185% Cryptocurrency Growth Predicted By VanEck: Is This The One To Buy?

Table of Contents

VanEck, a prominent investment firm, has made a bold prediction: a staggering 185% cryptocurrency growth is on the horizon. This projection sparks excitement for potential investors, promising significant returns. However, it's crucial to understand that such potential for high reward comes with equally high risk. This article delves into VanEck's prediction, exploring the factors driving this forecast and the crucial considerations before jumping into the cryptocurrency market. We will analyze the potential for Cryptocurrency Growth and what it means for investors.

VanEck's Prediction and its Basis

The 185% Figure - Methodology and Assumptions

VanEck's 185% cryptocurrency growth prediction isn't plucked from thin air. Their analysis likely involves a complex methodology, encompassing several factors. While the exact details of their model might not be publicly available, we can speculate on the key components:

- Breakdown of their market analysis: This likely involves assessing current market capitalization, adoption rates, technological advancements, and regulatory changes.

- Specific cryptocurrencies included in the prediction (if applicable): The prediction might focus on the overall crypto market or a specific subset of cryptocurrencies, such as those with strong fundamentals or promising technology.

- Economic factors considered: Macroeconomic trends like inflation, interest rates, and global economic growth undoubtedly play a role in their projections.

- Potential risks and uncertainties: Any responsible prediction would acknowledge inherent risks and uncertainties in the cryptocurrency market, including regulatory uncertainty, market volatility, and technological disruptions.

Historical Cryptocurrency Growth Trends

Examining past cryptocurrency market performance provides valuable context for VanEck's prediction. While past performance doesn't guarantee future results, it offers insights into potential growth trajectories. We can observe periods of explosive growth followed by sharp corrections. Comparing this historical volatility with the projected 185% growth highlights the magnitude of the prediction.

- 2017 Bull Run: A massive surge in cryptocurrency prices, followed by a significant downturn.

- 2021 Bull Run: Another period of rapid growth, again followed by a correction.

- Current Market Conditions: Analyzing current market trends against historical data provides a framework for evaluating the validity of the 185% prediction.

Factors Contributing to Predicted Cryptocurrency Growth

Growing Institutional Adoption

The increasing involvement of institutional investors is a significant factor fueling cryptocurrency growth predictions. These large players bring financial stability and credibility to the market.

- Examples of major institutions investing in crypto: BlackRock, Fidelity, and other major financial institutions are increasingly allocating assets to cryptocurrencies, signaling growing acceptance.

- The positive influence of institutional backing on market stability: This influx of institutional capital can help reduce volatility and increase market liquidity.

Technological Advancements in Blockchain

Continuous innovation within the blockchain ecosystem is a key driver of cryptocurrency growth. Developments in areas like scalability, security, and decentralized applications (dApps) are expanding the potential use cases for cryptocurrencies.

- Examples of innovative blockchain projects: Layer-2 scaling solutions, improved consensus mechanisms, and advancements in smart contract technology are all contributing to a more efficient and user-friendly cryptocurrency ecosystem.

- Potential impact of Layer-2 scaling solutions: These solutions aim to address scalability issues, increasing transaction speeds and reducing fees.

- The growth of decentralized applications (dApps): dApps built on blockchain technology are expanding the range of applications for cryptocurrencies beyond simple transactions.

Regulatory Developments (Positive and Negative)

Regulatory clarity or uncertainty significantly impacts market sentiment and Cryptocurrency Growth. Positive regulations can boost investor confidence, while unclear or negative regulations can hinder growth.

- Examples of positive regulatory developments: Clearer regulatory frameworks in some jurisdictions can provide legal certainty and encourage wider adoption.

- Examples of negative regulatory developments: Restrictive regulations or outright bans can stifle growth and drive investment elsewhere.

- The impact of regulatory clarity (or lack thereof) on market sentiment: Uncertainty creates volatility, whereas clarity can foster stability and attract more investment.

Risks and Considerations Before Investing

Volatility and Market Uncertainty

The cryptocurrency market is notoriously volatile, with prices subject to rapid and unpredictable swings. Investing in cryptocurrencies carries a significant risk of substantial losses.

- Historical examples of cryptocurrency price fluctuations: Past price movements demonstrate the inherent volatility of the market.

- Factors contributing to market volatility: News events, regulatory changes, and market sentiment all contribute to volatility.

- Strategies for mitigating risk (e.g., diversification): Diversifying investments across multiple cryptocurrencies and asset classes can help reduce risk.

Security Risks and Scams

Cryptocurrency investments are also vulnerable to security breaches and scams. It is crucial to protect your assets from theft and fraud.

- Common types of cryptocurrency scams: Phishing attacks, rug pulls, and Ponzi schemes are common threats.

- Best practices for securing crypto assets: Use strong passwords, enable two-factor authentication, and store your crypto in secure wallets.

- Importance of using reputable exchanges and wallets: Choose reputable platforms with a proven track record of security.

Tax Implications of Cryptocurrency Investments

The tax implications of cryptocurrency investments vary widely depending on jurisdiction. Understanding these implications is vital to avoid costly mistakes.

- Cryptocurrency tax laws: Tax laws regarding cryptocurrency vary significantly across different countries. Some jurisdictions treat cryptocurrency as property, others as a currency.

- Capital gains tax: Profits from selling cryptocurrencies are typically subject to capital gains tax.

- Tax reporting requirements: Accurate record-keeping is essential for complying with tax reporting requirements.

