Bitcoin's Golden Cross: Historical Data And Future Price Predictions

Table of Contents

Understanding the Bitcoin Golden Cross

A golden cross is a bullish technical indicator that occurs when a shorter-term moving average crosses above a longer-term moving average. In Bitcoin trading, this often involves the 50-day moving average crossing above the 200-day moving average. This crossover suggests a potential shift from a bearish to a bullish trend, indicating a possible upward price movement.

-

Significance: The golden cross is not a guaranteed predictor of future price increases, but it's a valuable signal often used by traders to identify potential buying opportunities. It suggests growing bullish momentum and a potential reversal of a downtrend.

-

Importance in Technical Analysis: Technical analysts use the golden cross in conjunction with other indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and volume analysis to confirm the strength and sustainability of the bullish trend. A confirmation from multiple indicators strengthens the signal.

-

Visual Representation: [Insert a chart here clearly showing a Bitcoin golden cross event, ideally with labeled axes and clear indication of the 50-day and 200-day moving averages crossing.]

Historical Bitcoin Golden Cross Events

Examining past Bitcoin golden cross events provides valuable insights into its potential impact on future price movements. While past performance isn't indicative of future results, analyzing these instances offers a historical perspective.

Case Study 1: [Date, e.g., October 2015] At this time, Bitcoin's price was around $[Price]. The golden cross occurred when the 50-day MA crossed above the 200-day MA.

- Price movement in the weeks/months following the cross: [Describe the price action, e.g., a steady increase over the next three months, reaching a peak of $[Price] before a correction.]

- Overall market conditions during that period: [Describe the general market sentiment and any relevant external factors, e.g., positive media coverage, increased institutional investment.]

- Impact on Bitcoin's market capitalization: [Quantify the impact, e.g., market cap increased by X% during the period.]

Case Study 2: [Date, e.g., August 2019] Bitcoin's price was approximately $[Price] when this golden cross event took place.

- Price movement in the weeks/months following the cross: [Describe the price action.]

- Overall market conditions during that period: [Describe the market conditions.]

- Impact on Bitcoin's market capitalization: [Quantify the impact.]

Case Study 3: [Date, e.g., March 2023] Bitcoin’s price at the time of this golden cross was $[Price].

- Price movement in the weeks/months following the cross: [Describe the price action.]

- Overall market conditions during that period: [Describe the market conditions.]

- Impact on Bitcoin's market capitalization: [Quantify the impact.]

Summary Table:

| Date | Price at Crossover | Subsequent Price Performance (e.g., % change over 3 months) |

|---|---|---|

| [Date 1] | $[Price 1] | [Percentage Change 1] |

| [Date 2] | $[Price 2] | [Percentage Change 2] |

| [Date 3] | $[Price 3] | [Percentage Change 3] |

Factors Influencing Post-Golden Cross Performance

While the golden cross provides a valuable signal, several factors can significantly influence Bitcoin's price performance following the event.

-

Macroeconomic Conditions: Global economic events like inflation, recession fears, and geopolitical instability can dramatically impact Bitcoin's price, regardless of technical indicators.

-

Regulatory Developments: Government regulations and announcements concerning cryptocurrency can create significant price volatility. Positive regulatory developments tend to be bullish, while negative news can trigger sell-offs.

-

Bitcoin Adoption and Network Growth: Increased adoption by businesses and individuals, along with improvements in the Bitcoin network's scalability and efficiency, contribute to long-term price appreciation.

-

Whale Activity & Market Sentiment: The actions of large Bitcoin holders ("whales") and overall market sentiment (fear, uncertainty, and doubt (FUD) versus greed) play a considerable role in short-term price fluctuations.

Future Bitcoin Price Predictions Based on Golden Cross Analysis

Predicting Bitcoin's future price with certainty is impossible. However, based on historical golden cross events, we can outline potential scenarios:

-

Cautious Optimism: Historical data suggests a potential for price increases following a golden cross, but this isn't guaranteed.

-

Range-Bound Movement: The price may consolidate within a specific range after the crossover before a significant move in either direction.

-

Potential for Explosive Growth: Under favorable macroeconomic conditions, positive regulatory developments, and sustained high market sentiment, a golden cross could precede a substantial price surge.

-

Disclaimer: These are potential scenarios based on historical analysis and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Conclusion

Analyzing historical Bitcoin golden cross events reveals a potential correlation with subsequent price increases, though not always substantial or sustained. The golden cross acts as a valuable signal within a broader technical analysis framework. However, it's crucial to remember that technical analysis alone is insufficient for making sound investment decisions. Fundamental analysis, considering macroeconomic conditions, regulatory developments, and adoption rates, is equally important.

To effectively utilize the Bitcoin golden cross as part of your investment strategy, stay informed about macroeconomic factors and Bitcoin network developments. Learn more about Bitcoin's price movements and the intricacies of technical indicators like the golden cross. Remember to consult a financial advisor before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Counting Crows Snl Performance A Career Altering Event

May 08, 2025

Counting Crows Snl Performance A Career Altering Event

May 08, 2025 -

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025 -

Bitcoin Rally Starting Analysts Chart Highlights Key Zones May 6 2024

May 08, 2025

Bitcoin Rally Starting Analysts Chart Highlights Key Zones May 6 2024

May 08, 2025 -

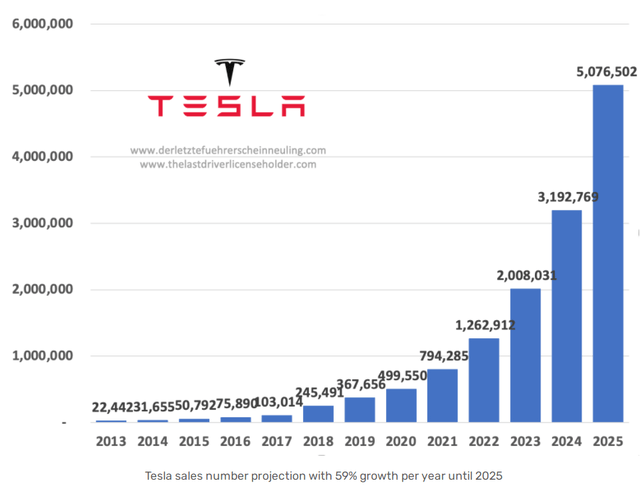

New Pushback From Car Dealers On Electric Vehicle Requirements

May 08, 2025

New Pushback From Car Dealers On Electric Vehicle Requirements

May 08, 2025 -

The Long Walk Movie A Realistic Look At Stephen Kings Classic

May 08, 2025

The Long Walk Movie A Realistic Look At Stephen Kings Classic

May 08, 2025

Latest Posts

-

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025 -

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025 -

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025 -

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025 -

Kripto Lider Nedir Ve Neden Herkes Konusuyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Konusuyor

May 08, 2025