Stock Market News: Sensex, Nifty Rise; Sector-Specific Analysis

Table of Contents

Sensex and Nifty Performance Overview

The Sensex and Nifty experienced a robust rally today, closing at significantly higher values compared to the previous day. This positive trend reflects an overall optimistic investor sentiment. The market breadth, indicated by the advance-decline ratio, also showed a healthy increase, suggesting broad-based participation in the rally. Trading volume was considerably high, further indicating robust market activity. The overall market sentiment can be described as bullish, with investors exhibiting confidence in the market's future prospects.

- Sensex:

- Opening Value: [Insert Value]

- Closing Value: [Insert Value]

- Percentage Change: [Insert Percentage] (compared to the previous day)

- High: [Insert Value]

- Low: [Insert Value]

- Nifty:

- Opening Value: [Insert Value]

- Closing Value: [Insert Value]

- Percentage Change: [Insert Percentage] (compared to the previous day)

- High: [Insert Value]

- Low: [Insert Value]

Key factors influencing this market movement include positive global cues, driven by improved economic data from major economies, and positive domestic news, including government announcements on infrastructure spending and easing of certain regulatory norms.

Sector-Specific Analysis

The market rally wasn't uniform across all sectors. Let's delve into the performance of some key sectors:

Banking and Finance Sector

The Banking and Finance sector witnessed robust growth today, driven by positive investor sentiment and expectations of improved credit growth. Leading public and private sector banks experienced significant gains.

- Performance of major banks: SBI, HDFC Bank, and ICICI Bank all saw substantial percentage increases in their stock prices. [Insert specific percentage increases for each bank].

- Impact of RBI policies: Recent announcements by the Reserve Bank of India (RBI) regarding monetary policy and credit easing seem to have positively impacted investor confidence in this sector.

- Mergers and Acquisitions: Any recent mergers or acquisitions within the sector could also have contributed to the positive performance. [Mention any relevant news].

IT Sector

The IT sector also performed strongly, driven by continued high demand for IT services globally. Strong Q[Quarter] earnings and positive outlook for future contracts fuelled the sector’s rise.

- Performance of major IT companies: TCS, Infosys, and Wipro all recorded significant gains. [Insert specific percentage increases for each company].

- Impact of global economic conditions: While global economic uncertainty persists, the demand for IT services remains robust, particularly in cloud computing and digital transformation.

- Contract wins and losses: Any major contract wins or losses by leading IT companies should be mentioned here. [Insert relevant details].

FMCG Sector

The Fast-Moving Consumer Goods (FMCG) sector showed mixed results, with some companies outperforming others. Inflationary pressures and changing consumer preferences continue to impact this sector.

- Performance of major FMCG companies: HUL, Nestle, and ITC showed varied performances. [Insert specific details on individual company performance].

- Impact of inflation and consumer preferences: Rising inflation is impacting consumer spending, while changing preferences towards healthier and more sustainable products are reshaping the market.

- New product launches and marketing campaigns: Successful new product launches and effective marketing campaigns have boosted certain FMCG companies' performance.

Pharma Sector

The Pharma sector displayed a steady performance, though the gains were less pronounced compared to some other sectors. This sector is often less susceptible to short-term market fluctuations.

- Performance of major pharma companies: Sun Pharma, Cipla, and Dr. Reddy's Laboratories showed moderate gains. [Insert specific details on individual company performance].

- Impact of new drug approvals and clinical trial results: Any significant news regarding new drug approvals or clinical trial results would impact this sector's performance. [Insert relevant details].

- Global demand for pharmaceutical products: Global demand for pharmaceuticals remains consistent, providing stability to this sector.

Factors Driving Market Rise

The significant rise in the Sensex and Nifty can be attributed to a combination of macro and micro factors:

- Positive global economic indicators: Positive economic data from major global economies boosted investor sentiment.

- Government policies and initiatives: Government policies focused on infrastructure development and economic reforms have contributed to positive market sentiment.

- Corporate earnings reports: Strong corporate earnings reports from several companies have fuelled the market rally.

