Activist Investor Pressure Fails To End Rio Tinto's Dual Listing

Table of Contents

The Activist Investor Campaign: Strategies and Objectives

Several prominent activist investors have targeted Rio Tinto's dual listing, motivated by a belief that simplifying the corporate structure would unlock significant shareholder value. Their primary objective is to improve corporate governance and enhance returns for investors. These investors believe a single listing would streamline operations, reduce administrative costs, and potentially increase the company's share price.

The strategies employed have included:

- Shareholder resolutions: Submitting proposals at annual general meetings demanding a review of the dual listing.

- Public pressure campaigns: Utilizing media outlets to highlight the perceived inefficiencies of the dual listing structure and to pressure the board of directors.

- Direct engagement: Holding private meetings with Rio Tinto's management to present their arguments and seek a resolution.

Specific examples include [insert names of specific activist investors and their actions, citing reliable sources]. Their ultimate goal was to achieve a more efficient and transparent corporate structure that would maximize shareholder value.

Rio Tinto's Resistance: Reasons for Maintaining the Dual Listing

Rio Tinto's management has consistently resisted calls to end its dual listing, citing several key advantages:

- Access to a broader investor base: Maintaining listings on both the London and Australian exchanges provides access to a wider pool of investors, facilitating greater capital raising opportunities.

- Diversification of funding sources: A dual listing offers greater flexibility in accessing different capital markets, reducing reliance on any single source of funding.

- Enhanced market liquidity: The dual listing structure potentially increases trading volume and liquidity, benefiting shareholders.

- Strategic considerations: Maintaining a presence in both London and Australia is crucial for Rio Tinto's global operations and relationships with key stakeholders in these regions.

The complexities of unwinding a decades-long dual listing are also significant, requiring extensive legal and regulatory approvals, potentially leading to significant costs and delays. [Insert specific details about the potential costs and complexity of unwinding the dual listing, sourced from reputable financial news outlets].

The Role of Regulatory and Legal Frameworks

The regulatory and legal landscapes in both the UK and Australia play a crucial role in the feasibility of ending Rio Tinto's dual listing. Significant hurdles exist, including:

- Listing rules and regulations: Both the London Stock Exchange and the Australia Stock Exchange have specific rules and regulations governing delisting, which must be carefully adhered to.

- Shareholder approval: Securing the necessary approvals from shareholders in both jurisdictions requires significant engagement and potentially overcoming resistance.

- Tax implications: Restructuring the listing could trigger significant tax liabilities in one or both countries.

- Legal challenges: Potential legal challenges from disgruntled shareholders or other stakeholders could delay or even prevent the delisting.

These regulatory complexities and potential legal challenges represent significant barriers to any attempt to simplify Rio Tinto's corporate structure.

Implications for Shareholder Value and Future Outlook

The failure of the activist investor campaign to date has had a mixed impact on Rio Tinto's share price and investor sentiment. While some investors may view the decision to retain the dual listing as a sign of inflexibility, others may appreciate the management's focus on maintaining strategic advantages. [Include details about the impact on share price and investor sentiment, citing reliable financial data sources].

The long-term implications remain uncertain. Several future scenarios are possible:

- Continued pressure: Activist investors may continue their campaign, potentially employing new strategies.

- A shift in strategy by Rio Tinto: The company might reconsider its position if market conditions change or new information emerges.

- A successful future campaign: A more compelling case or changing circumstances could ultimately lead to a change in the dual listing structure.

Predicting the future with certainty is impossible; however, the ongoing debate highlights the ongoing tension between shareholder activism and management prerogatives within large multinational corporations.

Conclusion: The Future of Activist Investor Pressure on Rio Tinto's Dual Listing

The failure of the recent activist investor pressure campaign to end Rio Tinto's dual listing underscores the complexities involved in challenging established corporate structures. Rio Tinto's strategic arguments for maintaining its presence on both the London and Australian exchanges, coupled with significant regulatory and legal hurdles, have so far proven insurmountable for activist investors. However, the debate is far from over. The future trajectory of Rio Tinto's listing structure will depend on a multitude of factors, including evolving market dynamics, the persistence of activist investor pressure, and any potential shifts in the company's strategic priorities. What do you think the future holds for Rio Tinto's dual listing? Share your thoughts in the comments below!

