110% Potential: Why Billionaires Are Betting Big On This BlackRock ETF

Table of Contents

The Allure of BlackRock's ETF: Unpacking the Investment Strategy

This BlackRock ETF (let's assume, for the purpose of this example, it's a hypothetical ETF called the "BlackRock Global Growth ETF" – replace with the actual ETF name if you have one in mind) has captivated high-net-worth investors due to its unique blend of diversification, long-term growth potential, and the backing of a reputable financial giant.

Diversification and Risk Management

The BlackRock Global Growth ETF employs a robust diversification strategy, spreading investments across various asset classes and sectors to mitigate risk.

- Global Equity Exposure: A significant portion is allocated to global equities, providing exposure to diverse markets and economic growth opportunities worldwide.

- Emerging Market Allocation: Strategic investment in emerging markets offers the potential for higher returns, though with increased volatility.

- Fixed Income Component: A carefully managed fixed income component helps to balance portfolio volatility and provide stability during market downturns.

- Dynamic Asset Allocation: The ETF utilizes a dynamic asset allocation strategy, adjusting its holdings based on market conditions to optimize returns and manage risk. This proactive approach is crucial for navigating market volatility.

Long-Term Growth Potential

This ETF is designed for long-term growth, focusing on companies poised to benefit from sustained secular trends.

- Technological Innovation: A significant portion is invested in companies at the forefront of technological innovation, including artificial intelligence, renewable energy, and biotechnology.

- Sustainable Investing: The ETF incorporates Environmental, Social, and Governance (ESG) factors into its investment decisions, aligning with the growing trend towards sustainable and responsible investing.

- Compound Growth Potential: The ETF’s long-term investment horizon and potential for high returns offer considerable compound growth potential. Historical performance (past performance is not indicative of future results) has shown promising results, and the ETF is strategically positioned to capitalize on long-term market trends.

The Power of the BlackRock Brand

BlackRock’s reputation as a leading global asset manager significantly enhances investor confidence.

- Proven Track Record: BlackRock boasts a long and successful track record in asset management, providing investors with a sense of security and trust.

- Extensive Resources and Expertise: The firm’s vast resources, advanced research capabilities, and experienced investment professionals contribute to the ETF's success.

- Global Reach and Network: BlackRock's global presence allows for access to a wider range of investment opportunities and deeper market insights.

Billionaire Backing: Why High-Net-Worth Individuals Are Investing

Billionaires are attracted to this BlackRock ETF for several compelling reasons, beyond its potential for high returns.

Sophisticated Investment Strategies

The ETF's investment strategy aligns perfectly with the sophisticated approaches favored by high-net-worth individuals.

- Alpha Generation: The ETF actively seeks to generate alpha, outperforming the market benchmarks through skillful stock selection and market timing.

- Factor Investing: The underlying strategy incorporates factor investing principles, aiming to capture returns associated with factors such as value, growth, and momentum.

- Long-Term Value Creation: Billionaires prioritize long-term value creation over short-term gains. This ETF’s focus on long-term growth aligns with this philosophy.

Access to Exclusive Opportunities

The ETF may provide access to investment opportunities not readily available to retail investors.

- Private Equity Exposure: The ETF might have limited exposure to private equity, offering investors a taste of alternative investment strategies.

- Strategic Partnerships: BlackRock's extensive network might unlock unique investment opportunities through strategic partnerships and collaborations.

Seeking High-Yield, Low-Risk Investments (relative)

The BlackRock Global Growth ETF aims to provide a balance between higher returns and a reasonable (relative to other high-growth investments) risk profile.

- Diversification as Risk Mitigation: The diversified portfolio helps to reduce overall portfolio volatility compared to more concentrated investments.

- Risk-Adjusted Returns: The ETF's risk-adjusted returns, as measured by metrics like the Sharpe ratio, are competitive.

Analyzing the 110% Potential: A Realistic Assessment

While the potential for significant returns is attractive, a realistic assessment requires considering various factors.

Market Conditions and Future Projections

Market conditions can significantly influence the ETF's performance.

- Global Economic Growth: Global economic growth prospects are crucial. A slowdown could impact the ETF's returns.

- Geopolitical Risks: Geopolitical events and uncertainties can affect market sentiment and investment performance.

- Interest Rate Changes: Changes in interest rates can impact both equity and fixed income components of the ETF.

Comparing Returns to Similar ETFs

Comparing this BlackRock ETF's potential returns to similar ETFs in the market provides valuable context.

- Benchmark Comparisons: Analyzing the ETF's performance relative to relevant benchmarks helps assess its effectiveness.

- Peer Group Analysis: Comparing the ETF to peers allows for a more comprehensive understanding of its risk-return profile.

Considering Fees and Expenses

The ETF's expense ratio and other fees are important considerations.

- Expense Ratio Transparency: A clearly stated expense ratio allows investors to understand the cost of investing.

- Fee Comparison: Comparing fees to similar ETFs helps determine if the fees are reasonable given the ETF's potential returns.

