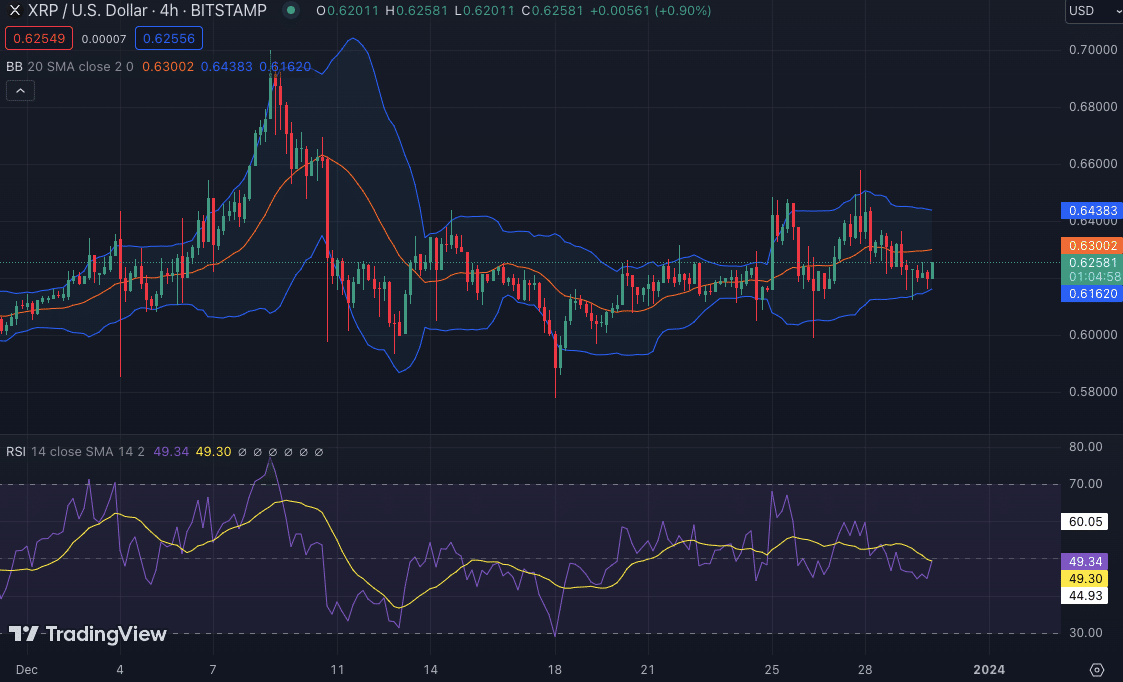

XRP Price Prediction 2025: Can XRP Hit $5?

Table of Contents

XRP's Technological Advancements and Ecosystem Growth

XRP's potential for price appreciation is intrinsically linked to the growth and development of its underlying technology and ecosystem. Several factors contribute to this potential.

RippleNet and On-Demand Liquidity (ODL):

The adoption of RippleNet and its On-Demand Liquidity (ODL) solution is a crucial driver of XRP demand. ODL allows for near-instantaneous cross-border payments, significantly reducing transaction costs and processing times. This increased efficiency makes XRP a vital asset for international financial transactions.

- Examples of ODL partnerships and success: Several major financial institutions have partnered with Ripple to utilize ODL, including MoneyGram and several major banks in various regions. These partnerships have led to a significant increase in XRP transaction volume.

- Expansion of RippleNet: RippleNet continues to expand its global reach, adding new partners and increasing the utility of XRP. This network effect strengthens the demand for XRP as more businesses integrate it into their operations.

- Quantifiable growth: While precise figures aren't always publicly available due to commercial sensitivities, reports indicate a substantial increase in transaction volume handled through ODL, demonstrating growing adoption.

XRPL Development and Upgrades:

The XRP Ledger (XRPL) is constantly undergoing improvements, enhancing its speed, scalability, and energy efficiency. These upgrades are crucial for attracting developers and businesses to build on the platform.

- Specific examples of upgrades: Recent upgrades have focused on improving transaction throughput, reducing transaction fees, and enhancing the security of the network.

- Planned future developments: Ripple continues to invest in the XRPL's development, with plans to introduce further scalability solutions and new features to attract more decentralized applications (dApps).

- Competitive advantages of the XRPL: Compared to other blockchain networks, the XRPL offers faster transaction speeds and lower fees, making it a more attractive platform for various applications.

