XRP Regulatory Uncertainty: Latest News And SEC Classification

Table of Contents

The SEC's Case Against Ripple

The SEC's lawsuit against Ripple Labs, the company behind XRP, alleges that Ripple conducted an unregistered securities offering, violating federal securities laws. The core of the SEC's case hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. The Howey Test considers four key factors: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived primarily from the efforts of others. The SEC argues that XRP satisfies all four prongs of the Howey Test, claiming that XRP sales were investments promising profits generated through Ripple's efforts.

- Summary of the SEC's complaint: The SEC alleges that Ripple sold billions of XRP without registering them as securities, defrauding investors.

- Key arguments presented by the SEC: The SEC emphasizes Ripple's control over XRP distribution and its efforts to increase XRP's value, arguing these actions created a reasonable expectation of profit for investors.

- Ripple's counterarguments and defense strategy: Ripple maintains that XRP is a decentralized digital asset, not a security, and that its sales were not investment contracts. They argue XRP functions similarly to other cryptocurrencies like Bitcoin and Ethereum.

- Discussion of the legal precedents cited by both sides: Both sides have cited various legal precedents and interpretations of securities law, leading to a complex legal battle with significant implications for the future of cryptocurrency regulation.

Key Developments and Recent News

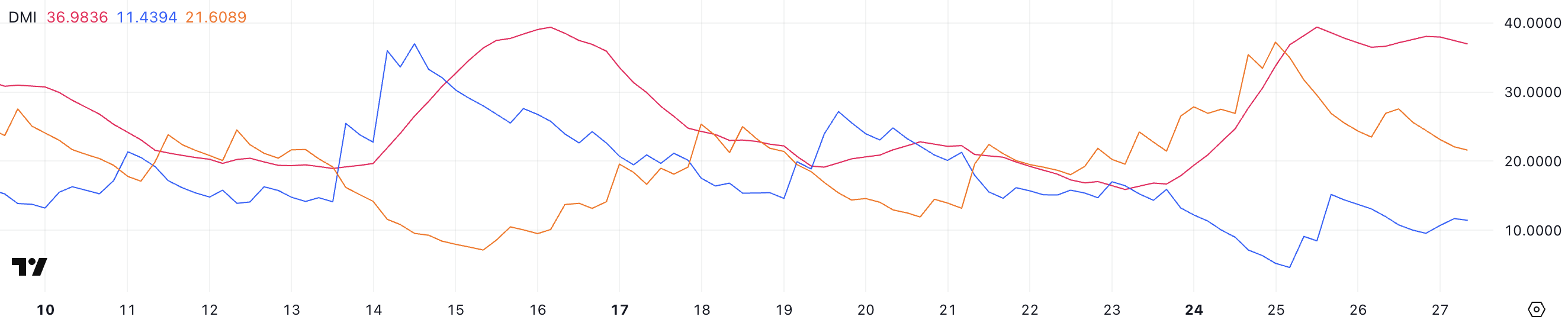

The Ripple vs. SEC lawsuit has seen significant developments, impacting the XRP price and market sentiment. Several court rulings, expert testimonies, and amicus briefs have shaped the narrative. The judge's decisions on various motions have been closely scrutinized by the crypto community and legal experts.

- Timeline of key events in the lawsuit: The lawsuit began in December 2020 and has progressed through various stages, including discovery, motion to dismiss hearings, and expert witness testimony. Tracking these milestones is crucial for understanding the evolving legal landscape.

- Summaries of important court decisions: Key decisions regarding the admissibility of evidence, motions to dismiss, and rulings on specific legal arguments have significantly impacted the trajectory of the case.

- Analysis of the impact of specific testimonies or filings: Expert testimony on the technological aspects of XRP and its market functioning has played a vital role, as have filings detailing Ripple's business practices and communications.

- Discussion of the market volatility associated with the legal proceedings: The XRP price has experienced significant volatility directly correlated with developments in the lawsuit, highlighting the substantial market sensitivity surrounding this case.

Potential Outcomes and Their Implications

The Ripple vs. SEC lawsuit could end in several ways: a settlement, a win for the SEC, or a win for Ripple. Each outcome has significant implications for XRP, its investors, and the broader cryptocurrency regulatory landscape.

- Potential scenarios and their likelihood: A settlement is possible, although the terms would likely impact XRP's price and future trajectory. A win for the SEC could lead to severe penalties for Ripple and potentially establish a precedent that negatively impacts other cryptocurrencies. A win for Ripple could provide regulatory clarity and potentially boost XRP's price.

- Impact on XRP price and market capitalization under each scenario: Each potential outcome would have a profound effect on XRP's price and market capitalization. A favorable outcome for Ripple could see a substantial price increase, while a decision against Ripple could result in a significant drop.

- Effects on investor confidence and future investment in XRP: Investor confidence is intrinsically linked to regulatory certainty. A clear resolution, regardless of the outcome, could help stabilize the market. Prolonged uncertainty, however, could deter further investment.

- Broader implications for cryptocurrency regulation: The outcome will have far-reaching consequences for the regulatory landscape of cryptocurrencies. A win for either side could influence how other cryptocurrencies are classified and regulated in the future.

