Bitcoin Rebound: A New Bull Market Or Temporary Rally?

Table of Contents

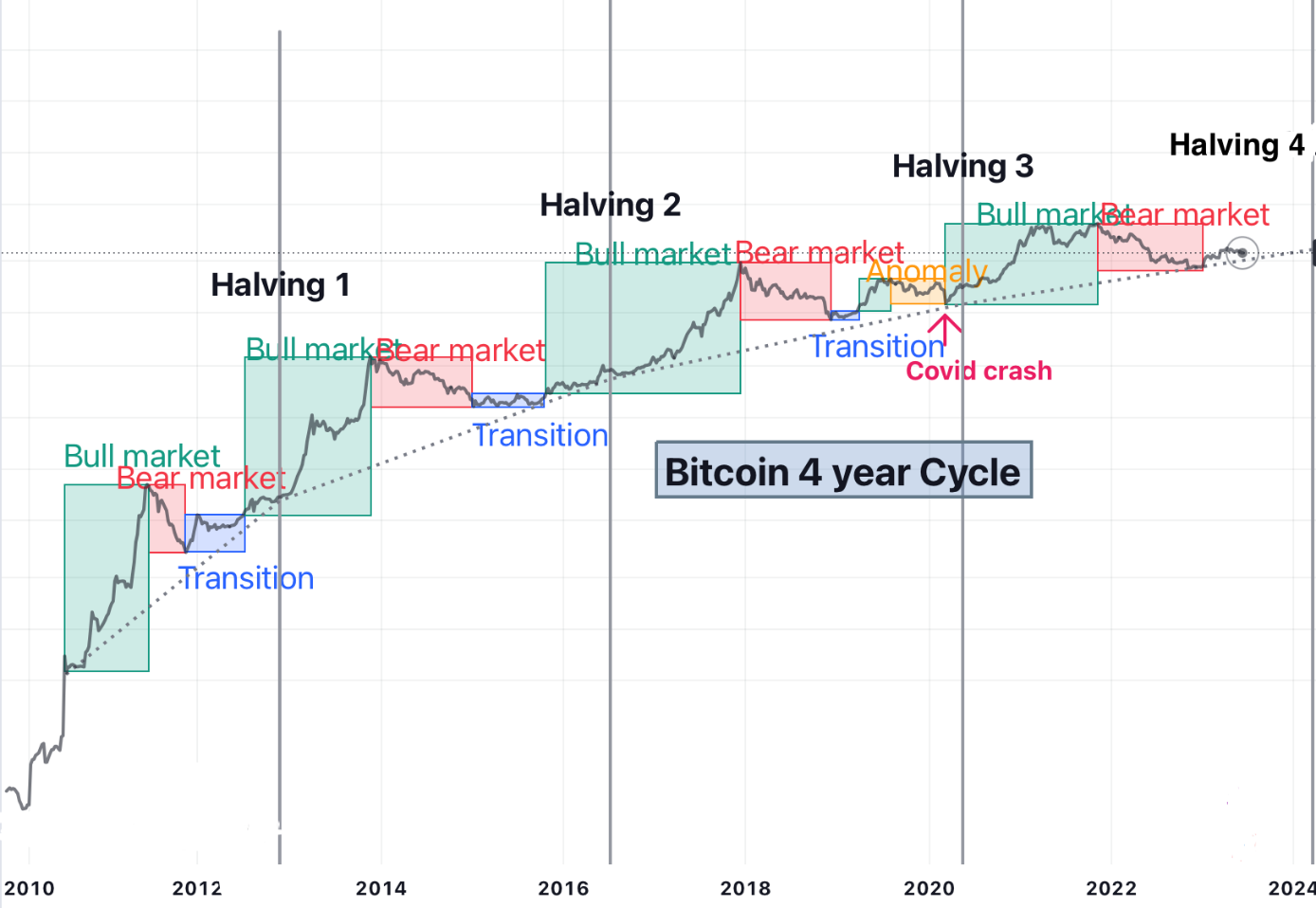

Technical Analysis of the Bitcoin Rebound

Analyzing Bitcoin's price charts is crucial for understanding the current rebound. Technical indicators offer valuable insights into potential future price movements. Let's examine some key metrics:

- Moving Averages: A strong breakout above the crucial 200-day moving average often suggests a shift in bullish momentum. This suggests a potential sustained upward trend, although confirmation is needed. [Insert image of Bitcoin price chart highlighting the 200-day MA].

- RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI nearing overbought territory (typically above 70) might signal a potential short-term correction, indicating a temporary pause in the upward trend. [Insert image of Bitcoin RSI chart].

