X's Debt Sale: A Deep Dive Into The New Financial Landscape

Table of Contents

The Genesis of X's Debt Sale

Background on X's Financial Situation

Prior to the debt sale, X's financial health was characterized by a significant accumulation of debt. Several factors contributed to this situation:

- Aggressive Expansion: X's ambitious expansion strategy, involving multiple acquisitions and market entry into new territories, placed considerable strain on its financial resources, leading to increased borrowing.

- Market Downturn: A recent economic downturn significantly impacted X's revenue streams, reducing profitability and making it harder to service existing debt obligations.

- Increased Operating Costs: Rising operational costs, including raw material prices and labor expenses, also contributed to the company's financial difficulties.

Key financial indicators reflected this precarious situation:

- High Debt-to-Equity Ratio: X's debt-to-equity ratio far exceeded industry averages, indicating a high level of financial leverage and increased vulnerability to market fluctuations.

- Declining Credit Rating: Credit rating agencies downgraded X's credit rating, signaling increased risk to lenders and making future financing more challenging.

- Missed Interest Payments: X experienced difficulties in making timely interest payments on its outstanding debt, further exacerbating its financial woes.

The Decision to Sell Debt

Faced with mounting financial pressures, X made the strategic decision to sell a significant portion of its debt. This was largely a reactive measure to avoid potential bankruptcy or financial distress.

The benefits of this decision included:

- Improved Balance Sheet: The debt sale significantly reduced X's debt burden, strengthening its balance sheet and improving its overall financial position.

- Reduced Interest Payments: By shedding a portion of its debt, X lowered its interest expense, freeing up cash flow for operational needs and future investments.

- Access to Capital: The sale provided X with additional capital, potentially enabling the company to pursue restructuring initiatives and implement necessary cost-cutting measures.

However, the sale also came with drawbacks:

- Loss of Control: The new debt holders may have gained significant influence over X's operational decisions and strategic direction.

- Negative Market Perception: The debt sale could be viewed negatively by some investors and stakeholders, raising concerns about X's long-term viability.

The Sale Process and Key Players

Identifying the Buyers

X's debt was primarily acquired by a consortium of hedge funds and private equity firms. These investors were attracted by:

- Potential for High Returns: They saw an opportunity to generate substantial returns through debt restructuring and potential future equity participation.

- Restructuring Opportunities: The buyers aimed to restructure X's operations, improving efficiency and profitability to maximize their investment.

The bidding process was highly competitive, resulting in a final sale price that reflected the perceived risk and potential rewards associated with the investment.

The Role of Advisors and Legal Counsel

Facilitating this complex transaction required the expertise of several key players:

- Investment Banks: Leading investment banks provided financial advisory services, managing the sale process and ensuring optimal pricing.

- Legal Firms: Specialized legal firms handled the intricate legal aspects of the transaction, ensuring compliance with all relevant regulations.

- Accounting Firms: Independent accounting firms conducted thorough due diligence, verifying the accuracy of X's financial statements and other relevant information.

The meticulous due diligence and legal compliance were critical to ensure the smooth execution of the debt sale.

Implications and Future Outlook

Impact on X's Financial Health

The debt sale has had a significant impact on X's financial health:

- Short-Term Benefits: X immediately benefited from reduced debt levels and interest payments, improving its short-term liquidity and financial flexibility.

- Long-Term Uncertainty: The long-term impact remains uncertain, depending on X's ability to implement successful restructuring initiatives and regain investor confidence.

- Credit Rating Improvement (Potential): The reduction in debt could lead to an eventual improvement in X's credit rating, facilitating access to future financing.

X's operational strategies and growth plans will need to be carefully aligned with its revised financial position.

Broader Market Implications

The X's debt sale has broader implications for the market:

- Investor Confidence: The success or failure of the restructuring will significantly impact investor confidence in similar distressed companies.

- Market Sentiment: The event could influence market sentiment towards high-yield debt instruments and the overall credit market.

- Ripple Effects: The sale might trigger similar debt restructuring initiatives in other companies facing financial challenges.

- Investment Strategies: Investors may adjust their investment strategies in light of the events surrounding X's debt sale, potentially focusing on distressed debt opportunities or seeking alternative investment avenues.

