8% Stock Market Jump On Euronext Amsterdam: Impact Of Trump's Tariff Decision

Table of Contents

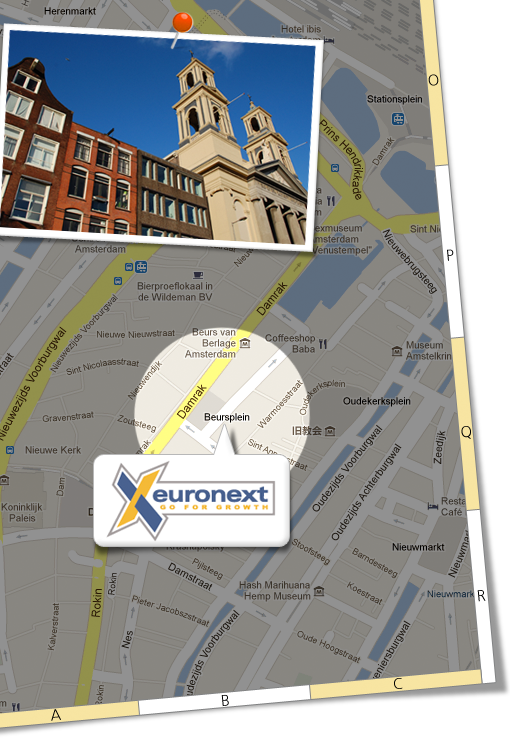

Understanding the Tariff Decision's Impact on Euronext Amsterdam

The initial market reaction:

The market reacted with breathtaking speed. The AEX index, a key indicator of Euronext Amsterdam's performance, opened at [Insert Opening Price] and closed at [Insert Closing Price], representing an 8% increase. Trading volume surged dramatically, exceeding [Insert Volume Data] compared to the previous day's average. This unprecedented volatility highlighted the market's sensitivity to the unexpected tariff announcement.

- The AEX index experienced an 8% surge, while other indices like the [Insert other relevant indices and percentage changes] also showed significant gains.

- The Technology sector experienced disproportionately large gains, exceeding [Insert Percentage] increase, while the energy sector saw a more moderate increase of [Insert Percentage].

- "The speed and magnitude of the market reaction underscore the significant uncertainty surrounding US trade policy," commented [Quote from a reputable financial analyst or news source].

Why Euronext Amsterdam was particularly affected:

Euronext Amsterdam's strong reaction wasn't isolated; however, several factors contributed to its exceptional volatility. The Netherlands' strong trade ties with the US, particularly in [Mention specific sectors like technology or agriculture], made it particularly susceptible to tariff changes.

- The Netherlands' significant exports of [Specific products impacted by tariffs] to the US made it directly vulnerable to retaliatory measures or changes in market demand.

- Pre-existing concerns about the Dutch economy's reliance on global trade amplified the impact of the tariff decision, creating a climate of heightened uncertainty.

- Investor speculation, fueled by anticipation of further market movements and potential escalation of trade tensions, played a significant role in the dramatic price swings.

Analyzing the Short-Term and Long-Term Implications

Short-term consequences:

The immediate impact of the 8% jump on Euronext Amsterdam was multifaceted. Investors experienced a rapid increase in portfolio value, but this short-term gain came with substantial risk.

- While many investors enjoyed substantial short-term gains, the volatile nature of the market created risks of equally rapid losses if the market corrected.

- Increased investment flowed into sectors perceived as less vulnerable to tariff impacts, while others experienced a flight of capital.

- The market surge's impact on consumer confidence remains uncertain, with potential for both increased spending due to perceived wealth increase and reduced spending due to market uncertainty.

Long-term outlook and potential risks:

The long-term implications remain uncertain, heavily dependent on the evolution of trade negotiations and the broader global economic climate.

- Sustained growth is possible if the tariff decision proves to be a one-off event and investor confidence is restored. However, a market correction remains a significant risk.

- Further tariff adjustments or retaliatory measures could trigger additional market volatility and negatively impact long-term growth.

- The ongoing uncertainty surrounding global trade relations necessitates cautious long-term investment strategies, emphasizing diversification and risk mitigation.

Strategies for Navigating Market Volatility after the 8% Jump

Risk management and diversification:

In the wake of such volatility, effective risk management is paramount. Investors need to adapt their strategies to minimize potential losses.

- Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and geographical regions reduces exposure to the risks associated with a single market or sector.

- Hedging strategies, such as using options or futures contracts, can help mitigate potential losses during periods of market uncertainty.

- Seeking advice from a qualified financial advisor is crucial for developing a personalized investment strategy tailored to individual risk tolerance and financial goals.

Opportunities amidst volatility:

While volatility presents risks, it also creates opportunities for astute investors.

- Sectors less affected by tariffs or those benefiting from shifts in global supply chains might offer attractive investment prospects.

- The market jump may have created opportunities for bargain hunting, as some assets may be temporarily undervalued.

- Thorough due diligence, fundamental analysis, and a long-term investment horizon are crucial for capitalizing on opportunities within this volatile market.

