XRP ETF Risks: High Supply And Limited Institutional Adoption

Table of Contents

The High Supply of XRP and its Impact on Price Volatility

Understanding XRP's Total Supply

XRP boasts a significantly large total supply compared to many other cryptocurrencies. While Bitcoin has a capped supply of 21 million, XRP's total supply is a considerably higher 100 billion tokens. This substantial number, coupled with the ongoing release of tokens from escrow, raises concerns about potential inflationary pressures.

- Total XRP Supply: 100 billion

- Ongoing Token Release: A significant portion of XRP is held in escrow and released periodically, potentially impacting market supply and price.

- Inflationary Potential: The continuous release of tokens can dilute the value of existing XRP, potentially hindering price appreciation.

A large circulating supply can suppress price appreciation. The sheer volume of XRP available makes it more susceptible to market manipulation and price volatility. This inherent characteristic presents a substantial risk for investors considering XRP ETFs. Understanding the dynamics of supply and demand within the XRP ecosystem is crucial for accurately assessing its long-term value proposition.

The Impact of Supply on ETF Pricing and Returns

The high XRP supply directly impacts the potential pricing and returns of an XRP ETF. A high supply can lead to:

- Price Stagnation or Decline: An oversupply can outweigh demand, leading to stagnant or even declining prices.

- Limited Growth Potential: The potential for significant price appreciation may be limited compared to assets with scarcer supply.

- Increased Price Volatility: The large supply makes XRP more sensitive to market sentiment shifts, resulting in heightened price fluctuations.

Managing an ETF with a volatile underlying asset like XRP presents considerable challenges for fund managers. They must navigate unpredictable market forces and balance investor expectations while mitigating the risks associated with such a large and potentially volatile supply.

Limited Institutional Adoption of XRP and its Regulatory Uncertainty

The Current State of Institutional Investment in XRP

Compared to Bitcoin and Ethereum, institutional investment in XRP remains relatively limited. Major financial institutions have shown greater enthusiasm for Bitcoin and Ethereum, leaving XRP with a considerably smaller institutional footprint.

- Low Institutional Holdings: Statistics indicate a significantly lower level of institutional holdings of XRP compared to other leading cryptocurrencies.

- Lack of Major Institutional Support: The absence of significant backing from major financial institutions poses a considerable risk to XRP's long-term growth.

- Reasons for Limited Adoption: Regulatory uncertainty and past legal challenges have likely contributed to the hesitancy among large institutional investors.

Regulatory Risks and their Impact on ETF Approval and Performance

The regulatory landscape surrounding XRP is complex and presents significant risks to ETF approval and subsequent performance. The ongoing SEC lawsuit against Ripple, the creator of XRP, casts a long shadow over its future.

- SEC Lawsuit Implications: The outcome of the SEC lawsuit could dramatically impact the price of XRP and the viability of an XRP ETF.

- Regulatory Uncertainty: Uncertainty surrounding XRP's regulatory status creates significant investor hesitancy and market volatility.

- Impact on ETF Approval: Regulatory ambiguity could delay or even prevent the approval of XRP ETFs.

Regulatory uncertainty can lead to periods of significant price volatility, making it difficult to accurately predict the performance of an XRP ETF. Investor confidence is crucial for the success of any ETF, and the regulatory challenges faced by XRP pose a considerable threat to this crucial element.

Conclusion

Investing in an XRP ETF carries significant risks. The high supply of XRP, coupled with limited institutional adoption and prevailing regulatory uncertainties, creates a complex and potentially volatile investment landscape. Before investing, carefully consider these factors: the vast XRP supply, the comparatively low level of institutional investment, and the ongoing regulatory challenges. Conduct thorough due diligence and seek professional financial advice before making any investment decisions related to XRP ETFs. Understand the full implications of XRP ETF risks before investing.

