Investor Concerns About Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on Stock Market Valuations

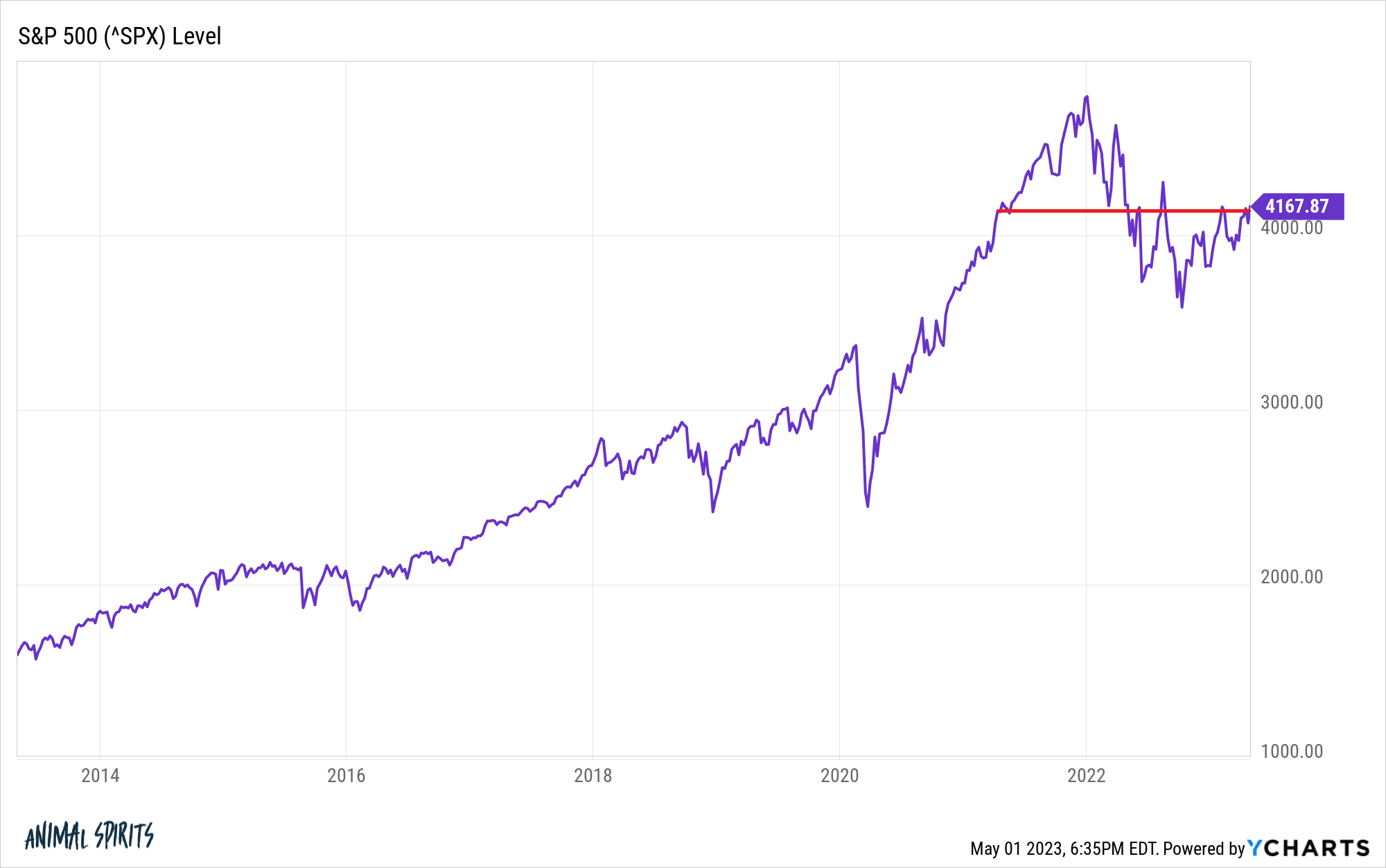

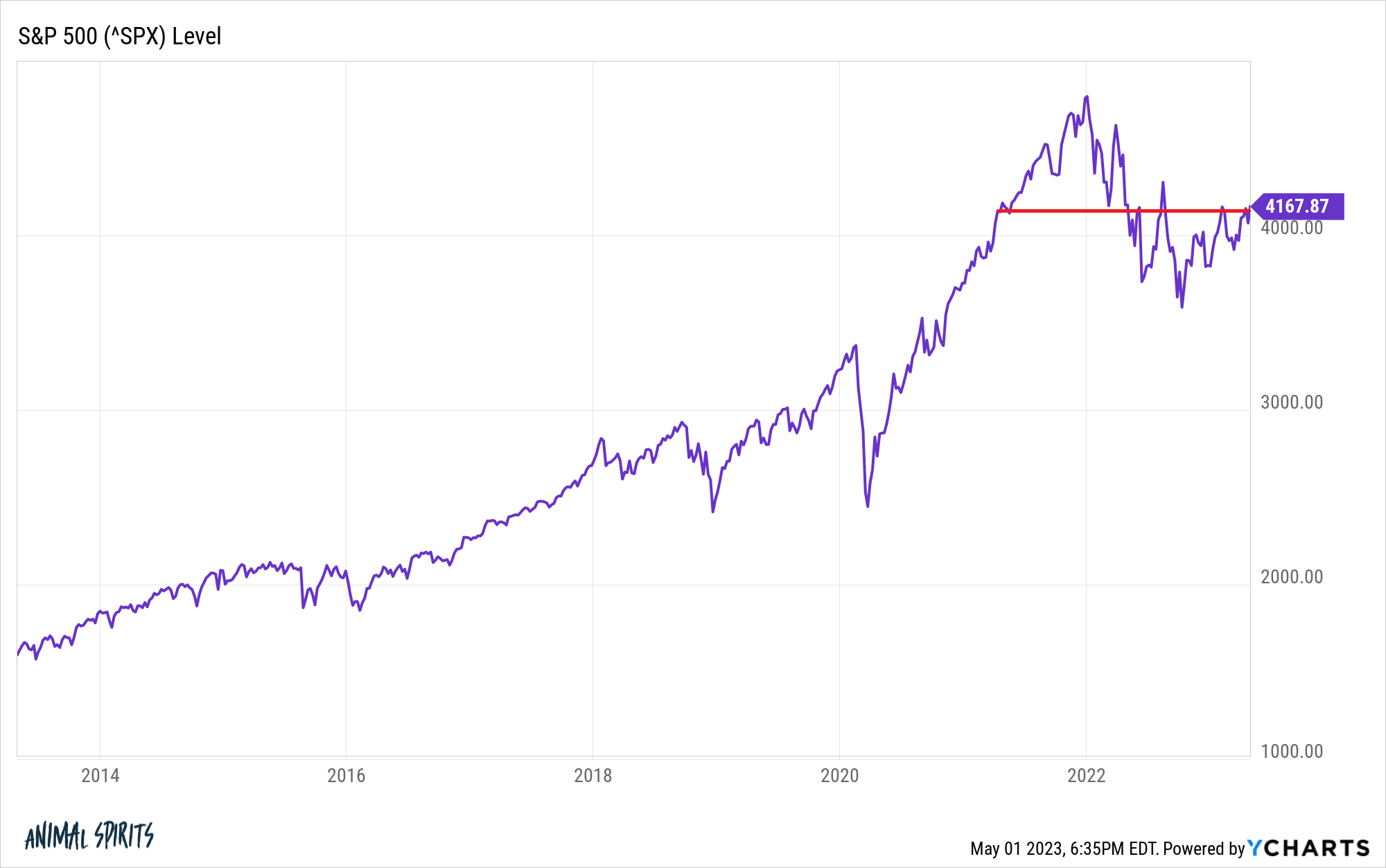

BofA's recent report paints a nuanced picture of current stock market valuations. While not outright declaring a market bubble, the analysis suggests that valuations in certain sectors are stretched, indicating a potential for increased risk. The overall assessment leans towards caution, urging investors to carefully consider the current market environment before making significant investment decisions. The report emphasizes the need for a thorough understanding of stock market valuations and their implications.

Valuation Metrics Used by BofA

BofA employed several key valuation metrics to arrive at its assessment. Understanding these metrics is crucial for interpreting the report's findings.

