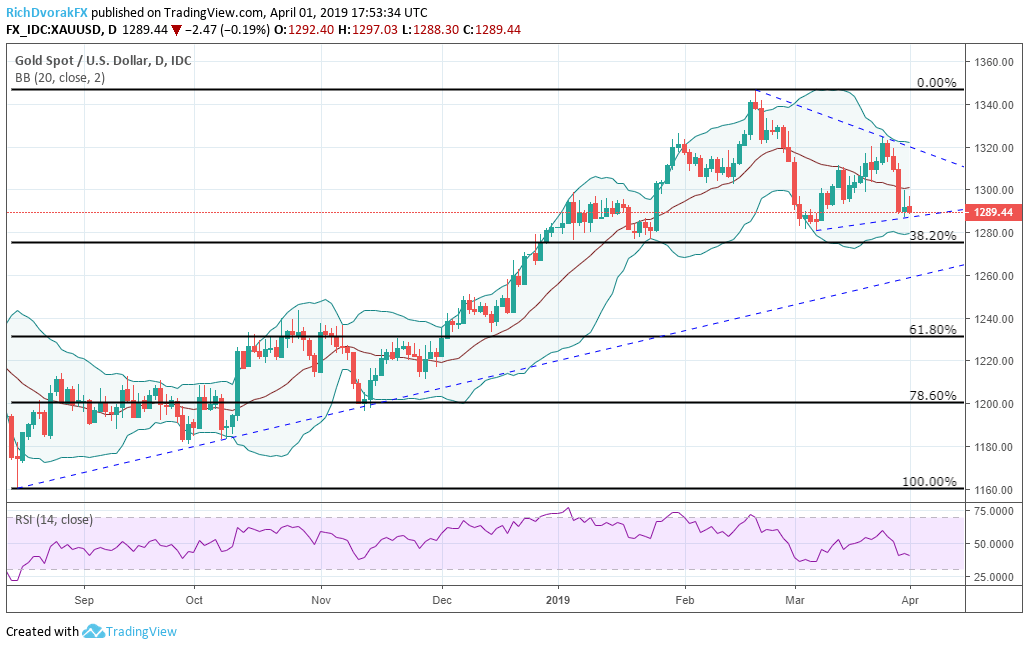

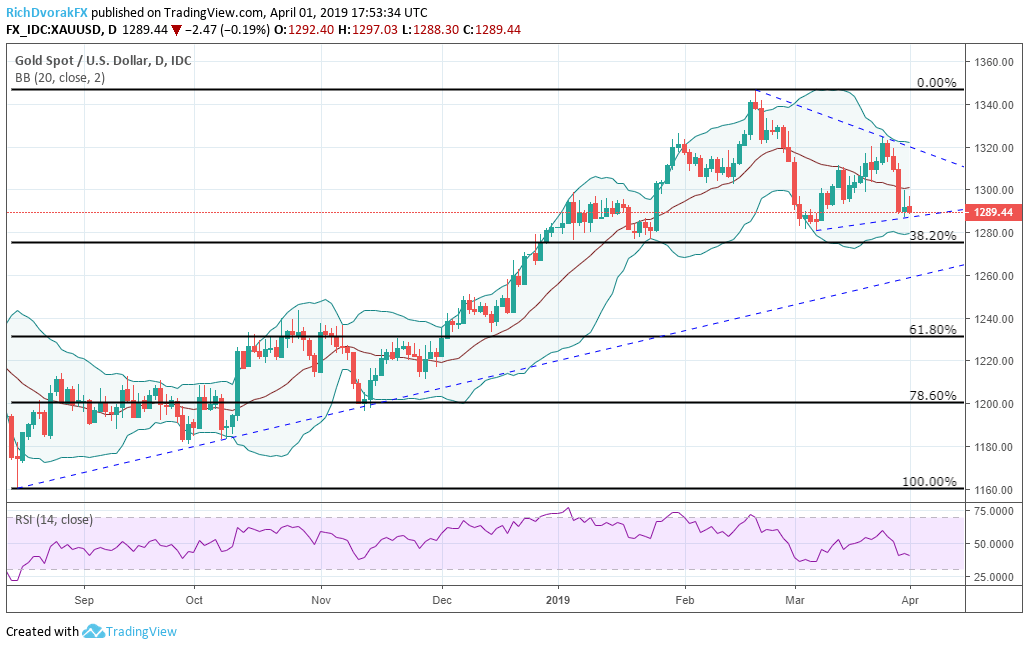

XAUUSD Gold Price Recovery: US Economic Data And Fed Rate Hike Bets

Table of Contents

The Impact of US Economic Data on XAUUSD

US economic data releases significantly impact the XAUUSD, creating volatility and influencing investor decisions. Understanding this interplay is key to successful gold trading.

Inflationary Pressures and Gold's Safe-Haven Status

Gold often acts as a hedge against inflation. There's an inverse relationship between inflation and the US dollar. When inflation rises, the purchasing power of the dollar decreases, making gold a more attractive investment. High inflation boosts gold's appeal as a safe-haven asset.

- CPI data releases and their immediate impact on XAUUSD: The Consumer Price Index (CPI) is a key indicator of inflation. Unexpectedly high CPI figures usually lead to a surge in gold prices as investors seek protection from eroding purchasing power.

- PPI data and its influence on gold price predictions: Producer Price Index (PPI) data, reflecting inflation at the producer level, also influences gold price predictions. Rising PPI often foreshadows higher CPI, prompting anticipatory gold purchases.

