$3.40 XRP Price Target: A Realistic Expectation For Ripple?

Table of Contents

Ripple's Ongoing Legal Battle with the SEC

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and overall market sentiment. The SEC's claim that XRP is an unregistered security has created considerable uncertainty, affecting investor confidence and trading volume.

The Impact of the SEC Lawsuit on XRP Price

The lawsuit's outcome will dramatically influence XRP's price. A positive ruling for Ripple could trigger a significant price surge, potentially exceeding investor expectations. Conversely, a negative ruling could lead to a substantial price drop, potentially pushing XRP far below its current trading range.

-

Core Arguments: The SEC argues XRP is a security due to the expectation of profit based on Ripple's efforts. Ripple counters that XRP is a decentralized currency, similar to Bitcoin or Ether, not subject to SEC regulations.

-

Market Reaction: A positive ruling could unleash pent-up demand, driving a significant price increase, potentially propelling XRP towards the $3.40 target or even higher. A negative ruling, however, could cause widespread selling pressure and a sharp decline in XRP's price.

-

Investor Sentiment & Volume: The legal uncertainty has led to fluctuating investor sentiment and trading volume. Periods of positive news generate excitement and increased trading, while negative developments dampen enthusiasm.

-

Expert Opinions: Many legal experts and crypto analysts offer differing opinions on the case's potential outcome, highlighting the inherent uncertainty and the difficulty in accurately predicting XRP's future price.

XRP's Technological Advancements and Adoption

XRP's technology and adoption rate are crucial factors influencing its potential price. The XRP Ledger's features, such as speed and low transaction costs, are vital to its future.

XRP Ledger's Scalability and Efficiency

The XRP Ledger boasts impressive scalability and efficiency compared to many other cryptocurrencies. Its fast transaction speeds and low fees make it attractive for cross-border payments and various applications.

-

Speed and Low Fees: XRP transactions are significantly faster and cheaper than those on many other blockchains, enhancing its appeal for both individuals and institutions.

-

Cross-Border Payments: XRP's potential for facilitating efficient and low-cost cross-border payments is a major driver of its adoption. Several financial institutions are exploring XRP's capabilities in this space.

-

Partnerships and Integrations: New partnerships and integrations with payment providers and financial institutions could significantly boost XRP's adoption and drive its price higher.

-

Improved Scalability: Ongoing improvements to the XRP Ledger's scalability will further enhance its ability to handle large transaction volumes, making it more competitive in the evolving cryptocurrency market.

Market Sentiment and Overall Crypto Market Conditions

XRP's price is heavily influenced by broader market sentiment and the performance of other cryptocurrencies, particularly Bitcoin.

The Influence of Bitcoin and the Broader Crypto Market on XRP's Price

Bitcoin often sets the tone for the entire cryptocurrency market. A bullish Bitcoin market typically leads to increased interest in altcoins like XRP, while a bearish Bitcoin market can negatively impact XRP's price.

-

Market Sentiment (Bull vs. Bear): During bull markets, investors are more willing to take risks, potentially driving XRP's price upward. Conversely, bearish markets often lead to selling pressure and lower prices.

-

Regulatory Changes: Regulatory changes in the cryptocurrency space, both globally and regionally, can significantly influence market sentiment and XRP's price.

-

Macroeconomic Factors: Macroeconomic conditions such as inflation, recession, and interest rate changes can also influence the overall cryptocurrency market and XRP's price.

-

Investment Diversification: Diversification is crucial when investing in cryptocurrencies. Relying solely on one asset like XRP carries significant risk.

Factors Contributing to a Potential $3.40 XRP Price Target

Several optimistic scenarios could lead to a substantial increase in XRP's price.

Optimistic Scenarios and Potential Catalysts

Reaching a $3.40 XRP price target hinges on several positive developments.

-

Favorable SEC Ruling: A win for Ripple in the SEC lawsuit would likely trigger a significant price surge.

-

Increased Institutional Adoption: Wider institutional adoption and integration into existing financial systems could drive demand and increase XRP's price.

-

Growth in Cross-Border Payments: A significant increase in the use of XRP for cross-border payments would boost its value and utility.

