Your Place In The Sun Awaits: Navigating The International Property Market

Table of Contents

Researching Your Ideal International Property Location

Before diving into the exciting world of property viewings, thorough research is paramount. This crucial initial step sets the stage for a successful international property investment.

Understanding Your Needs and Preferences

Before you even start browsing online property portals, it’s vital to define your needs and preferences. Consider these key aspects:

- Lifestyle: Do you envision a bustling city life or a peaceful rural retreat? Think about proximity to amenities like shops, restaurants, and entertainment venues.

- Climate: Are you seeking year-round sunshine or a location with distinct seasons? Climate significantly impacts your enjoyment of the property and its potential rental value.

- Budget: Establishing a realistic budget is non-negotiable. This includes not just the property purchase price but also associated costs like legal fees, taxes, and ongoing maintenance.

- Investment Goals: Are you looking for a holiday home, a long-term rental investment, or a combination of both? This influences your property choice and location strategy.

Furthermore, it's crucial to investigate visa requirements for the country you're considering. Research the local healthcare system and transportation links to ensure they align with your expectations. Useful research tools include online property portals like Rightmove, Zoopla (depending on the region), and local expat forums where you can gain valuable insights from those already living in your target location. Don't underestimate the importance of understanding potential tax implications – seek advice from a qualified tax advisor.

Analyzing Market Trends and Potential ROI

Understanding the local market is critical for making smart investment decisions in the international property market.

- Property Price Trends: Analyze historical property price data to identify upward or downward trends in your target location.

- Rental Yields: Research average rental yields to determine the potential rental income from your property. This is vital if you plan to generate rental income.

- Capital Appreciation Potential: Assess the potential for capital appreciation – the increase in the property's value over time. Factors like economic growth and infrastructure development play a significant role.

Utilize resources such as government statistics on property markets, reputable real estate market reports, and local news sources to gain a comprehensive understanding of the economic conditions and future development plans impacting your target area. This thorough due diligence can significantly improve your chances of a profitable investment in the international property market.

Finding and Evaluating International Properties

Once you've defined your ideal location, the next step is to start your property search.

Utilizing Online Resources and Real Estate Agents

The international property market offers a plethora of online resources to facilitate your search:

- Online Property Portals: Many specialized portals list international properties, offering detailed descriptions, photos, and virtual tours.

- Local vs. International Agents: Using a local agent provides in-depth market knowledge, but an international agent can streamline the process if you're unfamiliar with the local language and customs. Weigh the pros and cons carefully.

It's crucial to verify the credentials of any real estate agent you consider. Check online reviews and seek recommendations before engaging their services.

Due Diligence and Legal Considerations

Thorough due diligence is non-negotiable when purchasing property internationally.

- Property Inspections and Surveys: Engage a qualified surveyor to conduct a thorough inspection of the property to identify any potential issues.

- Legal Expertise: Hire a lawyer specializing in international property transactions to review contracts and ensure your interests are protected.

- Local Property Laws: Understanding local property laws and regulations is crucial to avoid unforeseen legal complications. This includes zoning laws, building codes, and inheritance laws.

Financing Your International Property Purchase

Securing financing for an international property purchase requires careful planning and research.

Securing a Mortgage for International Property

Obtaining a mortgage for an overseas property can present unique challenges:

- Mortgage Options: Research mortgage options available to foreign buyers. Availability and terms vary significantly depending on your nationality and the country where you're purchasing.

- Challenges and Considerations: Higher interest rates, stricter lending criteria, and the need for larger deposits are common.

- Comparing Lenders: Compare interest rates and loan terms from different lenders before making a decision.

Exploring Alternative Financing Options

Besides mortgages, other financing options exist:

- Cash Purchases: Buying with cash offers simplicity and avoids mortgage-related complexities but requires significant upfront capital.

- Private Loans: Explore private loan options from family, friends, or private lenders.

- Joint Ventures: Partnering with others can reduce the financial burden and share the risk. Each option has benefits and drawbacks; carefully assess which best aligns with your financial situation.