Growing XRP Ecosystem and DeFi Applications:

The XRP ecosystem is expanding rapidly, with a growing number of projects and applications being built on the XRPL. The rise of decentralized finance (DeFi) on the XRPL further boosts its utility and potential.

- Examples of successful DeFi projects on XRPL: Several promising DeFi projects are emerging on the XRPL, offering various financial services like lending, borrowing, and trading.

- Potential for further ecosystem expansion: As the XRPL ecosystem matures, we can expect to see even more innovative DeFi applications and other projects built upon it, driving demand for XRP. This growth directly correlates to a potential price increase.

Regulatory Landscape and Legal Battle Impact on XRP Price

The regulatory landscape and the ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) significantly impact XRP's price.

SEC Lawsuit and its Potential Outcomes:

The SEC lawsuit against Ripple casts a considerable shadow over XRP's price. The outcome of this case will significantly influence investor sentiment and market perception.

- Different scenarios and their likely consequences on the price: A positive outcome could lead to a surge in XRP's price, while a negative outcome might result in a significant price drop.

- Expert opinions and market sentiment: Expert opinions on the case are divided, reflecting the uncertainty surrounding the outcome. Market sentiment plays a crucial role in driving price fluctuations.

- Positive developments in the case: Any positive developments in the lawsuit, such as favorable court rulings or settlements, could lead to a significant increase in XRP's price.

Global Regulatory Developments:

The regulatory landscape for cryptocurrencies is constantly evolving globally, impacting XRP's price. Increased clarity and favorable regulations in major markets can boost investor confidence.

- Examples of positive and negative regulatory developments in different countries: Some jurisdictions are embracing cryptocurrencies, while others remain hesitant or even hostile. This creates a dynamic and unpredictable environment for XRP.

- Potential for increased clarity and its effect on investor confidence: Increased regulatory clarity can reduce uncertainty and attract more institutional investors, leading to increased demand for XRP.

Market Adoption and Demand for XRP

The adoption of XRP by financial institutions and retail investors is a critical factor in determining its price.

Growing Institutional Adoption:

The increasing adoption of XRP by financial institutions and corporations shows the growing recognition of its utility in cross-border payments.

- Examples of institutions using XRP: Several financial institutions are already using XRP for efficient and cost-effective cross-border transactions.

- Factors driving institutional adoption: The speed, low cost, and efficiency of XRP-based transactions are major factors driving its adoption by institutions.

Retail Investor Sentiment and Market Speculation:

Retail investor sentiment and market speculation play a significant role in XRP's price fluctuations. Social media trends and news coverage can influence investor behavior.

- Trends in investor sentiment: Investor sentiment toward XRP can shift dramatically depending on news events, regulatory developments, and market trends.

- Influence of social media and news on XRP's price: Social media platforms and news outlets can significantly influence investor perception and drive price volatility.

Conclusion: Final Thoughts on XRP Price Prediction 2025

Predicting the future price of any cryptocurrency, including XRP, is inherently speculative. However, by considering the technological advancements, regulatory landscape, and market adoption discussed above, we can form a more informed opinion. While reaching $5 by 2025 is ambitious, it’s not entirely impossible if several positive factors align, particularly a favorable outcome in the SEC lawsuit and continued robust adoption of ODL. Conversely, negative regulatory developments or continued legal uncertainty could significantly hinder XRP's price appreciation. Ultimately, a balanced perspective recognizes both the potential for substantial growth and the significant risks associated with cryptocurrency investments.

Do your own research and decide if an XRP investment aligns with your risk tolerance and financial goals. Keep an eye on the evolving XRP price prediction for 2025 and beyond.

Featured Posts

-

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025 -

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025

Best Krypto Stories Of All Time A Comprehensive List

May 08, 2025 -

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025

Should You Buy Xrp After Its 400 Price Jump A Detailed Look

May 08, 2025 -

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025 -

Bitcoin Fiyati Guencel Deger Grafik Ve Piyasa Analizi

May 08, 2025

Bitcoin Fiyati Guencel Deger Grafik Ve Piyasa Analizi

May 08, 2025

Latest Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investment

May 08, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Gelecegi Ne

May 08, 2025 -

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025

Black Rock Etf Poised For Massive Gains Billionaire Investors Pile In

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025