XRP Price Prediction: Should You Buy Ripple Under $3?

Table of Contents

XRP, a digital asset designed for fast and low-cost international payments, has seen its fair share of ups and downs. Recent market events, particularly the ongoing legal battle with the SEC, have significantly impacted its price. Let's delve into a comprehensive analysis to understand the potential of XRP and whether buying it under $3 is a wise move.

Analyzing Current Market Conditions for XRP

Recent Price Performance and Trends

The XRP price chart reveals a complex history. While it has experienced periods of significant growth, it's also seen considerable dips, often correlated with regulatory news and broader market trends. Analyzing the XRP price history, we can identify key support and resistance levels.

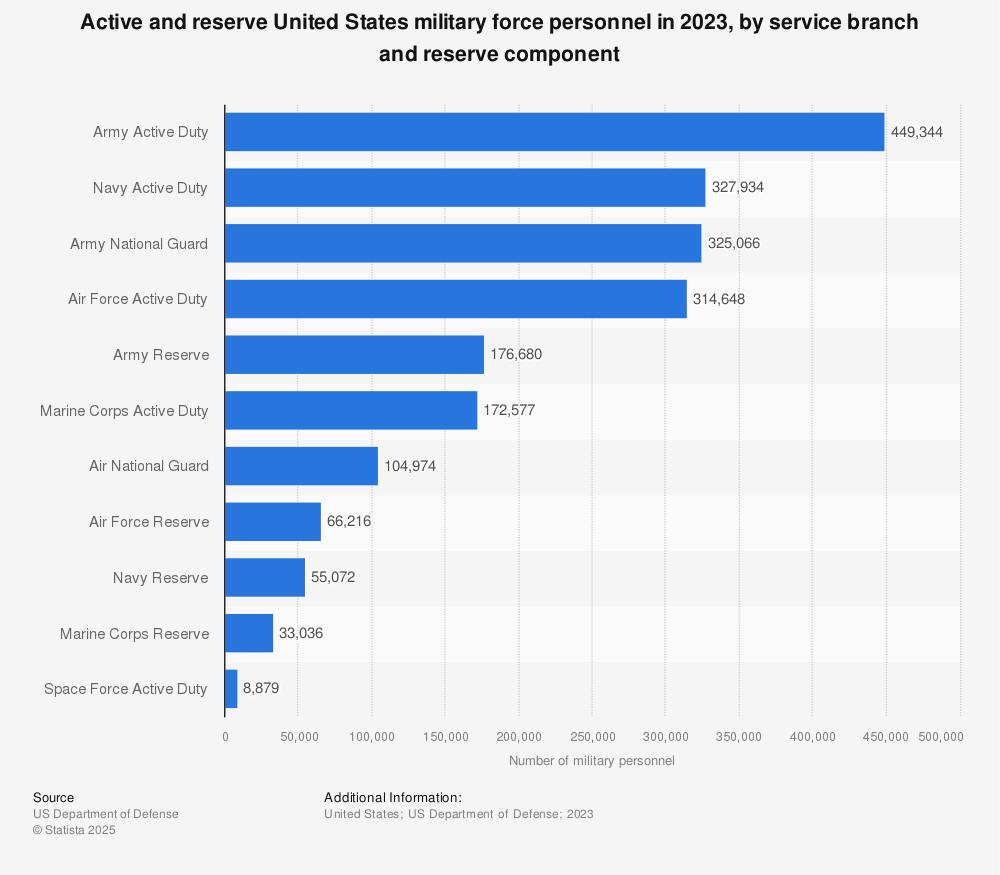

- Significant Price Points: Observe key highs and lows in the past year, noting specific dates for context. (Include a chart here showcasing XRP's price movements over the relevant period).

- Technical Indicators: Mention relevant indicators such as moving averages (e.g., 50-day, 200-day MA) and Relative Strength Index (RSI) to support the price analysis. Note any bullish or bearish signals these indicators suggest.

- Trading Volume: Analyze trading volume alongside price movements. High volume during price increases confirms strength, while high volume during price decreases can signal selling pressure. (Include relevant charts and graphs illustrating this relationship).

Regulatory Landscape and its Impact

The ongoing legal battle between Ripple Labs and the SEC casts a long shadow over XRP's price. The SEC's claim that XRP is an unregistered security has created significant regulatory uncertainty, impacting investor confidence.

- Key Developments: Summarize recent court filings, hearings, and expert testimonies related to the case.

- Potential Outcomes: Discuss the potential outcomes of the lawsuit—a settlement, a win for Ripple, or a win for the SEC—and their respective impacts on the XRP price. Include expert opinions and predictions from respected analysts.

- Regulatory Clarity: Highlight the significance of a clear regulatory framework for XRP's future price.

