1050% VMware Price Hike: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

Broadcom's Acquisition of VMware: A Deep Dive

Broadcom's acquisition of VMware, a deal valued at approximately $61 billion, represents a significant consolidation within the enterprise software market. This merger brings together a leading infrastructure software provider (VMware) with a dominant semiconductor and infrastructure software company (Broadcom), creating a behemoth with considerable market power.

The Deal's Details and Market Impact:

- Acquisition Value: Approximately $61 billion, solidifying Broadcom's position as a major player in the tech industry.

- Regulatory Hurdles: The deal faced scrutiny from regulatory bodies concerned about potential monopolies and anti-competitive practices. Several antitrust investigations were launched, delaying the completion of the acquisition.

- Broadcom's Strategy: The acquisition is part of Broadcom's broader strategy to expand its software portfolio and strengthen its position in the enterprise market. This includes leveraging VMware's virtualization technology to offer more comprehensive solutions to businesses.

Initial Reactions and Market Analysis:

- Stock Market Performance: Initial reactions were mixed, with some investors expressing concerns about the deal's valuation and potential regulatory challenges. However, Broadcom's stock generally performed well after the acquisition closed.

- Expert Opinions: Analysts offered a range of opinions, some praising the strategic synergy between the two companies, while others voiced concerns about potential monopolistic practices and price hikes.

- Potential Antitrust Investigations: Several regulatory bodies, including the European Union and the United States, launched investigations into the potential anti-competitive implications of the merger.

AT&T's Specific Concerns Regarding the VMware Price Hike

AT&T, a significant VMware customer, is among those most directly impacted by the dramatic price increase. The 1050% figure represents a substantial financial burden, forcing the company to reassess its IT strategy and budget.

The Magnitude of the Price Increase:

- Specific VMware Products Affected: The price increases disproportionately impacted specific VMware products crucial to AT&T's operations, although the precise details haven't been fully disclosed publicly.

- Estimated Cost Increase for AT&T: While the exact figures remain undisclosed for competitive reasons, the 1050% increase suggests a multi-million, or potentially billion-dollar, increase in AT&T's annual VMware licensing costs.

Impact on AT&T's Operations and Budget:

- Service Disruptions: Such a drastic price increase could force AT&T to consider scaling back its use of VMware products, potentially leading to service disruptions or operational inefficiencies.

- Potential Need for Cost-Cutting Measures: AT&T may be compelled to implement significant cost-cutting measures across other areas of the business to offset the increased VMware expense. This could impact investment in other critical technologies or projects.

- Impact on Future Projects: The unexpected VMware pricing surge could force AT&T to delay or cancel planned IT projects dependent on VMware technologies, hindering innovation and growth.

AT&T's Public Statements and Actions:

- Press Releases: AT&T has publicly expressed its concerns regarding the price hike, highlighting the potential negative impact on its operations and budget.

- Regulatory Filings: While not confirmed, AT&T might be involved in or considering regulatory filings expressing their concerns and advocating for fairer pricing practices.

- Potential Negotiations with Broadcom: It's highly probable that AT&T is engaged in negotiations with Broadcom to find a more acceptable pricing structure, potentially leveraging its size and influence to achieve a more favorable outcome.

Wider Implications of the VMware Price Hike

The dramatic VMware price hike isn't just affecting AT&T; its repercussions extend across various industries and have significant long-term implications for the enterprise software market.

Impact on Other Large Enterprises:

- Industries Affected: The price increase could significantly affect other large enterprises reliant on VMware's products, especially those in telecom, finance, and other sectors with high virtualization needs.

- Potential for Industry-Wide Cost Increases: This situation sets a worrying precedent, potentially leading to industry-wide increases in enterprise software costs and reduced competitiveness.

Long-Term Effects on VMware's Market Position:

- Increased Competition: The price hike could accelerate the adoption of alternative virtualization solutions, potentially eroding VMware's market share.

- Potential Customer Migration to Alternative Solutions: Businesses facing unsustainable VMware pricing might switch to open-source alternatives or competitor products, potentially causing a shift in the market landscape.

