20 Million XRP Bought By A Whale: Impact On Ripple's Ecosystem

Table of Contents

A significant purchase of 20 million XRP by a crypto whale has sent ripples (pun intended!) through the cryptocurrency market. This substantial investment raises important questions about the future of XRP and the broader Ripple ecosystem. This article will delve into the potential implications of this large transaction, analyzing its effects on price, market sentiment, and the overall health of Ripple's network.

Immediate Impact on XRP Price and Volatility

Short-Term Price Fluctuations

The immediate aftermath of the 20 million XRP purchase saw a noticeable spike in the XRP price. While the exact magnitude varied across different exchanges, reports indicated a short-term increase ranging from 2% to 5% depending on the platform. However, this price surge wasn't entirely sustained. The price quickly consolidated, demonstrating the volatile nature of the cryptocurrency market.

-

Examine trading volume spikes in relation to the purchase: The whale's purchase coincided with a significant increase in XRP trading volume, indicating increased market activity directly linked to the large transaction. This surge suggests heightened interest and participation from both retail and institutional investors.

-

Consider the influence of news coverage on price volatility: News outlets and social media platforms widely reported the whale's purchase, fueling speculation and further contributing to short-term price volatility. Positive news coverage generally amplifies the effects of such large transactions.

-

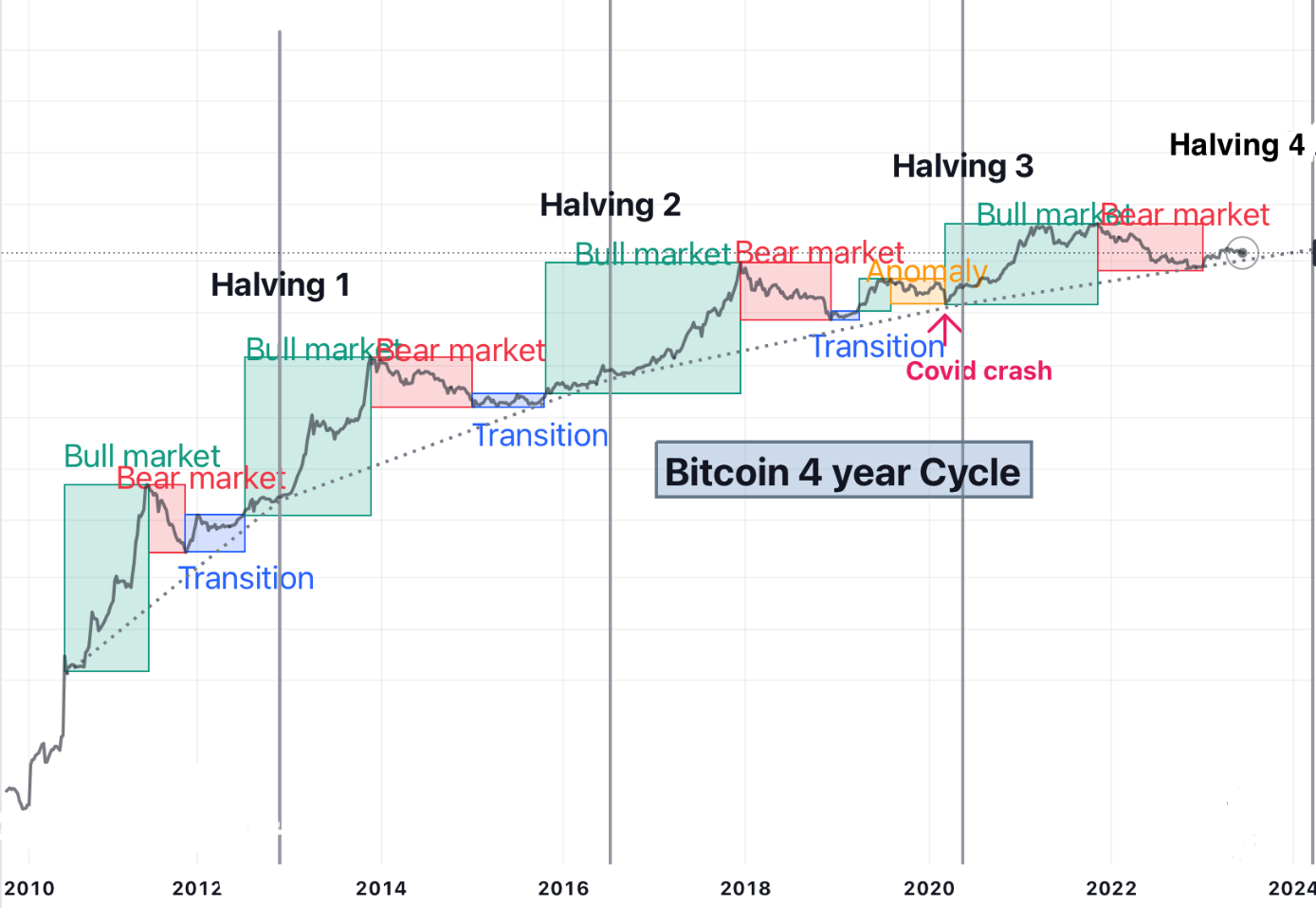

Mention any correlation with broader cryptocurrency market trends: The price fluctuation of XRP, even in response to a large purchase, is intertwined with the overall performance of the broader cryptocurrency market. A positive trend in Bitcoin or other major cryptocurrencies often provides a supportive environment for altcoins like XRP.