- Foreign Institutional Investor (FII) activity: Positive FII inflows have also played a significant role in driving the market up.

Conclusion

Today's market witnessed a significant surge in the Sensex and Nifty indices, driven by a combination of positive global cues, strong corporate performance, and positive government initiatives. While the Banking and Finance, and IT sectors led the rally, other sectors showed varying degrees of growth. Understanding these sector-specific trends and the driving forces behind them is crucial for making informed investment decisions.

Call to Action: Stay tuned for more insightful Stock Market News and in-depth sectoral analyses to navigate the dynamic Indian stock market effectively. Follow us for daily updates on Sensex and Nifty performance and stay ahead of the curve with our comprehensive Stock Market News analysis. Continuous monitoring of Stock Market News is paramount for successful investing.

Featured Posts

-

When Are The Champions League Semi Finals Barcelona Inter Arsenal Psg Fixtures

May 09, 2025

When Are The Champions League Semi Finals Barcelona Inter Arsenal Psg Fixtures

May 09, 2025 -

Expensive Babysitting Leads To Even More Expensive Daycare A Cautionary Tale

May 09, 2025

Expensive Babysitting Leads To Even More Expensive Daycare A Cautionary Tale

May 09, 2025 -

Pochemu Sinoptiki Ne Mogut Tochno Predskazat Snegopady V Mae

May 09, 2025

Pochemu Sinoptiki Ne Mogut Tochno Predskazat Snegopady V Mae

May 09, 2025 -

Ray Epps Sues Fox News For Defamation Details Of The Jan 6 Lawsuit

May 09, 2025

Ray Epps Sues Fox News For Defamation Details Of The Jan 6 Lawsuit

May 09, 2025 -

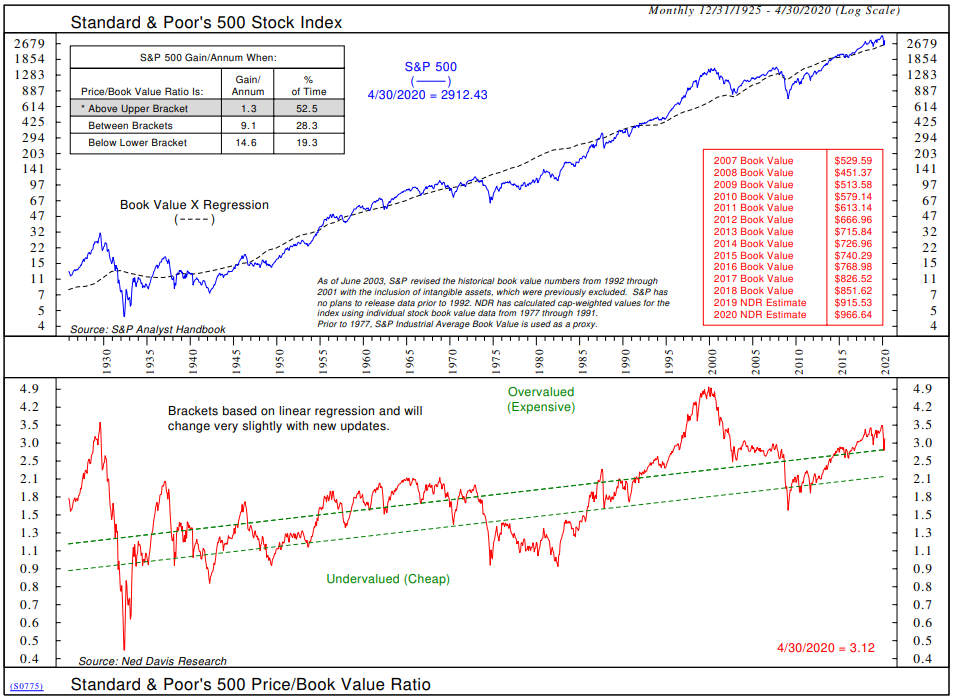

Are High Stock Market Valuations A Worry Bof As Take

May 09, 2025

Are High Stock Market Valuations A Worry Bof As Take

May 09, 2025