XRP Price Surge: Ripple SEC Case Update And US ETF Possibilities

Table of Contents

Ripple SEC Lawsuit Update: Implications for XRP Price

The Ripple SEC lawsuit has cast a long shadow over XRP's price trajectory. This protracted legal battle centers around the SEC's claim that XRP is an unregistered security. The outcome will significantly impact XRP's regulatory landscape and, consequently, its price. The keywords Ripple vs SEC, legal battle, court decision, XRP price prediction, regulatory uncertainty are all heavily interwoven with the ongoing narrative.

- Recent court filings and their significance: Recent rulings have offered glimmers of hope for Ripple, with certain arguments finding favor with the court. These developments have often corresponded with short-term price increases. However, the case is far from over, and uncertainty remains a key factor.

- Expert opinions on the likely outcome: Legal experts offer varied predictions, ranging from a complete SEC victory to a partial or complete dismissal of the case. These divergent opinions highlight the inherent uncertainty and the potential for significant price fluctuations depending on the final ruling.

- Historical price movements correlated with lawsuit developments: A clear correlation exists between key developments in the lawsuit and XRP's price. Positive news generally results in price increases, while negative developments often lead to declines. Analyzing this historical correlation can offer valuable insights into potential future price movements.

Growing Institutional Interest in XRP

Beyond the legal battles, growing institutional interest significantly contributes to XRP's price surge. Large-scale investors are increasingly recognizing XRP's potential, driven by its utility in cross-border payments and its established network. Keywords such as institutional adoption, XRP investors, large-scale transactions, market capitalization reflect this trend.

- Examples of institutions using or investing in XRP: While precise details are often kept confidential, there's increasing evidence of institutional adoption, with some reports suggesting substantial investments by large financial firms. This quiet accumulation can drive price increases without triggering immediate market volatility.

- Analysis of increased trading volume from institutional sources: Increased trading volume, particularly in large blocks, indicates institutional involvement. This surge in activity demonstrates growing confidence and contributes to a more stable price structure.

- Impact of institutional adoption on price stability and future growth: Institutional investment tends to inject stability into the market. Large-scale buy-ins typically lessen the impact of short-term volatility, signaling a more mature and potentially less speculative investment landscape for XRP.

US ETF Approval Possibilities and their Effect on XRP

The possibility of a US-listed XRP ETF represents a potential game-changer. An ETF would dramatically increase XRP's accessibility and liquidity, potentially driving significant price appreciation. Keywords like XRP ETF, exchange-traded fund, SEC approval, regulatory landscape, trading volume are central to understanding this potential impact.

- Comparison to other crypto ETFs already listed: The approval of other crypto ETFs, while not directly comparable due to the regulatory issues surrounding XRP, sets a precedent and offers a framework for evaluating the likelihood of XRP ETF approval.

- Potential timeline for approval (if any): Predicting a timeline is challenging given the regulatory hurdles. However, analyzing the SEC's past actions with other crypto assets can offer some clues.

- Factors influencing SEC’s decision on XRP ETF approval: The SEC's decision will heavily depend on the outcome of the Ripple lawsuit and its overall stance on cryptocurrency regulation. A favorable ruling in the lawsuit significantly increases the chances of ETF approval.

Conclusion: Navigating the Future of XRP

The future of XRP is interwoven with the resolution of the Ripple SEC lawsuit, the continued growth of institutional interest, and the potential approval of a US XRP ETF. Each of these factors has the potential to significantly influence XRP's price. While there are considerable risks associated with investing in cryptocurrencies, understanding the interplay of these factors is crucial for informed decision-making.

The current surge in XRP's price offers both exciting opportunities and inherent risks. Staying informed about further developments in the Ripple SEC case and the potential for a US XRP ETF is paramount. Conduct thorough research and due diligence before investing in XRP or any other cryptocurrency. Remember, this analysis is for informational purposes only and doesn't constitute financial advice. Consider consulting a financial advisor before making any investment decisions related to XRP investment, crypto market analysis, or the future of XRP.

