XRP: Navigating The ETF Landscape, SEC Challenges, And The Path Ahead

Table of Contents

The SEC Lawsuit and its Implications for XRP

The ongoing SEC lawsuit against Ripple Labs has significantly impacted XRP's price and adoption. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This legal battle has created considerable uncertainty in the market.

-

Summary of the SEC's arguments: The SEC claims XRP sales constituted unregistered securities offerings, harming investors who weren't fully informed of the risks. They argue that the "howey test" – a legal framework for determining whether an investment is a security – applies to XRP.

-

Ripple's defense strategy: Ripple contends that XRP is a currency, not a security, and that its sales did not violate securities laws. Their defense hinges on demonstrating XRP's decentralized nature and its use in facilitating cross-border payments.

-

Potential outcomes of the lawsuit and their effect on XRP: A ruling in favor of the SEC could severely impact XRP's price and adoption, potentially leading to delisting from exchanges. A win for Ripple, however, could significantly boost XRP's price and legitimize its position in the cryptocurrency market. The outcome will greatly influence the cryptocurrency regulation landscape.

-

Impact on investor confidence and trading volume: The uncertainty surrounding the lawsuit has led to volatility in XRP's price and reduced trading volume. Many investors are hesitant to invest heavily in XRP until the legal uncertainty is resolved. This highlights the importance of "cryptocurrency regulation" clarity.

The legal arguments presented in this case have broader implications for the cryptocurrency market, setting precedents for how other cryptocurrencies might be classified under US securities law. The outcome will influence how other projects navigate the complex landscape of "SEC regulation" and the broader implications of "Ripple lawsuit" related events.

Exploring the Potential for XRP ETFs

The potential for an XRP ETF is a significant factor in shaping its future. While several Bitcoin and Ethereum ETFs have already been approved, the SEC's stance on XRP remains uncertain due to the ongoing lawsuit.

-

Benefits of an XRP ETF: An XRP ETF would increase liquidity and accessibility, making it easier for institutional and retail investors to gain exposure to XRP. This would potentially boost its price and market capitalization.

-

Challenges to obtaining SEC approval for an XRP ETF: The SEC lawsuit is a major hurdle. Approval hinges on resolving the regulatory uncertainty surrounding XRP's classification as a security or a currency.

-

Comparison to other crypto ETFs already approved or in the pipeline: The approval process for other crypto ETFs provides some insight into the potential hurdles XRP might face. However, the unique legal circumstances surrounding XRP complicate any direct comparison.

-

The impact of the SEC lawsuit on the likelihood of XRP ETF approval: A favorable outcome for Ripple in the SEC lawsuit would significantly increase the chances of XRP ETF approval. Conversely, an unfavorable ruling could delay or even prevent it indefinitely. The "XRP ETF" market remains very much contingent upon this legal battle's resolution.

The creation of an "XRP ETF" would signify a significant step towards broader cryptocurrency adoption, mirroring the progress seen with other "crypto ETF" offerings. This potential development highlights the importance of SEC approval and its effects on the "exchange-traded fund" market.

Technical Analysis and Price Predictions for XRP

XRP's price has historically been highly volatile, influenced heavily by the ongoing legal battles and broader market sentiment.

-

Key technical indicators and their implications: Technical analysis tools, such as moving averages and relative strength index (RSI), can provide insights into potential price movements, but should be considered alongside fundamental analysis.

-

Potential price targets based on various scenarios: Price predictions vary wildly depending on the outcome of the SEC lawsuit. A positive outcome could lead to significant price increases, while a negative outcome could result in further price declines.

-

Analysis of trading volume and market capitalization: Examining trading volume and market capitalization offers further insights into investor sentiment and market strength. High volume and market cap generally suggest increased confidence in the asset.

-

Discussion of potential catalysts for price increases or decreases: News related to the lawsuit, partnerships, technological advancements, and broader market trends all serve as potential catalysts for price fluctuations. Monitoring these factors is crucial for understanding "XRP price prediction" trends.

Analyzing "XRP technical analysis" provides a valuable perspective, but "XRP price prediction" remains speculative, contingent on numerous factors and subject to considerable uncertainty. Similarly, interpreting "cryptocurrency price prediction" for any asset requires a holistic approach.

The Future of XRP: Adoption and Utility

Beyond its use in cross-border payments, XRP's potential use cases are expanding.

-

RippleNet and its ongoing growth: RippleNet, Ripple's payment network, continues to expand, adding new partners and increasing transaction volume. This growth could positively impact XRP's adoption and price.