-

Bullish Market Cycle: A sustained period of positive market sentiment and a broader bullish crypto market cycle would significantly increase XRP's potential to reach the $3.40 target.

Challenges and Risks to Reaching the $3.40 XRP Price Target

Despite the potential for growth, several challenges could prevent XRP from reaching the $3.40 target.

Pessimistic Scenarios and Potential Headwinds

Several factors could hinder XRP's price appreciation.

-

Unfavorable SEC Ruling: An unfavorable ruling could significantly depress XRP's price and impact investor confidence.

-

Increased Competition: Competition from other cryptocurrencies offering similar functionalities could limit XRP's growth.

-

Negative Regulatory Changes: Stringent regulations or bans in key markets could negatively impact XRP's price.

-

Prolonged Bear Market: A prolonged period of bearish market sentiment could suppress XRP's price for an extended period.

Conclusion

Predicting XRP's price with certainty is impossible. While a $3.40 XRP price target is ambitious, understanding the factors influencing its price—the SEC lawsuit, technological advancements, market sentiment, and macroeconomic conditions—is crucial for informed investment decisions. A favorable outcome in the SEC case, coupled with increased adoption and a bullish market, could push XRP towards this target. However, an unfavorable ruling or negative market conditions could significantly hinder its progress. Remember to conduct thorough due diligence and consult with a financial advisor before investing in any cryptocurrency, including XRP. Continue your research on XRP price predictions and stay updated on the latest developments before making any investment choices related to the $3.40 XRP price target or other XRP price predictions.

Featured Posts

-

Ayesha Currys Honest Take On Marriage And Family

May 07, 2025

Ayesha Currys Honest Take On Marriage And Family

May 07, 2025 -

Pittsburgh Steelers Announce Decision Regarding Top Wide Receiver

May 07, 2025

Pittsburgh Steelers Announce Decision Regarding Top Wide Receiver

May 07, 2025 -

John Wick 5 Keanu Reevess Character And The Question Of Return

May 07, 2025

John Wick 5 Keanu Reevess Character And The Question Of Return

May 07, 2025 -

Vedno Bos V Nasih Srcih Ohranjanje Spomina Na Dragega

May 07, 2025

Vedno Bos V Nasih Srcih Ohranjanje Spomina Na Dragega

May 07, 2025 -

First Inning Domination Mariners Crush Marlins 14 0

May 07, 2025

First Inning Domination Mariners Crush Marlins 14 0

May 07, 2025

Latest Posts

-

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025 -

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 M In Week 1 Inflows Upon Approval

May 08, 2025 -

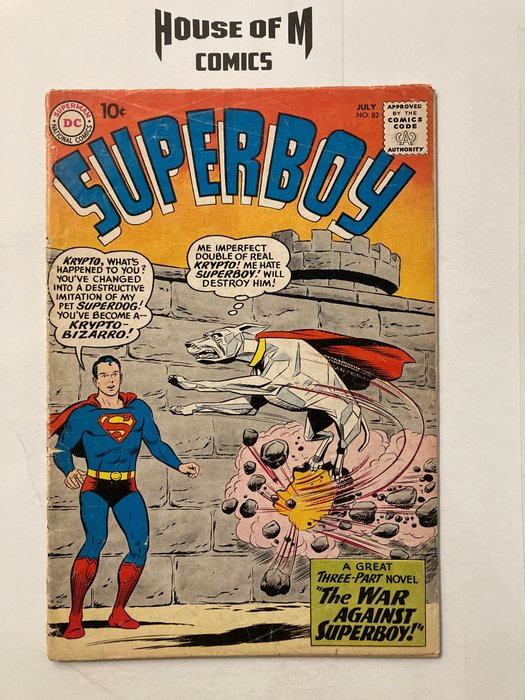

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025 -

Could Xrp Reach 5 In 2025 A Realistic Look At Xrps Price Prediction

May 08, 2025

Could Xrp Reach 5 In 2025 A Realistic Look At Xrps Price Prediction

May 08, 2025 -

Cute Krypto Scenes A Sneak Peek From Upcoming Superman Movie

May 08, 2025

Cute Krypto Scenes A Sneak Peek From Upcoming Superman Movie

May 08, 2025