XRP Up 400% In Three Months: Is It Time To Invest? Risks And Rewards.

Table of Contents

The Allure of XRP's 400% Surge: Understanding the Price Increase

XRP's recent price explosion is a complex phenomenon driven by several converging factors. While pinpointing the exact cause is impossible, several key elements likely contributed to this significant growth.

-

Increased Trading Volume: A surge in trading activity indicates growing interest and demand for XRP, pushing the price higher. Increased trading volume often signals a belief in future price appreciation.

-

Positive Regulatory Developments (or lack of negative news): While the Ripple lawsuit continues, the absence of significantly negative legal news has potentially eased investor concerns, allowing the price to rise. Any positive developments in the lawsuit could further fuel XRP's price.

-

Growing Interest in Blockchain Technology: The broader adoption and growing interest in blockchain technology are contributing to a more positive overall sentiment towards cryptocurrencies, including XRP.

-

Speculative Trading and Market Hype: The rapid price increase itself can create a self-fulfilling prophecy. Speculative trading, driven by fear of missing out (FOMO), can amplify price fluctuations.

Bullet Points Summarizing Contributing Factors:

- Increased institutional adoption of XRP.

- Positive Ripple lawsuit developments (or lack of negative ones).

- Growing interest in blockchain technology and its applications.

- Speculative trading and market hype.