Featured Posts

-

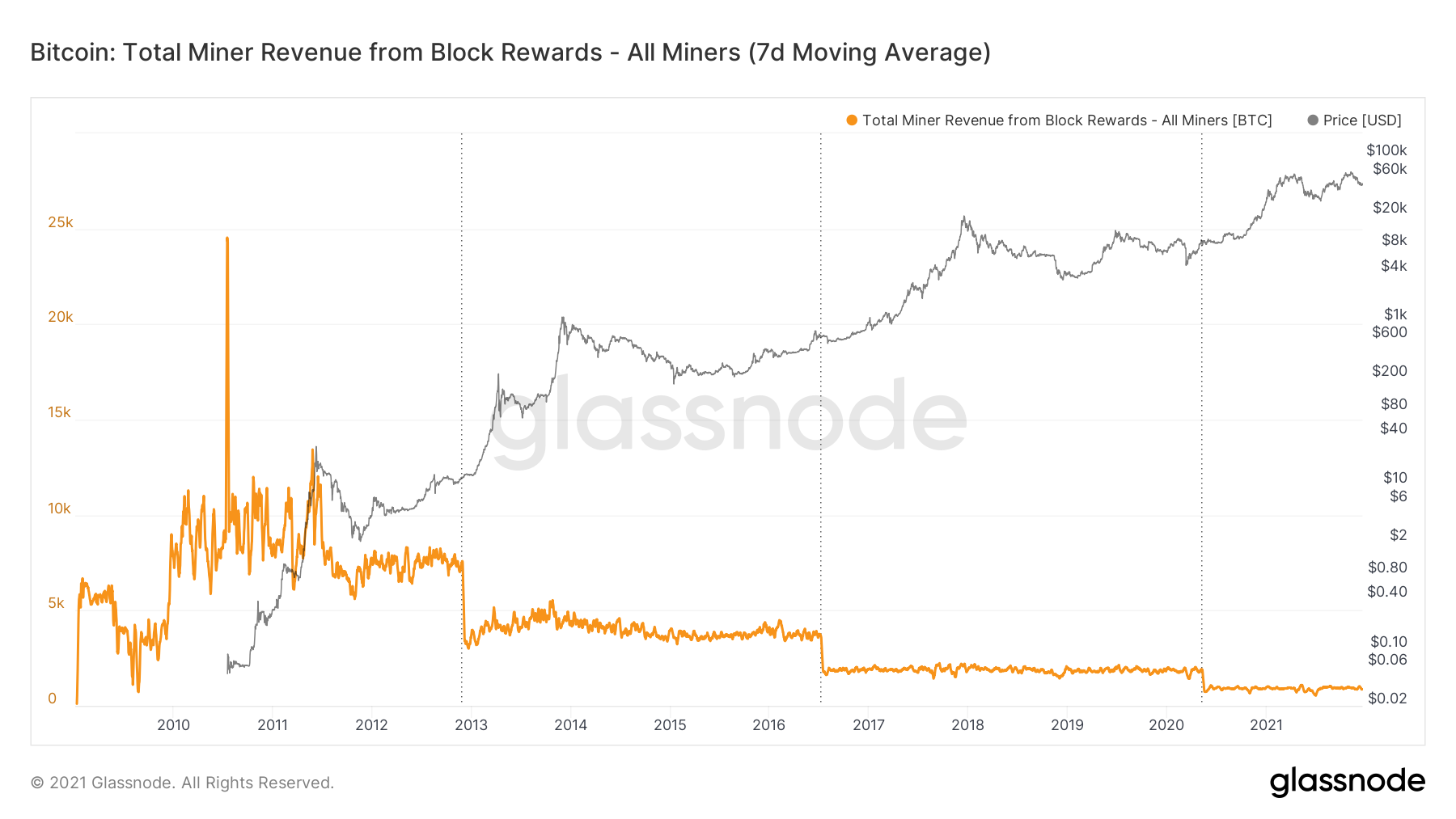

Recent Bitcoin Mining Boom A Deep Dive Into The Causes

May 08, 2025

Recent Bitcoin Mining Boom A Deep Dive Into The Causes

May 08, 2025 -

Why Bitcoin Miner Revenue Surged This Week

May 08, 2025

Why Bitcoin Miner Revenue Surged This Week

May 08, 2025 -

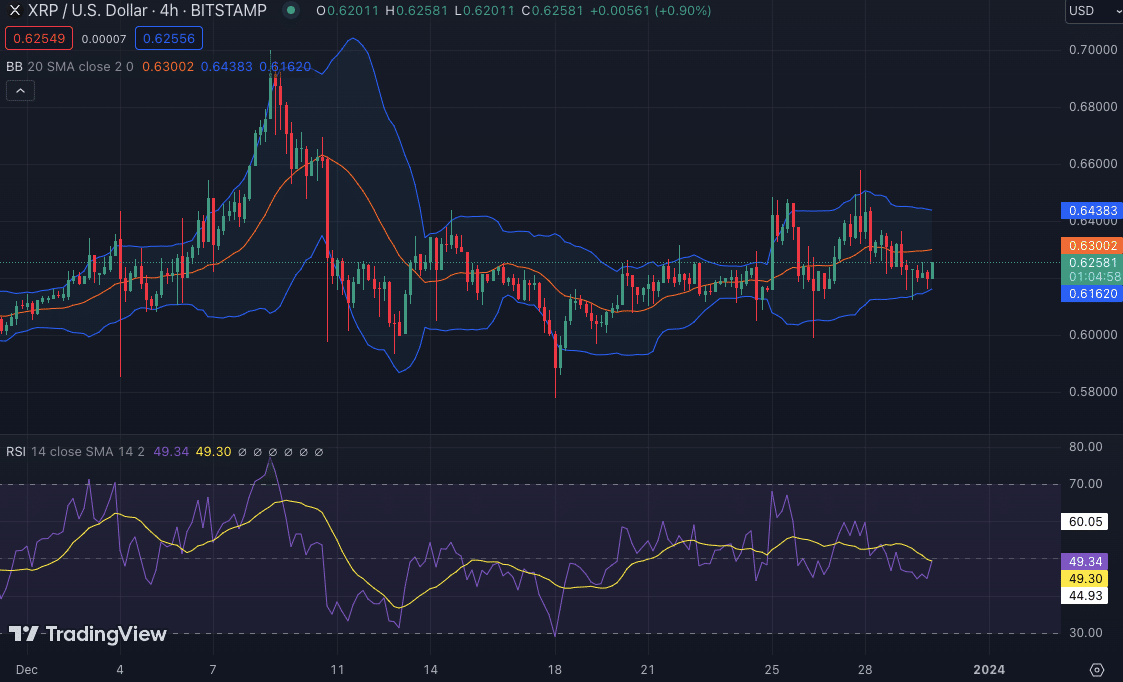

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025 -

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025 -

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 08, 2025

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 08, 2025

Latest Posts

-

Brutal Rina Entre Flamengo Y Botafogo Agresiones En El Campo Y Vestuarios

May 08, 2025

Brutal Rina Entre Flamengo Y Botafogo Agresiones En El Campo Y Vestuarios

May 08, 2025 -

Uber One Launches In Kenya Enjoy Exclusive Benefits

May 08, 2025

Uber One Launches In Kenya Enjoy Exclusive Benefits

May 08, 2025 -

Sancion En El Brasileirao Detalles De La Suspension Del Jugador Argentino

May 08, 2025

Sancion En El Brasileirao Detalles De La Suspension Del Jugador Argentino

May 08, 2025 -

Uber One Kenya Discounts And Free Deliveries Now Available

May 08, 2025

Uber One Kenya Discounts And Free Deliveries Now Available

May 08, 2025 -

Jugadores De Flamengo Y Botafogo Se Enfrentan En Batalla Campal

May 08, 2025

Jugadores De Flamengo Y Botafogo Se Enfrentan En Batalla Campal

May 08, 2025