Adani Ports Up, Eternal Down: Detailed Stock Market Update (Sensex, Nifty)

Table of Contents

Adani Ports' Rise: Analyzing the Positive Momentum

H3: Strong Financials and Growth Prospects: Adani Ports' recent success is underpinned by robust financial performance and promising growth prospects. The company has consistently demonstrated impressive revenue and profit growth, driven by several key factors.

- Increased Cargo Volume: Adani Ports has witnessed a substantial increase in cargo volume handled across its various ports, reflecting the growth of India's import and export sectors.

- Expansion Projects: Strategic investments in port infrastructure expansion and modernization have enhanced operational efficiency and capacity.

- Strategic Acquisitions: Acquisitions of smaller ports and logistics companies have broadened Adani Ports' reach and market share.

- Positive Industry Outlook: The overall positive outlook for the Indian port sector, driven by government infrastructure initiatives, further bolsters Adani Ports' prospects.

[Insert relevant chart showing Adani Ports' revenue and profit growth over the past few quarters/years]. This positive financial data directly translates into a rising Adani Ports share price, attracting significant investor interest. The Adani Ports future outlook remains bright, given the company's strategic position and proactive growth strategy. Analyzing Adani Ports financials reveals a clear picture of sustainable growth and profitability.

H3: Investor Sentiment and Market Confidence: The surge in Adani Ports share price is also fueled by strong investor sentiment and market confidence.

- Government Policies: Supportive government policies focusing on infrastructure development and ease of doing business have boosted investor confidence.

- Infrastructure Development: India's ongoing infrastructure development significantly benefits companies like Adani Ports, driving increased demand for port services.

- Strong Management Team: Adani Ports' experienced and capable management team has instilled confidence in investors.

- Global Market Trends: Favorable global trade patterns have also contributed to the positive investor sentiment.

News surrounding government initiatives and successful project milestones has significantly impacted market confidence, contributing to the positive Adani Ports investment narrative.

Eternal's Decline: Understanding the Negative Trajectory

H3: Sectoral Headwinds and Competitive Pressure: Eternal's downward trajectory can be attributed to several challenges within its sector and increased competitive pressure.

- Increased Competition: Intensified competition from new entrants and established players has eroded Eternal's market share.

- Regulatory Hurdles: Navigating regulatory hurdles and compliance requirements has impacted operational efficiency and profitability.

- Economic Slowdown: A potential economic slowdown or sector-specific downturn has negatively affected demand for Eternal's products or services.

- Changing Consumer Preferences: Shifting consumer preferences or evolving market trends may have rendered some of Eternal's offerings less relevant.

A detailed competitive landscape analysis reveals Eternal's struggles to maintain its market position effectively. Understanding these sectoral challenges is crucial to grasping the current Eternal share price dynamics.

H3: Financial Performance and Future Outlook: Eternal's recent financial performance has been less encouraging, raising concerns about its future prospects.

- Decreased Revenue: A decline in revenue indicates weakening demand for Eternal's products or services.

- Profit Margins: Squeezed profit margins highlight the pressure on profitability.

- Debt Levels: High debt levels may pose significant financial risks for the company.

- Potential Restructuring Plans: The need for potential restructuring plans suggests underlying financial instability.

Analyzing Eternal stock performance requires a careful evaluation of these negative indicators. The Eternal financial analysis necessitates a thorough understanding of the company's financial health and strategies to address the challenges. The future outlook for Eternal remains uncertain, contingent upon the successful implementation of corrective measures.

Broader Market Context: Sensex and Nifty's Overall Performance

H3: Macroeconomic Factors and Global Influences: The overall performance of the Sensex and Nifty is influenced by a multitude of macroeconomic factors and global influences.

- Inflation: High inflation rates can negatively impact investor sentiment and economic growth.

- Interest Rates: Changes in interest rates influence borrowing costs and investment decisions.

- Geopolitical Events: Geopolitical instability can create uncertainty in the market.

- Global Market Trends: Global market trends, such as economic growth in major economies, can significantly impact the Indian stock market.

These macroeconomic factors have a ripple effect, impacting both Adani Ports and Eternal, underscoring the importance of considering the broader market context when assessing individual stock performance. A comprehensive Sensex analysis and Nifty analysis reveal the interplay of these factors and their influence on market sentiment.

Conclusion: Navigating the Market: Adani Ports vs. Eternal

The contrasting performances of Adani Ports and Eternal highlight the complexities of the stock market. Adani Ports' success stems from strong financials, positive investor sentiment, and a favorable industry outlook, while Eternal faces challenges related to sectoral headwinds and financial performance. Understanding the broader macroeconomic context, as reflected in the Sensex and Nifty's performance, is crucial for interpreting these individual stock movements. The Indian stock market remains volatile, with both opportunities and risks. To navigate this market effectively, stay informed about Adani Ports, Eternal, Sensex, and Nifty market movements by regularly checking for updates and conducting thorough research before making any investment decisions. Remember to understand market volatility and manage investment risks effectively.