Conclusion

The sale of X's debt marks a significant turning point, not only for the company itself but also for the broader financial landscape. Understanding the intricacies of this transaction, from its underlying causes to its far-reaching consequences, is crucial for investors and businesses alike. By analyzing the key players, the sale process, and the potential future implications, we can gain valuable insights into the evolving dynamics of corporate debt and financial restructuring. Staying informed about future developments in the aftermath of this significant X's Debt Sale is essential for navigating the shifting sands of the financial world. Further research into the long-term impact of such large-scale debt sales will be vital for informed decision-making. Keep abreast of developments related to X's debt restructuring and X's financial recovery for a complete picture of the evolving situation.

Featured Posts

-

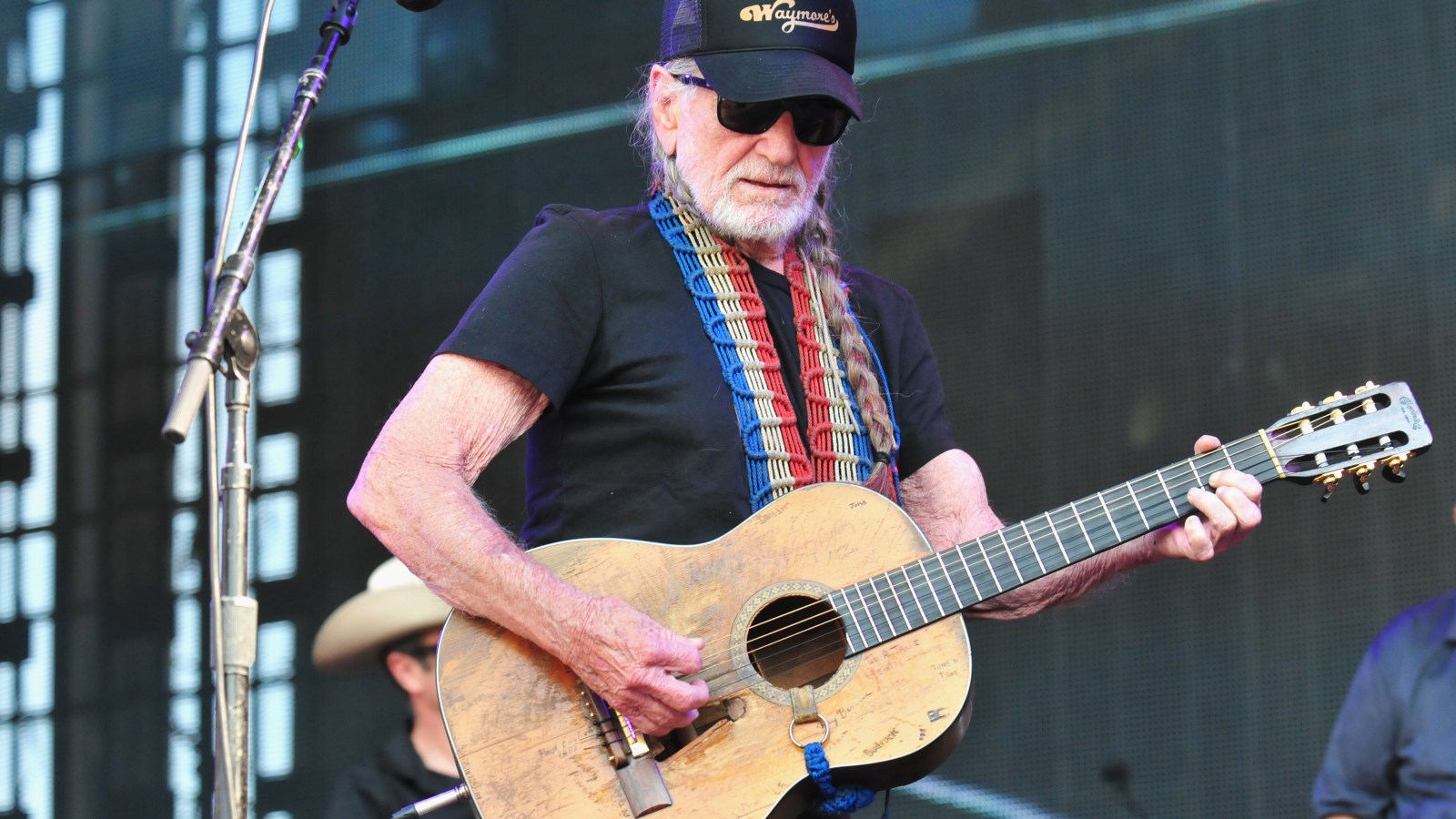

Willie Nelsons New Documentary Honors His Longtime Roadie

Apr 29, 2025

Willie Nelsons New Documentary Honors His Longtime Roadie

Apr 29, 2025 -

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025 -

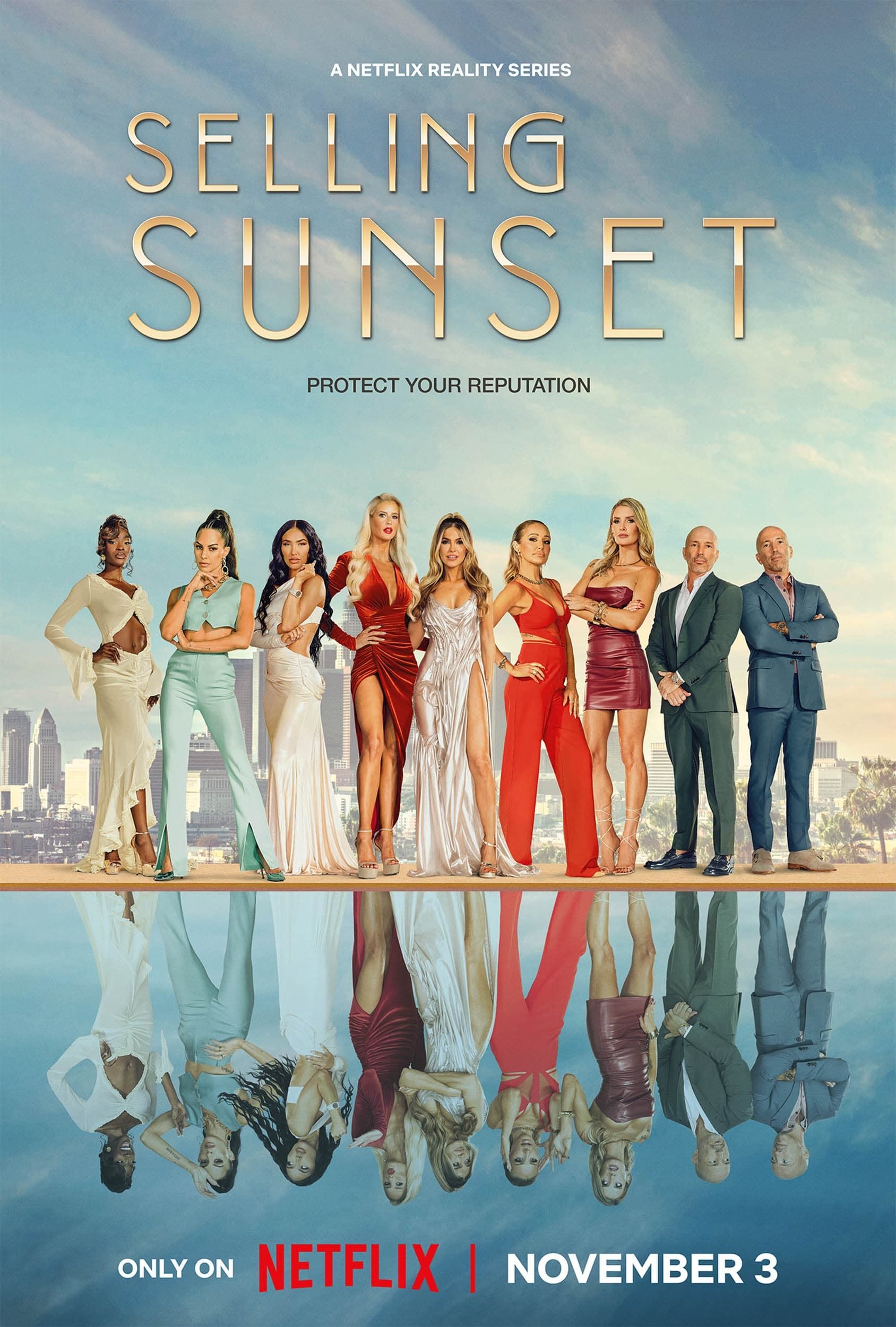

Increased Rent In La After Fires A Selling Sunset Star Highlights Price Gouging

Apr 29, 2025

Increased Rent In La After Fires A Selling Sunset Star Highlights Price Gouging

Apr 29, 2025 -

Legal Showdown Us Attorney General And Minnesota Clash Over Transgender Athlete Policy

Apr 29, 2025

Legal Showdown Us Attorney General And Minnesota Clash Over Transgender Athlete Policy

Apr 29, 2025 -

Blue Origins Subsystem Malfunction Leads To Launch Cancellation

