XRP (Ripple) Price Analysis: Should You Buy Below $3?

Table of Contents

Technical Analysis of XRP Price

Analyzing XRP's price trajectory requires a deep dive into technical indicators and chart patterns. Understanding these patterns can offer valuable insights into potential future price movements.

Chart Patterns and Indicators

The Ripple price chart reveals a dynamic interplay of forces. Let's analyze key indicators to understand the potential for XRP to break above, or consolidate below, the $3 mark.

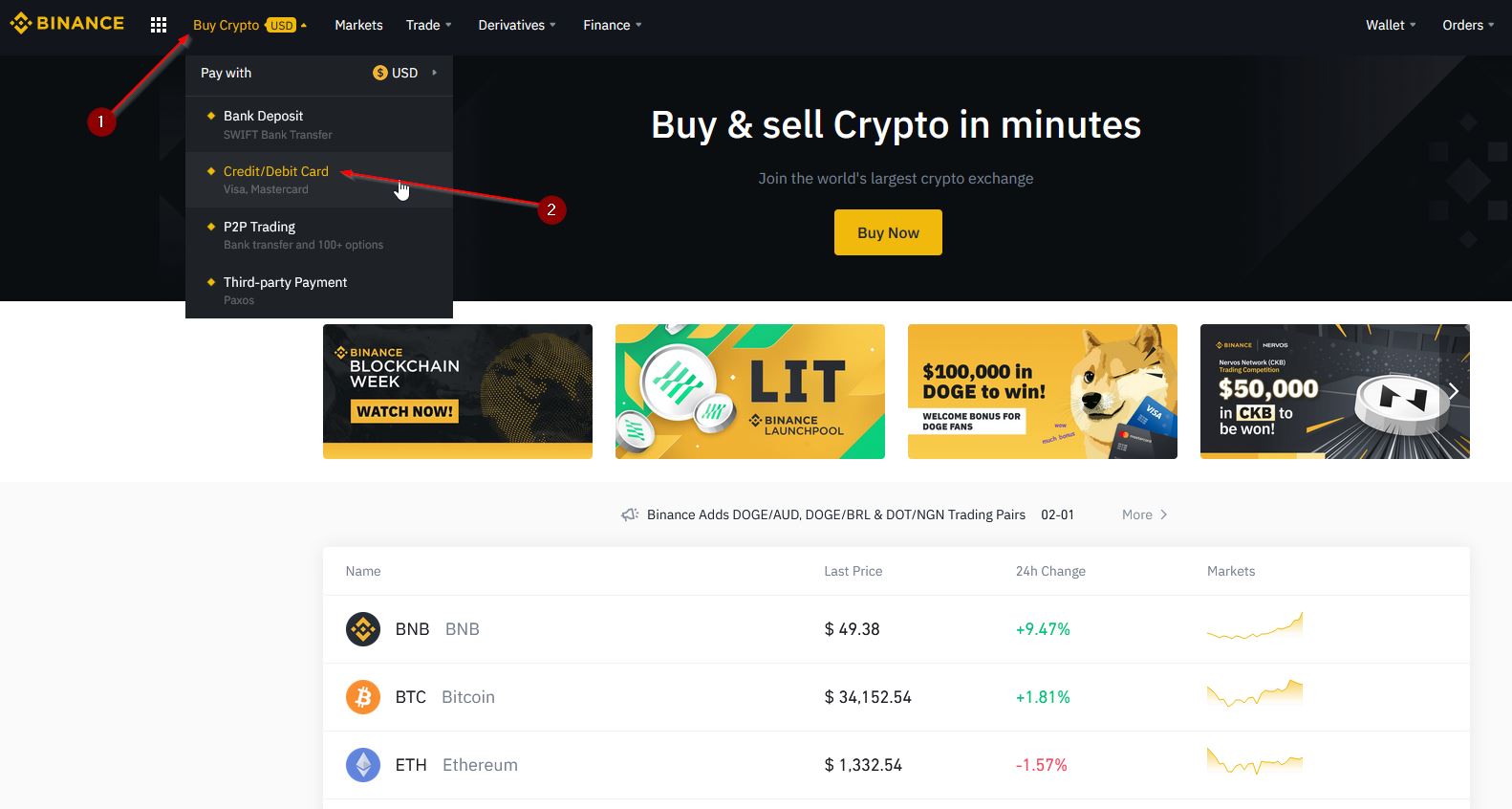

- Moving Averages (MA): The 50-day and 200-day MAs can provide significant support or resistance levels. A bullish crossover (50-day MA crossing above the 200-day MA) could signal a potential price surge. Conversely, a bearish crossover could suggest a continuation of the downward trend. [Insert chart showing MA crossovers]

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests the market is overbought, indicating potential price correction, while an RSI below 30 suggests an oversold condition, potentially signaling a price rebound. [Insert chart highlighting RSI levels]

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish MACD crossover (fast MA crossing above slow MA) indicates a potential uptrend, while a bearish crossover suggests a potential downtrend. [Insert chart showing MACD crossover]

- Support and Resistance: The $3 level acts as a key psychological resistance level. Breaking above this level could trigger a significant price increase. Conversely, failure to break through could lead to further consolidation or a price drop towards lower support levels.