Conclusion:

The 8% stock market jump on Euronext Amsterdam, directly linked to Trump's tariff decision, underscores the profound impact of global trade policies on financial markets. Understanding the short-term and long-term implications is crucial for investors navigating this volatility. By implementing effective risk management strategies, diversifying portfolios, and remaining informed about global economic trends, investors can adapt to market fluctuations and potentially capitalize on emerging opportunities. To stay informed on the latest developments and learn more about how to navigate future market shifts impacting Euronext Amsterdam, continue to follow our financial news and analysis. Don't miss out – stay updated on all Euronext Amsterdam related news and investment strategies.

Featured Posts

-

Frankfurt Stock Market Update Dax Climbs Nearing Record

May 24, 2025

Frankfurt Stock Market Update Dax Climbs Nearing Record

May 24, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 24, 2025

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 24, 2025 -

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025 -

Proverte Svoi Znaniya Oleg Basilashvili Test Dlya Kinomanov

May 24, 2025

Proverte Svoi Znaniya Oleg Basilashvili Test Dlya Kinomanov

May 24, 2025

Latest Posts

-

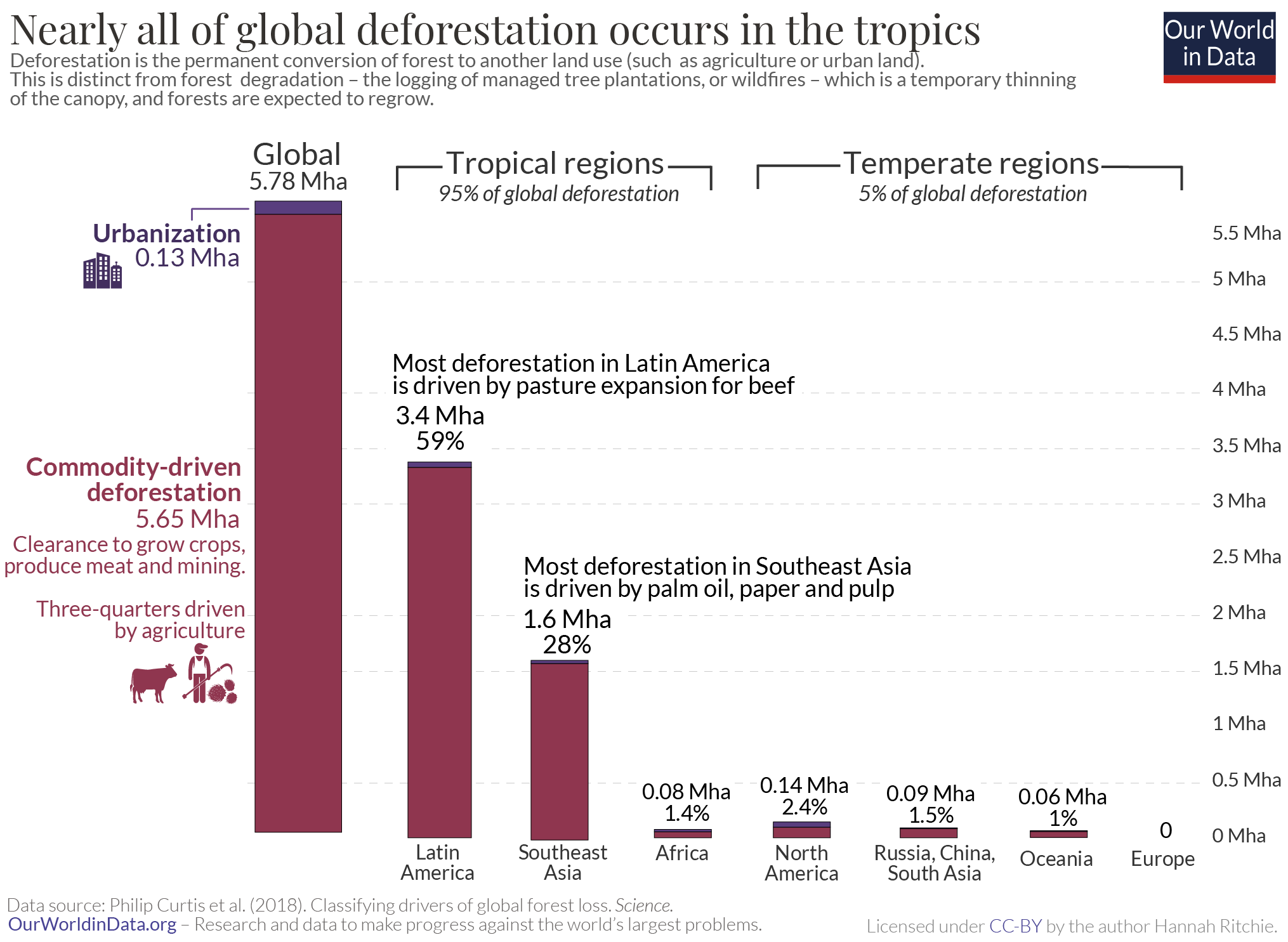

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025 -

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025 -

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025