XRP Price Prediction: Impact Of Ripple's Reduced $50M SEC Settlement

Table of Contents

Ripple's Reduced $50M SEC Settlement: A Detailed Analysis

The settlement between Ripple Labs and the Securities and Exchange Commission (SEC) marked a significant turning point for XRP. While the SEC initially sought far greater penalties, the $50 million fine represents a considerable reduction, signaling a potential shift in the regulatory narrative surrounding XRP. This outcome, though not a complete victory for Ripple, offers a degree of clarity previously absent.

- Summary of the settlement terms: Ripple neither admitted nor denied the SEC's allegations but agreed to pay a $50 million penalty. This avoided a protracted and costly legal battle.

- Key concessions made by Ripple: While the specifics remain complex, Ripple likely made concessions regarding future operations and internal processes to reach this settlement.

- Impact on Ripple's operational capabilities: The settlement allows Ripple to continue its operations, albeit with potential ongoing regulatory scrutiny.

- Legal precedent set by the case: The case's outcome sets a precedent, though its implications for other cryptocurrencies remain to be seen. The lack of a clear definition of what constitutes a security significantly impacts future regulatory approaches.

Impact on Market Sentiment and Investor Confidence

The settlement immediately impacted XRP's price, initially causing a surge before settling into a period of relative stability. However, the long-term impact on investor sentiment remains to be seen.

- Positive and negative reactions from the crypto community: While some celebrated the avoidance of a worse outcome, others remained cautious, citing the ongoing regulatory uncertainty.

- Changes in trading volume and market capitalization: The news resulted in increased trading volume, indicating heightened investor interest and market volatility.

- Increased or decreased institutional investment: The settlement's impact on institutional investment is still unfolding, with some institutions potentially seeing it as a positive sign.

- Impact on retail investor confidence: Retail investors' reactions have been mixed, with some viewing the settlement favorably and others retaining concerns about future regulatory actions.

Regulatory Landscape and Future Outlook for XRP

The Ripple-SEC case highlights the evolving and often unclear regulatory landscape surrounding cryptocurrencies. While the settlement offers some clarity, considerable uncertainty remains.

- Clarity vs. ambiguity regarding XRP's legal status: While the settlement is a step towards clarity, XRP's classification as a security or commodity remains ambiguous in certain jurisdictions.

- Potential for further SEC scrutiny of other crypto projects: The SEC might utilize the precedent set by the Ripple case to scrutinize other cryptocurrency projects, potentially influencing the entire crypto market.

- Impact on global regulatory approaches to cryptocurrencies: The case's outcome could influence how other countries regulate cryptocurrencies, leading to varying approaches globally.

- Predictions for future regulatory changes impacting XRP: The future regulatory outlook for XRP remains uncertain, with potential for further legal challenges or regulatory changes influencing its price trajectory.

Technological Advancements and Adoption Rate of XRP

Ripple continues to develop the XRP Ledger, introducing new features and enhancing its functionality. The adoption rate of XRP for cross-border payments is also a critical factor in its price prediction.

- New features and updates to the XRP Ledger: Ongoing development improves the XRP Ledger's speed, security, and efficiency, potentially attracting more users and developers.

- Expansion of partnerships and collaborations: New partnerships can broaden XRP's adoption across various industries, leading to increased demand.

- Growth in the usage of XRP for cross-border payments: Expansion of its use in cross-border payments could significantly drive XRP's adoption and price.

- Technological advancements that could drive adoption: Innovations like improved scalability and interoperability could further propel XRP's growth.

XRP Price Prediction: Short-Term and Long-Term Forecasts

Predicting XRP's price with certainty is impossible. However, based on the factors discussed above, we can offer some reasoned forecasts.

- Conservative price prediction: A conservative prediction might suggest a gradual price increase over the next year, driven by increased adoption and regulatory clarity.

- Optimistic price prediction: An optimistic prediction could anticipate a more significant price rise if XRP gains wider adoption and benefits from positive regulatory developments.