Volume Analysis

Analyzing trading volume alongside price movements provides crucial context. High volume during price increases confirms the strength of the uptrend, while high volume during price decreases suggests a strong bearish sentiment.

- High-Volume Breakouts: Significant price increases accompanied by high trading volume indicate strong buyer conviction and signal a potential sustained uptrend.

- Low-Volume Consolidation: Periods of low trading volume often suggest a period of indecision in the market before a significant price movement.

- Volume and the $3 Target: Observing volume around the $3 price point is critical. High volume accompanying a break above $3 confirms its significance as a resistance level.

Fundamental Analysis of Ripple

While technical analysis looks at price charts, fundamental analysis focuses on the underlying factors driving the value of XRP.

RippleNet Adoption and Partnerships

RippleNet's expansion significantly impacts XRP's value. Increased adoption and strategic partnerships boost confidence and demand for XRP.

- Recent Partnerships: Ripple's partnerships with major financial institutions globally bolster the network's credibility and potential for growth. [List specific examples of recent partnerships and their impact on XRP.]

- Global Adoption: The wider adoption of RippleNet for cross-border payments enhances XRP's utility and increases its potential for price appreciation.

SEC Lawsuit Update and its Influence

The ongoing SEC lawsuit against Ripple significantly impacts investor sentiment and XRP price.

- Latest Developments: [Summarize recent developments in the lawsuit, including any significant court rulings or settlements.] This information is crucial as it dictates a great deal of the market's outlook.

- Impact on Price: The uncertainty surrounding the lawsuit creates volatility. A positive resolution could trigger a substantial price increase, while a negative outcome could lead to further price declines.

XRP Utility and Ecosystem

XRP's utility extends beyond just payments. Its use in decentralized exchanges (DEXs) and other applications broadens its appeal.

- DEX Usage: The growing use of XRP in DEXs adds to its utility, driving demand. [Mention specific DEXs using XRP.]

- Other Applications: [Highlight other applications of XRP, demonstrating its broader utility.]

Risk Assessment and Investment Strategies

Investing in XRP, or any cryptocurrency, carries inherent risks. A cautious approach is essential.

Volatility and Risk Tolerance

Cryptocurrency markets are incredibly volatile. XRP's price can fluctuate significantly in short periods.

- High-Risk, High-Reward: Investing in XRP offers the potential for significant gains but also carries the risk of substantial losses.

- Risk Tolerance: Only invest what you can afford to lose. Your investment strategy should align with your risk tolerance.

Diversification and Portfolio Management

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket.

- Diversified Portfolio: Spread your investments across various asset classes, including cryptocurrencies, stocks, and bonds.

- Risk Management: Regularly review your portfolio and adjust your allocation based on market conditions and your risk tolerance.

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Mitigating Risk: DCA reduces the impact of volatility by averaging out your purchase price.

- Long-Term Strategy: DCA is a long-term strategy that can help you accumulate assets over time.

Conclusion

This XRP (Ripple) price analysis reveals a complex picture. While technical indicators offer short-term insights, fundamental factors like RippleNet adoption and the SEC lawsuit significantly influence XRP's long-term outlook. The $3 price point represents a key psychological barrier, and breaking above it could trigger substantial price increases. However, the inherent volatility of the cryptocurrency market and the ongoing legal uncertainty necessitate a cautious approach.

Final Verdict: Whether or not to buy XRP below $3 depends entirely on your individual risk tolerance and investment strategy. A thorough understanding of both technical and fundamental factors is crucial before making any investment decisions.

Call to Action: After considering this XRP (Ripple) price analysis, make an informed decision about whether buying below $3 aligns with your investment strategy and risk tolerance. Remember to always conduct thorough research before investing in any cryptocurrency, and consider seeking advice from a qualified financial advisor.

Featured Posts

-

Frances Rugby Triumph Duponts Masterclass In 11 Point Victory Against Italy

May 01, 2025

Frances Rugby Triumph Duponts Masterclass In 11 Point Victory Against Italy

May 01, 2025 -

Is It Wise To Buy Xrp Ripple Now

May 01, 2025

Is It Wise To Buy Xrp Ripple Now

May 01, 2025 -

Six Nations Showdown Englands Daly Secures Thrilling Win Over France

May 01, 2025

Six Nations Showdown Englands Daly Secures Thrilling Win Over France

May 01, 2025 -

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 01, 2025

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 01, 2025 -

Six Nations 2025 Assessing Frances Chances Of Victory

May 01, 2025

Six Nations 2025 Assessing Frances Chances Of Victory

May 01, 2025

Latest Posts

-

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025

President Trumps First 100 Days 39 Approval And The Travel Ban Effect

May 01, 2025 -

39 Approval Analyzing Trumps First 100 Days And Travel Restrictions

May 01, 2025

39 Approval Analyzing Trumps First 100 Days And Travel Restrictions

May 01, 2025 -

Trump Approval Rating At 39 Slow Travel And Policy Impact

May 01, 2025

Trump Approval Rating At 39 Slow Travel And Policy Impact

May 01, 2025 -

Trumps Approval Rating Plummets A Deep Dive Into The First 100 Days

May 01, 2025

Trumps Approval Rating Plummets A Deep Dive Into The First 100 Days

May 01, 2025 -

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025