XRP Price Prediction: Analysis And Forecast Following SEC Developments

Table of Contents

The Ripple vs. SEC Lawsuit: A Deep Dive

The Ripple SEC case is central to any XRP price prediction. The SEC alleges that Ripple's sale of XRP constituted an unregistered securities offering, violating federal securities laws. This Ripple legal battle has cast a long shadow over XRP's price, creating significant uncertainty for investors. Ripple, however, maintains that XRP is not a security.

- Summary of the SEC's claims: The SEC argues that XRP sales constituted investment contracts, meaning investors reasonably expected profits based on Ripple's efforts.

- Ripple's counterarguments and legal strategy: Ripple defends its position by arguing that XRP is a currency, used for payments on its network, and therefore not subject to securities laws. Their legal strategy involves highlighting XRP's decentralized nature and widespread usage.

- Key rulings and their market impact on XRP: Significant court rulings and procedural developments have directly influenced XRP's price. Favorable developments often lead to price increases, while unfavorable news can trigger sharp declines.

- Analysis of expert opinions and legal predictions: Legal experts offer varying opinions on the potential outcome. These differing views are reflected in the volatility of XRP's price, as investors weigh the probabilities of different scenarios.

Analyzing Market Sentiment and Trading Volume

Understanding market sentiment and trading volume is critical for any accurate XRP price forecast. Analyzing XRP's price chart reveals periods of significant volatility directly tied to news related to the Ripple SEC case.

- Current XRP trading volume compared to historical data: Examining trading volume helps gauge investor interest and potential price momentum. High trading volume often accompanies periods of significant price movement.

- Analysis of positive and negative sentiment from news sources and social media: News articles, social media discussions, and online forums provide valuable insights into prevailing investor sentiment. Positive sentiment generally correlates with price increases, while negative sentiment can lead to declines.

- Interpretation of key technical indicators (e.g., moving averages, RSI): Technical analysis tools, such as moving averages and Relative Strength Index (RSI), can help identify potential price trends and predict future movements.

- Correlation between news events and price movements: Observing how XRP's price responds to news events – court rulings, regulatory announcements, and partnerships – is crucial for understanding market dynamics.

Potential Scenarios and XRP Price Forecast

Predicting XRP's future price requires considering various scenarios, dependent on the outcome of the Ripple SEC case and broader market conditions.

- Bullish scenario: Positive court ruling and increased adoption. A favorable court ruling could significantly boost XRP's price, potentially leading to increased adoption by financial institutions and a surge in trading volume. Price target: $2-$5 (short-term), $10-$20 (long-term). This is speculative.

- Bearish scenario: Negative court ruling and continued regulatory uncertainty. An unfavorable ruling could lead to further price declines and increased regulatory scrutiny. Price target: Sub-$0.20 (short-term), remaining below $1 (long-term). This is speculative.

- Neutral scenario: Indecisive court ruling, maintaining current price range. A less decisive ruling could lead to a period of consolidation, with prices remaining within a relatively narrow range. Price target: $0.30-$0.80 (short-term), remaining between $1 and $3 (long-term). This is speculative.

- Factors influencing the accuracy of the forecast: The accuracy of this XRP price prediction depends on many unpredictable factors, including the outcome of the SEC lawsuit, the broader cryptocurrency market, and regulatory developments.

Factors Affecting XRP Price Beyond the SEC Case

The Ripple SEC case isn't the only factor influencing XRP's price. Several other elements play a significant role.

- Adoption by financial institutions and payment providers: Widespread adoption by major financial institutions and payment processors would significantly boost XRP's value.

- Technological improvements and upgrades to the XRP Ledger: Technological advancements and enhancements to the XRP Ledger can improve efficiency and attract more users.

- Impact of global cryptocurrency regulations: The regulatory environment surrounding cryptocurrencies globally will influence XRP's price. Favorable regulations can boost its value.

- Competition from other cryptocurrencies: Competition from other cryptocurrencies with similar functionalities could impact XRP's market share and, consequently, its price.

Conclusion

Predicting the price of XRP is challenging, given the uncertainties surrounding the Ripple SEC lawsuit and broader market conditions. Our analysis suggests several potential scenarios, ranging from a bullish outlook following a favorable ruling to a bearish outlook in the event of a negative outcome. This XRP price prediction offers insights based on current information, but it is not financial advice.