-

Price-to-Earnings ratio (P/E): This metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, often indicating high growth expectations but also higher risk. A low P/E ratio could signal undervaluation or lower growth prospects.

-

Price-to-Sales ratio (P/S): This ratio compares a company's stock price to its revenue. It's particularly useful for valuing companies with negative earnings, offering a broader perspective on valuation than the P/E ratio alone. A high P/S ratio can suggest overvaluation, especially when compared to industry peers.

-

Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): Also known as the CAPE ratio, this metric smooths out earnings fluctuations over a ten-year period, providing a longer-term view of valuation. It's considered a more robust indicator than the standard P/E ratio, especially during periods of economic uncertainty.

High P/E ratios generally suggest that the market is optimistic about future earnings growth, but also carry higher risk. Conversely, low P/E ratios might indicate undervaluation or concerns about future profitability.

Sectors with the Highest and Lowest Valuations

BofA's analysis pinpoints specific sectors with notably high and low valuations.

-

Overvalued Sectors: The report flagged technology stocks as exhibiting elevated valuations, particularly within specific sub-sectors like software-as-a-service (SaaS). This is attributed to strong recent growth, but the analysis suggests that this growth may not be entirely sustainable at the current pace, leading to potentially higher risk.

-

Undervalued Sectors: Conversely, certain sectors in the cyclical industries showed relatively lower valuations. This often reflects market uncertainty around future demand. However, these sectors might present opportunities for long-term investors with a higher risk tolerance.

Technology stocks, while showing strong growth, are showing elevated valuations according to BofA's analysis, potentially making them more susceptible to market corrections. This highlights the need for careful sector-specific analysis when evaluating stock market valuations.

Investor Concerns Stemming from High Stock Market Valuations

The elevated valuations highlighted in BofA's report raise several significant concerns for investors.

Risk of a Market Correction

The elevated valuations, particularly in certain sectors, increase the risk of a market correction. This means a significant and rapid decline in stock prices. BofA's analysis doesn't predict a crash, but it does caution against complacency.

- Potential Triggers: Several factors could trigger a correction, including:

- Rising interest rates: Increased borrowing costs can dampen economic growth and reduce corporate profitability.

- Inflationary pressures: Persistent inflation erodes purchasing power and can negatively impact corporate earnings.

- Geopolitical instability: Unpredictable global events can create market uncertainty and volatility.

BofA's analysis suggests that a significant rise in interest rates could trigger a sell-off in currently overvalued sectors.

Impact of Inflation on Stock Market Valuations

Inflation significantly impacts stock market valuations. High inflation erodes the real value of future earnings, leading to lower stock prices. BofA's analysis indicates that persistently high inflation presents a major headwind for current stock market valuations.

Persistent high inflation could erode corporate profits, leading to lower stock valuations.

The Role of Interest Rates in Stock Market Valuations

Interest rates and stock valuations have an inverse relationship. Higher interest rates increase borrowing costs for companies, impacting their profitability and slowing down growth, leading to lower stock valuations. BofA's analysis incorporates predictions for future interest rate movements, emphasizing their crucial role in shaping stock market valuations.

Rising interest rates increase borrowing costs for companies, potentially slowing down growth and impacting stock prices.

BofA's Recommendations for Investors

Based on its valuation analysis, BofA offers several recommendations for investors:

- Maintain a diversified portfolio across different asset classes to mitigate risk.

- Carefully assess individual company valuations and avoid overexposure to potentially overvalued sectors.

- Consider long-term investment horizons rather than focusing on short-term market fluctuations.

- Consult with a financial advisor to tailor an investment strategy that aligns with your risk tolerance and financial goals.

BofA recommends a cautious approach, suggesting diversification across different asset classes to mitigate risk.

Conclusion

BofA's analysis of stock market valuations reveals a market where certain sectors show signs of overvaluation, presenting increased risks for investors. Concerns about rising interest rates, persistent inflation, and geopolitical uncertainty further complicate the picture. Understanding these factors and their influence on stock market valuations is critical for making informed investment decisions. Therefore, before making any investment choices, it is crucial to conduct thorough research and assess stock market valuations carefully. Consult with a financial advisor to create a well-diversified portfolio that aligns with your risk tolerance and long-term goals. Thoroughly understanding and assessing stock market valuations is key to navigating the current market successfully.

