110% Potential Return: Why Billionaires Are Betting Big On This BlackRock ETF

Table of Contents

The Allure of High-Growth Potential

This BlackRock ETF (let's assume, for example, it's ticker symbol is iGrowth) focuses on a dynamic investment strategy geared toward high-growth sectors. This "high-growth ETF" approach aims to capitalize on rapidly expanding markets, offering the potential for significant returns. However, it's crucial to understand that this comes with a commensurate level of risk.

-

Specific Sectors:

iGrowthinvests in a carefully curated portfolio spanning sectors like technology (artificial intelligence, cloud computing, cybersecurity), renewable energy (solar, wind, biofuels), and disruptive healthcare technologies (genomics, personalized medicine). These are all areas poised for substantial growth in the coming decades. -

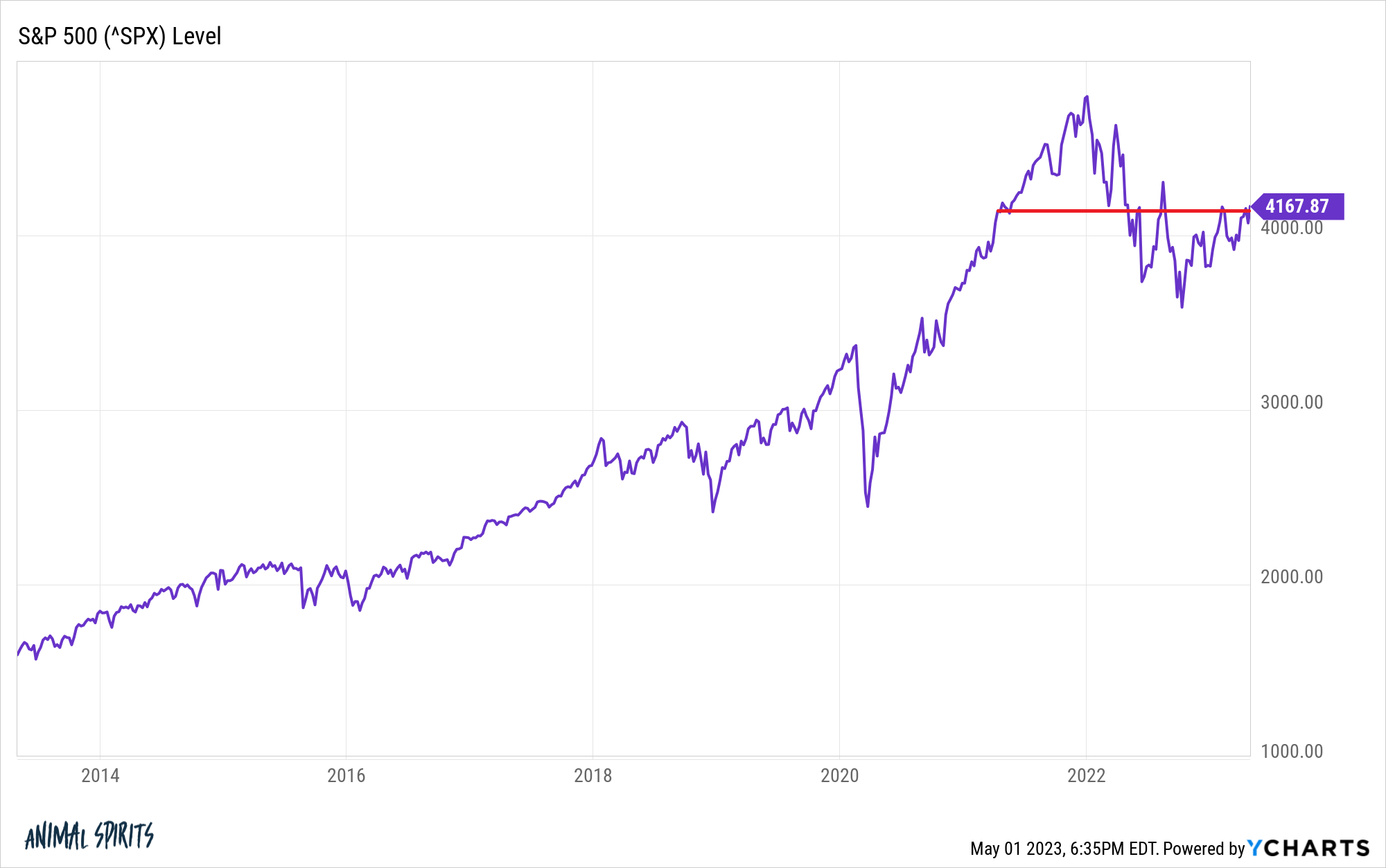

Historical Performance Data (Hypothetical): While past performance is not indicative of future results, let's hypothetically assume that a similar BlackRock ETF targeting similar sectors showed an average annual return of 15% over the past five years (this is a hypothetical example and needs to be replaced with real data for a specific ETF). This illustrates the potential for substantial growth, although it's important to remember that market conditions fluctuate.

