XRP Commodity Classification: Latest News On The Ripple SEC Lawsuit Settlement

Table of Contents

The SEC's Case Against Ripple

The Allegation of Unregistered Securities Offerings

The SEC alleges that Ripple's sales of XRP constituted unregistered securities offerings, violating federal securities laws. The core of their argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security.

-

The Howey Test: This test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues that XRP sales met all these criteria.

-

Ripple's Counter-Arguments: Ripple counters that XRP is a decentralized digital asset, operating independently of Ripple's efforts. They argue that XRP functions more like a currency or a commodity, not a security. Their defense emphasizes the decentralized nature of the XRP Ledger and its widespread use outside of Ripple's control.

-

Key Evidence: Both sides have presented substantial evidence. The SEC highlighted Ripple's internal communications and sales strategies, arguing these demonstrate an intent to profit from XRP sales. Ripple presented evidence emphasizing XRP's decentralized nature, its use in various applications, and the lack of centralized control.

-

Potential Penalties: If found guilty, Ripple faced significant penalties, including substantial fines and potential injunctions against future sales of XRP. The implications extend beyond Ripple, potentially impacting the broader cryptocurrency market's regulatory landscape.

Recent Developments and Court Proceedings

Key Rulings and Judge's Opinions

The Ripple case has seen several significant rulings and opinions from the presiding judge. While the final verdict is pending, certain aspects have been clarified.

-

Significant Procedural Developments: The case has involved numerous motions, hearings, and expert witness testimonies, shaping the direction of the legal battle. Key among these are the judge's rulings on specific motions to dismiss certain aspects of the SEC's complaint.

-

Partial Victories and Setbacks: Both Ripple and the SEC have experienced both victories and setbacks throughout the proceedings. The judge's decisions on specific aspects of the case have provided insights into their overall legal strategy and the strengths and weaknesses of their respective arguments.

-

Implications on XRP Classification: Key rulings have offered hints regarding the judge's thinking on the classification of XRP. These rulings, even if not directly determining the final classification, have influenced market sentiment and investor expectations.

Potential Outcomes and Impact on XRP Classification

Scenarios for a Settlement or Verdict

Several potential outcomes exist for the Ripple SEC lawsuit, each with significant consequences for XRP's classification and market value.

-

Settlement: A settlement could involve Ripple agreeing to pay a fine and potentially altering its future operations relating to XRP. The terms of such a settlement would likely influence how XRP is perceived legally, potentially leading to a more ambiguous classification or a tacit acknowledgment of its security-like characteristics.

-

Ruling in Favor of the SEC (XRP as a Security): This outcome would have wide-ranging implications, potentially significantly impacting XRP's price and accessibility within the US. It could also set a precedent for how other cryptocurrencies are regulated.

-

Ruling in Favor of Ripple (XRP as a Commodity or Not a Security): This outcome would be a major victory for Ripple and could provide greater regulatory clarity for XRP, potentially boosting its price and adoption. It could also influence the legal battles faced by other crypto projects.

-

Impact on XRP's Price and Trading: Regardless of the outcome, the Ripple case significantly impacts XRP's price and trading volume. Uncertainty surrounding the legal proceedings has created volatility in the market.

The Broader Implications for the Cryptocurrency Industry

Regulatory Uncertainty and Future of Crypto

The Ripple case highlights the significant regulatory uncertainty within the cryptocurrency space and the need for clearer legal frameworks.

-

Impact on Other Cryptocurrencies: The outcome of the Ripple case will undoubtedly impact other cryptocurrencies facing similar legal challenges. It will set a precedent that could influence how regulators approach other projects.

-

Increased Regulatory Scrutiny: The case has already heightened regulatory scrutiny of cryptocurrency projects, emphasizing the need for compliance with existing securities laws.

-

Shaping Future Cryptocurrency Regulations: The outcome of the lawsuit will inevitably shape future cryptocurrency regulations, potentially influencing how policymakers approach the classification and regulation of digital assets.

Conclusion

The Ripple SEC lawsuit and the ongoing debate surrounding XRP's commodity classification have profound implications for the cryptocurrency market. The various potential outcomes – a settlement, a ruling in favor of the SEC, or a ruling in favor of Ripple – each carry significant consequences for XRP's price, trading, and legal status, as well as for the regulatory landscape of the broader cryptocurrency industry. The legal battle has highlighted the regulatory uncertainty surrounding cryptocurrencies and the need for clearer guidelines.

Call to Action: Stay informed about the latest developments in the XRP commodity classification debate. Continue to monitor legal updates surrounding the Ripple SEC lawsuit and its implications for investors and the broader crypto community. Understanding the ongoing discussion surrounding XRP classification and its potential impact is crucial for navigating the evolving cryptocurrency market.

