XRP Classification: Ripple And SEC Near Settlement With Commodity Designation?

Table of Contents

The SEC's Case Against Ripple

The Security vs. Commodity Debate

The SEC argues that XRP is an unregistered security, relying heavily on the Howey Test. This test establishes whether an investment contract exists, based on four criteria: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived from the efforts of others. The SEC focuses on Ripple's sales of XRP, claiming these sales constituted the offer and sale of unregistered securities.

- Howey Test Criteria: The SEC argues that investors purchased XRP with the expectation of profit, relying on Ripple's efforts to develop the XRP Ledger and increase XRP's value.

- Ripple's XRP Sales: The SEC highlights Ripple's institutional sales of XRP as a key component of its argument, emphasizing the direct relationship between Ripple and its purchasers.

- Arguments Against Security Classification: Conversely, many argue that XRP, once distributed, functions independently of Ripple's efforts, pointing towards its decentralized nature and utility in the XRP Ledger ecosystem. This decentralized functionality is a central point of contention.

Key Arguments Presented by Ripple

Ripple's defense centers on XRP's decentralized nature and its use as a functional cryptocurrency within the XRP Ledger. They argue XRP's value isn't solely dependent on Ripple's actions but on market forces and the broader cryptocurrency ecosystem.

- XRP's Functionality: Ripple emphasizes that XRP functions independently of Ripple's actions, highlighting its use for fast and low-cost cross-border payments.

- The Role of the XRP Ledger: The decentralized nature of the XRP Ledger, managed by a global community, is a cornerstone of Ripple's defense, suggesting a lack of centralized control.

- Independent Market Forces: Ripple stresses that the price of XRP is subject to market forces, similar to other cryptocurrencies, and not directly controlled by the company.

The Judge's Rulings and Their Significance

The presiding judge's rulings have significantly shaped the case's trajectory. Several key decisions have influenced both sides, offering hints at potential outcomes.

- Significant Court Proceedings: Specific rulings on the admissibility of evidence and the interpretation of legal precedents have influenced the ongoing narrative.

- Rulings Favoring Either Side: Some rulings have favored Ripple's arguments regarding XRP's decentralized nature, while others have supported the SEC's claims regarding certain aspects of Ripple's sales practices.

- Implications on Potential Outcome: The overall impact of these rulings remains a subject of intense debate among legal experts and market analysts, influencing predictions of the final outcome and the potential XRP classification.

Potential Implications of a Commodity Designation for XRP

Impact on XRP Price and Trading

A commodity designation for XRP could significantly impact its price and liquidity.

- Potential Price Fluctuations: The removal of the "security" label could lead to increased investor confidence and a surge in XRP's price. Conversely, some might view it as a less innovative asset, resulting in a price decrease.

- Changes in Trading Volume and Regulations: Trading volumes could increase significantly as it becomes easier to list on various exchanges, but it would also be subject to different regulatory frameworks compared to securities.

- Impacts on Investor Confidence: A clear classification will likely bring more clarity and stability, boosting overall confidence.

Regulatory Clarity and Future of Ripple

A commodity classification would provide Ripple with much-needed regulatory clarity.

- Reduction in Regulatory Uncertainty: A commodity classification would significantly reduce the regulatory uncertainty surrounding XRP and Ripple's operations.

- Impact on Ripple's Partnerships and Future Projects: This newfound clarity could potentially foster new partnerships and accelerate the development of Ripple's future projects.

- Long-Term Effects on the Cryptocurrency Market: The outcome of this case will have significant ramifications for the wider cryptocurrency market, influencing how other crypto projects navigate regulatory landscapes.

Comparison with Other Cryptocurrencies

The XRP classification case offers valuable insights into the regulatory challenges faced by the cryptocurrency industry.

- Examples of Other Cryptocurrencies and their Regulatory Status: Comparing XRP to other cryptocurrencies like Bitcoin and Ethereum, which have faced varying degrees of regulatory scrutiny, provides a broader perspective.

- Similarities and Differences with the XRP Case: Analyzing these similarities and differences helps to understand the unique aspects of the XRP case and its potential implications for the wider crypto market.

Signs Pointing Towards a Potential Settlement

Recent developments hint at a possible settlement between Ripple and the SEC.

Negotiations and Behind-the-Scenes Developments

Reports and rumors suggest intense negotiations between both parties.

- News Sources and Reporting: Various news outlets have reported on potential settlement talks, suggesting a potential compromise might be on the horizon.

- Potential Terms of a Settlement: While specific terms remain undisclosed, a potential settlement could involve stipulations on Ripple's future sales practices or other concessions.

Impact of a Settlement on the Crypto Market

A settlement would have profound implications for the crypto market.

- Positive or Negative Effects on the Overall Cryptocurrency Market: A settlement could restore investor confidence and market stability, fostering more positive sentiment. A drawn-out legal battle could have the opposite effect.

- Influence on Other Regulatory Decisions: The outcome, regardless of specifics, will serve as a precedent, potentially influencing how regulators approach other cryptocurrencies and blockchain projects.

Conclusion

The XRP classification case is a defining moment for the cryptocurrency industry. While uncertainty remains, the possibility of a settlement leading to an XRP commodity designation offers a path to regulatory clarity. This could stabilize the market, enhance investor confidence, and reshape Ripple's future. Staying abreast of XRP classification developments is crucial for anyone invested in the cryptocurrency market. Continue to monitor the situation for a comprehensive understanding of this landmark case's implications.