Apr 29, 2025

Blue Origins Subsystem Malfunction Leads To Launch Cancellation

Apr 29, 2025

Latest Posts

-

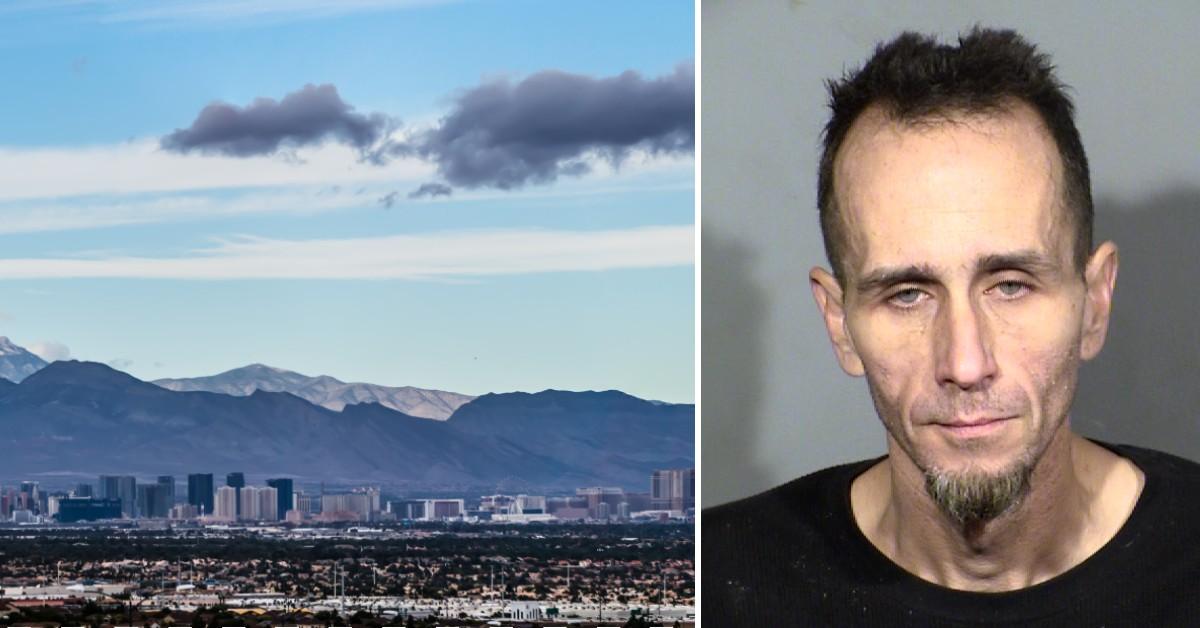

Update British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025

Update British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025 -

Sam Ruddock Missing British Paralympians Disappearance In Las Vegas

Apr 29, 2025

Sam Ruddock Missing British Paralympians Disappearance In Las Vegas

Apr 29, 2025 -

Lietuvos Porsche Rinkos Augimas 2024 Metu Rezultatai

Apr 29, 2025

Lietuvos Porsche Rinkos Augimas 2024 Metu Rezultatai

Apr 29, 2025 -

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025 -

Missing Person British Paralympian Sam Ruddock Vanishes In Las Vegas

Apr 29, 2025

Missing Person British Paralympian Sam Ruddock Vanishes In Las Vegas

Apr 29, 2025