Featured Posts

-

Is Ethereums Price Drop To 1 500 Inevitable Analyzing Current Support Levels

May 08, 2025

Is Ethereums Price Drop To 1 500 Inevitable Analyzing Current Support Levels

May 08, 2025 -

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025 -

Bitcoin Mining Profits Soar Understanding The Recent Increase

May 08, 2025

Bitcoin Mining Profits Soar Understanding The Recent Increase

May 08, 2025 -

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025 -

Finding A Ps 5 Before The Price Goes Up Top Retailers And Tips

May 08, 2025

Finding A Ps 5 Before The Price Goes Up Top Retailers And Tips

May 08, 2025

Latest Posts

-

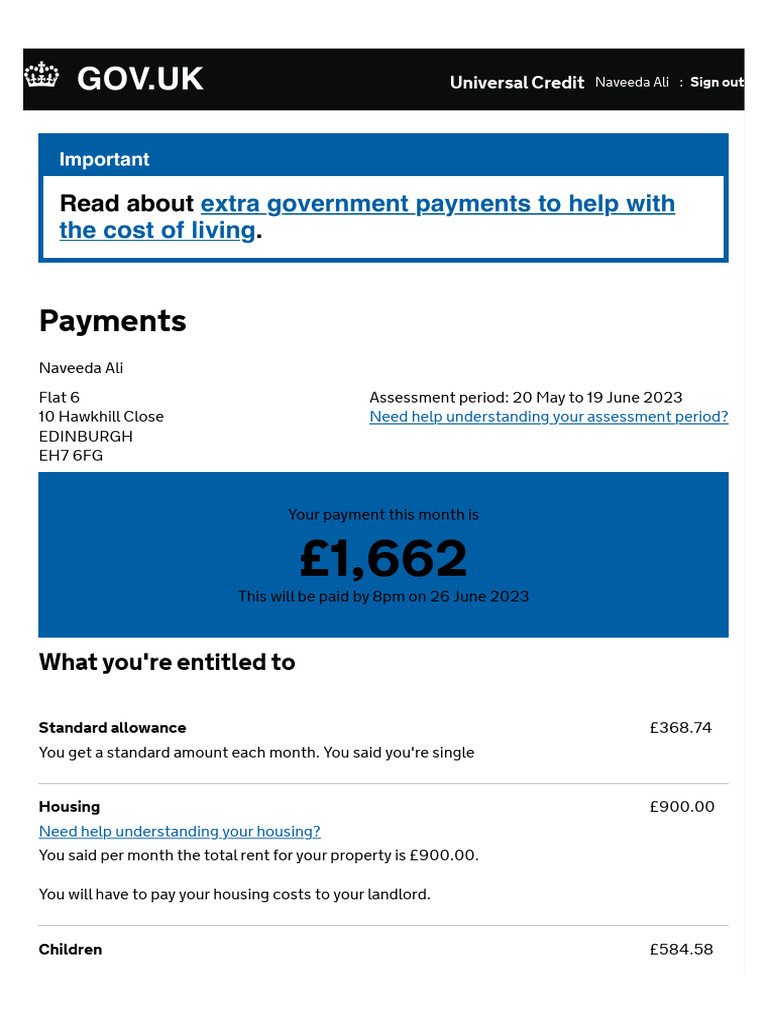

Universal Credit Claimants At Risk Following Dwp Reforms

May 08, 2025

Universal Credit Claimants At Risk Following Dwp Reforms

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Approaching

May 08, 2025

Dwp To Axe Two Benefits Final Payments Approaching

May 08, 2025 -

Dwp Overhaul Potential Loss Of Universal Credit Payments

May 08, 2025

Dwp Overhaul Potential Loss Of Universal Credit Payments

May 08, 2025 -

Universal Credit Changes Warnings For Claimants Facing Benefit Cuts

May 08, 2025

Universal Credit Changes Warnings For Claimants Facing Benefit Cuts

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Is Imkani Detayli Bilgiler

May 08, 2025

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Is Imkani Detayli Bilgiler

May 08, 2025