Featured Posts

-

Fortnite Item Shop Update Helpful New Feature For Players

May 02, 2025

Fortnite Item Shop Update Helpful New Feature For Players

May 02, 2025 -

Strengthening Vaccine Surveillance Us Responds To Measles Crisis

May 02, 2025

Strengthening Vaccine Surveillance Us Responds To Measles Crisis

May 02, 2025 -

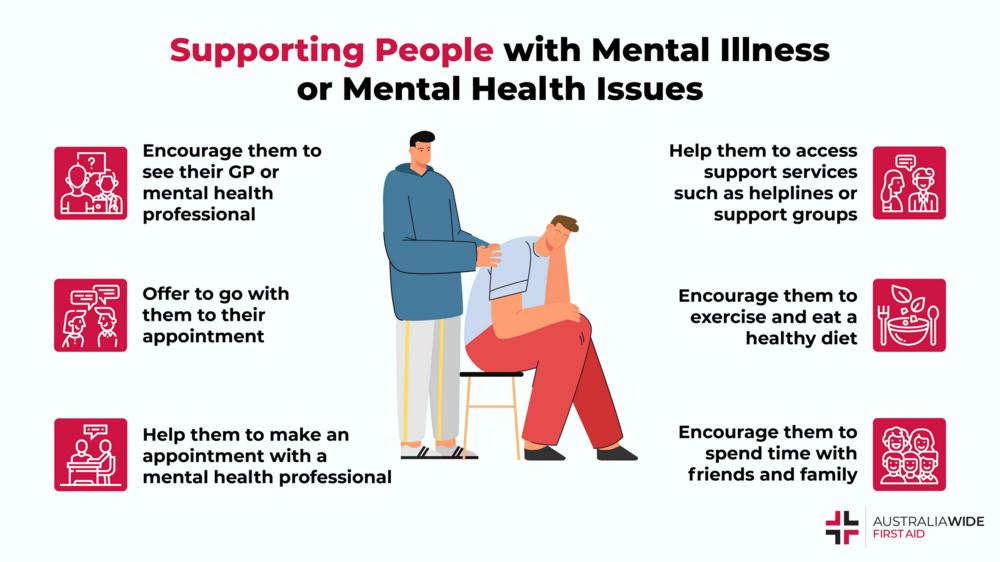

Strengthening Community Support For Mental Health 5 Practical Approaches

May 02, 2025

Strengthening Community Support For Mental Health 5 Practical Approaches

May 02, 2025 -

Media Vs Geen Stijl Verschillende Definities Van Een Zware Auto

May 02, 2025

Media Vs Geen Stijl Verschillende Definities Van Een Zware Auto

May 02, 2025 -

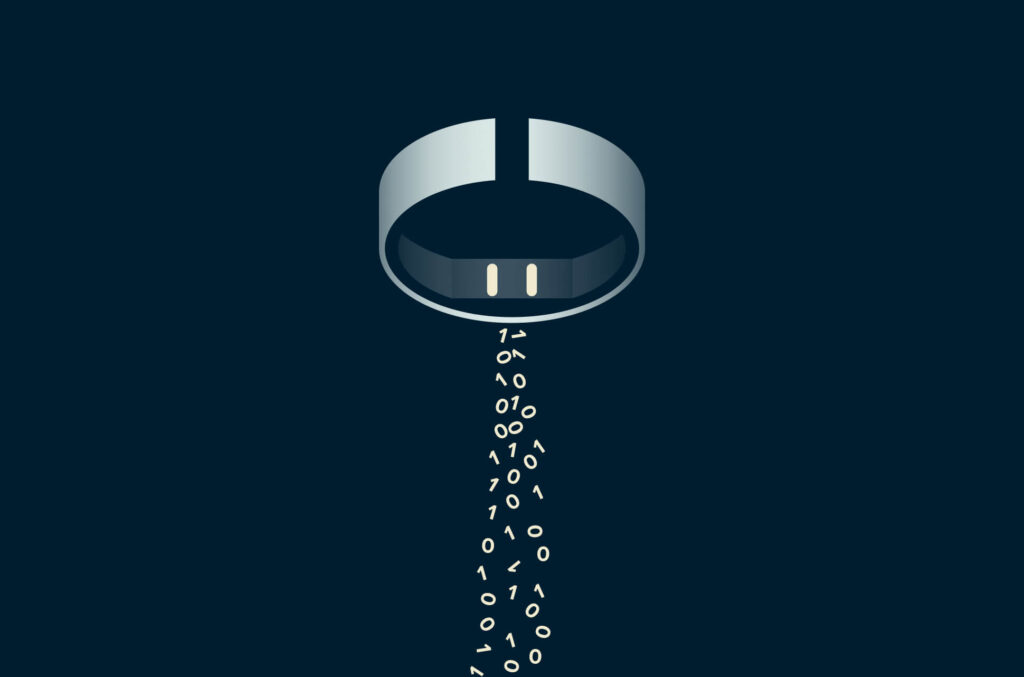

Can A Smart Ring Increase Relationship Trust

May 02, 2025

Can A Smart Ring Increase Relationship Trust

May 02, 2025

Latest Posts

-

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025 -

End Of School Desegregation Order Implications For Education

May 02, 2025

End Of School Desegregation Order Implications For Education

May 02, 2025 -

Fortnites Latest Icon Skin Release Date Price And Features

May 02, 2025

Fortnites Latest Icon Skin Release Date Price And Features

May 02, 2025 -

The Justice Departments Decision To End School Desegregation A Deeper Look

May 02, 2025

The Justice Departments Decision To End School Desegregation A Deeper Look

May 02, 2025 -

The Fortnite Backward Music Update A Critical Analysis

May 02, 2025

The Fortnite Backward Music Update A Critical Analysis

May 02, 2025