While this XRP price prediction provides valuable insights, remember to always perform your own due diligence before investing in XRP. Stay informed about the Ripple vs. SEC case and market developments to make well-informed decisions about your XRP investments. Understanding the risks associated with XRP and the ongoing legal battle is crucial before making any investment decisions.

Featured Posts

-

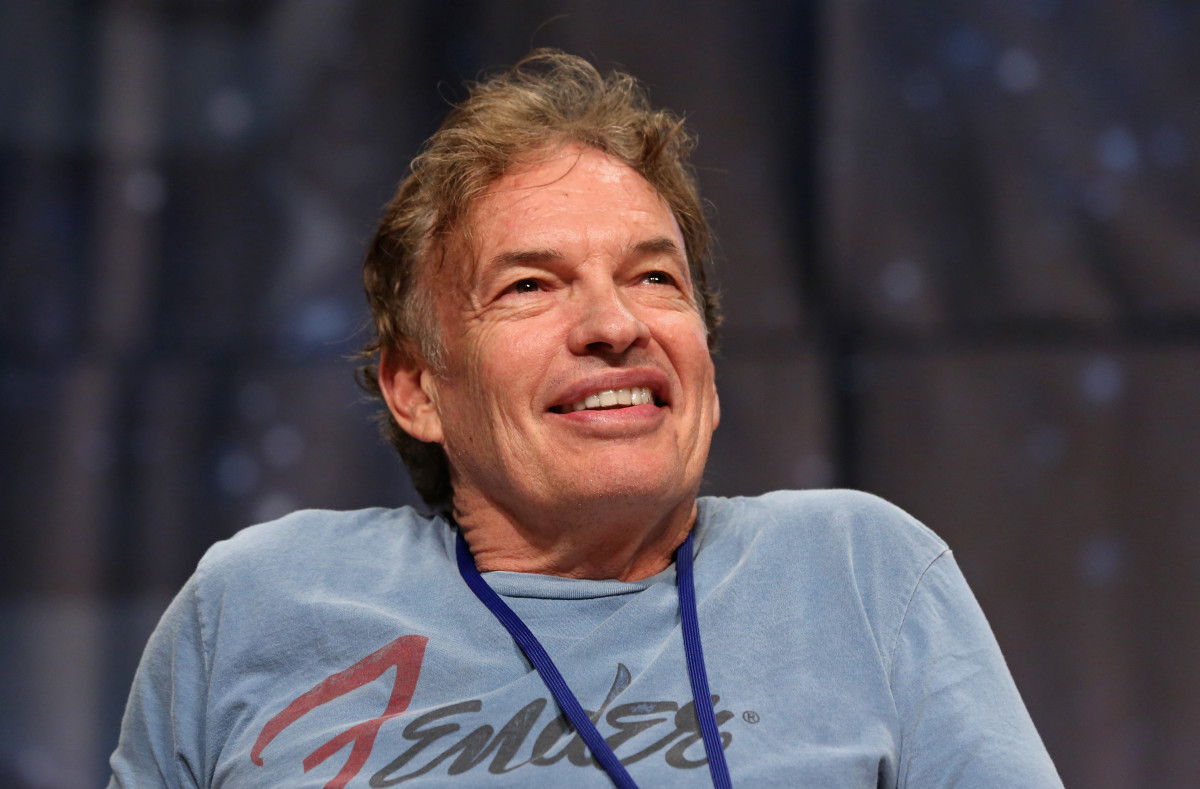

Verandering Bij Nrc Vandaag Bram Endedijk Neemt Presentatie Over

May 01, 2025

Verandering Bij Nrc Vandaag Bram Endedijk Neemt Presentatie Over

May 01, 2025 -

Kycklingnuggets I Majsflingor Det Perfekta Receptet

May 01, 2025

Kycklingnuggets I Majsflingor Det Perfekta Receptet

May 01, 2025 -

Bharty Ryasty Dhsht Grdy Kshmyr Myn Eyd Pr Khwn Bhaw

May 01, 2025

Bharty Ryasty Dhsht Grdy Kshmyr Myn Eyd Pr Khwn Bhaw

May 01, 2025 -