Featured Posts

-

Krispiga Kycklingnuggets I Majsflingor Recept And Enkel Kalsallad

May 02, 2025

Krispiga Kycklingnuggets I Majsflingor Recept And Enkel Kalsallad

May 02, 2025 -

Priscilla Pointer Dead At 100 Remembering The Carrie Actress And Her Daughter

May 02, 2025

Priscilla Pointer Dead At 100 Remembering The Carrie Actress And Her Daughter

May 02, 2025 -

De Baesta Kycklingnuggets Friterade I Majsflingor Med Kalsallad

May 02, 2025

De Baesta Kycklingnuggets Friterade I Majsflingor Med Kalsallad

May 02, 2025 -

Enexis Noord Nederland Optimaliseer Uw Elektrische Auto Oplaadkosten

May 02, 2025

Enexis Noord Nederland Optimaliseer Uw Elektrische Auto Oplaadkosten

May 02, 2025 -

Data Breach Millions Stolen Through Compromised Executive Office365 Accounts

May 02, 2025

Data Breach Millions Stolen Through Compromised Executive Office365 Accounts

May 02, 2025

Latest Posts

-

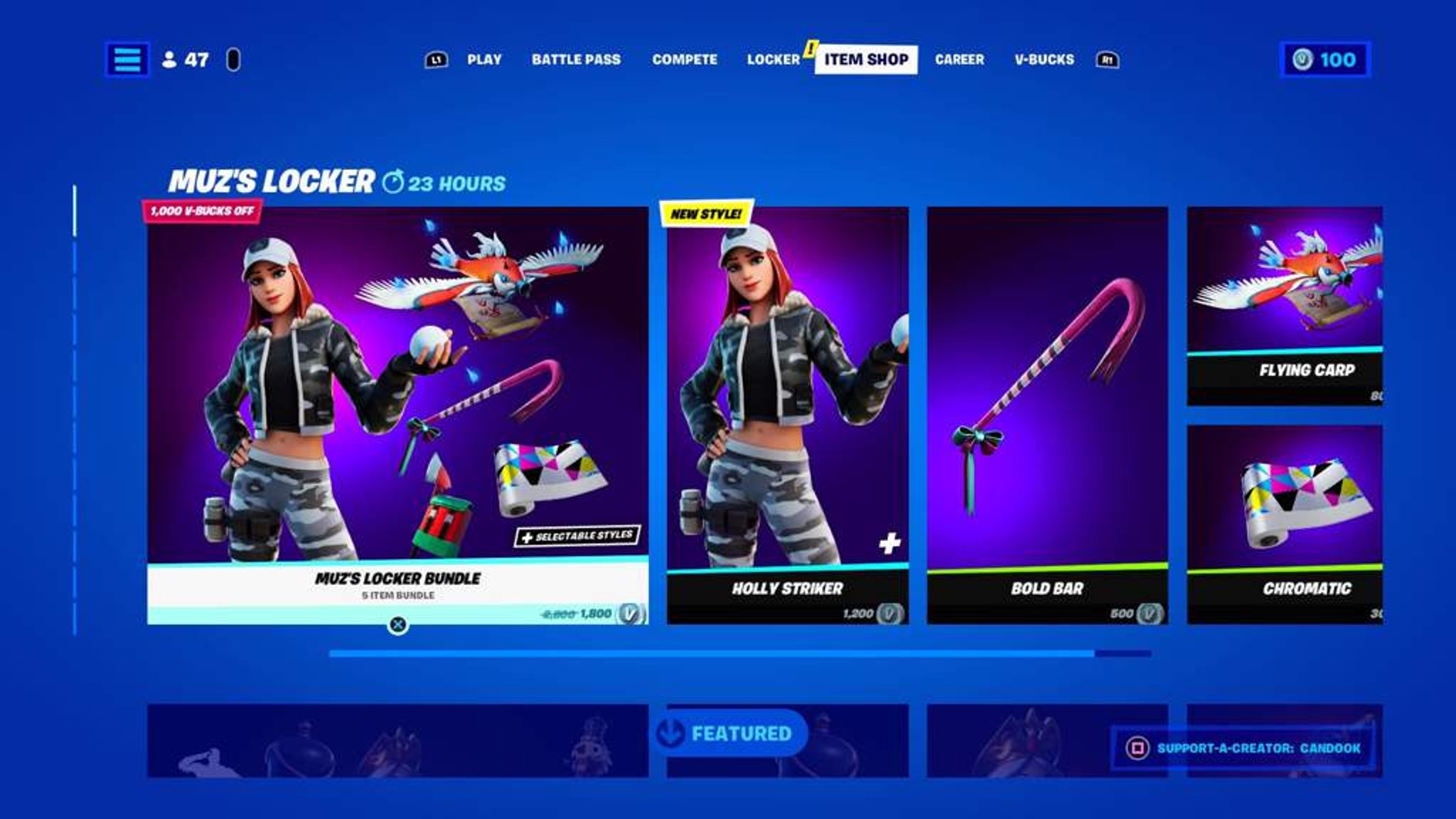

Grab Your Free Captain America Gear Fortnite Item Shop Promotion

May 02, 2025

Grab Your Free Captain America Gear Fortnite Item Shop Promotion

May 02, 2025 -

End Of An Era Justice Department Ends Decades Old School Desegregation Order

May 02, 2025

End Of An Era Justice Department Ends Decades Old School Desegregation Order

May 02, 2025 -

Limited Time Fortnite Offer Free Captain America Skins And Cosmetics

May 02, 2025

Limited Time Fortnite Offer Free Captain America Skins And Cosmetics

May 02, 2025 -

Captain America Freebies Arrive In The Fortnite Item Shop

May 02, 2025

Captain America Freebies Arrive In The Fortnite Item Shop

May 02, 2025 -

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025