The Impact on XRP Holders and Investors

The regulatory uncertainty surrounding XRP presents significant investment risks. XRP holders and investors need to be aware of these risks and take steps to mitigate their exposure. Careful due diligence and portfolio diversification are crucial.

- XRP holders: Holders should closely monitor the legal proceedings and understand the potential implications of different outcomes.

- Investment risks: The significant uncertainty makes XRP a high-risk investment.

- Portfolio diversification: Diversifying your investment portfolio across various asset classes is essential to minimize risk.

- Due diligence: Thorough research and understanding of the legal and technological aspects of XRP are critical before investing.

Conclusion

The ongoing Ripple vs. SEC lawsuit highlights the considerable regulatory uncertainty surrounding XRP. The SEC's classification of XRP as an unregistered security has far-reaching consequences for Ripple, XRP investors, and the wider cryptocurrency industry. Understanding the various potential outcomes and their implications is crucial for navigating this complex situation.

Call to Action: Stay informed about the ongoing Ripple vs. SEC case and understand the risks associated with investing in XRP. Continue researching XRP regulatory developments to make informed decisions about your investments. Thorough due diligence is crucial before investing in any cryptocurrency, especially those facing significant regulatory uncertainty.

Featured Posts

-

Chinas Impact On Bmw And Porsche Sales Market Headwinds For Luxury Brands

May 01, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds For Luxury Brands

May 01, 2025 -

Leading Doctor Identifies The Food Worse Than Smoking For Your Health

May 01, 2025

Leading Doctor Identifies The Food Worse Than Smoking For Your Health

May 01, 2025 -

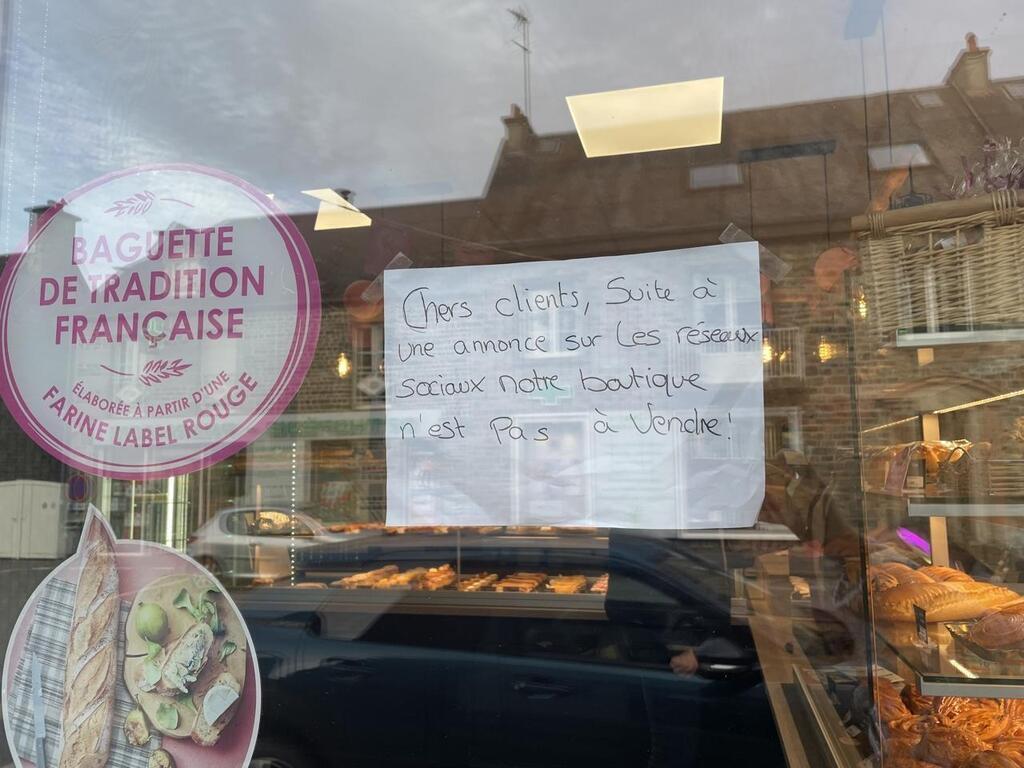

Premier Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 01, 2025

Premier Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 01, 2025 -

Michael Sheens Generous 1 Million Impact And Transparency

May 01, 2025

Michael Sheens Generous 1 Million Impact And Transparency

May 01, 2025 -

Understanding Nuclear Litigation Current Trends And Challenges

May 01, 2025

Understanding Nuclear Litigation Current Trends And Challenges

May 01, 2025

Latest Posts

-

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025 -

39 Approval Analyzing Trumps First 100 Days And Travel Restrictions

May 01, 2025

39 Approval Analyzing Trumps First 100 Days And Travel Restrictions

May 01, 2025 -

Trump Approval Rating At 39 Slow Travel And Policy Impact

May 01, 2025

Trump Approval Rating At 39 Slow Travel And Policy Impact

May 01, 2025 -

Trumps Approval Rating Plummets A Deep Dive Into The First 100 Days

May 01, 2025

Trumps Approval Rating Plummets A Deep Dive Into The First 100 Days

May 01, 2025 -

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025