Palantir Stock Prediction 2025: Should You Invest Now?

Table of Contents

Palantir Technologies (PLTR) has captured significant market attention, sparking considerable debate about its future stock performance. Predicting Palantir stock in 2025 requires a nuanced understanding of its current market standing, technological trajectory, competitive landscape, and the broader economic climate. This article delves into these crucial factors to provide a well-informed perspective on the wisdom of investing in Palantir today.

Palantir's Current Market Position and Growth Potential

Analyzing Palantir's Revenue Streams and Market Share

Palantir's revenue streams are diverse, offering a degree of resilience. This diversification is a key factor in Palantir stock prediction models.

- Government Contracts: A substantial portion of Palantir's revenue stems from large government contracts, particularly in the US and allied nations. These contracts often involve long-term partnerships and provide a stable revenue base.

- Commercial Partnerships: Palantir is increasingly focusing on expanding its commercial partnerships, targeting various sectors such as healthcare, finance, and energy. This diversification reduces reliance on government contracts and opens avenues for significant growth.

- Foundry Platform Growth: Palantir's Foundry platform is a key driver of growth, offering a comprehensive data integration and analytics solution. Its scalability and adaptability make it attractive to a wide range of clients.

- Market Penetration in Key Sectors: Palantir is actively penetrating key sectors with high data analytics needs. Success in these sectors could significantly boost revenue and market share.

Recent financial reports show fluctuating growth rates, influenced by the timing and size of government contracts. Comparing Palantir's performance to competitors like AWS and Microsoft Azure reveals its unique position as a specialist in data integration and analysis for complex, sensitive data. Further analysis of Palantir revenue and PLTR market share is critical to understanding its future potential.

Technological Innovation and Future Product Development

Palantir's commitment to technological innovation is a critical element in any Palantir stock prediction.

- AI Advancements: Palantir is heavily investing in Artificial Intelligence (AI) and machine learning, integrating these capabilities into its products to enhance data analysis and decision-making.

- Data Analytics Capabilities: Palantir's core strength lies in its advanced data analytics capabilities, enabling clients to derive actionable insights from vast and complex datasets.

- New Product Launches: Continuous product development and the launch of new solutions are vital for maintaining a competitive edge. Analyzing Palantir's product roadmap offers insights into future growth potential.

- Research and Development Investments: Significant investment in research and development (R&D) underscores Palantir's commitment to innovation and staying ahead of the curve in the rapidly evolving data analytics landscape.

Assessing Palantir’s patent portfolio, R&D expenditure, and future product roadmaps is essential to evaluate its capacity to maintain its competitive advantage in the data analytics market. The advancements in Palantir AI and data analytics are key drivers of future growth.

Risks and Challenges Facing Palantir

Competition and Market Saturation

The data analytics market is highly competitive, presenting challenges to Palantir's growth trajectory.

- Major Competitors: Companies like AWS, Microsoft Azure, and Google Cloud Platform offer competing data analytics solutions, posing a significant threat to Palantir’s market share.

- Increasing Competition: The data analytics market is experiencing rapid growth, attracting new entrants and intensifying competition.

- Potential for Market Saturation: The potential for market saturation in specific segments presents a risk to Palantir's future expansion.

Evaluating the competitive landscape and anticipating potential disruptions is crucial to accurately forecasting Palantir's future performance. Analyzing Palantir competitors and their strategies is essential for any informed Palantir stock prediction.

Financial Risks and Dependence on Government Contracts

Palantir’s financial health and reliance on government contracts represent inherent risks.

- Profitability: Achieving consistent profitability is vital for long-term sustainability. Analyzing Palantir's profit margins and operating expenses is crucial.

- Debt Levels: High levels of debt can significantly impact Palantir's financial flexibility and risk profile.

- Reliance on Government Contracts: A significant portion of Palantir's revenue is derived from government contracts, making it vulnerable to changes in government spending priorities or contract cancellations.

- Potential for Contract Cancellations or Delays: Unforeseen circumstances can lead to contract cancellations or delays, impacting Palantir's revenue and financial stability.

A thorough assessment of Palantir financial performance, debt levels, and the potential risks associated with its reliance on government contracts is essential for evaluating its investment potential. Understanding the nuances of Palantir debt and government contract risk is critical to any effective Palantir stock prediction.