- Impact of unexpected inflationary surprises on gold trading: Significant deviations from expected inflation figures – both positive and negative – can cause sharp and immediate changes in XAUUSD trading activity, leading to price swings.

Employment Data and its Influence on Fed Policy

Strong employment numbers often signal a robust economy, leading to expectations of further interest rate hikes by the Federal Reserve.

- Non-farm payroll reports and their effect on gold prices: Strong non-farm payroll figures often push the XAUUSD lower as they strengthen the dollar and increase the likelihood of rate hikes.

- Unemployment rate figures and their correlation with XAUUSD volatility: Lower unemployment rates can increase the pressure on the Fed to raise rates, potentially dampening gold prices. Conversely, unexpectedly high unemployment can lead to reduced rate hike expectations and potentially support gold prices.

- Market reaction to unexpected employment figures: Surprises in employment data, whether positive or negative, can trigger significant volatility in the XAUUSD market, highlighting the importance of staying informed.

GDP Growth and its Role in Gold Price Movements

Robust GDP growth can strengthen the US dollar, potentially exerting downward pressure on XAUUSD. Conversely, slower-than-expected growth can lead to a weaker dollar and potentially higher gold prices.

- Impact of positive GDP surprises on XAUUSD: Stronger-than-expected GDP growth tends to support the US dollar, potentially pushing XAUUSD lower as investors favor dollar-denominated assets.

- Negative GDP growth and its effect on investor sentiment towards gold: Recessions or periods of negative GDP growth can increase investor demand for gold as a safe haven, driving XAUUSD higher.

- The interplay between GDP growth and inflation in influencing gold prices: The relationship between GDP growth and inflation is complex. High growth accompanied by high inflation can drive gold prices, while low growth with low inflation may have a less pronounced impact.

Fed Rate Hike Bets and their Effect on XAUUSD

The Federal Reserve's monetary policy decisions are a major driver of XAUUSD price movements.

Understanding the Fed's Monetary Policy

Interest rate hikes by the Fed typically strengthen the US dollar, making dollar-denominated assets more attractive and, consequently, putting downward pressure on gold prices.

- The effect of higher interest rates on the attractiveness of US dollar-denominated assets: Higher interest rates increase the returns on dollar-denominated investments, diverting capital away from gold.

- The role of the Federal Funds Rate in influencing XAUUSD: The Federal Funds Rate, the target rate for overnight lending between banks, is a key indicator of the Fed's monetary policy stance and its impact on XAUUSD is significant.

- Market speculation leading up to and following Fed announcements: Market participants closely monitor statements and actions from the Fed, leading to significant price swings before, during, and after official announcements.

Market Sentiment and Speculation

Market expectations regarding future rate hikes significantly influence gold prices. Unexpected shifts in Fed policy can cause heightened volatility.

- Analyzing market forecasts and their accuracy: Understanding market sentiment and analyzing the accuracy of forecasts concerning rate hikes is crucial for predicting XAUUSD movements.

- The role of market psychology and fear in driving gold demand: During times of uncertainty and fear, investors often flock to gold as a safe haven, driving up demand and prices.

- The impact of geopolitical events on Fed decisions and gold prices: Geopolitical events can influence both Fed decisions and investor sentiment, creating ripple effects in the gold market.

The Role of Quantitative Tightening (QT)

Quantitative tightening (QT), the reduction of the Federal Reserve's balance sheet, reduces the money supply, impacting liquidity and gold prices.

- How QT influences interest rates and investor behavior: QT indirectly influences interest rates and investor behavior, potentially affecting demand for gold.

- The correlation between QT and gold price volatility: QT can increase volatility in the XAUUSD market due to its impact on liquidity and investor confidence.

- Potential long-term effects of QT on the XAUUSD market: The long-term effects of QT on the XAUUSD are still unfolding and are a subject of ongoing analysis and debate among market experts.

Conclusion

The XAUUSD gold price recovery is intricately linked to US economic data releases and ongoing speculation surrounding the Federal Reserve's rate hike trajectory. Understanding the impact of inflation, employment figures, GDP growth, and the Fed's monetary policy, including quantitative tightening, is crucial for navigating the complexities of this volatile market. By carefully monitoring these factors and considering the interplay between them, investors can develop a more informed strategy for trading the XAUUSD. Stay informed about key economic indicators and Fed pronouncements to make well-informed decisions regarding your XAUUSD investments. Continue to monitor the XAUUSD gold price and its relationship with US economic data for optimal investment strategies.

Featured Posts

-

Knicks Vs Pistons Prediction New Yorks Home Court Advantage

May 17, 2025

Knicks Vs Pistons Prediction New Yorks Home Court Advantage

May 17, 2025 -

Jalen Brunson The Face Of Lady Liberty A Knicks Fans Bold Petition

May 17, 2025

Jalen Brunson The Face Of Lady Liberty A Knicks Fans Bold Petition

May 17, 2025 -

Josh Hart Shatters Knicks Single Season Triple Double Record

May 17, 2025

Josh Hart Shatters Knicks Single Season Triple Double Record

May 17, 2025 -

Finding Serenity In The City Soundproof Apartments And Quiet Spaces In Tokyo

May 17, 2025

Finding Serenity In The City Soundproof Apartments And Quiet Spaces In Tokyo

May 17, 2025 -

Cybercriminals Office365 Heist Millions In Losses Fbi Investigation

May 17, 2025

Cybercriminals Office365 Heist Millions In Losses Fbi Investigation

May 17, 2025