- Factors that could impact the prediction (e.g., market conditions, regulatory changes): Market sentiment, broader cryptocurrency market trends, and future regulatory actions could all significantly influence XRP's price.

Conclusion

The Ripple-SEC settlement, though not a complete victory for Ripple, provides a degree of clarity, influencing the XRP price prediction. While the reduced $50M fine is significant, the future of XRP's price hinges on several factors: market sentiment, regulatory developments, technological advancements, and adoption rate. Any XRP price prediction must acknowledge inherent uncertainty. Conducting thorough research and carefully considering your risk tolerance is crucial before making investment decisions. Remember to use this XRP Price Prediction as a starting point for your own XRP investment analysis and XRP price forecast, taking into account the inherent risks associated with cryptocurrency investments.

Featured Posts

-

Tyn Jngwn Ke Bed Bhy Kshmyr Tnazeh Hl Nhyn Hwa Kya Ds Jngwn Se Hl Mmkn He

May 02, 2025

Tyn Jngwn Ke Bed Bhy Kshmyr Tnazeh Hl Nhyn Hwa Kya Ds Jngwn Se Hl Mmkn He

May 02, 2025 -

Boost Your Paul Gauguin Sales With Ponants 1 500 Flight Credit Incentive

May 02, 2025

Boost Your Paul Gauguin Sales With Ponants 1 500 Flight Credit Incentive

May 02, 2025 -

Tongas Strong Showing Dashes Samoas Olympic Aspirations

May 02, 2025

Tongas Strong Showing Dashes Samoas Olympic Aspirations

May 02, 2025 -

Tongas U 19 Womens Team Secures Spot In 2025 Ofc Championship

May 02, 2025

Tongas U 19 Womens Team Secures Spot In 2025 Ofc Championship

May 02, 2025 -

Play Station Beta Program Eligibility And How To Register With Sony

May 02, 2025

Play Station Beta Program Eligibility And How To Register With Sony

May 02, 2025

Latest Posts

-

Kivalo Minosegu Baromfihus A Mecsek Baromfi Kft Tol Kme Vedjegyes Termekek

May 02, 2025

Kivalo Minosegu Baromfihus A Mecsek Baromfi Kft Tol Kme Vedjegyes Termekek

May 02, 2025 -

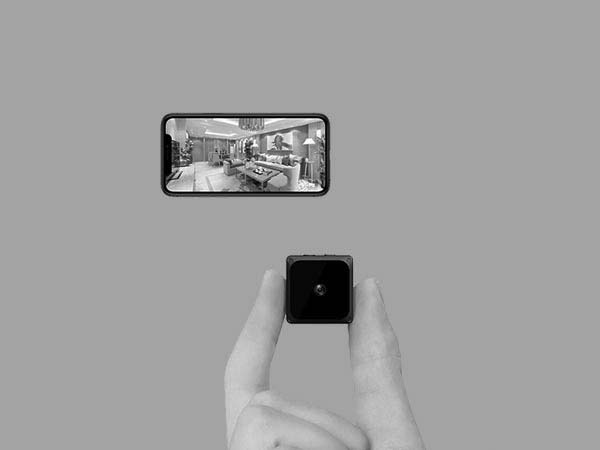

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 02, 2025

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 02, 2025 -

Mini Cameras Espias Em Formato De Chaveiro Avaliacao E Melhores Opcoes

May 02, 2025

Mini Cameras Espias Em Formato De Chaveiro Avaliacao E Melhores Opcoes

May 02, 2025 -

Ahead Computings 21 5 M Seed Funding Fueling Future Growth

May 02, 2025

Ahead Computings 21 5 M Seed Funding Fueling Future Growth

May 02, 2025 -

Mini Camera Chaveiro Discreta Funcional E Popular Descubra

May 02, 2025

Mini Camera Chaveiro Discreta Funcional E Popular Descubra

May 02, 2025