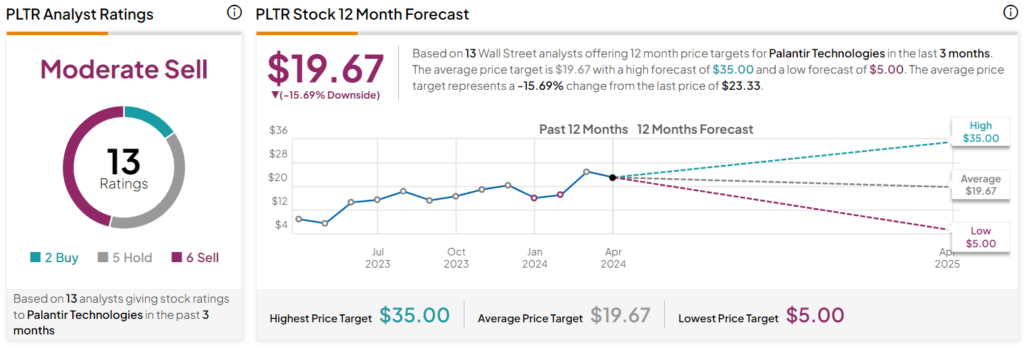

Predicting Palantir Stock Price in 2025

Factors Influencing Future Stock Price

Numerous factors will influence Palantir's stock price in 2025.

- Market Trends: Broader market trends, including economic growth, interest rates, and investor sentiment, will have a significant impact on PLTR's stock price.

- Economic Conditions: Global economic conditions and any potential recessions will significantly influence investor appetite for riskier investments like Palantir.

- Technological Advancements: Continued innovation and successful product development will be key drivers of future growth.

- Company Performance: Palantir's financial performance, including revenue growth, profitability, and market share, will be critical in determining its stock price.

- Investor Sentiment: Positive or negative investor sentiment can significantly impact stock prices.

Integrating these factors into a comprehensive prediction model (while acknowledging the inherent uncertainty in stock market predictions) is essential. Using historical data, market analysis, and expert opinions can inform this model. Charts and graphs visualizing key trends can aid in understanding the potential future price of PLTR.

Potential Scenarios and Investment Strategies

Several scenarios are possible, each requiring a distinct investment strategy.

- Bullish Scenario: A bullish scenario assumes sustained growth in Palantir's revenue, successful expansion into new markets, and positive investor sentiment. This could lead to significant stock price appreciation.

- Bearish Scenario: A bearish scenario considers factors like increased competition, slower-than-expected revenue growth, or negative investor sentiment. This could result in a decline in the stock price.

- Risk Mitigation Strategies: Investors can employ risk mitigation strategies such as diversification across different asset classes to reduce the impact of any potential downturn in Palantir's stock price.

- Diversification: Diversification of investments across various asset classes is crucial for mitigating risk.

Considering different possible outcomes and adopting appropriate investment strategies based on risk tolerance is crucial. A balanced approach considering both bullish and bearish scenarios is recommended for informed decision-making. Implementing a robust Palantir investment strategy involves careful consideration of risk management techniques.

Conclusion

This analysis has examined Palantir's current market position, growth potential, and associated risks, offering a nuanced perspective on predicting its stock price in 2025. While Palantir's innovative technology presents significant opportunities, investors must carefully weigh the inherent risks before committing capital.

Ultimately, the decision of whether to invest in Palantir stock now is a personal one. Thoroughly research the company, consider your risk tolerance, and consult with a financial advisor before making any investment decisions. Remember to always perform your own due diligence before investing in any stock, including making a Palantir stock prediction for 2025.

Featured Posts

-

Is Palantir Stock A Buy Before May 5th A Wall Street Perspective

May 09, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Perspective

May 09, 2025 -

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025 -

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025 -

Barbwza Wmarakana Qst Khsart Alasnan Fy Nzal Tarykhy

May 09, 2025

Barbwza Wmarakana Qst Khsart Alasnan Fy Nzal Tarykhy

May 09, 2025 -

Elon Musk Still Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 09, 2025

Elon Musk Still Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 09, 2025