1050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Specific Concerns and the 1050% Claim

AT&T, a major telecommunications company and a significant user of VMware's virtualization technologies, has voiced strong opposition to Broadcom's proposed acquisition. Their core concern revolves around a projected 1050% increase in the cost of specific VMware services. This isn't a hypothetical figure; it's based on AT&T's internal projections and analysis of Broadcom's past pricing strategies following similar acquisitions.

AT&T relies heavily on VMware's vSphere, a crucial component of its data center infrastructure, enabling efficient server virtualization and resource management. Broadcom's acquisition, AT&T argues, will eliminate competition and allow Broadcom to leverage its market dominance to drastically inflate prices. This isn't just about a single product; the price increase could ripple across AT&T's entire networking and cloud infrastructure.

- Specific VMware product affected: vSphere and related services.

- Current pricing: (While precise figures are unavailable publicly, AT&T's statement implies substantial current spending on VMware solutions.)

- Projected pricing after acquisition: A 1050% increase based on AT&T's internal estimations.

- Impact on AT&T's operations and bottom line: A significant increase in operational costs, potentially impacting profitability and service offerings.

Antitrust Concerns and Regulatory Scrutiny

The potential for a Broadcom-VMware merger to create a monopoly is a major concern for antitrust regulators worldwide. The sheer scale of the acquisition, combining Broadcom's existing portfolio of networking and infrastructure solutions with VMware's dominant position in server virtualization, raises significant red flags.

Regulatory bodies like the Federal Trade Commission (FTC) in the US and the European Commission (EC) in Europe are tasked with reviewing the merger to assess its potential impact on competition. They will scrutinize the deal for evidence of anti-competitive practices, including price-fixing, reduced innovation, and stifled consumer choice.

- Potential monopolies created by the merger: The combined entity could control a significant portion of the enterprise software and cloud computing markets, potentially leading to a monopoly.

- Reduced competition in the market: Fewer choices for businesses relying on virtualization and related technologies.

- Impact on innovation and consumer choice: A lack of competition can stifle innovation and limit consumer options.

- Previous antitrust cases involving similar mergers: Precedents set by past antitrust cases will influence the regulatory decisions in this instance.

Broader Impact on the Enterprise Software Market

The potential consequences extend far beyond AT&T. Numerous businesses worldwide rely on VMware's products for their IT infrastructure. A significant price hike following the acquisition could have a cascading effect throughout the enterprise software market.

Small and medium-sized businesses (SMBs), often with tighter budgets, would be particularly vulnerable to substantial price increases. Furthermore, the merger increases the risk of vendor lock-in, forcing companies to become heavily dependent on Broadcom products, limiting their ability to switch providers.

- Impact on small and medium-sized businesses (SMBs): Potentially crippling price increases forcing business closures or severely impacting their operations.

- Potential for increased lock-in with Broadcom products: Reduced flexibility and increased dependency on a single vendor.

- Shift in the competitive landscape of the enterprise software sector: Consolidation of market power, potentially leading to less innovation and higher prices.

Alternative Solutions and Mitigation Strategies

Businesses concerned about potential price increases have several options to explore. These include investigating open-source alternatives to VMware's offerings, negotiating aggressively with vendors to secure favorable pricing, and diversifying their IT infrastructure providers to avoid over-reliance on a single vendor.

- Open-source alternatives to VMware: Projects like Proxmox VE and oVirt offer viable open-source alternatives to VMware's virtualization solutions.

- Strategies for negotiating better pricing with vendors: Leveraging market competition and building strong relationships with alternative providers.

- Diversification of IT infrastructure providers: Spreading the risk across multiple vendors to reduce dependence on any single provider.

Conclusion

AT&T's alarm regarding a potential 1050% price hike following Broadcom's acquisition of VMware underscores serious concerns about the deal's impact on competition, pricing, and innovation within the enterprise software and cloud computing landscape. Regulatory scrutiny and potential antitrust challenges are crucial to ensure fair competition and prevent monopolistic practices. The potential for increased costs, vendor lock-in, and stifled innovation are significant threats to businesses of all sizes.

Call to Action: Stay informed about the developments in the Broadcom-VMware merger. Understanding the potential implications of this massive acquisition is vital for businesses relying on VMware's services and for those concerned about the future of competition in the enterprise software market. Monitor regulatory decisions and explore alternative solutions to mitigate potential price increases and vendor lock-in related to the Broadcom VMware deal. Actively assess your current reliance on VMware and plan for potential shifts in the market landscape.

