5% 30-Year Yield: Analyzing The Resurgence Of The "Sell America" Narrative

Table of Contents

The 5% 30-Year Yield: A Sign of Economic Strength or Weakness?

The 5% 30-year yield represents a significant shift in the bond market. Is this a sign of robust economic growth or a harbinger of looming trouble? Understanding the forces behind this rise is crucial.

Inflationary Pressures and Interest Rate Hikes

Persistent inflation remains a major concern globally. To combat this, the Federal Reserve (Fed) has aggressively raised interest rates. This directly impacts bond yields.

- Higher interest rates make existing bonds less attractive: Investors are incentivized to buy newly issued bonds offering higher yields, driving down the price of older bonds and increasing their yield.

- Reduced investment and slower growth: Increased borrowing costs can stifle business investment, leading to reduced economic growth and potentially a recession. High interest rates make it more expensive for companies to borrow money for expansion and hiring.

- Data points: Inflation, as measured by the Consumer Price Index (CPI), has remained stubbornly above the Fed's target, necessitating further rate hikes. The Fed Funds rate has increased substantially in the past year, directly influencing the 30-year Treasury yield.

Global Economic Uncertainty and Safe-Haven Demand

Global economic instability plays a crucial role. Amidst geopolitical uncertainties and fears of recessions in other major economies, investors often flock to US Treasuries as a safe haven asset. This increased demand can push yields higher, even in the face of rising interest rates.

- Geopolitical risks: Ongoing conflicts and escalating tensions contribute to global market volatility, increasing demand for US Treasuries.

- Recessions abroad: Economic slowdowns in other countries can drive capital flows towards the perceived stability of the US market.

- Correlation: The correlation between global uncertainty and increased demand for US Treasuries is well-documented, impacting the 30-year yield.

The "Sell America" Narrative: Examining the Arguments

The 5% 30-year yield has coincided with a renewed "Sell America" narrative, fueled by several concerns.

Concerns about US Debt and Fiscal Policy

Critics point to the soaring US national debt and unsustainable fiscal policies as reasons to be bearish on the US economy. These concerns directly influence investor confidence and can impact bond yields.

- National debt and deficits: The sheer magnitude of the US national debt and persistent budget deficits raise concerns about the long-term solvency of the government.

- Sustainability of spending: Concerns about the sustainability of current spending levels on entitlements and defense contribute to negative sentiment.

- Expert opinions: While some experts warn of the potential consequences of unchecked debt, others argue that the current level is manageable in the long run.

Competition from Emerging Markets

The rise of emerging markets, particularly China, challenges the US's historical economic dominance. This shift in global economic power is often cited as a factor contributing to the "Sell America" sentiment.

- The rise of China: China's economic growth and technological advancements have altered the global economic landscape, potentially affecting capital flows and investment decisions.

- Implications for US leadership: The shifting balance of power raises questions about the long-term economic leadership of the United States.

- Impact on investment: Investors may reconsider their allocations, potentially reducing investment in US assets, influencing the 30-year yield.

Analyzing the Interplay between the 5% 30-Year Yield and the "Sell America" Narrative

The relationship between the 5% 30-year yield and the resurgence of the "Sell America" narrative is complex.

Correlation or Causation?

Is the high yield causing the "Sell America" narrative, or are both symptoms of underlying economic anxieties? Evidence supports both possibilities.

- Causation argument: The high yield might signal waning investor confidence, fueling the "Sell America" sentiment.

- Correlation argument: Both the high yield and the narrative reflect broader concerns about inflation, global uncertainty, and US fiscal policy.

- Other factors: Several other factors, including supply chain disruptions and geopolitical events, contribute to the overall picture.

Market Sentiment and Investor Behavior

Investor sentiment and behavior play a significant role in shaping both the 30-year yield and the strength of the "Sell America" narrative.

- Risk aversion: Increased risk aversion can drive investors towards safe-haven assets, increasing demand for US Treasuries and affecting yields.

- Speculation: Market speculation can exacerbate existing trends, influencing both the yield and the prevailing narrative.

- Herd behavior: Investors often follow the actions of others, amplifying market movements.

Conclusion

The 5% 30-year yield and the resurgence of the "Sell America" narrative are intertwined, reflecting complex economic and geopolitical forces. While a direct causal link isn't definitively established, both phenomena highlight underlying concerns about inflation, global uncertainty, and US fiscal policy. The implications for the US economy and global markets are significant. Continued monitoring of the 30-year Treasury yield, high bond yields, and interest rate trends is crucial for informed investment strategies and accurate economic forecasting. Further research is needed to fully understand the complexities of the "Sell America" narrative and its long-term impact on the US economy. Stay informed about these crucial shifts in the global financial landscape.