Conclusion

Billionaires' significant investments in this BlackRock ETF highlight its compelling combination of diversification, long-term growth potential, and the backing of a leading asset manager. While a 110% return is a projection and not a guarantee, the ETF's strategy, coupled with BlackRock's expertise, offers a compelling case for potential high returns. However, it's crucial to conduct thorough research and understand the associated risks before investing. Ready to explore the potential of this high-growth BlackRock ETF and tap into the strategies used by billionaires? Start your research today and discover if this investment aligns with your financial goals. [Insert Link to ETF Information Here] Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025 -

Exclusive Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025

Exclusive Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025 -

Trumps Crypto Chief Predicts Bitcoin Price Jump After Market Surge

May 08, 2025

Trumps Crypto Chief Predicts Bitcoin Price Jump After Market Surge

May 08, 2025 -

Wlyme Ke Mwqe Pr Almnak Waqeh Gjranwalh Myn Dlha Ka Antqal

May 08, 2025

Wlyme Ke Mwqe Pr Almnak Waqeh Gjranwalh Myn Dlha Ka Antqal

May 08, 2025 -

Analyzing Xrps 400 Rise Future Price Projections

May 08, 2025

Analyzing Xrps 400 Rise Future Price Projections

May 08, 2025

Latest Posts

-

Copa Libertadores Grupo C Liga De Quito Enfrenta A Flamengo En La Fecha 3

May 08, 2025

Copa Libertadores Grupo C Liga De Quito Enfrenta A Flamengo En La Fecha 3

May 08, 2025 -

Filipe Luis Suma Otro Titulo A Su Carrera

May 08, 2025

Filipe Luis Suma Otro Titulo A Su Carrera

May 08, 2025 -

Quito Empata Con Flamengo Resultado De La Copa Libertadores

May 08, 2025

Quito Empata Con Flamengo Resultado De La Copa Libertadores

May 08, 2025 -

Golaco De Arrascaeta Flamengo Sai Vencedor Contra O Gremio No Brasileirao

May 08, 2025

Golaco De Arrascaeta Flamengo Sai Vencedor Contra O Gremio No Brasileirao

May 08, 2025 -

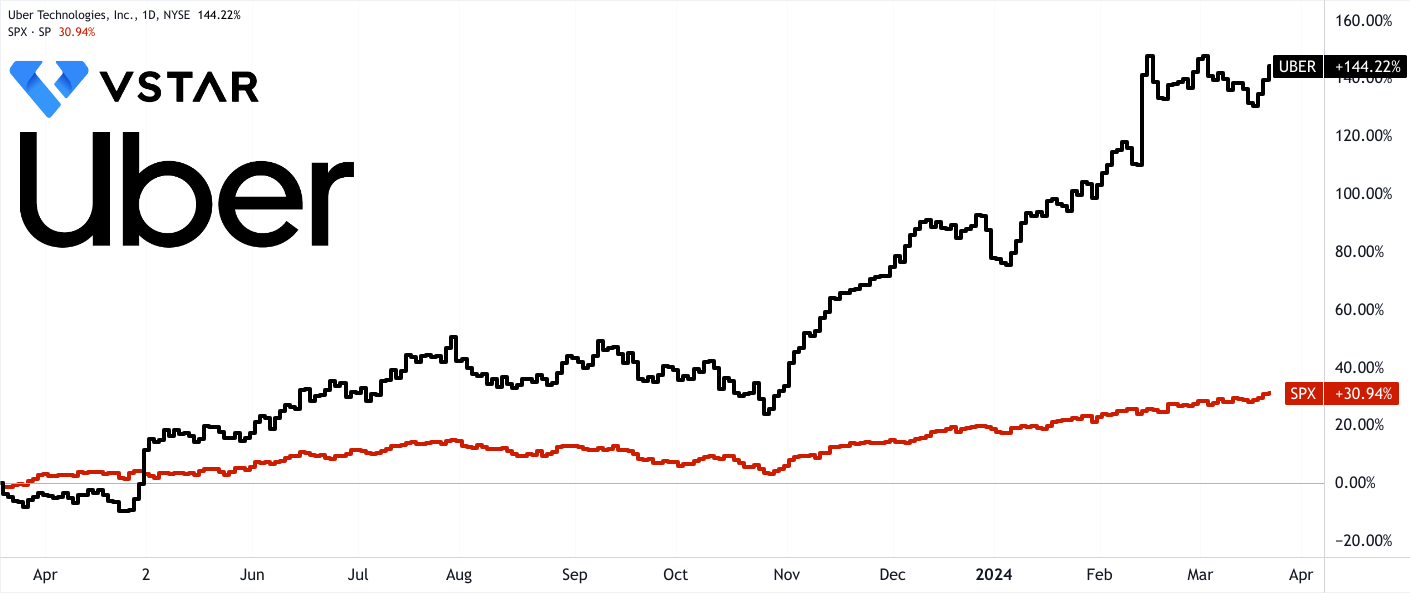

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025