XRP (Ripple) Price Prediction And Investment Strategy

Table of Contents

Analyzing Current Market Trends and XRP's Position

XRP's journey is deeply intertwined with the broader cryptocurrency landscape, but its unique position presents both opportunities and challenges. Let's delve into the key factors influencing its current market position.

Ripple's Legal Battle and its Impact

The ongoing SEC lawsuit against Ripple Labs has cast a long shadow over XRP's price. The outcome of this legal battle remains uncertain and significantly impacts investor sentiment.

- Potential Effects: A favorable ruling could lead to a surge in XRP's price, as regulatory uncertainty would be reduced. Conversely, an unfavorable ruling could severely depress the price.

- Expert Opinions: Analysts offer a wide range of opinions, with some predicting a significant price increase following a positive outcome, while others remain cautious. It's crucial to consider diverse viewpoints before making any investment decisions.

- Investor Sentiment: The lawsuit has undoubtedly created volatility, with investor confidence fluctuating depending on legal developments. Monitoring news and court proceedings is essential for gauging the impact on market sentiment. Keywords: XRP lawsuit, SEC Ripple case, regulatory uncertainty, legal implications

Technological Advancements and Adoption

Despite the legal challenges, Ripple continues to develop its technology and expand its RippleNet network. This expansion plays a crucial role in shaping XRP's future price.

- RippleNet Growth: The increasing adoption of RippleNet by financial institutions worldwide is a positive indicator. Its On-Demand Liquidity (ODL) solution facilitates faster and cheaper cross-border payments.

- Partnerships and Integrations: New partnerships and integrations with banks and payment processors are catalysts for increased XRP adoption and demand.

- Technological Upgrades: Future technological advancements within Ripple's ecosystem could further enhance its efficiency and appeal, potentially boosting XRP's value. Keywords: RippleNet, On-Demand Liquidity (ODL), cross-border payments, blockchain technology

Overall Market Sentiment and Crypto Trends

XRP's price is also influenced by broader cryptocurrency market trends and macroeconomic factors.

- Bitcoin's Influence: Bitcoin's price movements often correlate with the performance of other cryptocurrencies, including XRP. A bullish Bitcoin market often supports XRP's price, while a bearish market can negatively impact it.

- Regulatory Changes: Global regulatory changes affecting the cryptocurrency space have a significant influence on XRP's price. Stringent regulations can lead to price declines, while more favorable regulations could boost its value.

- Macroeconomic Factors: Global economic conditions, inflation rates, and interest rate adjustments influence investor risk appetite and can directly affect cryptocurrency prices, including XRP. Keywords: Bitcoin price, cryptocurrency market cap, market volatility, macroeconomic factors

XRP Price Predictions: A Range of Perspectives

Predicting cryptocurrency prices is inherently speculative, but analyzing different perspectives can offer a more comprehensive view.

Short-Term Price Predictions (Next 6-12 Months)

Several analysts offer short-term XRP price predictions, varying greatly depending on their methodologies and assumptions.

- Range of Predictions: Some analysts predict modest growth, citing the ongoing legal battle as a primary factor. Others suggest more significant price increases contingent on a positive court ruling.

- Influencing Factors: News events, market sentiment, and technical analysis are crucial in shaping short-term predictions. It's essential to scrutinize the reasoning behind each prediction. Keywords: XRP short-term forecast, price target, technical analysis, market sentiment analysis

Long-Term Price Predictions (Next 3-5 Years)

Long-term price predictions are even more uncertain, but considering potential drivers of growth or decline is still valuable.

- Potential for Growth: Widespread adoption of RippleNet, technological advancements, and regulatory clarity could lead to significant price appreciation.

- Factors Affecting Long-Term Value: Mass adoption, technological innovation, and overall market acceptance are crucial factors determining XRP's long-term value. Keywords: XRP long-term forecast, price projection, future outlook, long-term investment

Developing a Sound XRP Investment Strategy

Investing in XRP involves significant risk, and a well-defined strategy is essential.

Risk Assessment and Diversification

Cryptocurrency investments are inherently volatile. Never invest more than you can afford to lose.

- High-Risk Asset: XRP, like other cryptocurrencies, is a highly speculative asset. Price fluctuations can be dramatic and unpredictable.

- Portfolio Diversification: Diversifying your investment portfolio across different asset classes is crucial to mitigating risk. Don't put all your eggs in one basket. Keywords: Risk management, portfolio diversification, cryptocurrency investment risk

Investing Approaches (Dollar-Cost Averaging, Lump Sum)

Different investment strategies can be applied to XRP.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy helps mitigate the risk of investing a large sum at a market peak.

- Lump Sum Investment: This involves investing a significant amount of money at once. This strategy can be more rewarding if the market performs favorably, but it carries higher risk. Keywords: Dollar-cost averaging, lump sum investment, investment strategies

Secure Storage and Exchange Selection

Protecting your XRP investment requires careful consideration of storage and exchange security.

- Hardware Wallets: Hardware wallets offer the highest level of security for storing your XRP.

- Software Wallets: Software wallets offer convenience but are more vulnerable to hacking.

- Reputable Exchanges: Choose reputable and secure cryptocurrency exchanges for trading XRP. Keywords: Hardware wallet, software wallet, cryptocurrency exchange, secure storage

Conclusion: Navigate the XRP Landscape with Confidence

XRP's price is influenced by numerous factors, making prediction challenging. However, by understanding current market trends, evaluating various price predictions, and implementing a sound investment strategy, you can navigate the XRP landscape with greater confidence. Remember, thorough research and a clear understanding of the risks involved are paramount. Start your informed XRP (Ripple) investment journey today by researching further and developing a personalized strategy!

