XRP's Future: SEC's Potential Commodity Designation And Ripple's Settlement

Table of Contents

Ripple's Partial Settlement with the SEC: A Turning Point for XRP?

The settlement between Ripple and the SEC, while not a complete victory for either side, has undeniably shifted the landscape for XRP. It represents a significant development in the ongoing regulatory uncertainty surrounding cryptocurrencies.

Key Terms of the Settlement:

The settlement agreement involved a substantial payment from Ripple to the SEC, but crucially, Ripple did not admit guilt. This nuanced outcome leaves the door open for future legal interpretations and sets a precedent for other cryptocurrency companies facing similar regulatory scrutiny. The agreement also outlines Ripple’s commitment to enhanced regulatory compliance moving forward.

- No admission of guilt: This prevents a damaging legal precedent being set against Ripple.

- Significant financial payment: The substantial payment to the SEC represents a significant cost but potentially avoids more extensive legal battles.

- Future regulatory compliance: Ripple committed to improved internal controls and compliance measures to prevent future regulatory issues.

Market Reaction to the Settlement:

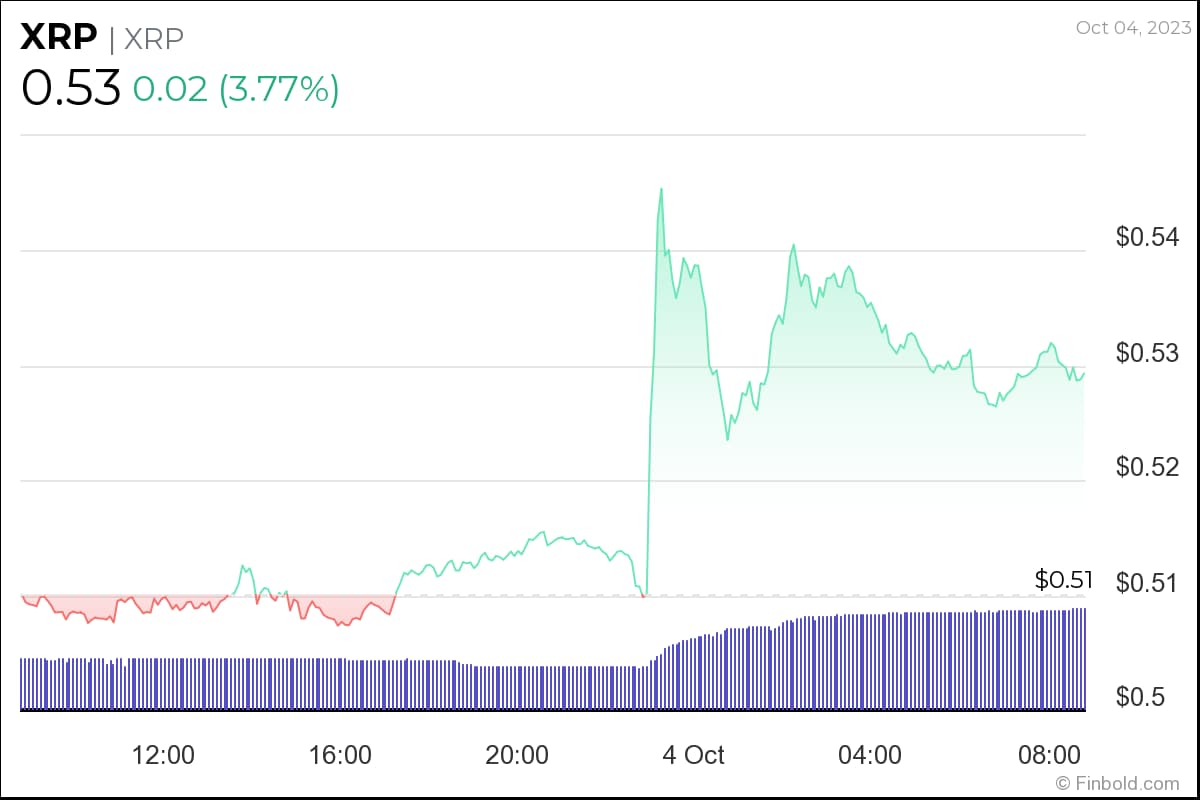

The market reacted swiftly to the settlement news. Initially, XRP experienced a significant price surge, reflecting investor relief. However, the price has since consolidated, indicating ongoing uncertainty regarding the long-term implications of the ruling.

- Pre-settlement: XRP price showed significant volatility, heavily influenced by the ongoing lawsuit.

- During settlement announcement: A sharp, positive price spike occurred.