Featured Posts

-

Kort Geding Kampen Vs Enexis Stroomnetaansluiting Centraal

May 01, 2025

Kort Geding Kampen Vs Enexis Stroomnetaansluiting Centraal

May 01, 2025 -

France Secure Six Nations Victory Scotland Overwhelmed By Ramos Led Team

May 01, 2025

France Secure Six Nations Victory Scotland Overwhelmed By Ramos Led Team

May 01, 2025 -

Brtanwy Wzyr Aezm Kw Kshmyr Ke Tnazee Se Mtelq Drkhwast Pysh Ky Gyy

May 01, 2025

Brtanwy Wzyr Aezm Kw Kshmyr Ke Tnazee Se Mtelq Drkhwast Pysh Ky Gyy

May 01, 2025 -

Dallas And Carrie Legend Dead Amy Irving Pays Tribute

May 01, 2025

Dallas And Carrie Legend Dead Amy Irving Pays Tribute

May 01, 2025 -

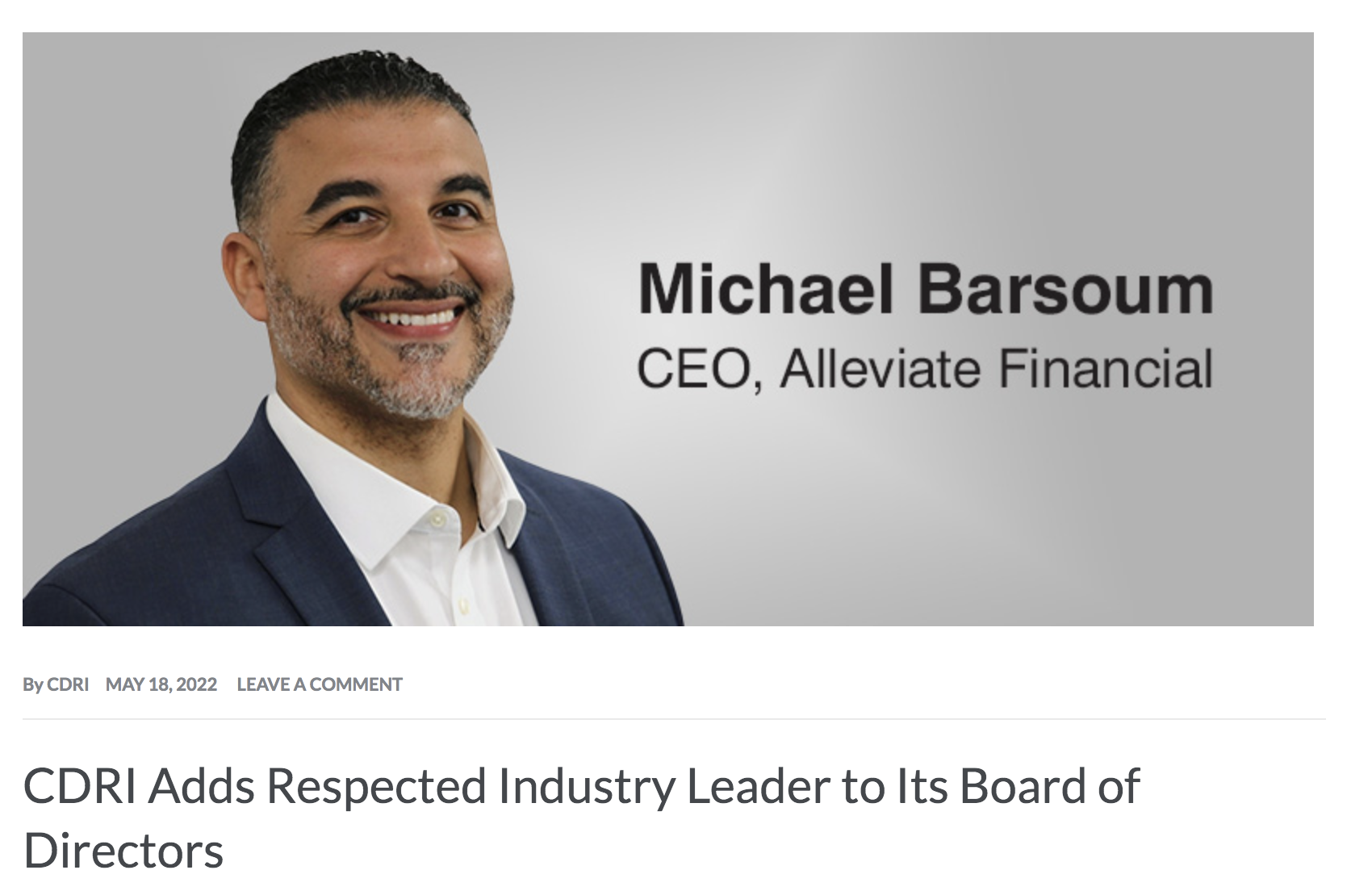

Michael Sheens Generosity 1 Million Debt Relief Initiative

May 01, 2025

Michael Sheens Generosity 1 Million Debt Relief Initiative

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025