XRP As A Commodity? Analyzing The SEC's Potential Decision In Ripple Case

Table of Contents

The SEC's Argument Against XRP as a Commodity

The SEC's case against Ripple rests heavily on the Howey Test, a decades-old legal framework used to determine whether an investment constitutes a security. The SEC argues that XRP sales, particularly those made by Ripple Labs to institutional investors, meet the criteria of an investment contract under the Howey Test.

- The SEC's key arguments include:

- Expectation of Profits: The SEC contends that investors purchased XRP with the expectation of profits based primarily on Ripple's efforts to develop and promote the cryptocurrency. They argue that the inherent value of XRP was secondary to the potential for future price appreciation driven by Ripple's actions.

- Common Enterprise: The SEC points to a common enterprise between Ripple and XRP holders, arguing that Ripple's actions directly influenced the value and success of XRP, creating a shared investment outcome.

- Lack of Direct Control: Investors, according to the SEC, lacked significant direct control over XRP's value or its underlying technology. The value was largely dependent on Ripple's activities and market sentiment.

- Investment as Primary Purpose: The SEC emphasizes that the primary purpose of the XRP sales was investment, not its use as a functional currency or digital asset for payments.

The SEC's arguments draw upon its previous actions against other cryptocurrency projects, particularly those deemed to be unregistered securities offerings. The legal precedent set by cases involving initial coin offerings (ICOs) and other digital asset sales is being heavily scrutinized in this case. The SEC's stance reflects a broader regulatory push to categorize many crypto assets as securities, necessitating compliance with stringent regulations.

Ripple's Defense: XRP as a Decentralized Currency/Commodity

Ripple's defense focuses on portraying XRP as a decentralized digital asset with inherent utility as a functional currency, distinct from a security. They emphasize XRP's characteristics and its operation on the independent XRP Ledger (XRPL).

- Ripple's key arguments include:

- Decentralized Nature: Ripple highlights XRP's operation on a public, decentralized ledger (XRPL), arguing that this fundamentally differentiates it from assets controlled by a central entity. The XRPL's open-source nature and community involvement are central to this argument.

- Functional Utility: Ripple emphasizes XRP's functionality as a payment mechanism for efficient and cost-effective cross-border transactions. This focus on utility, they argue, diminishes the investment contract aspects highlighted by the SEC.

- Market-Driven Price: Ripple stresses that XRP's price is determined by market forces of supply and demand, not by Ripple's actions. This contrasts with the SEC's assertion that Ripple's actions were the primary driver of XRP's value.

- Distinction between sales and issuance: Ripple argues a crucial difference exists between the initial sales of XRP and the issuance of a security. They emphasize that post-initial sales, XRP functions independently of Ripple's direct control.

Expert testimony on XRP's technical features, market dynamics, and its decentralization has been crucial to Ripple's defense. Ripple has pointed to various initiatives designed to promote the decentralization of XRP, further solidifying their argument that it’s not a centrally controlled asset.

Potential Outcomes and Market Implications of the Ripple Case

The Ripple case presents several potential outcomes, each with significant implications for the cryptocurrency market:

- SEC Wins: An SEC victory would likely classify XRP as a security, potentially impacting its trading on major exchanges, impacting its use in payment systems, and significantly altering its price. This outcome would solidify the SEC’s regulatory authority over the crypto space and establish a strong precedent.

- Ripple Wins: A Ripple victory would likely boost investor confidence and potentially pave the way for clearer regulatory frameworks that distinguish between utility tokens and securities. It could also lead to a reclassification of XRP as a commodity or currency, opening the door for more widespread adoption.

- Settlement: A negotiated settlement could result in a compromise, potentially involving stricter compliance measures for Ripple but avoiding a complete ban on XRP trading. This would offer some regulatory clarity but might leave lingering uncertainties.

The impact on the broader cryptocurrency market is substantial. The outcome will significantly affect how regulators approach other crypto projects facing similar scrutiny. Investor confidence will be heavily impacted by whichever way the ruling goes, potentially resulting in significant price volatility for XRP and potentially other digital assets.

- Potential Market Reactions:

- Price Volatility: Significant price swings are expected regardless of the outcome.

- Regulatory Clarity (or Lack Thereof): The ruling will either provide much-needed clarity or perpetuate regulatory uncertainty.

- Investor Confidence: A Ripple win would boost investor confidence, while an SEC win could significantly dampen it.