- Post-settlement: The price stabilized, but continues to be sensitive to market sentiment and news related to the SEC's stance on crypto regulation. (Include chart/graph here if possible)

Long-Term Implications of the Settlement:

The long-term effects of the settlement remain to be seen. While it removes the immediate threat of a complete shutdown, the uncertainty around XRP's classification as a security or commodity continues to impact its price and adoption.

- Increased regulatory clarity (potentially): The settlement might spur further regulatory clarity within the broader crypto space.

- Increased institutional adoption (potentially): A clearer regulatory path could encourage increased institutional adoption of XRP.

- Continued price volatility: Regulatory uncertainty is likely to persist, resulting in continued price volatility.

The SEC's Stance on Cryptocurrencies and the Potential for Commodity Designation of XRP

The SEC's stance on cryptocurrencies, particularly its application of the Howey Test, is crucial to understanding the potential future of XRP.

Understanding the SEC's Definition of a Security:

The Howey Test is the primary legal framework the SEC uses to determine whether an asset qualifies as a security. It considers whether an investment involves an investment of money in a common enterprise with an expectation of profits solely from the efforts of others.

- Investment of Money: Did the investor put money into the venture?

- Common Enterprise: Was there a common investment scheme?

- Expectation of Profits: Did the investor expect to profit from the venture?

- Solely from the Efforts of Others: Were profits dependent on the efforts of others (promoter, issuer)?

Arguments for and Against XRP as a Commodity:

The debate surrounding XRP's classification highlights the complexities of defining digital assets within existing regulatory frameworks.

Arguments for Commodity Classification:

- Decentralized nature: XRP operates on a decentralized ledger, reducing reliance on a central authority.

- Utility as a payment token: XRP functions as a payment facilitator within the RippleNet network.

Arguments against Commodity Classification:

- Centralized development initially: XRP's initial development was centralized under Ripple's control.

- Potential for price manipulation: Concerns exist regarding the possibility of price manipulation due to Ripple's significant XRP holdings.

The Ripple Effect on Other Cryptocurrencies:

The SEC's decision on XRP will have a ripple effect (pun intended) across the broader cryptocurrency market. A ruling that designates XRP as a security could lead to stricter regulation of other similar digital assets. Conversely, a commodity classification could set a precedent for other cryptocurrencies seeking similar legal status.

The Future of XRP: Predictions and Investment Strategies

Predicting the future price of any cryptocurrency is inherently speculative. However, considering the current situation, some analysts offer potential scenarios.

Price Predictions and Market Analysis:

Numerous sources offer XRP price predictions, ranging from cautiously optimistic to significantly bearish. These projections are based on various factors, including regulatory developments, market sentiment, and adoption rates. (Include bullet points summarizing different predictions and their sources, emphasizing the speculative nature of such predictions)

Risk Assessment for XRP Investments:

Investing in XRP carries significant risks. The regulatory uncertainty alone makes it a high-risk investment.

- Regulatory changes: Further regulatory actions could negatively impact XRP's price and usability.

- Market volatility: The cryptocurrency market is highly volatile, leading to potential substantial losses.

- Competition from other cryptocurrencies: The competitive landscape of the crypto market is constantly evolving.

Diversification and Responsible Investing:

It's crucial to remember that diversification is key in any investment portfolio, especially within the high-risk cryptocurrency market. Only invest what you can afford to lose and conduct thorough research before making any investment decisions.

Conclusion: XRP's Path Forward – Navigating the Regulatory Landscape

The Ripple settlement represents a pivotal moment for XRP, but it doesn't resolve all the uncertainties surrounding its future. The potential for a commodity designation, coupled with the ongoing complexities of cryptocurrency regulation, creates a challenging environment for investors. The SEC's stance on digital assets and their classification will significantly impact the long-term trajectory of XRP and the broader crypto landscape. Conduct thorough research, understand the inherent risks, and carefully consider your investment strategy before engaging with XRP investment. Stay informed about ongoing regulatory developments surrounding XRP, SEC cryptocurrency regulation, and potential changes in XRP price prediction.

Featured Posts

-

De Komst Van Het Verdeelstation In Oostwold Een Onherroepelijk Besluit

May 01, 2025

De Komst Van Het Verdeelstation In Oostwold Een Onherroepelijk Besluit

May 01, 2025 -

Priscilla Pointer Dalla Actress And Sf Actor Workshop Co Founder Dies At 100

May 01, 2025

Priscilla Pointer Dalla Actress And Sf Actor Workshop Co Founder Dies At 100

May 01, 2025 -

Rugby World Cup Tongas Upset Victory Over Si

May 01, 2025

Rugby World Cup Tongas Upset Victory Over Si

May 01, 2025 -

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025 -

Ripple Secures Dubai License Impact On Xrp Price And 10 Target

May 01, 2025

Ripple Secures Dubai License Impact On Xrp Price And 10 Target

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025