financial independence. Start planning your financial future today. Avoid these common financial mistakes for women and take charge of your finances! Learn more about women's financial planning and secure your tomorrow.

Featured Posts

-

Peppa Pig Meets The Baby A 10 Episode Cinema Experience This May

May 22, 2025

Peppa Pig Meets The Baby A 10 Episode Cinema Experience This May

May 22, 2025 -

Voyage Architectural La Petite Italie De L Ouest Et Son Style Toscan

May 22, 2025

Voyage Architectural La Petite Italie De L Ouest Et Son Style Toscan

May 22, 2025 -

Abn Amro Toenemend Autobezit Drijft Occasionverkoop

May 22, 2025

Abn Amro Toenemend Autobezit Drijft Occasionverkoop

May 22, 2025 -

Understanding Gen Zs Love For Little Britain A Cultural Analysis

May 22, 2025

Understanding Gen Zs Love For Little Britain A Cultural Analysis

May 22, 2025 -

Vi Sao Co Hai Lo Vuong Tren Dau Noi Usb Hien Dai

May 22, 2025

Vi Sao Co Hai Lo Vuong Tren Dau Noi Usb Hien Dai

May 22, 2025