Conclusion

VanEck's 185% cryptocurrency growth prediction is certainly eye-catching, suggesting substantial potential returns. However, this projection is based on several assumptions and factors, some of which are inherently unpredictable. The cryptocurrency market's volatility and the existence of security risks need to be carefully considered. While the potential for Cryptocurrency Growth is significant, thorough research and due diligence are absolutely crucial before investing. Considering the predicted 185% Cryptocurrency Growth, are you ready to explore the opportunities and risks in the crypto market? Start your research today!

Featured Posts

-

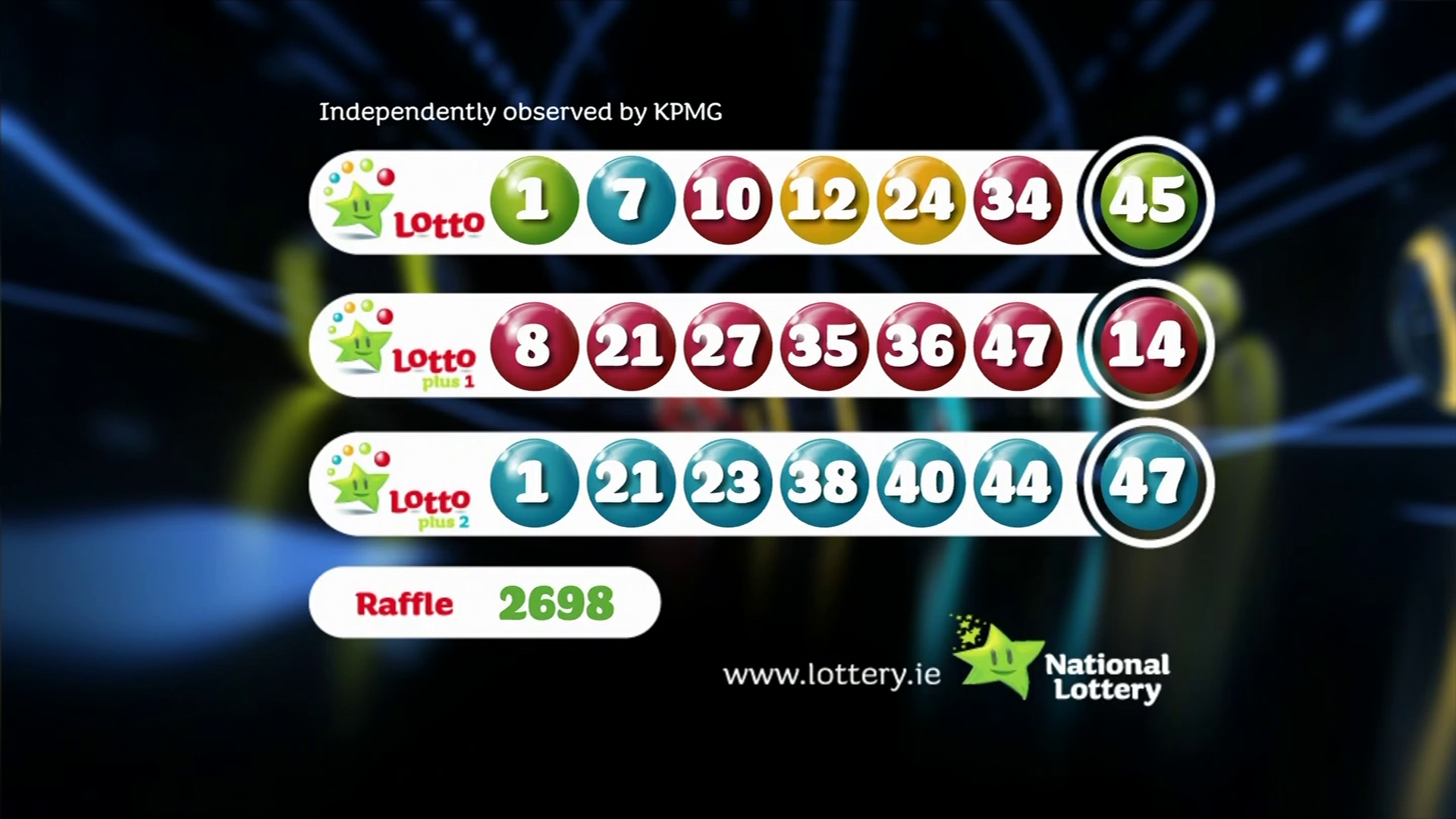

Lotto Results Wednesday 16 April 2025

May 08, 2025

Lotto Results Wednesday 16 April 2025

May 08, 2025 -

Six Month Trend Reverses Bitcoin Buying Outpaces Selling On Binance

May 08, 2025

Six Month Trend Reverses Bitcoin Buying Outpaces Selling On Binance

May 08, 2025 -

Bitcoins Golden Cross Historical Data And Future Price Predictions

May 08, 2025

Bitcoins Golden Cross Historical Data And Future Price Predictions

May 08, 2025 -

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025

Latest Posts

-

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf

May 08, 2025 -

Krachy Pwlys Ky Karkrdgy Pr Swalat Awdhw Ka Aetraf

May 08, 2025

Krachy Pwlys Ky Karkrdgy Pr Swalat Awdhw Ka Aetraf

May 08, 2025 -

Armghan Kys Krachy Pwlys Chyf Ne Naahly Tslym Ky

May 08, 2025

Armghan Kys Krachy Pwlys Chyf Ne Naahly Tslym Ky

May 08, 2025 -

Jawyd Ealm Awdhw Ka Armghan Kys Pr Bra Byan Pwlys Ky Nakamy Ka Aetraf

May 08, 2025

Jawyd Ealm Awdhw Ka Armghan Kys Pr Bra Byan Pwlys Ky Nakamy Ka Aetraf

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025