XRP's Trajectory: ETF Prospects, SEC Scrutiny, And Ripple's Next Chapter

Table of Contents

The SEC Lawsuit and its Impact on XRP's Price and Adoption

The SEC lawsuit against Ripple Labs has significantly impacted XRP's price and adoption. Understanding the core allegations, Ripple's defense, and the broader implications for the crypto industry is crucial for assessing XRP's future.

The Core Allegations and Ripple's Defense

The SEC alleges that Ripple conducted an unregistered securities offering of XRP, arguing that XRP functioned as an investment contract. They claim Ripple sold XRP to raise capital, expecting profits based on the efforts of Ripple Labs. Ripple counters that XRP is a decentralized digital asset, not a security, and that its sales were not subject to SEC registration requirements. They point to XRP's use in facilitating cross-border payments on the XRP Ledger as evidence of its utility and decentralized nature. The lawsuit's impact on XRP's price has been significant, causing periods of high volatility depending on court developments and pronouncements. Key court decisions, such as summary judgment rulings on certain aspects of the case, have directly influenced market sentiment and price action.

The Broader Implications for the Crypto Industry

The Ripple case sets a critical precedent for the entire cryptocurrency industry. The SEC's arguments, if successful, could significantly impact how other crypto projects are regulated, potentially leading to increased scrutiny and limitations on fundraising and trading activities. The regulatory uncertainty stemming from this case has created a chilling effect, impacting investor confidence and market sentiment within the broader cryptocurrency market. The outcome will influence how other cryptocurrencies, particularly those with similar structures to XRP, are categorized and regulated.

- Key legal arguments from both sides: The SEC focuses on the Howey Test to define XRP as a security, while Ripple emphasizes XRP's decentralized nature and utility.

- Timeline of significant events: The lawsuit's filing, key motions, summary judgment rulings, and any potential settlement negotiations are important milestones.

- Expert opinions on the potential outcome: Legal experts and crypto analysts offer diverse predictions, influencing market sentiment.

XRP ETF Prospects: A Catalyst for Growth or a Distant Dream?

The potential listing of an XRP ETF is a highly debated topic. While an ETF could significantly boost XRP's liquidity and accessibility, numerous regulatory hurdles remain.

The Appeal of an XRP ETF

An XRP ETF would offer several advantages: increased liquidity, making it easier to buy and sell XRP; greater accessibility to institutional investors, potentially driving demand; and the potential for increased price stability due to increased trading volume. Comparing XRP's ETF prospects to other crypto ETFs already approved or in the pipeline (such as Bitcoin or Ethereum ETFs) highlights the challenges and potential successes. The price impact of an approved XRP ETF listing could be substantial, potentially leading to a significant surge in its value.

Regulatory Hurdles to ETF Approval

The SEC's main concern revolves around XRP's classification as a security. Meeting SEC requirements for ETF listing – proving sufficient market surveillance, demonstrating regulatory compliance, and addressing concerns around manipulation – poses substantial challenges. Potential pathways to approval could involve a settlement with the SEC, or a shift in regulatory policy that clarifies the classification of cryptocurrencies.

- Potential ETF providers: Major asset managers and financial institutions are potential candidates for creating and managing an XRP ETF.

- Timeline of potential ETF application and approval processes: The process could take months or even years, depending on regulatory review and court decisions.

- Market sentiment towards an XRP ETF: Investor interest and expectations surrounding an XRP ETF greatly influence its potential success.

Ripple's Strategic Moves and Future Plans for XRP

Ripple's ongoing technological development, strategic partnerships, and community engagement play crucial roles in shaping XRP's future.

Technological Developments and Partnerships

Ripple continues to invest in the XRP Ledger, improving its scalability, efficiency, and overall functionality. Strategic partnerships with financial institutions allow Ripple to expand the practical use cases for XRP in cross-border payments and other financial transactions, strengthening XRP's utility and adoption.

Community Engagement and Advocacy

Ripple actively engages with the XRP community through various channels, fostering loyalty and advocacy. Their lobbying efforts influence cryptocurrency regulation, aiming to create a more favorable environment for XRP and other digital assets. Strong community support can contribute significantly to XRP's long-term viability and success.