Featured Posts

-

X Blocks Jailed Turkish Mayors Facebook Page Opposition Outcry

May 09, 2025

X Blocks Jailed Turkish Mayors Facebook Page Opposition Outcry

May 09, 2025 -

Mans 3 K Babysitting Bill Turns Into A 3 6 K Daycare Nightmare

May 09, 2025

Mans 3 K Babysitting Bill Turns Into A 3 6 K Daycare Nightmare

May 09, 2025 -

Ryujinx Switch Emulator Project Ceases After Nintendo Contact

May 09, 2025

Ryujinx Switch Emulator Project Ceases After Nintendo Contact

May 09, 2025 -

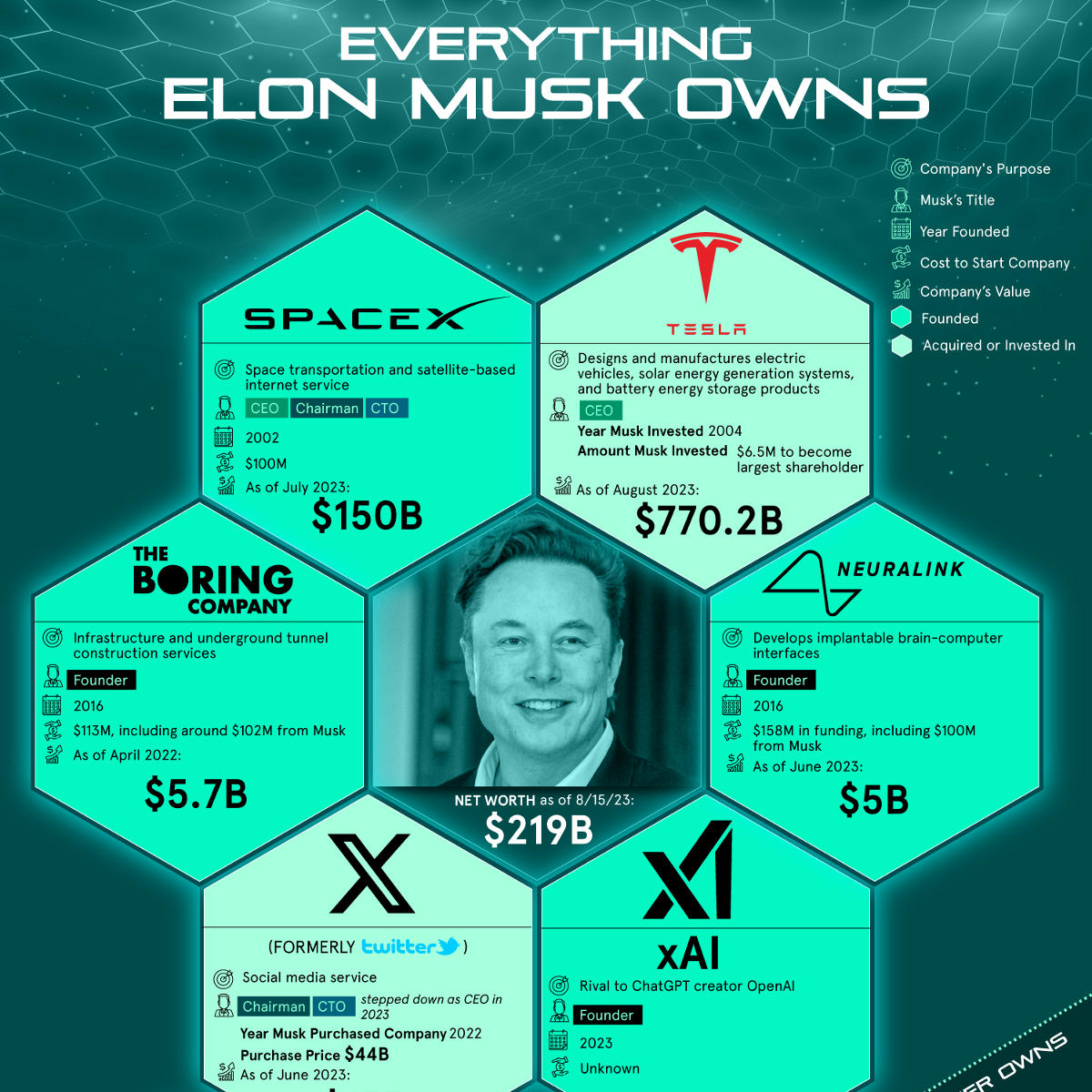

Understanding Elon Musks Net Worth A Journey Through His Entrepreneurial Endeavors

May 09, 2025

Understanding Elon Musks Net Worth A Journey Through His Entrepreneurial Endeavors

May 09, 2025 -

Where To Invest A Geographic Analysis Of New Business Hotspots

May 09, 2025

Where To Invest A Geographic Analysis Of New Business Hotspots

May 09, 2025