Featured Posts

-

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025 -

Disneys Profit Outlook Upgraded Parks And Streaming Drive Growth

May 09, 2025

Disneys Profit Outlook Upgraded Parks And Streaming Drive Growth

May 09, 2025 -

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025 -

Why Did Williams Let Colapinto Go To Alpine Explained

May 09, 2025

Why Did Williams Let Colapinto Go To Alpine Explained

May 09, 2025 -

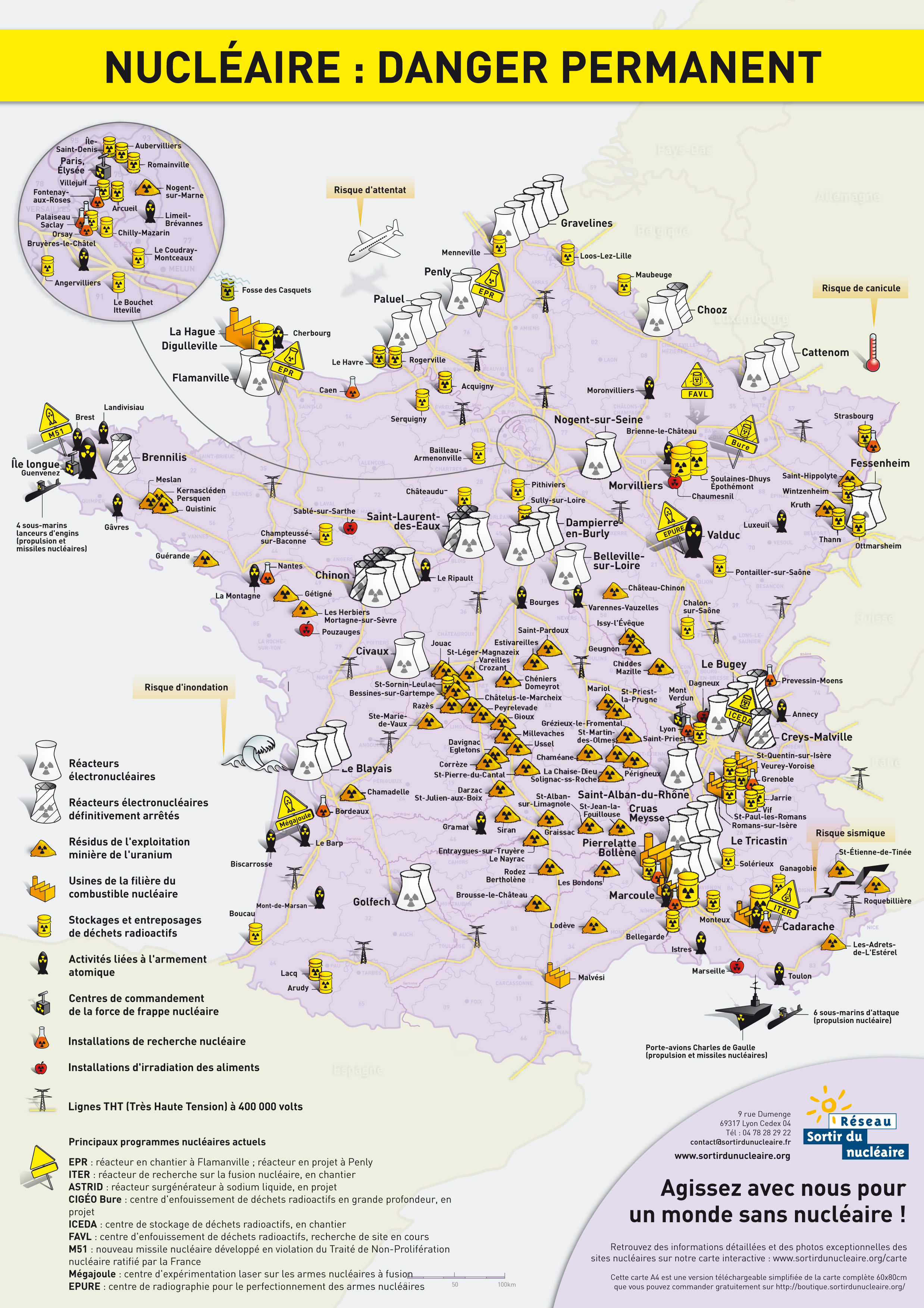

La France Et Le Nucleaire Le Ministre Europeen Defend Un Partage Du Bouclier

May 09, 2025

La France Et Le Nucleaire Le Ministre Europeen Defend Un Partage Du Bouclier

May 09, 2025