Adoption and Partnerships

Ripple's technology, RippleNet, facilitates cross-border payments for financial institutions. Increased adoption by these institutions is a crucial factor influencing XRP's long-term price prediction.

- Key Partnerships: List prominent banks and financial institutions currently using or partnering with Ripple. Highlight the geographical reach and transaction volume associated with these partnerships.

- RippleNet Growth: Analyze the growth of RippleNet in terms of the number of participating institutions and transaction volume. The expansion of its network directly contributes to XRP's utility and potential value.

- Institutional Adoption: Emphasize the significance of institutional adoption for price stability and potential future growth.

Factors Influencing Future XRP Price

Technological Advancements

Ripple's continuous technological advancements play a crucial role in shaping XRP's future.

- XRPL Upgrades: Discuss any upcoming upgrades to the XRP Ledger (XRPL) including improvements to speed, scalability, and security.

- New Features: Mention any new features or functionalities being developed for RippleNet or the XRPL that might enhance its appeal and adoption rate.

- Innovation and Competition: Analyze Ripple's competitive position within the broader landscape of blockchain technology and cross-border payment solutions.

Market Sentiment and Investor Confidence

Investor sentiment and overall market conditions significantly influence XRP's price.

- Social Media Sentiment: Analyze the overall sentiment towards XRP on social media platforms. A positive sentiment can fuel price increases, while negative sentiment can drive prices down.

- Analyst Predictions: Summarize the predictions and opinions of prominent cryptocurrency analysts regarding XRP's potential.

- News and Events: Discuss the impact of news events, both positive and negative, on investor confidence and subsequent price movements.

Macroeconomic Factors

Broader macroeconomic factors also influence cryptocurrency prices, including XRP.

- Inflation and Interest Rates: Explain how inflation and interest rates affect investor risk appetite and the overall cryptocurrency market.

- Economic Growth and Recession: Discuss the impact of global economic conditions on cryptocurrency investments.

- Regulatory Changes: Highlight the influence of global regulatory changes regarding cryptocurrencies on investor sentiment and price stability.

XRP Price Prediction Scenarios

Bullish Scenario

A positive outcome in the Ripple-SEC lawsuit, coupled with increased institutional adoption and broader market bullishness, could drive XRP significantly above $3.

- Catalysts for Growth: List specific factors that would need to align to create a bullish scenario.

- Price Targets: Offer a potential price target based on this scenario (with appropriate caveats about uncertainty).

Bearish Scenario

A negative court ruling, decreased adoption, or a major cryptocurrency market downturn could lead to a further decline in XRP's price.

- Factors Contributing to a Bearish Trend: Highlight potential negative scenarios that could impact XRP’s price negatively.

- Price Floor: Discuss a potential price floor, which represents the lowest expected price.

Neutral Scenario

A neutral scenario assumes a balance between positive and negative factors, resulting in moderate price growth.

- Price Range: Provide a range of potential price points based on this neutral outlook.

- Market Stability: Discuss the potential for sustained market stability or a sideways trend.

Conclusion

The XRP price prediction is complex, influenced by the ongoing legal battle, technological advancements, market sentiment, and broader macroeconomic factors. While a price above $3 is certainly possible under a bullish scenario, significant risk remains. Before investing in XRP, carefully consider the information presented here and conduct your own thorough research to determine if an XRP price under $3 represents a suitable buying opportunity for your portfolio. Remember, this analysis is not financial advice.