Ywm Ykjhty Kshmyr Kshmyr Ky Azady Ky Jdwjhd Ka Azhar

May 01, 2025

Ywm Ykjhty Kshmyr Kshmyr Ky Azady Ky Jdwjhd Ka Azhar

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Latest Posts

-

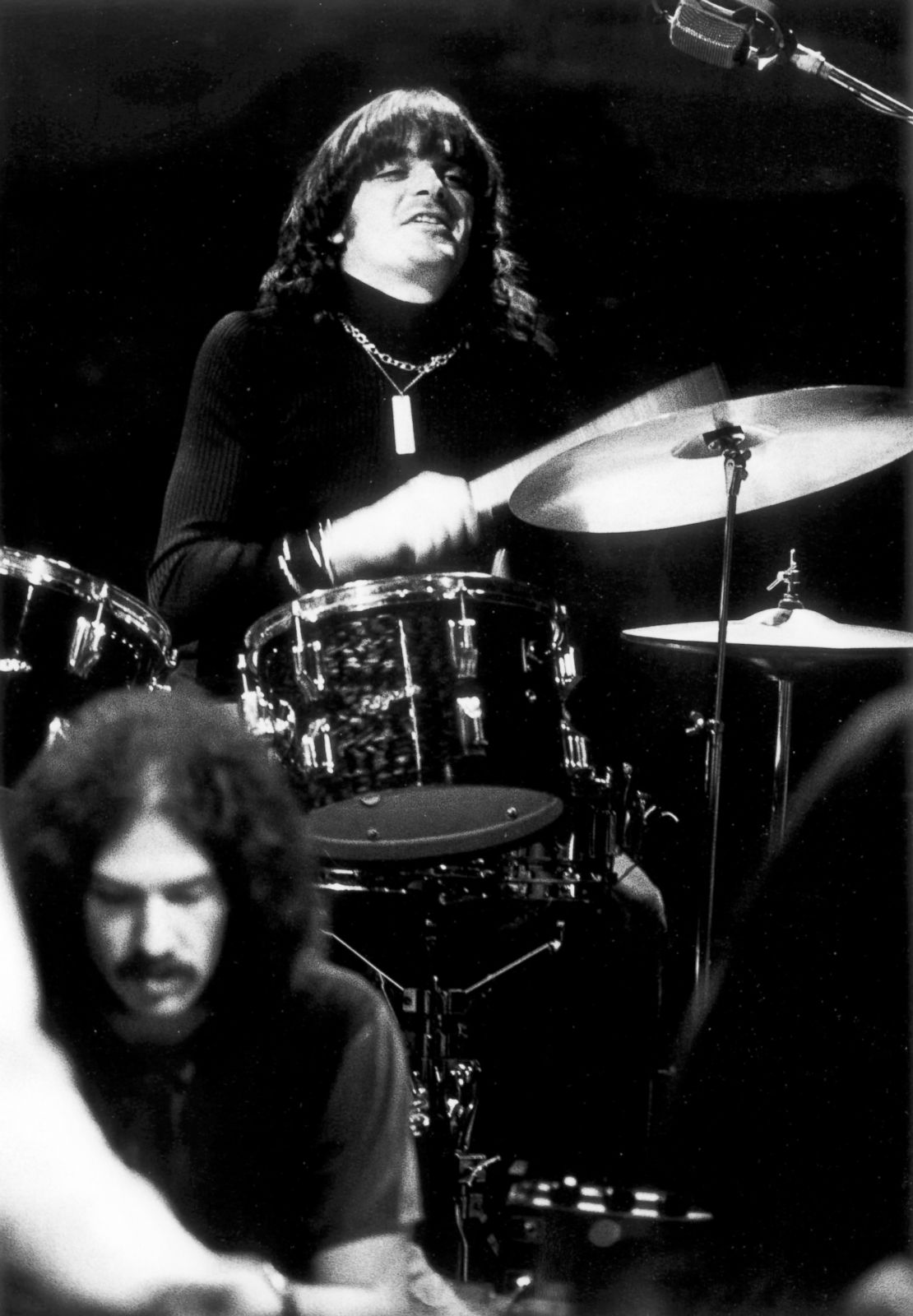

Remembering A Dallas Legend Another 80s Soap Star Dies

May 01, 2025

Remembering A Dallas Legend Another 80s Soap Star Dies

May 01, 2025 -

Death Of A Dallas Tv Icon 80s Soap Opera Mourns Another Loss

May 01, 2025

Death Of A Dallas Tv Icon 80s Soap Opera Mourns Another Loss

May 01, 2025 -

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025 -

Dallas Tv Star Dies Another 80s Soap Legend Lost

May 01, 2025

Dallas Tv Star Dies Another 80s Soap Legend Lost

May 01, 2025 -

Remembering Priscilla Pointer Actress And Amy Irvings Mother

May 01, 2025

Remembering Priscilla Pointer Actress And Amy Irvings Mother

May 01, 2025