The Broader Implications for Crypto Regulation

The Ripple case's outcome will profoundly influence the SEC's future approach to cryptocurrency regulation. It could set a precedent for how other digital assets are classified and regulated, potentially impacting innovation and adoption within the cryptocurrency space. The case underscores the urgent need for clearer, more comprehensive regulatory frameworks for digital assets, harmonizing approaches across different jurisdictions. This would promote a more predictable and stable environment for crypto businesses and investors. The lack of global regulatory uniformity could lead to regulatory arbitrage and hinder the growth of the crypto market overall.

Conclusion

The SEC's decision on XRP's classification as a commodity or security will have far-reaching consequences for the cryptocurrency market. The arguments presented by both sides highlight the complexities of regulating decentralized technologies and the tension between innovation and investor protection. The outcome will likely establish a significant precedent for future crypto projects. Understanding the nuances of the XRP commodity debate and its potential implications is crucial for anyone involved in or interested in the cryptocurrency industry. Stay informed about the latest developments in the XRP commodity debate and its impact on the evolving crypto regulatory landscape. Continue to research the XRP commodity discussion to make informed decisions.

Featured Posts

-

Trump Claims Judicial Review Blocked For His Tariffs

May 02, 2025

Trump Claims Judicial Review Blocked For His Tariffs

May 02, 2025 -

Net Ziaire Williams Growth And Development In His Second Nba Season

May 02, 2025

Net Ziaire Williams Growth And Development In His Second Nba Season

May 02, 2025 -

Grab Your Free Captain America Gear Fortnite Item Shop Promotion

May 02, 2025

Grab Your Free Captain America Gear Fortnite Item Shop Promotion

May 02, 2025 -

Get Ready For The Sony Play Station Beta Program

May 02, 2025

Get Ready For The Sony Play Station Beta Program

May 02, 2025 -

Popular Indigenous Arts Festival Cancelled Due To Economic Crisis

May 02, 2025

Popular Indigenous Arts Festival Cancelled Due To Economic Crisis

May 02, 2025

Latest Posts

-

Minnesota Special Election Key Insights From Ap Decision Notes

May 02, 2025

Minnesota Special Election Key Insights From Ap Decision Notes

May 02, 2025 -

Jinapor On Npps 2024 Election Loss A Difficult Reality

May 02, 2025

Jinapor On Npps 2024 Election Loss A Difficult Reality

May 02, 2025 -

Abu Jinapor Npps Unexpected 2024 Election Defeat

May 02, 2025

Abu Jinapor Npps Unexpected 2024 Election Defeat

May 02, 2025 -

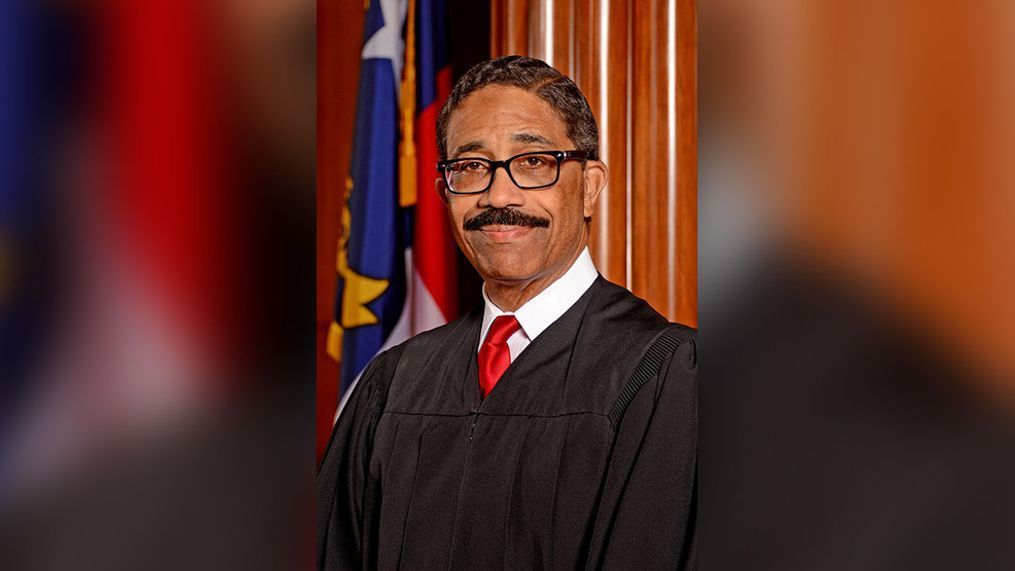

Understanding The Implications Gop Candidate Appeals North Carolina Supreme Court Decision

May 02, 2025

Understanding The Implications Gop Candidate Appeals North Carolina Supreme Court Decision

May 02, 2025 -

Gop Candidates North Carolina Supreme Court Appeal What It Means

May 02, 2025

Gop Candidates North Carolina Supreme Court Appeal What It Means

May 02, 2025