Featured Posts

-

Us Airlines Face Airbus Tariff Costs

May 02, 2025

Us Airlines Face Airbus Tariff Costs

May 02, 2025 -

Donate Warm Clothing Tulsa Day Centers Winter Preparedness

May 02, 2025

Donate Warm Clothing Tulsa Day Centers Winter Preparedness

May 02, 2025 -

The Truth About Michael Sheens Million Pound Donation

May 02, 2025

The Truth About Michael Sheens Million Pound Donation

May 02, 2025 -

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe De L Annee

May 02, 2025

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe De L Annee

May 02, 2025 -

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 02, 2025

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 02, 2025

Latest Posts

-

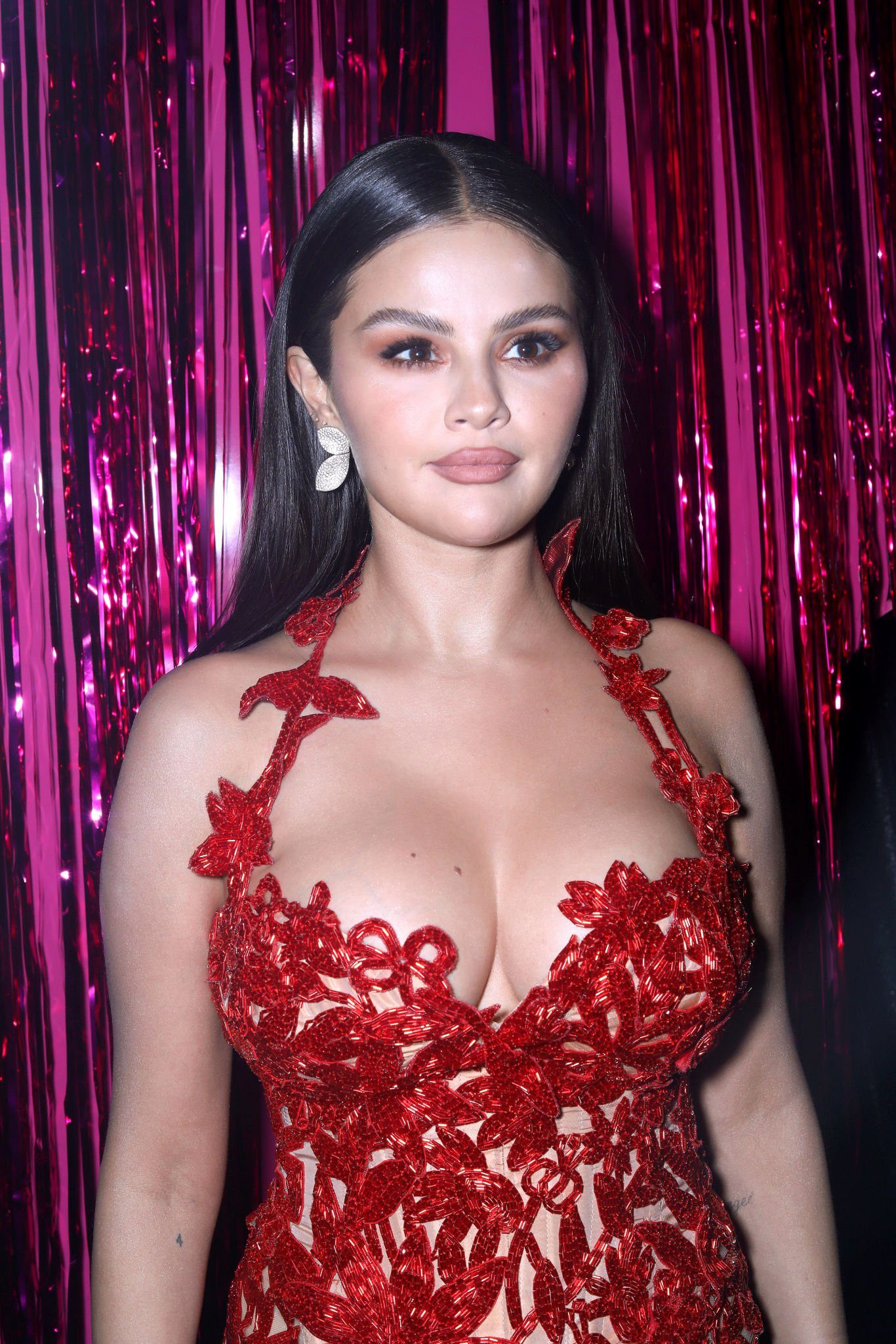

Selena Gomezs 80s Inspired High Waisted Suit A Modern Take On Classic Style

May 02, 2025

Selena Gomezs 80s Inspired High Waisted Suit A Modern Take On Classic Style

May 02, 2025 -

Selena Gomezs High Waisted Suit Reviving 80s Office Style

May 02, 2025

Selena Gomezs High Waisted Suit Reviving 80s Office Style

May 02, 2025 -

Selena Gomezs Sophisticated High Waisted Suit A Retro Workplace Style Icon

May 02, 2025

Selena Gomezs Sophisticated High Waisted Suit A Retro Workplace Style Icon

May 02, 2025 -

Selena Gomezs High Waisted Power Suit An 80s Office Inspiration

May 02, 2025

Selena Gomezs High Waisted Power Suit An 80s Office Inspiration

May 02, 2025 -

Chaos On Bbcs Celebrity Traitors High Profile Siblings Withdraw

May 02, 2025

Chaos On Bbcs Celebrity Traitors High Profile Siblings Withdraw

May 02, 2025