Completing the International Property Purchase

The final stages of the process require meticulous attention to detail.

Negotiating the Purchase Agreement

A legally sound purchase contract protects your interests:

- Clear Contract: Ensure the contract is clear, concise, and accurately reflects the agreed-upon terms.

- Understanding Clauses: Thoroughly understand all clauses and conditions before signing. Don't hesitate to seek legal advice.

Closing the Deal and Transferring Ownership

The final steps involve:

- Finalizing the Transaction: Complete all necessary paperwork and payments as stipulated in the contract.

- Documentation: Ensure all required documents are in order to avoid delays.

- Transferring Ownership: The process of transferring ownership and registering the property in your name varies by country.

Conclusion

Navigating the international property market requires careful planning, thorough research, and professional guidance. Key steps include researching your ideal location, finding and evaluating properties, securing financing, and completing the purchase. Thorough due diligence, professional advice from lawyers and financial advisors, and careful attention to legal and financial details are paramount. While investing in the international property market offers significant potential rewards, including capital appreciation, rental income, and a lifestyle upgrade, it's crucial to acknowledge the inherent risks. Start your journey towards finding your place in the sun today! Begin your research into the international property market and take the first step towards owning your dream overseas property.

Featured Posts

-

Doctor Whos Future Uncertain Showrunner Hints At Hiatus

May 03, 2025

Doctor Whos Future Uncertain Showrunner Hints At Hiatus

May 03, 2025 -

Manfaat Cangkang Telur Pupuk Alami Dan Suplemen Nutrisi Untuk Tanaman Dan Hewan Peliharaan

May 03, 2025

Manfaat Cangkang Telur Pupuk Alami Dan Suplemen Nutrisi Untuk Tanaman Dan Hewan Peliharaan