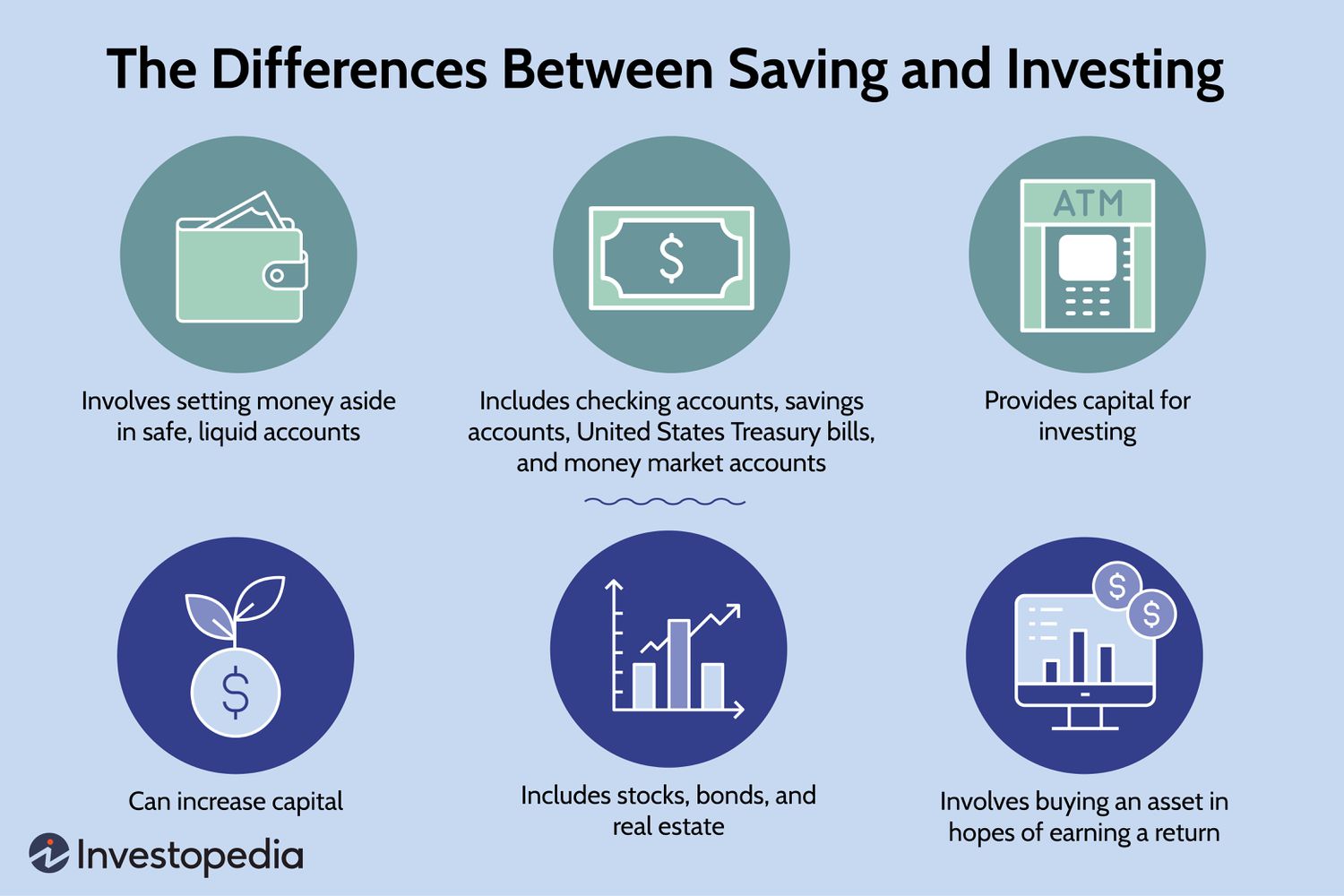

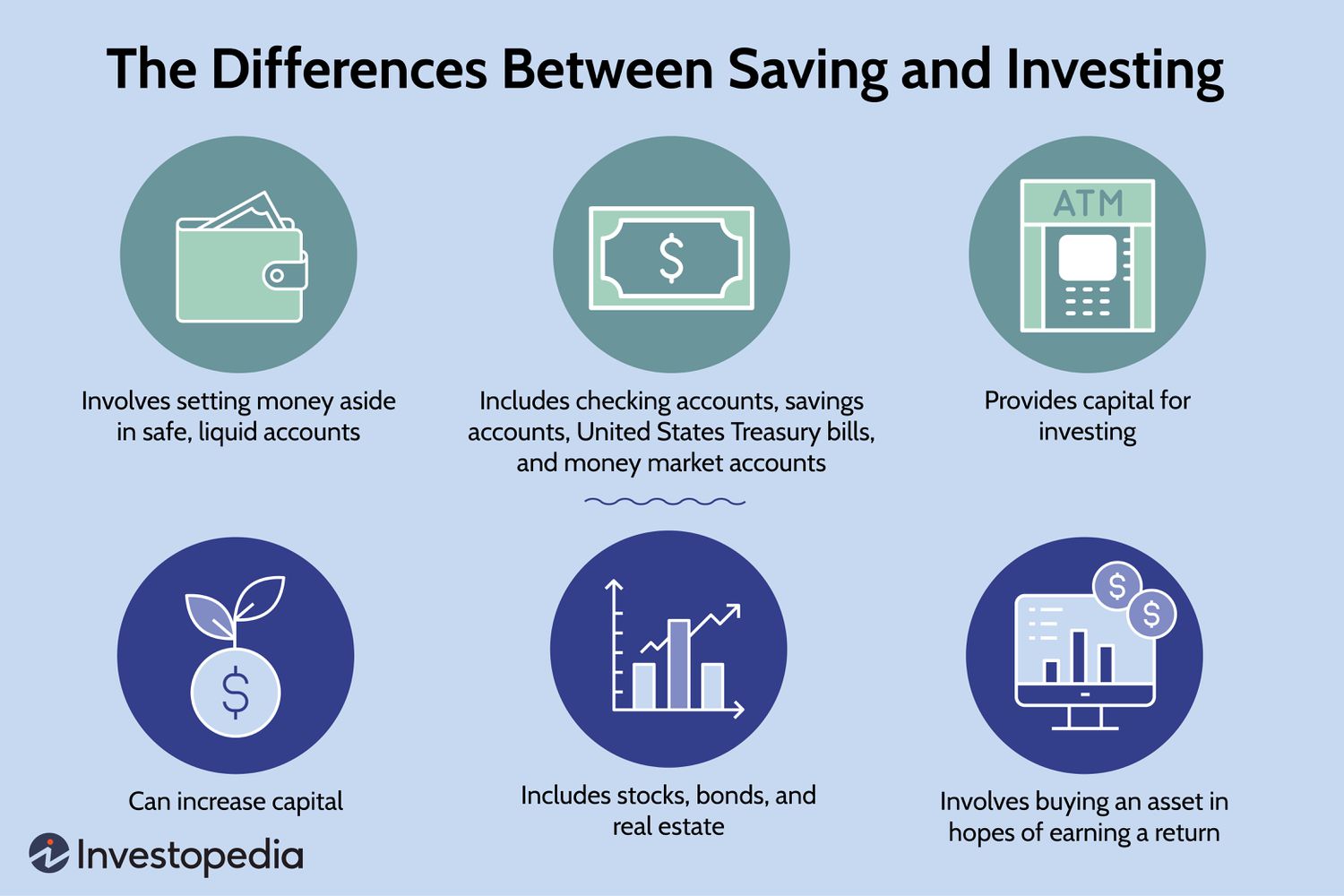

Analyzing the Potential Rewards of XRP Investment

The potential for high returns on XRP investment is undeniable, particularly given its volatile nature. A further price appreciation is possible, fueled by:

-

Continued Market Growth: The overall growth of the cryptocurrency market could lift XRP along with other digital assets.

