Your Step-by-Step Guide To Finance Loans: Interest Rates, EMIs, And Loan Tenure

Table of Contents

Understanding Interest Rates in Finance Loans

What are Interest Rates?

Interest rates represent the cost of borrowing money. Lenders charge interest as compensation for the risk they undertake when providing you with a loan. There are two main types of interest rates:

-

Fixed Interest Rates: These remain constant throughout the loan tenure, providing predictability in your monthly payments.

-

Variable Interest Rates: These fluctuate based on market conditions, potentially leading to changes in your EMIs over time.

-

APR (Annual Percentage Rate): This represents the annual cost of borrowing, including interest and other fees. It's crucial to compare APRs when evaluating different loan offers.

-

Compounding Interest: This is when interest accrues not only on the principal loan amount but also on the accumulated interest. Understanding compounding interest is vital, as it significantly impacts the total repayment amount over the loan's life.

The interest rate significantly affects the total amount you repay on your finance loan. For example, a lower interest rate will result in lower overall costs, while a higher interest rate increases the total amount paid over the loan's life.

Factors Affecting Interest Rates

Several factors influence the interest rate you'll receive on a finance loan:

- Credit Score: A higher credit score demonstrates your creditworthiness and typically qualifies you for lower interest rates.

- Loan Amount: Larger loan amounts often carry higher interest rates due to increased risk for the lender.

- Loan Type: Different types of loans (e.g., mortgage, personal loan, business loan) come with varying interest rates depending on the perceived risk.

- Market Conditions: Prevailing economic conditions and central bank policies influence overall interest rate levels.

Borrowers can improve their chances of securing lower interest rates by:

- Improving their credit score: Paying bills on time and maintaining a healthy credit utilization ratio are crucial.

- Making a larger down payment: A larger down payment reduces the loan amount, decreasing the lender's risk and potentially leading to a lower interest rate.

- Shopping around for the best rates: Comparing offers from multiple lenders ensures you find the most competitive interest rate.

Decoding EMIs (Equated Monthly Installments)

What are EMIs?

An EMI is a fixed monthly payment you make towards your loan repayment. Each EMI comprises two parts:

- Principal: The actual amount borrowed.

- Interest: The cost of borrowing the money.

A simple (though not entirely accurate without considering compounding) representation of EMI calculation is: EMI = (P x R x (1+R)^N) / ((1+R)^N-1), where P is the principal loan amount, R is the monthly interest rate (annual interest rate/12), and N is the loan tenure in months.

Consistent EMI payments allow for structured repayment and help borrowers manage their finances more effectively.

Calculating Your EMI

Calculating your EMI can be done using online calculators or financial formulas. Several factors affect your EMI amount:

- Loan Amount: A higher loan amount translates to a higher EMI.

- Interest Rate: A higher interest rate leads to a higher EMI.

- Loan Tenure: A longer loan tenure results in lower EMIs but increases the total interest paid.

Several reputable online EMI calculators are available; simply search for "EMI calculator" online to find one. Varying the loan tenure on these calculators quickly demonstrates the impact on your monthly payment. A longer loan term reduces your monthly payments, but you'll pay more in interest overall. A shorter term increases your monthly payment but reduces the total interest paid.

Choosing the Right Loan Tenure

What is Loan Tenure?

Loan tenure refers to the repayment period of your loan. It's expressed in months or years.

- Tenure, EMIs, and Total Interest: A shorter tenure leads to higher EMIs but lower total interest paid, while a longer tenure results in lower EMIs but higher total interest paid. It's a trade-off between affordability and total cost.

Factors to Consider When Choosing Loan Tenure

Selecting the right loan tenure depends on several factors:

- Affordability: Choose a tenure that allows comfortable EMI payments within your budget.

- Financial Goals: Consider your long-term financial plans and how the loan repayments will affect your other financial goals.

- Risk Tolerance: Shorter tenures carry higher risk due to larger monthly payments, while longer tenures carry the risk of paying significantly more in interest.

Finding the optimal balance involves careful consideration of affordability and minimizing total interest payments. Creating a detailed budget and exploring different tenure options with an EMI calculator is crucial for making an informed decision.

Conclusion

This guide provided a comprehensive overview of the key components of finance loans: interest rates, EMIs, and loan tenure. Understanding these elements is paramount to securing a loan that aligns with your financial capabilities and goals. By carefully considering these factors, you can make informed decisions and choose the best finance loan for your specific needs. Start exploring your finance loan options today! Remember to compare different loan offers and use online tools to calculate EMIs and assess the total cost before committing to a finance loan.

