30% Plunge For Palantir: Time To Invest?

Table of Contents

Analyzing Palantir's Recent Stock Drop

Understanding the Market Downturn

Palantir's recent fall isn't happening in a vacuum. The broader market has experienced significant volatility, impacting numerous tech stocks. Several factors contribute to this downturn:

- Increased Interest Rates: The Federal Reserve's efforts to combat inflation have led to higher interest rates, making borrowing more expensive and reducing investor appetite for riskier assets like Palantir.

- Tech Sector Sell-off: A general sell-off in the technology sector, driven by concerns about slowing growth and valuations, has disproportionately affected growth stocks like Palantir.

- Economic Uncertainty: Global economic uncertainty, including geopolitical instability and potential recessions, has further dampened investor sentiment.

These macroeconomic factors have created a challenging environment for many technology companies, contributing to the downward pressure on Palantir's stock price.

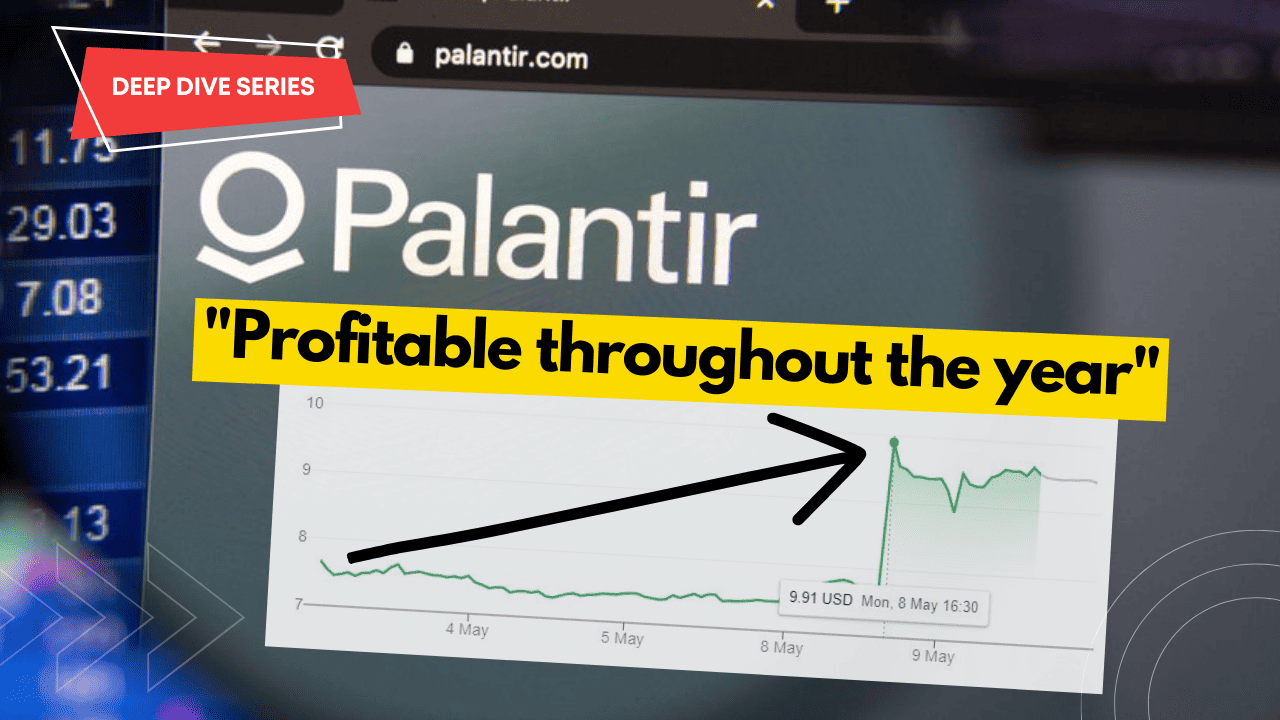

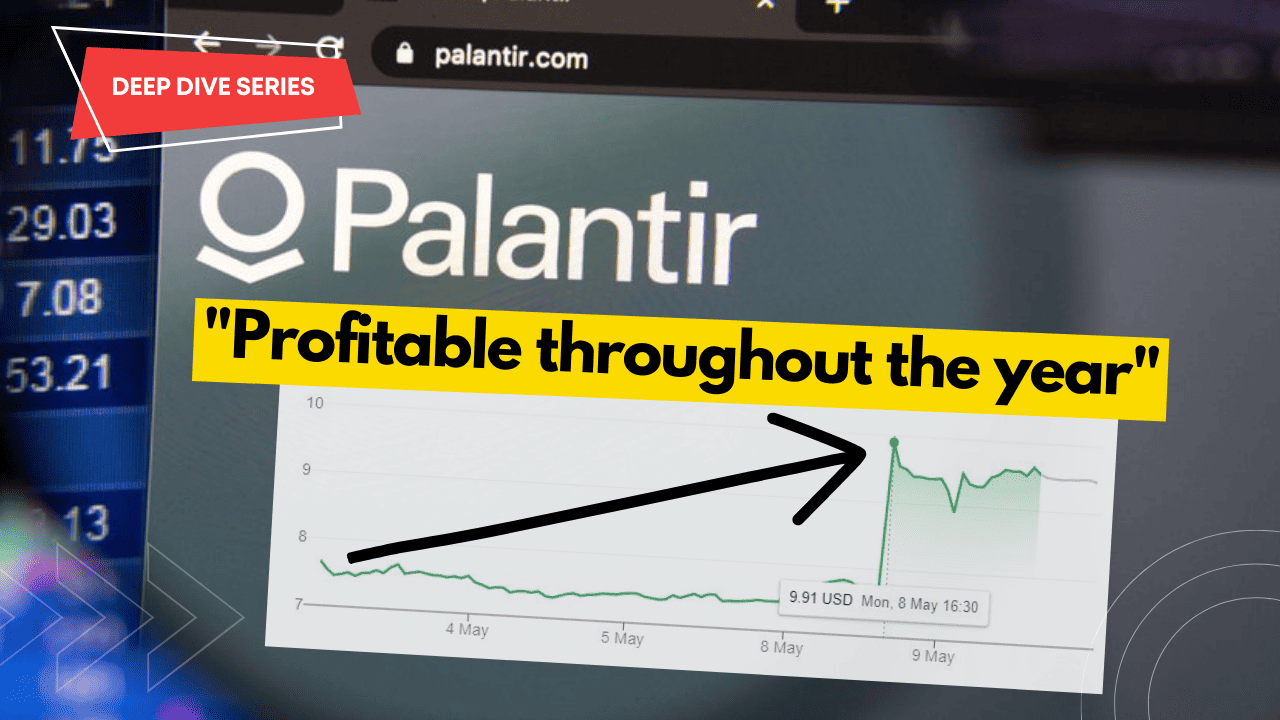

Palantir's Financial Performance

Examining Palantir's recent financial reports provides further context. While the company continues to grow its revenue, certain aspects require careful consideration:

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth may have slowed compared to previous periods. Analyzing the quarterly and annual reports is crucial to understand the trend.

- Profitability: Palantir's path to profitability remains a key focus for investors. Examining metrics like operating margins and net income will offer insights into the company's financial health.

- Revenue Streams: Palantir's revenue comes from both government and commercial sectors. Understanding the relative growth and stability of each sector is crucial for assessing future performance. A dependence on government contracts, for example, presents specific risks.

Assessing Palantir's Long-Term Prospects

Despite the recent stock drop, Palantir maintains significant long-term potential. Several factors support this view:

- Technological Advancements: Palantir continues to innovate in the field of data analytics, developing advanced AI and machine learning capabilities. This technological leadership positions them favorably in the long term.

- New Product Launches: The company regularly introduces new products and services, expanding its offerings and addressing diverse market needs. Tracking these developments and their market reception is vital.

- Strategic Partnerships: Collaborations with key players in various industries can significantly enhance Palantir's reach and market penetration. These partnerships can unlock new opportunities for growth.

- Expanding into New Markets: Palantir is actively expanding into new markets and sectors, diversifying its revenue streams and reducing its reliance on any single customer or industry.

Evaluating the Risk vs. Reward