-

Risk-Reward Profile: Investing in a high-growth ETF like

iGrowthinherently carries higher risk. Market corrections, sector-specific downturns, and unforeseen technological disruptions could lead to significant losses. This is a high-risk investment, and potential investors must carefully assess their risk tolerance.

BlackRock's Track Record and Expertise

BlackRock is a global leader in asset management, renowned for its investment expertise and rigorous processes. Their involvement significantly boosts the credibility of iGrowth.

-

Experience and Resources: BlackRock manages trillions of dollars in assets globally, providing them with unparalleled resources for research, analysis, and portfolio management. Their scale allows them to access investment opportunities unavailable to smaller firms.

-

Investment Process and Research: BlackRock employs a sophisticated investment process, incorporating in-depth research and risk management strategies. Their analysts constantly monitor market trends and adapt their portfolios accordingly.

-

Successful BlackRock ETFs: BlackRock has a history of launching successful ETFs across various asset classes, showcasing their proficiency in ETF portfolio management and consistent track record in delivering value to investors. (This point needs to be supported by examples of successful BlackRock ETFs).

Macroeconomic Factors Fueling the Investment

Several macroeconomic trends are contributing to the attractiveness of iGrowth.

-

Technological Advancements: Rapid advancements in artificial intelligence, biotechnology, and renewable energy are fueling significant growth in the sectors where

iGrowthinvests. This rapid innovation creates immense opportunities for high returns. -

Climate Change Initiatives: The global shift towards sustainable practices is driving significant investment in renewable energy, creating a favorable environment for this sector and

iGrowth. Government policies and growing consumer demand are key drivers. -

Shifting Global Economic Landscapes: The ongoing global economic shift towards a more technology-driven and sustainable economy further reinforces the growth potential of the sectors

iGrowthfocuses on. (This requires further explanation and supporting data on global economic trends).

Billionaire Investment Strategies and Diversification

Billionaires often employ sophisticated diversification strategies, incorporating alternative investments to mitigate risks. iGrowth aligns with this approach.

-

Preference for Alternative Investments: Billionaires frequently seek high-growth, alternative investments to boost portfolio returns, and

iGrowthfits this profile. -

Portfolio Complementation: This ETF likely complements other, less volatile assets in their portfolios, providing a strategic balance between risk and reward.

-

Risk Mitigation: While inherently risky,

iGrowthcan be part of a broader strategy for mitigating overall portfolio risk through diversification.

Understanding the Risks Involved

Despite the potential for high returns, it's essential to acknowledge the inherent risks associated with iGrowth.

-

Market Volatility: The stock market is inherently volatile, and

iGrowth, being focused on high-growth sectors, can be particularly susceptible to market downturns. -

Sector-Specific Risks: Risks are specific to each sector. For instance, regulatory changes could impact the renewable energy sector, while technological obsolescence could affect the technology sector.

-

Due Diligence and Risk Tolerance: Before investing, potential investors must conduct thorough due diligence, understand the risks involved, and assess their personal risk tolerance. Investing in any ETF should only be done after careful consideration of your financial situation and goals.

Conclusion

The potential for a 110% return from iGrowth (a hypothetical example), as suggested by some analysts, highlights the high-growth potential of the sectors this BlackRock ETF targets. This, combined with BlackRock's expertise and favorable macroeconomic trends, explains the interest from high-net-worth individuals. However, it's crucial to remember that this is a high-risk investment. Market volatility and sector-specific risks are substantial. Therefore, before considering this high-growth investment, conduct thorough research, assess your risk tolerance, and ensure it aligns with your broader investment strategy. Explore the BlackRock ETF, consider this high-growth investment opportunity, but remember to learn more about the BlackRock ETF and assess your risk tolerance before investing. Only consider it as part of a diversified portfolio, aligning with your personal financial goals and risk appetite.