- Recent announcements and press releases: Ripple's public communications highlight their progress and vision.

- Key partnerships and collaborations: Strategic alliances with banks and fintech companies broaden XRP's reach.

- Community engagement initiatives: Ripple's efforts to support and inform its community are vital for building confidence.

Conclusion

XRP's future remains intertwined with the SEC lawsuit's outcome and the prospect of ETF approval. Ripple's strategic actions and the broader regulatory environment will significantly shape XRP's trajectory. While uncertainty persists, understanding the interplay between legal battles, technological advancements, and regulatory developments is crucial. Stay updated on the latest XRP news and developments to make informed decisions about this dynamic digital asset. Further research into XRP's price action, regulatory updates, and technological advancements will be vital for navigating the complex world of cryptocurrency investments.

Featured Posts

-

Xrp Ripple Below 3 Investment Opportunities And Risks

May 02, 2025

Xrp Ripple Below 3 Investment Opportunities And Risks

May 02, 2025 -

I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Analytiki Paroysiasi

May 02, 2025

I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Analytiki Paroysiasi

May 02, 2025 -

April 4th Your Quick Guide To Pasifika Sipoti

May 02, 2025

April 4th Your Quick Guide To Pasifika Sipoti

May 02, 2025 -

Classic Play Station Themes Resurface On The Ps 5

May 02, 2025

Classic Play Station Themes Resurface On The Ps 5

May 02, 2025 -

Bio Based Basisschool Afhankelijk Van Dieselgeneratoren

May 02, 2025

Bio Based Basisschool Afhankelijk Van Dieselgeneratoren

May 02, 2025

Latest Posts

-

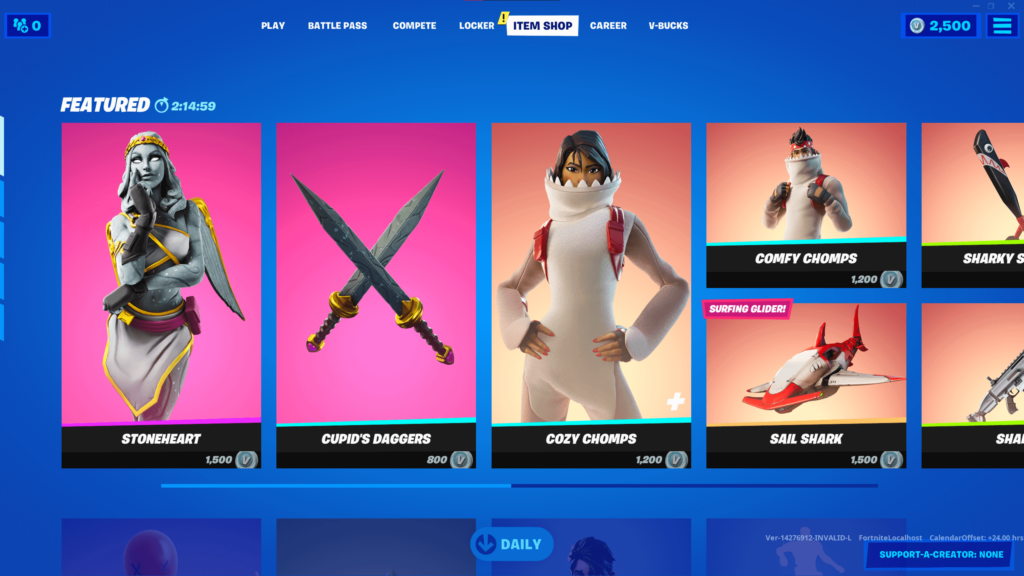

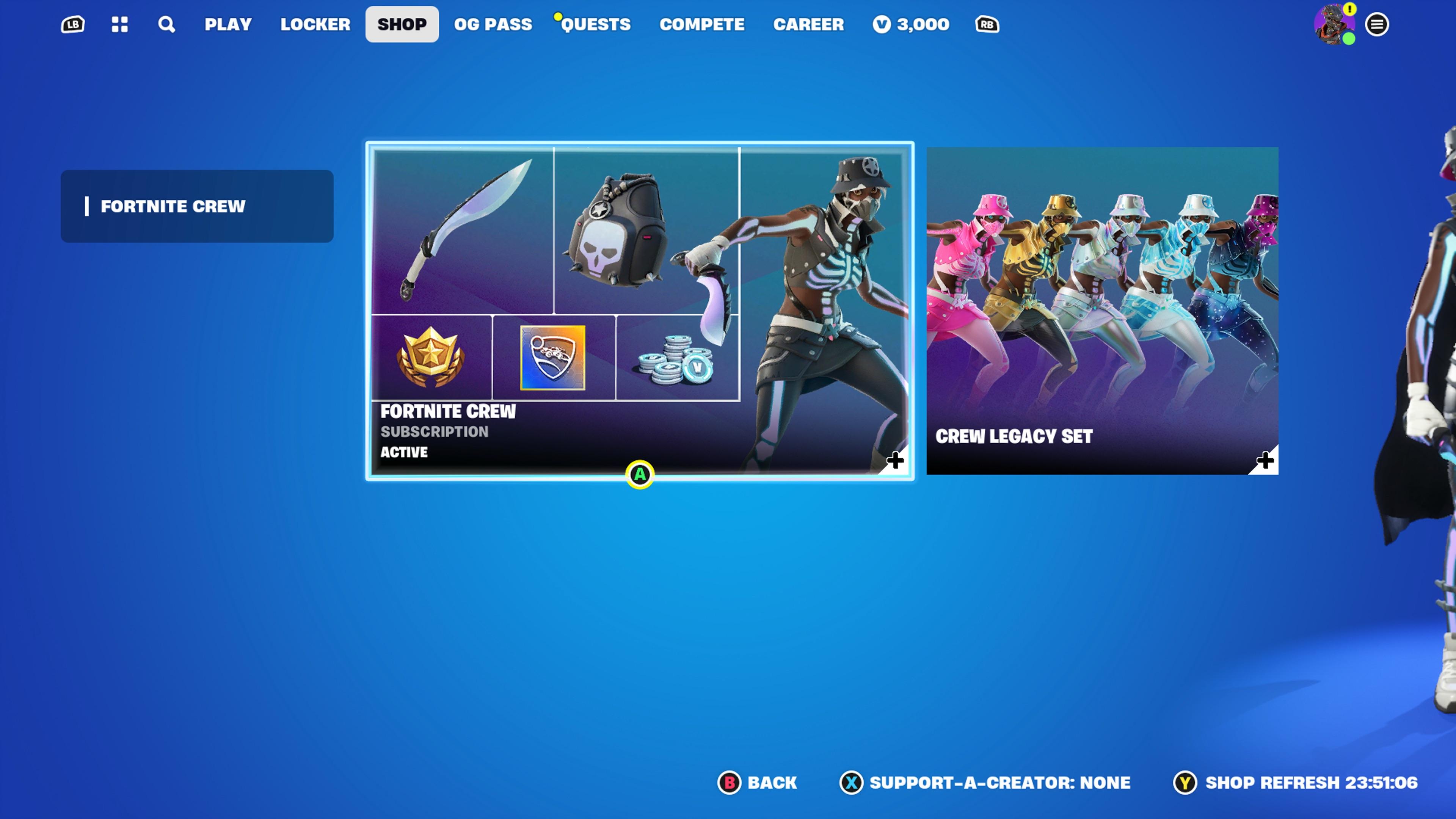

Improved Navigation Fortnite Item Shops New Feature

May 02, 2025

Improved Navigation Fortnite Item Shops New Feature

May 02, 2025 -

Fortnites Backward Music Update Player Backlash

May 02, 2025

Fortnites Backward Music Update Player Backlash

May 02, 2025 -

Fortnite Gets A Helpful Item Shop Upgrade

May 02, 2025

Fortnite Gets A Helpful Item Shop Upgrade

May 02, 2025 -

Fortnite Players Revolt Over Backward Music Change

May 02, 2025

Fortnite Players Revolt Over Backward Music Change

May 02, 2025 -

New Fortnite Item Shop Feature Makes Shopping Easier

May 02, 2025

New Fortnite Item Shop Feature Makes Shopping Easier

May 02, 2025