Featured Posts

-

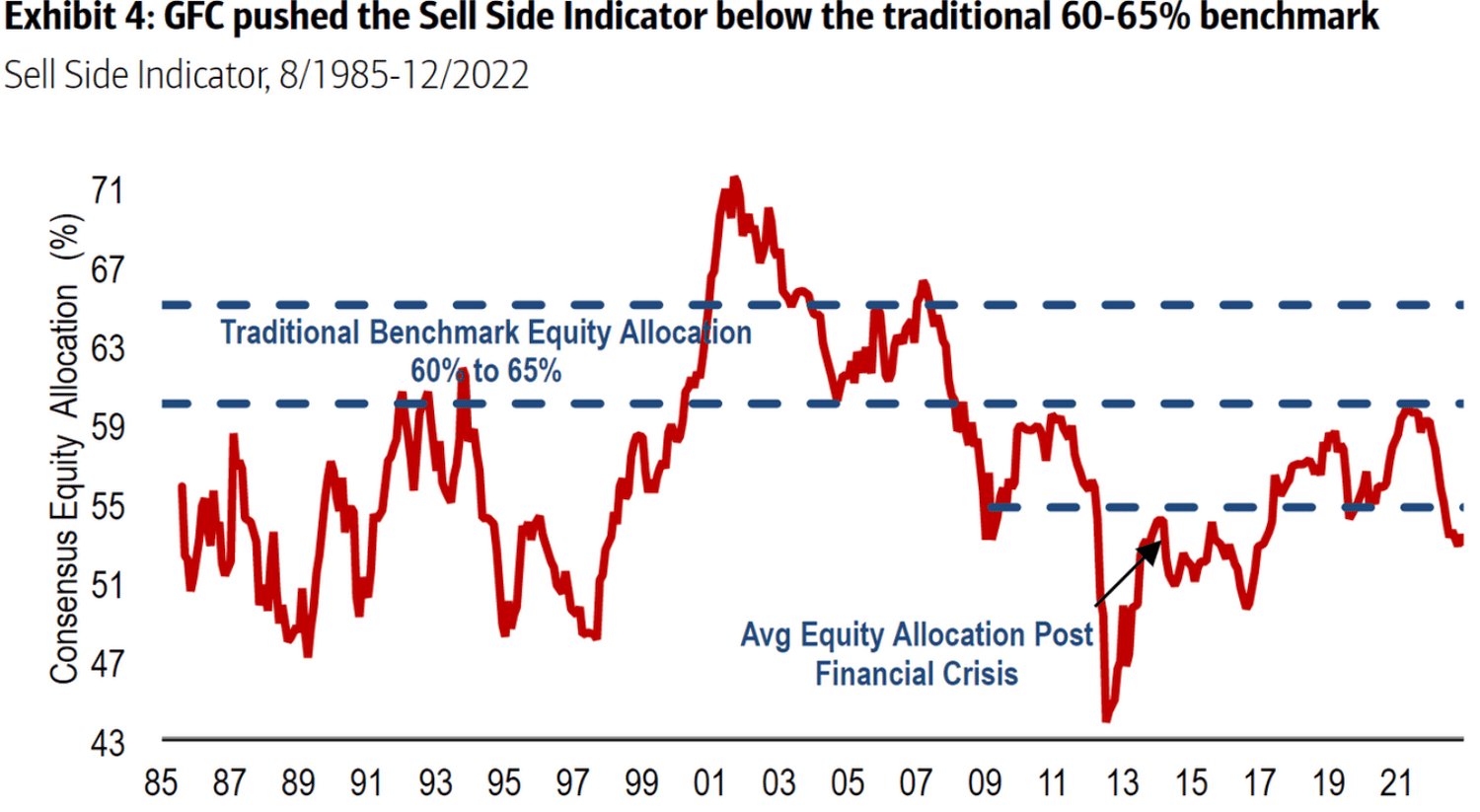

Stock Market Valuation Concerns Bof A Offers A Different View

May 21, 2025

Stock Market Valuation Concerns Bof A Offers A Different View

May 21, 2025 -

Hout Bay Fcs Success The Klopp Connection

May 21, 2025

Hout Bay Fcs Success The Klopp Connection

May 21, 2025 -

Svart Men Segerrikt Jacob Friis Startar Med Bortaseger Mot Malta

May 21, 2025

Svart Men Segerrikt Jacob Friis Startar Med Bortaseger Mot Malta

May 21, 2025 -

Navy Ethics Scandal Retired Admiral Faces Bribery Charges

May 21, 2025

Navy Ethics Scandal Retired Admiral Faces Bribery Charges

May 21, 2025 -

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025