May 03, 2025 -

Check The Bbc Two Hd Schedule Newsround Broadcast Times

May 03, 2025

Check The Bbc Two Hd Schedule Newsround Broadcast Times

May 03, 2025 -

Analysis Guido Fawkes Take On Revised Energy Policies

May 03, 2025

Analysis Guido Fawkes Take On Revised Energy Policies

May 03, 2025 -

Nigel Farages Reform Uk Five Threats To Its Future Success

May 03, 2025

Nigel Farages Reform Uk Five Threats To Its Future Success

May 03, 2025

Latest Posts

-

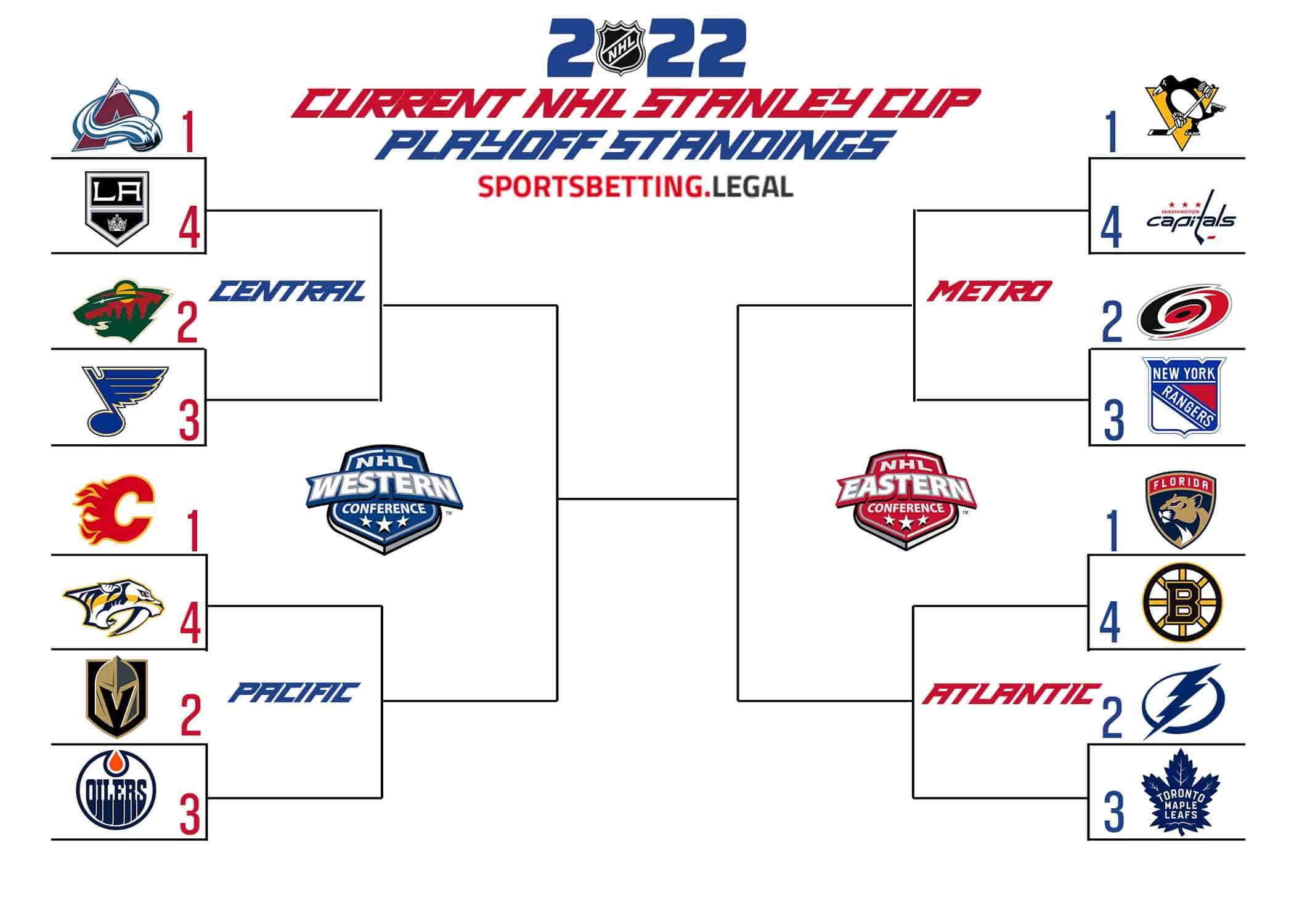

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025

Nhl Playoff Standings Showdown Saturday What To Watch

May 04, 2025 -

2025 Gold Market Potential For Back To Back Weekly Drops

May 04, 2025

2025 Gold Market Potential For Back To Back Weekly Drops

May 04, 2025 -

Is Gold Heading For Consecutive Weekly Losses In 2025

May 04, 2025

Is Gold Heading For Consecutive Weekly Losses In 2025

May 04, 2025 -

Morning Coffee Oilers Canadiens Matchup Game Day Preview

May 04, 2025

Morning Coffee Oilers Canadiens Matchup Game Day Preview

May 04, 2025 -

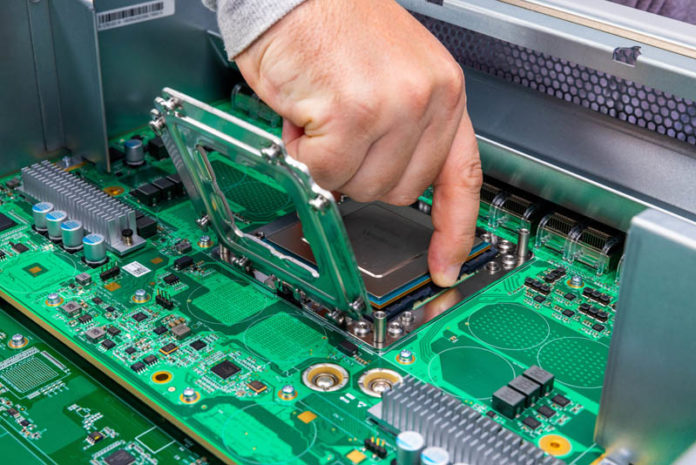

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 04, 2025

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 04, 2025