Investing in Palantir, even after a significant price drop, involves assessing both risks and rewards:

Potential Risks of Investing in Palantir

- Valuation Concerns: Some analysts express concerns about Palantir's valuation, suggesting it might still be overvalued despite the recent decline.

- Competition: The data analytics market is highly competitive. Palantir faces pressure from established players and emerging competitors.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or spending could significantly impact the company's performance.

Potential Rewards of Investing in Palantir

- Market Leadership: Palantir occupies a leading position in the data analytics and big data market, offering cutting-edge solutions to complex problems.

- Growth Potential: The company has significant growth potential, driven by increasing demand for data analytics solutions across various industries.

- Long-Term Technological Advantages: Palantir's advanced technology and data integration capabilities position it for long-term success in the evolving data landscape.

Comparing Palantir to Competitors

Comparing Palantir to its main competitors – such as companies like Snowflake, Databricks, and others – is crucial. While a detailed comparison requires extensive research, considering factors such as market share, financial performance, and growth strategies is essential. Palantir's unique focus on government and enterprise clients provides a competitive advantage, but also carries inherent risks.

Conclusion

The 30% plunge in Palantir's stock price presents a complex investment decision. While risks related to valuation, competition, and reliance on government contracts remain, the potential rewards for long-term investors, driven by its technological leadership and growth potential, warrant careful consideration. The macroeconomic headwinds impacting the tech sector also need to be factored into any investment strategy. Conduct thorough due diligence, analyze financial statements, and consult with a financial advisor before making any investment decisions related to Palantir. Is this the right time to invest in Palantir for you? Further research is crucial before making any investment decisions concerning Palantir stock.

Featured Posts

-

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 09, 2025

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 09, 2025 -

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 09, 2025

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 09, 2025 -

Analyzing Androids Redesign Its Effectiveness In Attracting Gen Z

May 09, 2025

Analyzing Androids Redesign Its Effectiveness In Attracting Gen Z

May 09, 2025 -

Elaxista Xionia Sta Imalaia Simadia Klimatikis Allagis

May 09, 2025

Elaxista Xionia Sta Imalaia Simadia Klimatikis Allagis

May 09, 2025 -

Stock Market News Sensex Nifty Rise Sector Specific Analysis

May 09, 2025

Stock Market News Sensex Nifty Rise Sector Specific Analysis

May 09, 2025