-

Increased Adoption: Wider adoption of XRP by financial institutions and businesses could significantly boost its value.

Bullet Points Highlighting Potential Rewards:

- High potential for ROI (Return on Investment).

- Relatively low initial investment threshold compared to other assets.

- Diversification benefits within a broader cryptocurrency portfolio.

- Potential for significant long-term growth in the evolving crypto market.

Unveiling the Risks of Investing in XRP

Despite the allure of high returns, investing in XRP carries substantial risks. The cryptocurrency market is notoriously volatile, and XRP is no exception.

-

High Volatility and Price Fluctuations: XRP's price can experience dramatic swings in short periods, leading to significant losses.

-

Regulatory Uncertainty and Legal Risks: The ongoing Ripple lawsuit creates considerable uncertainty regarding XRP's future regulatory status. An unfavorable ruling could severely impact its price.

-

Security Risks: Cryptocurrency exchanges are vulnerable to hacking and security breaches, posing risks to investors' funds.

-

Market Manipulation and Scams: The cryptocurrency market is susceptible to manipulation and fraudulent activities, potentially leading to significant financial losses.

Bullet Points Summarizing the Risks:

- High volatility and unpredictable price swings.

- Regulatory uncertainty and potential negative outcomes from the Ripple lawsuit.

- Security risks associated with cryptocurrency exchanges and wallets.

- Potential for market manipulation and fraudulent schemes.

Due Diligence Before Investing in XRP: Essential Steps

Before investing in XRP or any other cryptocurrency, thorough research and a realistic risk assessment are crucial.

-

Research XRP Technology and Ripple's Business Model: Understand the underlying technology and the company behind XRP to make an informed investment decision.

-

Understand Your Risk Tolerance: Assess how much risk you're comfortable taking. Investing in cryptocurrencies involves the potential for significant losses.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can mitigate risk.

-

Only Invest What You Can Afford to Lose: Never invest more than you can comfortably afford to lose. Cryptocurrency investments are highly speculative.

Bullet Points Summarizing Essential Steps:

- Thoroughly research XRP and Ripple.

- Understand your personal risk tolerance.

- Diversify your investment portfolio.

- Invest only what you can afford to lose.

- Use secure and reputable cryptocurrency exchanges.

Conclusion: Should You Invest in XRP? Weighing the Risks and Rewards

XRP's recent price surge presents both exciting opportunities and significant risks. The potential for high ROI is undeniable, but the volatility, regulatory uncertainty, and inherent risks of the cryptocurrency market cannot be ignored. Before considering XRP investment, conduct thorough research, assess your risk tolerance, and consider consulting a financial advisor. Is XRP investment right for you? Make an informed decision about XRP investing by carefully weighing the potential rewards against the substantial risks involved. Learn more about the risks and rewards of XRP investment before you invest.

Featured Posts

-

Analyzing Scholar Rocks Stock Performance The Monday Dip Explained

May 08, 2025

Analyzing Scholar Rocks Stock Performance The Monday Dip Explained

May 08, 2025 -

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025 -

Analiza E Lojes Si Psg Arriti Fitoren Minimale Ne Pjesen E Pare

May 08, 2025

Analiza E Lojes Si Psg Arriti Fitoren Minimale Ne Pjesen E Pare

May 08, 2025 -

Corruption In Ukraines Cemeteries Officials Profiting From Fallen Soldiers

May 08, 2025

Corruption In Ukraines Cemeteries Officials Profiting From Fallen Soldiers

May 08, 2025 -

Official Lotto And Lotto Plus Results Saturday 12th April 2025

May 08, 2025

Official Lotto And Lotto Plus Results Saturday 12th April 2025

May 08, 2025

Latest Posts

-

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025 -

Jayson Tatums Bone Bruise Will He Play In Game 2

May 08, 2025

Jayson Tatums Bone Bruise Will He Play In Game 2

May 08, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 08, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 08, 2025 -

Boston Celtics Head Coach Gives Injury Update On Jayson Tatum

May 08, 2025

Boston Celtics Head Coach Gives Injury Update On Jayson Tatum

May 08, 2025 -

Claiming Back Overpaid Universal Credit A Step By Step Guide

May 08, 2025

Claiming Back Overpaid Universal Credit A Step By Step Guide

May 08, 2025