Featured Posts

-

Prakiraan Cuaca Jawa Timur 24 Maret Hujan Lanjut Di Beberapa Daerah

May 28, 2025

Prakiraan Cuaca Jawa Timur 24 Maret Hujan Lanjut Di Beberapa Daerah

May 28, 2025 -

Prakiraan Cuaca Semarang Besok 22 April 2024 Hujan Siang Hari Di Jawa Tengah

May 28, 2025

Prakiraan Cuaca Semarang Besok 22 April 2024 Hujan Siang Hari Di Jawa Tengah

May 28, 2025 -

The Alejandro Garnacho Transfer Atletico Madrid Or Manchester United

May 28, 2025

The Alejandro Garnacho Transfer Atletico Madrid Or Manchester United

May 28, 2025 -

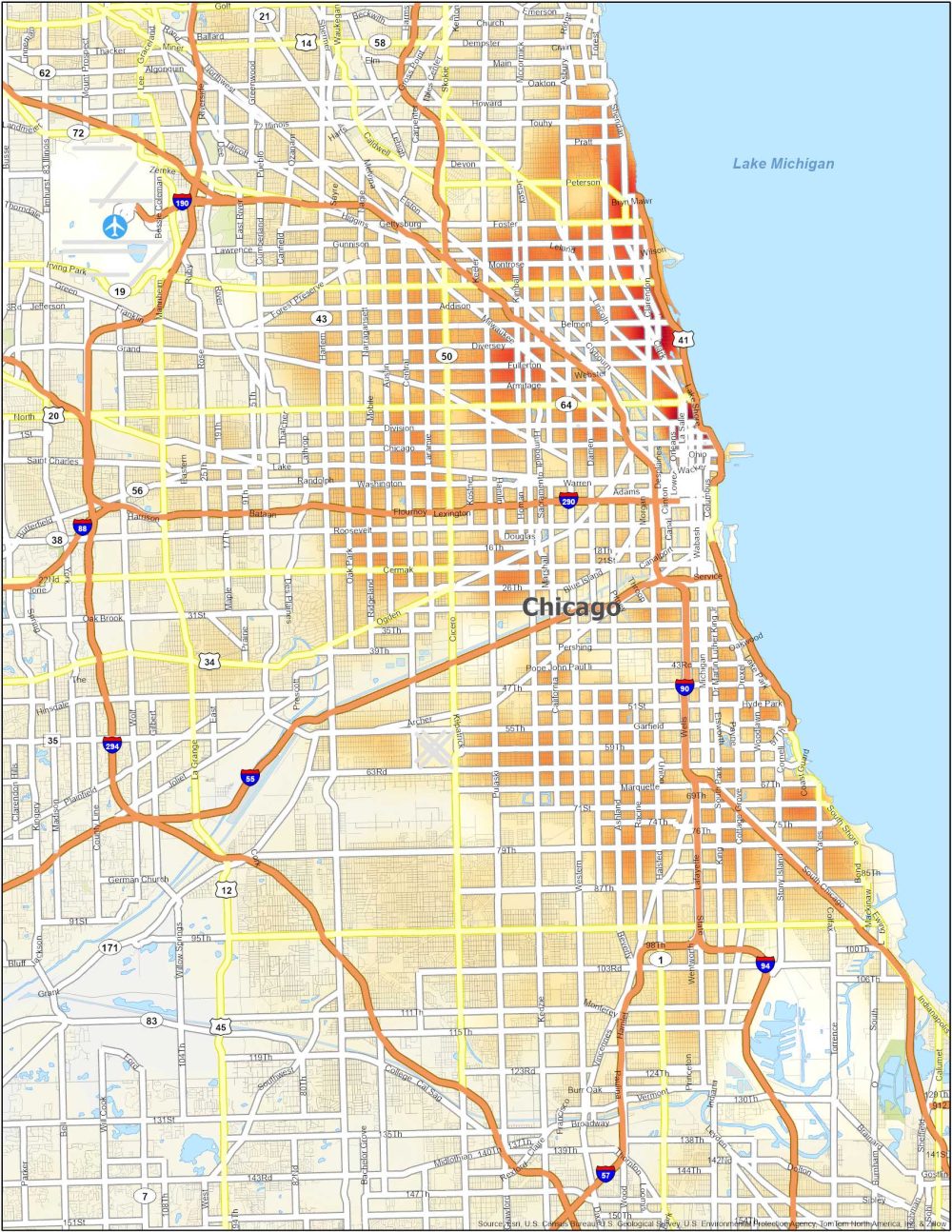

The Unexpected Chicago Crime Dip Analysis And Potential Explanations

May 28, 2025

The Unexpected Chicago Crime Dip Analysis And Potential Explanations

May 28, 2025 -

The Looming Bond Crisis Assessing The Risks And Opportunities

May 28, 2025

The Looming Bond Crisis Assessing The Risks And Opportunities

May 28, 2025