Featured Posts

-

Star Wars Shadow Of The Empire Dash Rendar Figure From Hasbro

May 02, 2025

Star Wars Shadow Of The Empire Dash Rendar Figure From Hasbro

May 02, 2025 -

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025 -

Veteran Actress Priscilla Pointer Known For Carrie Dies At 100

May 02, 2025

Veteran Actress Priscilla Pointer Known For Carrie Dies At 100

May 02, 2025 -

Play Station Credit Compensation Sonys Fix For Holiday Voucher Error

May 02, 2025

Play Station Credit Compensation Sonys Fix For Holiday Voucher Error

May 02, 2025 -

Selena Gomezs 80s Inspired High Waisted Suit A Modern Take On Classic Style

May 02, 2025

Selena Gomezs 80s Inspired High Waisted Suit A Modern Take On Classic Style

May 02, 2025

Latest Posts

-

Sc Election Results 93 Of Respondents Express Confidence

May 02, 2025

Sc Election Results 93 Of Respondents Express Confidence

May 02, 2025 -

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025

South Carolina Election Integrity A 93 Confidence Rate

May 02, 2025 -

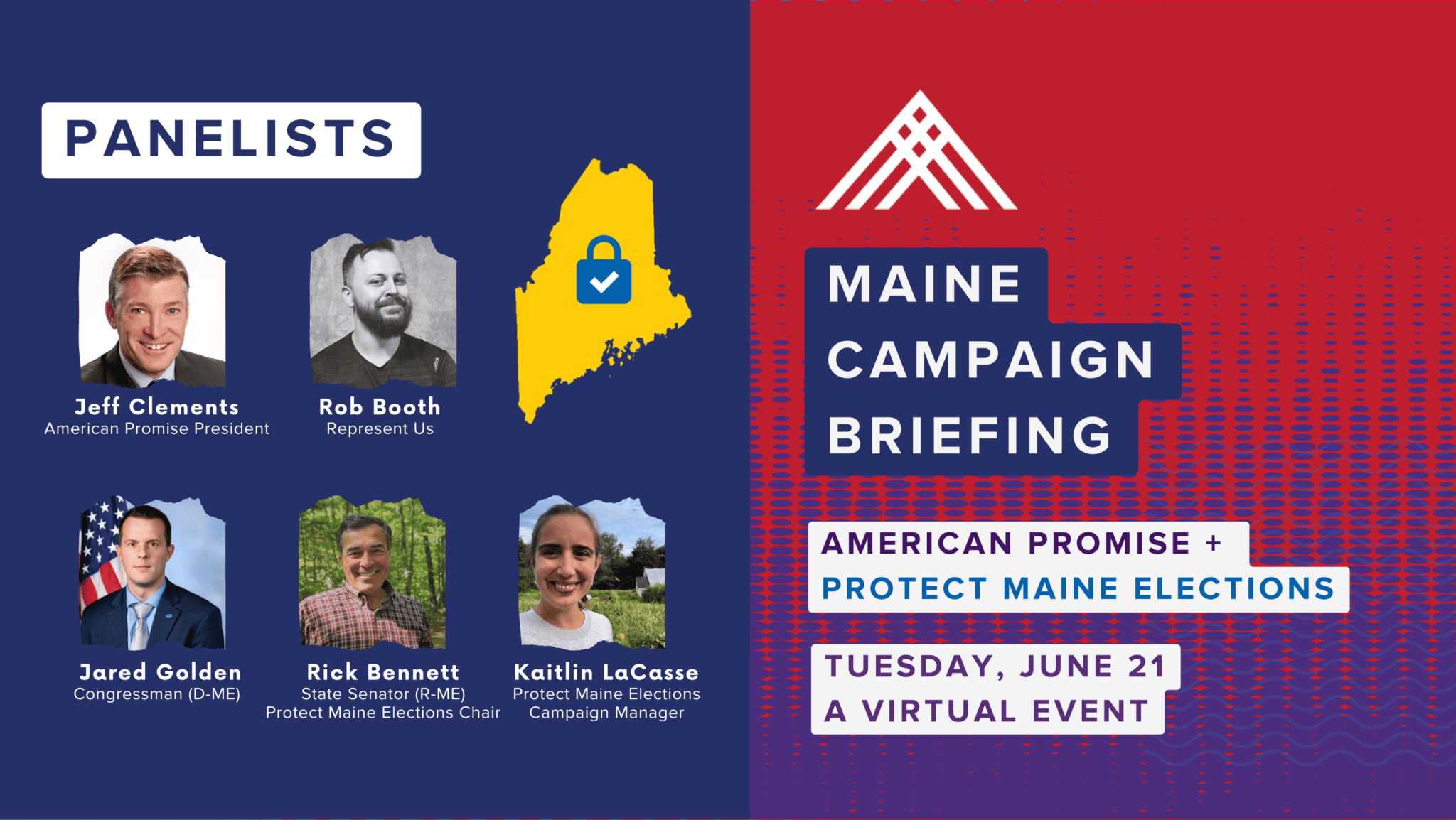

Examining Maines Inaugural Post Election Audit

May 02, 2025

Examining Maines Inaugural Post Election Audit

May 02, 2025 -

Post Election Audit Pilot Program Begins In Maine

May 02, 2025

Post Election Audit Pilot Program Begins In Maine

May 02, 2025 -

South Carolina Elections Public Trust Soars To 93

May 02, 2025

South Carolina Elections Public Trust Soars To 93

May 02, 2025