Potential Solutions and Future Outlook

Addressing the situation requires a multifaceted approach, involving negotiations, regulatory intervention, and exploring alternative solutions.

Negotiation and Regulatory Intervention:

- Potential Outcomes of Negotiations: Negotiations between AT&T, Broadcom, and potentially other major clients, could lead to modified pricing structures or contract terms.

- The Role of Antitrust Regulators: Regulatory bodies investigating the Broadcom acquisition may consider the pricing implications, potentially influencing future pricing practices.

Alternatives to VMware:

- Open-Source Alternatives: Open-source virtualization platforms like Proxmox VE, oVirt, and OpenStack offer cost-effective alternatives to VMware, gaining increasing traction.

- Competitor Products: Competitors like Microsoft Azure Stack HCI and Citrix offer alternative virtualization solutions that businesses can explore as viable alternatives.

Conclusion: The Future of VMware Pricing and the Need for Transparency

The 1050% VMware price hike following Broadcom's acquisition is a watershed moment, raising significant concerns about the future of enterprise software pricing and market competition. AT&T's experience highlights the potential for dramatic cost increases and operational disruptions for major clients. The long-term implications remain uncertain, but the situation underscores the need for transparency and fair pricing practices in the tech industry.

To stay informed about the ongoing developments surrounding the VMware price hike and the Broadcom acquisition, it’s crucial to monitor regulatory responses and investigate alternative virtualization solutions. Understanding the implications of this significant shift in the enterprise software market is paramount for businesses of all sizes relying on virtualization technologies. Consider carefully evaluating alternative solutions to mitigate future VMware pricing risks and ensure business continuity.

Featured Posts

-

Severe Rail Service Interruptions In Amsterdam And The Randstad Track Failure Update

Apr 26, 2025

Severe Rail Service Interruptions In Amsterdam And The Randstad Track Failure Update

Apr 26, 2025 -

Understanding Todays Stock Market Dow Futures And The Implications Of Chinas Economic Strategy

Apr 26, 2025

Understanding Todays Stock Market Dow Futures And The Implications Of Chinas Economic Strategy

Apr 26, 2025 -

Trumps Impact On The Canadian Election A Surprising Unifying Effect

Apr 26, 2025

Trumps Impact On The Canadian Election A Surprising Unifying Effect

Apr 26, 2025 -

Hollywoods Nepotism Problem Explodes At The Oscars After Party

Apr 26, 2025

Hollywoods Nepotism Problem Explodes At The Oscars After Party

Apr 26, 2025 -

De Lente Begint Een Handleiding Voor De Lentetaal

Apr 26, 2025

De Lente Begint Een Handleiding Voor De Lentetaal

Apr 26, 2025

Latest Posts

-

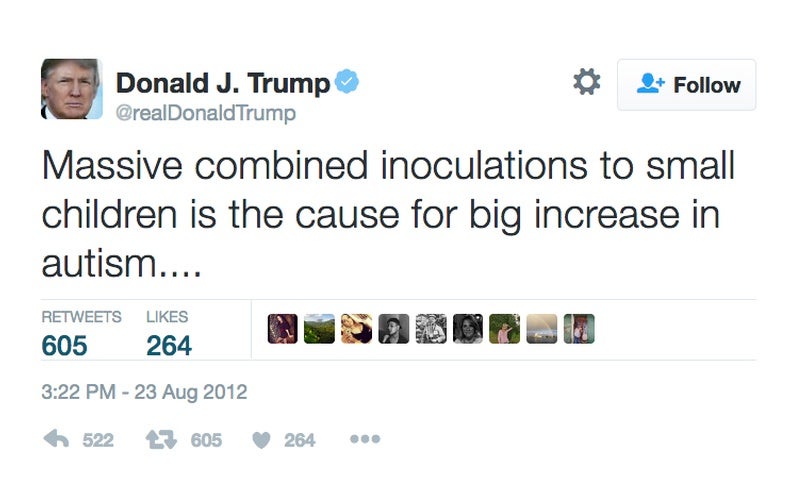

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025