- MACD (Moving Average Convergence Divergence): The MACD identifies changes in the strength, direction, momentum, and duration of a trend. A bullish crossover (MACD line crossing above the signal line) can be a strong indicator of a continuing uptrend. [Insert image of Bitcoin MACD chart].

- Support and Resistance Levels: Identifying key support and resistance levels is crucial. A strong break above a major resistance level like $30,000 (example) would confirm further bullish momentum. Conversely, a drop below a key support level could indicate a potential correction.

Macroeconomic Factors Influencing Bitcoin's Price

Bitcoin's price isn't solely driven by technical factors; macroeconomic conditions play a significant role.

- Inflation and Interest Rates: High inflation often pushes investors towards alternative assets like Bitcoin, seen as a hedge against inflation. However, rising interest rates can impact Bitcoin negatively as investors shift towards higher-yielding assets.

- Correlation with Traditional Markets: Bitcoin's correlation with traditional markets is complex and not always consistent. During periods of market uncertainty, Bitcoin can act as a safe haven, while during periods of risk appetite, its price may follow traditional markets.

- Government Regulations: Regulatory clarity and favorable policies can significantly boost institutional investment in Bitcoin, driving price appreciation. Conversely, stringent regulations can hinder growth and negatively impact the price.

On-Chain Metrics and Bitcoin Adoption

Analyzing on-chain data provides insights into the underlying strength and adoption of Bitcoin.

- Transaction Volume and Active Addresses: An increase in transaction volume and active addresses suggests growing user activity and potentially indicates future price appreciation, reflecting broader network usage.

- Mining Difficulty: A high mining difficulty shows a secure and resilient network, signifying the ongoing commitment and investment in Bitcoin's infrastructure.

- Institutional Adoption: Growing institutional adoption, such as through Bitcoin ETFs and investment by large corporations, signals increased confidence in Bitcoin's long-term value and can significantly drive up demand. The development and adoption of the Lightning Network also enhances Bitcoin's scalability and efficiency, further boosting adoption.

Potential Scenarios: Bull Market or Correction?

Several scenarios could unfold for Bitcoin's price:

- Scenario 1: Sustained Bull Market: Continued institutional adoption, positive macroeconomic conditions (e.g., controlled inflation, stable interest rates), and further technological advancements in the Bitcoin ecosystem could lead to a sustained bull market, potentially driving the price significantly higher.

- Scenario 2: Significant Price Correction: Increased regulatory scrutiny, a global economic downturn triggering risk-off sentiment, or a major security incident could trigger a substantial price correction.

Conclusion: Navigating the Bitcoin Rebound

Understanding the Bitcoin rebound requires a holistic analysis encompassing technical indicators, macroeconomic factors, and on-chain metrics. While the recent price increase is promising, the potential for both significant gains and considerable losses remains. The current situation presents a complex and uncertain outlook. Understanding the nuances of the Bitcoin rebound is crucial for navigating the cryptocurrency market. Continue your research on Bitcoin price action and develop a robust investment strategy. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Inter Beat Barcelona In A Champions League Classic To Reach The Final

May 08, 2025

Inter Beat Barcelona In A Champions League Classic To Reach The Final

May 08, 2025 -

Dwps 5 Billion Universal Credit Refund Whos Eligible

May 08, 2025

Dwps 5 Billion Universal Credit Refund Whos Eligible

May 08, 2025 -

Bitcoin Or Micro Strategy Stock Smart Investment Choices For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock Smart Investment Choices For 2025

May 08, 2025 -

Ps 5 Pro Sales Slowdown Is History Repeating Itself

May 08, 2025

Ps 5 Pro Sales Slowdown Is History Repeating Itself

May 08, 2025 -

Bitcoin Price Surge Trade Tensions And Bullish Crypto Bets

May 08, 2025

Bitcoin Price Surge Trade Tensions And Bullish Crypto Bets

May 08, 2025

Latest Posts

-

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025 -

Made In Pakistan Ahsans Plan For Global Trade Through Tech Adoption

May 08, 2025

Made In Pakistan Ahsans Plan For Global Trade Through Tech Adoption

May 08, 2025 -

Strategies For Expediting Crime Control Measures A Practical Approach

May 08, 2025

Strategies For Expediting Crime Control Measures A Practical Approach

May 08, 2025 -

Will Andor Season 2 Include Beloved Rebels Characters Exploring The Timeline

May 08, 2025

Will Andor Season 2 Include Beloved Rebels Characters Exploring The Timeline

May 08, 2025 -

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Hlak Mlzm Hlak

May 08, 2025

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Hlak Mlzm Hlak

May 08, 2025