-

Potential partnerships and collaborations that could boost XRP's adoption: Future partnerships with financial institutions and businesses could significantly enhance XRP's utility and adoption.

-

The role of technology and innovation in shaping XRP's future: Ongoing technological advancements, such as improvements in scalability and efficiency, could strengthen XRP's position in the market.

-

Long-term outlook for XRP based on technological advancements and market trends: The long-term outlook depends heavily on resolving the SEC case, securing wider adoption, and continuing technological innovation. "Cryptocurrency adoption" remains a key factor in the long-term viability of XRP. The success of "RippleNet" and "cross-border payments" solutions is directly linked to XRP’s future. The use of "blockchain technology" will be fundamental to its continued development.

Conclusion

The future of XRP remains uncertain, largely dependent on the outcome of the ongoing SEC lawsuit and the evolving regulatory landscape. While the potential for XRP ETFs offers a pathway to increased liquidity and mainstream adoption, navigating the legal challenges and market volatility requires careful consideration. Understanding the SEC's arguments, Ripple's counter-arguments, and the potential implications for price and adoption is crucial for investors. Stay informed about the latest developments concerning XRP, and continue researching this evolving market to make informed investment decisions. Remember, this information is for educational purposes only and not financial advice.

Featured Posts

-

Jenna Ortegas Rise The Making Of A Horror Icon

May 07, 2025

Jenna Ortegas Rise The Making Of A Horror Icon

May 07, 2025 -

2 0

May 07, 2025

2 0

May 07, 2025 -

Anthony Edwards Suspension A Deep Dive Into The Financial Ramifications

May 07, 2025

Anthony Edwards Suspension A Deep Dive Into The Financial Ramifications

May 07, 2025 -

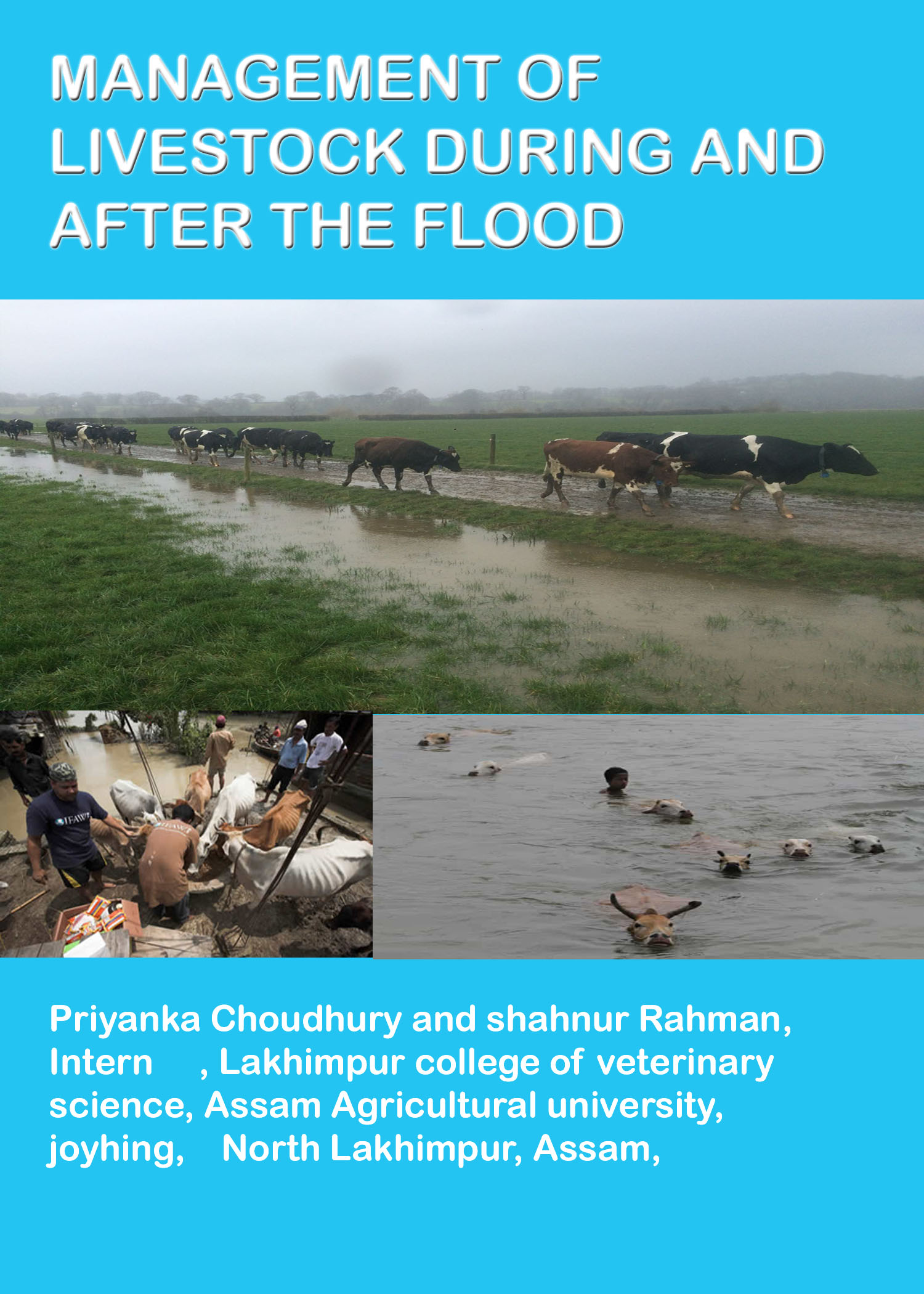

Assessing And Mitigating Flood Risks For Livestock

May 07, 2025

Assessing And Mitigating Flood Risks For Livestock

May 07, 2025 -

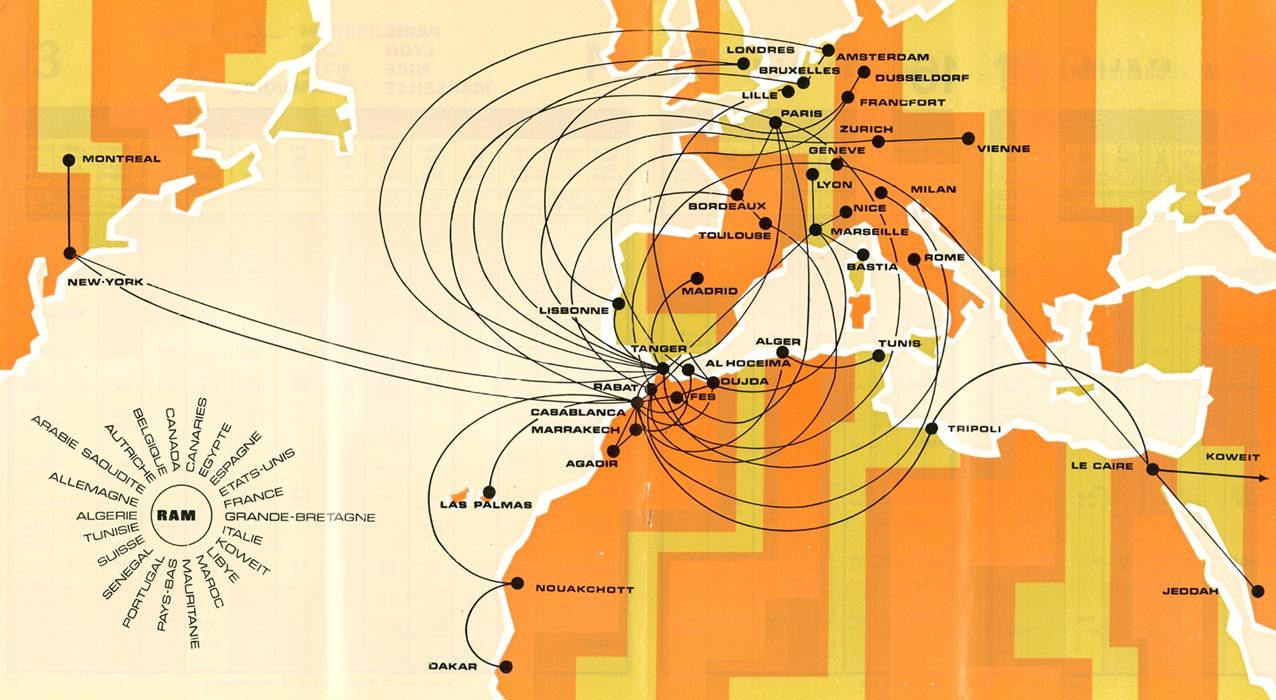

New Royal Air Maroc Route Stansted To Casablanca Now Available

May 07, 2025

New Royal Air Maroc Route Stansted To Casablanca Now Available

May 07, 2025

Latest Posts

-

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025 -

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025