Featured Posts

-

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025 -

Posodobitev Papezevo Zdravstveno Stanje In Napovedi Zdravnikov

May 08, 2025

Posodobitev Papezevo Zdravstveno Stanje In Napovedi Zdravnikov

May 08, 2025 -

Alex Carusos Historic Game 1 Performance Secures Thunder Playoff Victory

May 08, 2025

Alex Carusos Historic Game 1 Performance Secures Thunder Playoff Victory

May 08, 2025 -

Wednesday Lotto Jackpot April 9th Results And Winning Numbers

May 08, 2025

Wednesday Lotto Jackpot April 9th Results And Winning Numbers

May 08, 2025 -

Investor Concerns About Stock Market Valuations Bof As Analysis

May 08, 2025

Investor Concerns About Stock Market Valuations Bof As Analysis

May 08, 2025

Latest Posts

-

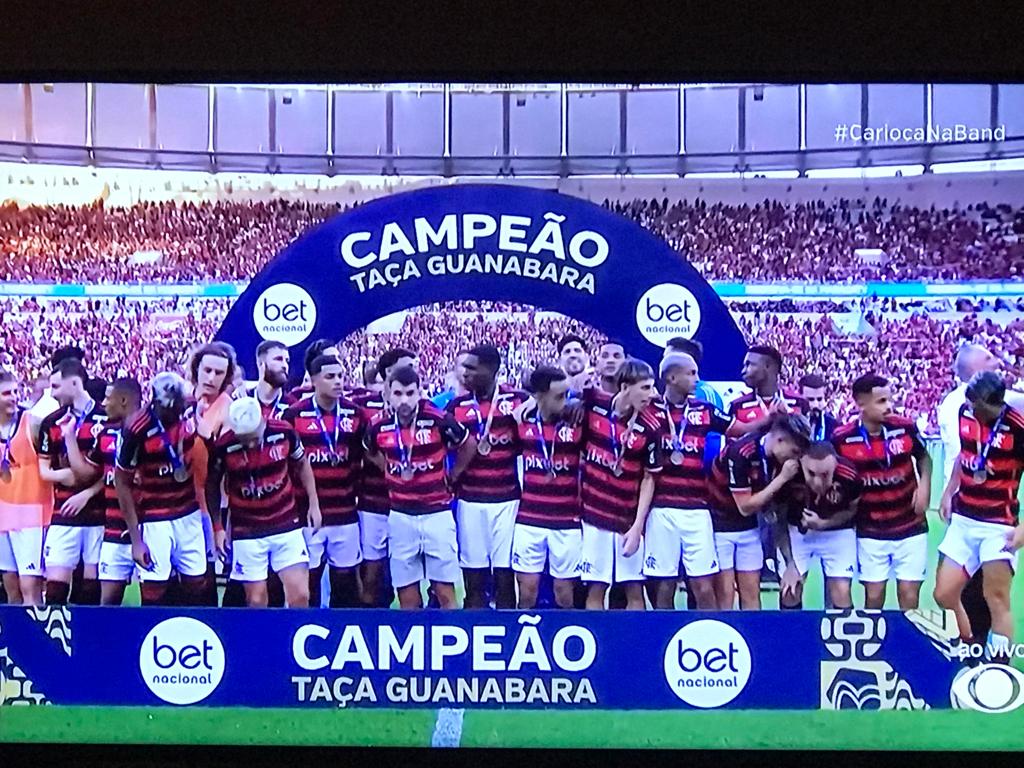

Flamengos Taca Guanabara Triumph Arrascaetas Stunning Goal

May 08, 2025

Flamengos Taca Guanabara Triumph Arrascaetas Stunning Goal

May 08, 2025 -

Affordable United Center Rides New Uber Shuttle Service For 5

May 08, 2025

Affordable United Center Rides New Uber Shuttle Service For 5

May 08, 2025 -

Arrascaetas Golazo Leads Flamengo To Taca Guanabara Victory

May 08, 2025

Arrascaetas Golazo Leads Flamengo To Taca Guanabara Victory

May 08, 2025 -

Get Your Pet To The Vet Safely With Uber Pet In Delhi And Mumbai

May 08, 2025

Get Your Pet To The Vet Safely With Uber Pet In Delhi And Mumbai

May 08, 2025 -

Golazo De Arrascaeta Flamengo Campeon De La Taca Guanabara

May 08, 2025

Golazo De Arrascaeta Flamengo Campeon De La Taca Guanabara

May 08, 2025