Featured Posts

-

Remembering Saigon Accounts From Us Military Personnel Who Defied Orders

May 02, 2025

Remembering Saigon Accounts From Us Military Personnel Who Defied Orders

May 02, 2025 -

Fans Fall At Cubs Pirates Game Hospitalized After Outfield Wall Incident

May 02, 2025

Fans Fall At Cubs Pirates Game Hospitalized After Outfield Wall Incident

May 02, 2025 -

Ndcs Techiman South Election Petition A High Court Decision

May 02, 2025

Ndcs Techiman South Election Petition A High Court Decision

May 02, 2025 -

Exclusive The Armys Plan For A Massive Drone Expansion

May 02, 2025

Exclusive The Armys Plan For A Massive Drone Expansion

May 02, 2025 -

Priscilla Pointer Dead At 100 Remembering The Carrie Actress And Her Daughter

May 02, 2025

Priscilla Pointer Dead At 100 Remembering The Carrie Actress And Her Daughter

May 02, 2025

Latest Posts

-

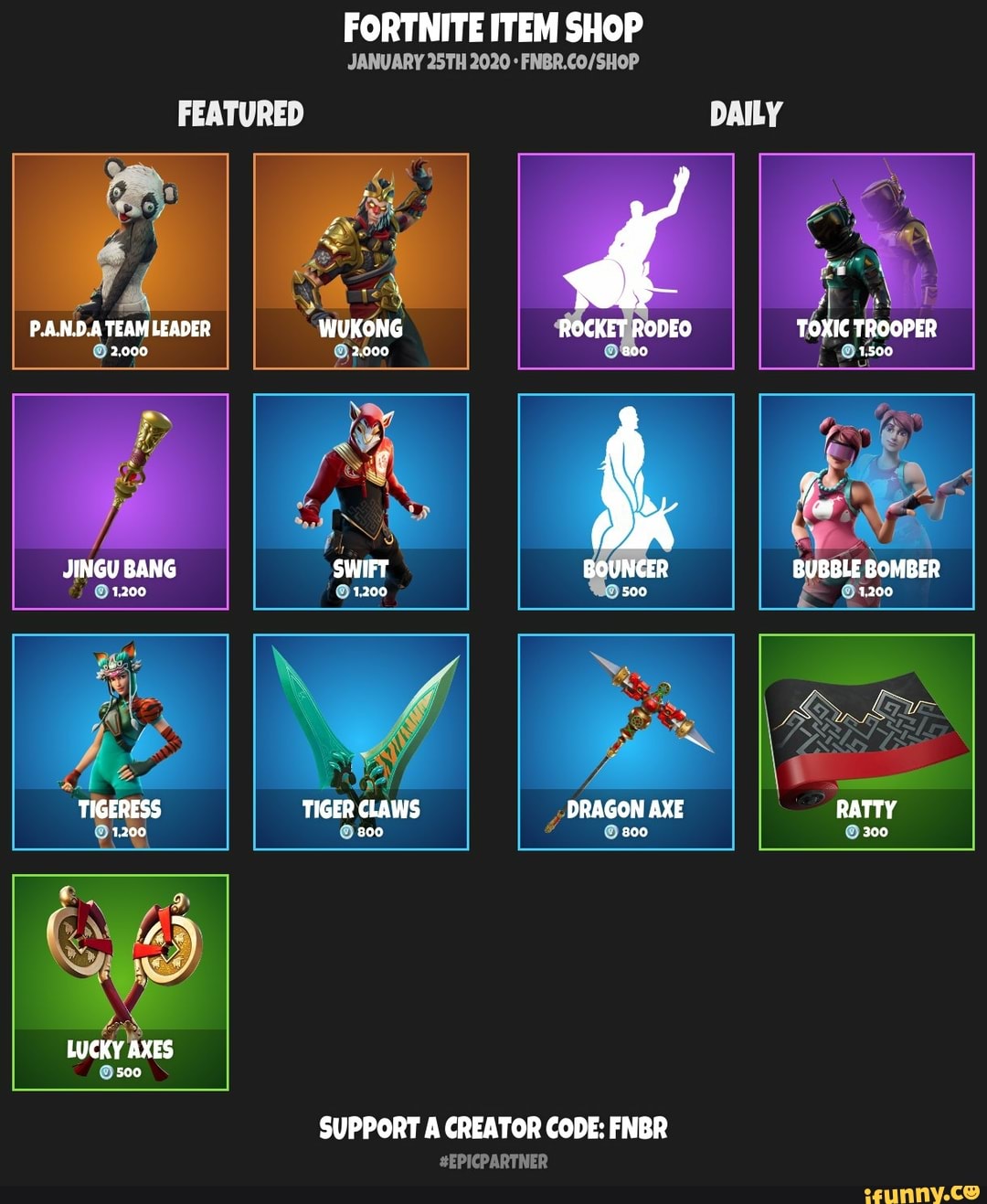

Get Free Captain America Items In The Fortnite Item Shop Limited Time

May 03, 2025

Get Free Captain America Items In The Fortnite Item Shop Limited Time

May 03, 2025 -

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025 -

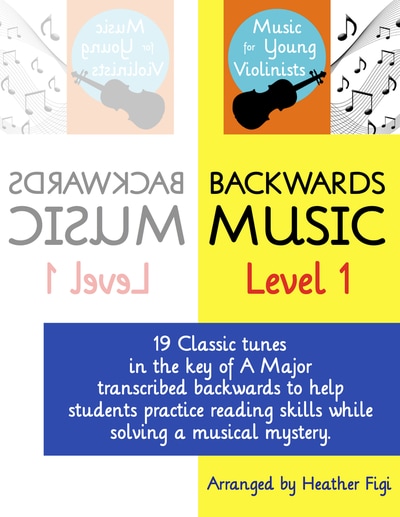

Backwards Music In Fortnite Players React Negatively To The Change

May 03, 2025

Backwards Music In Fortnite Players React Negatively To The Change

May 03, 2025 -

Fortnites Controversial Music Update Player Backlash Explained

May 03, 2025

Fortnites Controversial Music Update Player Backlash Explained

May 03, 2025 -

Fortnite Players Revolt The Backwards Music Controversy

May 03, 2025

Fortnite Players Revolt The Backwards Music Controversy

May 03, 2025