Increased Market Liquidity

A crucial aspect to consider is whether the large purchase improved XRP's liquidity. While a single transaction of this size can temporarily increase liquidity on specific exchanges, the long-term impact requires further analysis.

-

Discuss the implications of increased liquidity for smaller investors: Increased liquidity generally benefits smaller investors by allowing them to buy or sell XRP more easily without significantly impacting the price. This reduces the risk of slippage, where the actual execution price differs from the expected price.

-

Explain how increased liquidity can impact trading efficiency: Higher liquidity facilitates more efficient trading. It allows for faster execution of trades at better prices, leading to a more efficient market overall.

-

Mention the potential for reduced price slippage: As mentioned, increased liquidity directly translates to a lower risk of price slippage for traders, making XRP a more attractive asset for both large and small-scale investments.

Long-Term Implications for the Ripple Ecosystem

Increased Adoption and Institutional Interest

The 20 million XRP purchase could be interpreted as a vote of confidence from a significant player in the crypto market. This action might attract further institutional investment and accelerate XRP adoption.

-

Analyze the potential impact on attracting further institutional investment: Large-scale purchases often signal a belief in the long-term potential of an asset. This can encourage other institutional investors to enter the market, driving up demand and price.

-

Discuss the possibility of increased partnerships and integrations: A healthier ecosystem often attracts new partnerships and integrations. Increased adoption could lead to more businesses integrating XRP into their payment systems or utilizing RippleNet, Ripple's blockchain-based payment network.

-

Consider the role of this event in fostering wider XRP adoption: Increased market attention and positive sentiment surrounding the purchase can contribute to greater awareness and adoption of XRP among individuals and businesses alike.

Impact on XRP's Market Capitalization and Ranking

The whale's purchase directly affected XRP's market capitalization, albeit temporarily. An increase in market capitalization, while not solely due to this single transaction, is a positive indicator for investor sentiment.

-

Discuss the significance of its market capitalization increase: A rise in market capitalization reflects the increased valuation of the overall XRP supply. This is a key metric for assessing the cryptocurrency's market standing.

-

Analyze the implications of the increased market cap for investor sentiment: A larger market cap can boost investor confidence, attracting more investment and potentially leading to further price appreciation.

-

Consider potential future implications for XRP's place in the crypto market: While its ranking might fluctuate, a consistently healthy market cap and increased adoption could strengthen XRP's position within the broader cryptocurrency market.

Potential for Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple casts a significant shadow over XRP's future. This regulatory uncertainty can influence the impact of even large investment decisions like the recent whale purchase.

-

Analyze the potential effects of ongoing SEC lawsuits on XRP's price and adoption: The outcome of the lawsuit will have a profound impact on XRP's price and adoption. A favorable ruling could boost its value and adoption significantly.

-

Discuss the role of regulatory clarity in influencing large investment decisions: Regulatory clarity is crucial for attracting institutional investors. Uncertainty can deter large-scale investments, whereas clear regulations can foster a more stable and predictable market.

-

Consider the impact of different regulatory outcomes on the Ripple ecosystem: Different outcomes of the SEC lawsuit will significantly impact the Ripple ecosystem. A positive outcome could lead to a surge in adoption, while a negative outcome could negatively affect the price and overall development.

Conclusion

The 20 million XRP purchase by a whale represents a significant event with potential long-term consequences for the Ripple ecosystem. While the short-term impact on price and volatility is clear, the long-term effects will depend on various factors, including regulatory developments and wider market trends. Continued monitoring of XRP's price, trading volume, and market capitalization is crucial for understanding the full impact of this substantial investment. Stay informed about the latest developments in the XRP and Ripple ecosystem to make informed decisions regarding your investments in this dynamic market. Learn more about the evolving landscape of XRP and the Ripple network to understand the future potential of this cryptocurrency.

Featured Posts

-

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 07, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 07, 2025 -

Tom Holland And Zendaya A Paws And Love Encounter On The Euphoria Set

May 07, 2025

Tom Holland And Zendaya A Paws And Love Encounter On The Euphoria Set

May 07, 2025 -

Najpopularniejsze Publikacje Jacka Harlukowicza W Onecie 2024

May 07, 2025

Najpopularniejsze Publikacje Jacka Harlukowicza W Onecie 2024

May 07, 2025 -

Dallas Wings Vs Las Vegas Aces Wnba Preseason Live Stream Guide

May 07, 2025

Dallas Wings Vs Las Vegas Aces Wnba Preseason Live Stream Guide

May 07, 2025 -

Should The Wolves Pursue Julius Randle A Data Driven Analysis

May 07, 2025

Should The Wolves Pursue Julius Randle A Data Driven Analysis

May 07, 2025

Latest Posts

-

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025 -

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025 -

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025