2024 ING Group Annual Report: Form 20-F Analysis And Key Findings

Table of Contents

Financial Highlights of ING Group's 2024 Form 20-F

Revenue and Profitability

The 2024 Form 20-F reveals important details about ING Group revenue and profitability. Analyzing ING Group revenue streams, net income, and profitability margins provides a clear picture of the company's financial health. Key figures from the report, compared to previous years, will illuminate growth trends and identify potential areas of strength and weakness.

-

ING Group Revenue: The report will detail the breakdown of revenue across various segments, including Wholesale Banking, Retail Banking, and Insurance. Analyzing year-over-year growth in each segment will provide valuable insights into performance drivers. For example, a significant increase in Retail Banking revenue could indicate success in customer acquisition or product innovation. Conversely, a decline might warrant further investigation.

-

ING Group Net Income: Examination of net income, compared to previous years and industry benchmarks, provides a measure of overall profitability. Factors influencing net income, such as interest rate changes and operational efficiencies, need to be considered for a complete analysis.

-

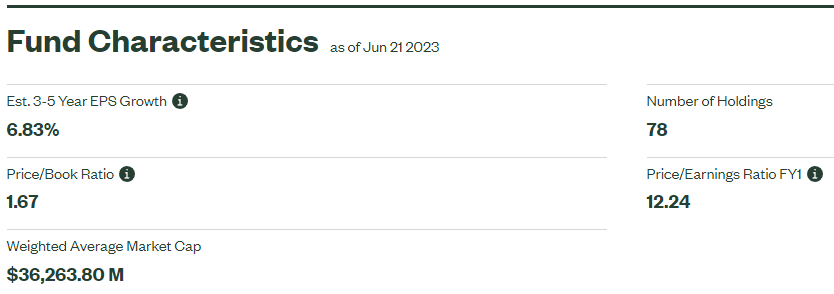

Profitability Analysis: Key financial ratios like Return on Equity (ROE) and Return on Assets (ROA) will be analyzed to assess the efficiency of ING Group's capital deployment and asset utilization. Benchmarking these ratios against competitors will further highlight ING Group's performance within the industry.

Asset Quality and Risk Management

Assessing ING Group asset quality is critical for understanding the company's financial stability. The Form 20-F provides data on non-performing loans, loan loss provisions, and overall credit risk exposure. A thorough review of these metrics is essential for evaluating the effectiveness of ING Group's risk management strategies.

-

ING Group Asset Quality: Key metrics such as the ratio of non-performing loans to total loans, and the level of loan loss provisions, indicate the quality of ING's loan portfolio and the potential for future losses.

-

Credit Risk: The report will detail the company's approach to managing credit risk, including its underwriting standards, risk appetite, and stress testing methodologies. An analysis of these strategies will reveal the robustness of ING's risk management framework.

-

Risk Management: The 2024 Form 20-F should outline the key risk management strategies employed by ING Group to mitigate potential losses, including diversification, hedging, and stress testing.

Capital Adequacy and Liquidity

ING Group's capital ratios and liquidity position are indicators of its financial resilience and ability to withstand economic shocks. The Form 20-F will provide details on key capital adequacy metrics and liquidity ratios.

-

ING Group Capital Adequacy: The Common Equity Tier 1 (CET1) ratio is a crucial indicator of ING's capital strength. A comparison of this ratio to regulatory requirements and industry benchmarks will show ING’s compliance and relative strength.

-

Liquidity Ratio: Analyzing liquidity ratios, such as the liquidity coverage ratio (LCR), reveals ING Group’s ability to meet short-term obligations.

-

Capital Strength: The overall assessment of ING’s capital adequacy and liquidity will highlight the company's financial stability and its preparedness for potential economic downturns.

Key Strategic Initiatives and Developments in 2024

Business Strategy and Growth Initiatives

ING Group’s 2024 strategic direction, expansion plans, and significant investments are outlined in the Form 20-F. Understanding these initiatives is crucial for assessing the company's future growth prospects.

-

ING Group Strategy: The report details ING's strategic priorities and long-term goals, including its vision for growth and market leadership.

-

Business Growth: The analysis will highlight ING's key growth strategies, such as market expansion into new geographies or expansion into new product lines.

-

Strategic Initiatives: The report describes significant investments made by ING Group to support its strategic objectives and propel its growth.

Digital Transformation and Technological Advancements

ING Group's progress in digital banking and its adoption of new technologies are essential for its competitiveness. The Form 20-F will showcase investments in digital transformation.

-

Digital Banking: An analysis of ING’s investments in digital platforms, mobile banking apps, and online services will show its commitment to enhancing customer experience and operational efficiency.

-

ING Group Technology: The report will detail investments in new technologies, such as artificial intelligence and blockchain, to improve service delivery and streamline operations.

-

Digital Transformation: The overall assessment of ING’s digital transformation journey will reveal the success of their initiatives in driving efficiency and enhancing customer satisfaction.

Sustainability and ESG Performance

The 2024 ING Group Annual Report will highlight the company's sustainability initiatives and Environmental, Social, and Governance (ESG) performance.

-

ING Group ESG: The report will detail ING’s commitment to ESG principles and its progress towards achieving its sustainability goals.

-

Sustainability Report: A review of ING’s sustainability report will showcase specific initiatives related to environmental protection, social responsibility, and good corporate governance.

-

Environmental Performance, Social Responsibility, Corporate Governance: Key performance indicators (KPIs) related to environmental impact, social programs, and governance practices will be analyzed to assess ING’s ESG performance.

Conclusion: Key Takeaways from the 2024 ING Group Annual Report (Form 20-F) Analysis

The 2024 ING Group Annual Report (Form 20-F) provides valuable insights into the company's financial performance and strategic direction. Key highlights include [mention 2-3 significant financial highlights and 2-3 key strategic developments based on the analysis above]. These findings provide crucial information for investors and stakeholders to evaluate ING Group’s financial health, risk profile, and future growth potential. To gain a more detailed understanding of ING Group's performance and strategic initiatives, we strongly encourage you to download the full 2024 ING Group Annual Report (Form 20-F) and review the complete ING Group financial statements. Stay informed about future ING Group performance and strategic updates by regularly reviewing their filings and publications.

Featured Posts

-

Rigetti Rgti And Ion Q Top Quantum Stock Performers Of 2025

May 21, 2025

Rigetti Rgti And Ion Q Top Quantum Stock Performers Of 2025

May 21, 2025 -

Les Novelistes A L Espace Julien En Attendant Le Hellfest

May 21, 2025

Les Novelistes A L Espace Julien En Attendant Le Hellfest

May 21, 2025 -

Rockies Fall To Tigers 6 8 Underperformance Explained

May 21, 2025

Rockies Fall To Tigers 6 8 Underperformance Explained

May 21, 2025 -

Who Is Nadiem Amiri Exploring The German Internationals Career

May 21, 2025

Who Is Nadiem Amiri Exploring The German Internationals Career

May 21, 2025 -

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 21, 2025

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 21, 2025