Ambani's Reliance Beats Estimates: How It Affects Indian Large-Cap Stocks

Table of Contents

Reliance Industries' Stellar Performance: A Deep Dive

Reliance Industries' recent financial report showcased impressive growth across various sectors. The company's robust performance stems from a confluence of factors, leading to a surge in its stock price and overall market valuation. Key highlights include:

- Exceptional Revenue Growth: RIL reported a significant year-on-year increase in revenue, driven primarily by strong performances in its petrochemicals, telecom (Jio Platforms), and retail divisions. Specific figures (insert actual data here if available, e.g., "Revenue grew by X% to reach ₹Y") would further substantiate this claim. This demonstrates a healthy expansion across diverse business verticals.

- Improved Profit Margins: The company's ability to enhance profit margins signifies increased efficiency and effective cost management. Details regarding profit margin improvements in each sector (e.g., "Jio Platforms saw a Z% increase in profit margins") would strengthen the argument. This data directly impacts Reliance Industries profit outlook and investor confidence.

- Strong Performance Across Sectors: The success isn't confined to a single segment. RIL's diversified portfolio provides resilience and shields it from sector-specific downturns. Analyzing the individual contributions of Jio Platforms, Reliance Retail, and the petrochemicals business to the overall Reliance Industries profit is crucial for a complete picture. This diversification is a key factor contributing to the overall success reflected in the Reliance Industries stock price.

The Contagion Effect: How RIL's Success Impacts Other Large-Caps

RIL's exceptional performance positively impacts market sentiment. Positive news from a dominant player like RIL often boosts investor confidence, leading to a ripple effect across other large-cap stocks. This phenomenon is driven by several factors:

- Market Sentiment: When a major player like RIL performs exceptionally well, it creates a positive sentiment in the market, leading investors to be more optimistic about the overall economy and the prospects of other large-cap companies. This impacts the Indian stock market as a whole.

- Sectoral Impacts: RIL's strong showing in telecom, for instance, can positively influence other telecom companies listed on the Indian stock exchanges. Similarly, its success in retail could boost the sentiment around other retail giants. Analyzing the sectoral impact requires careful examination of correlations and relationships between RIL and its competitors or companies in related industries.

- Spillover Effects: The success of RIL also benefits its suppliers and distributors, leading to positive impacts across the related supply chains. This multiplier effect contributes to the broader positive impact on the Indian large-cap index. Identifying and quantifying these spillover effects would provide a clearer picture.

Analyzing the Impact on Key Large-Cap Indices

The influence of RIL's performance is clearly visible in major Indian stock market indices. The impressive results have a direct bearing on:

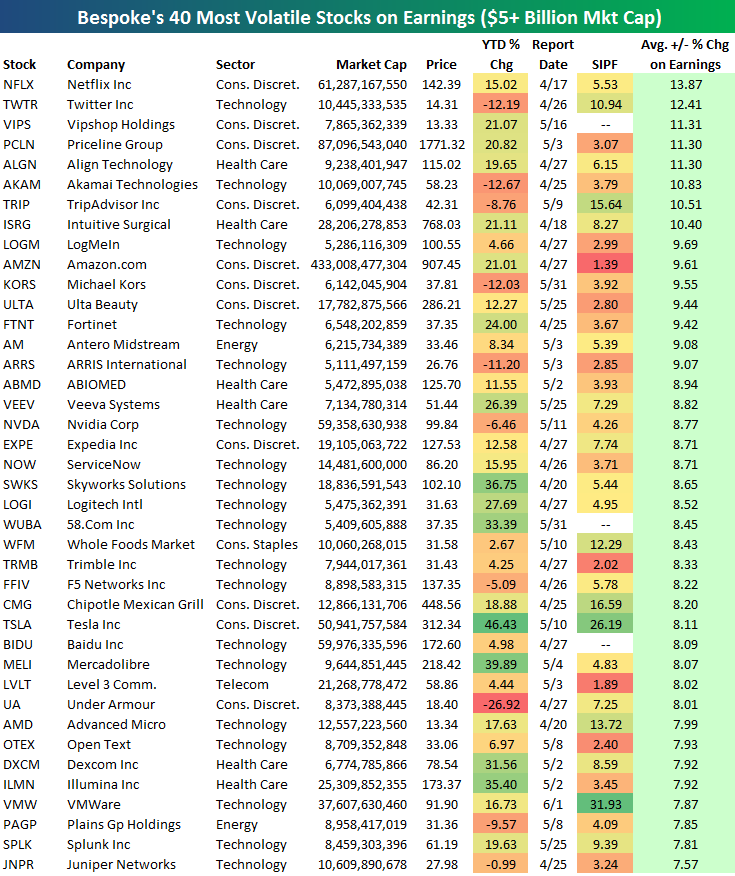

- Nifty 50 and Sensex: RIL's substantial weight in these indices means its positive performance directly contributes to their overall growth. Including charts showing the correlation between RIL's stock price movements and the Nifty 50/Sensex would visually demonstrate this impact.

- Market Capitalization: RIL's increased market capitalization boosts the overall market capitalization of the Indian stock market, enhancing investor confidence and attracting further investments.

- Specific Examples: Identifying specific other large-cap stocks that have shown correlated positive movements following RIL's results strengthens the argument.

Risks and Considerations: A Balanced Perspective

While RIL's success has a largely positive impact, it's crucial to maintain a balanced perspective:

- Market Risk: No investment is without risk. Global economic downturns, geopolitical instability, or sector-specific challenges could still negatively impact even the strongest large-cap stocks, including RIL itself.

- Global Economic Outlook: External factors like global inflation, recessionary fears, or changes in commodity prices could significantly influence the Indian stock market, potentially negating some of the positive impacts from RIL's performance.

- Investment Strategy: Investors should always diversify their portfolios to mitigate risk. Relying solely on the performance of a single company, even one as dominant as RIL, is not a sound investment strategy.

Conclusion: Navigating the Indian Large-Cap Market After Reliance's Success

Reliance Industries' outstanding performance has undeniably had a positive influence on other Indian large-cap stocks, boosting market sentiment and contributing to overall index growth. However, it's essential to remember that the market is complex and subject to various factors beyond the control of any single company. Understanding the interconnectedness within the Indian large-cap market is crucial for making informed investment decisions. Therefore, before investing in Indian large-cap stocks, conduct thorough research, analyze market trends, and consider consulting a qualified financial advisor. Remember to diversify your portfolio to manage risk effectively.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6 Reporting

Apr 29, 2025

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6 Reporting

Apr 29, 2025 -

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 29, 2025

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 29, 2025 -

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025 -

Luxury Car Sales In China Why Bmw And Porsche Are Facing Headwinds

Apr 29, 2025

Luxury Car Sales In China Why Bmw And Porsche Are Facing Headwinds

Apr 29, 2025 -

Analyzing The Effectiveness Of Minnesotas Film Tax Credit Program

Apr 29, 2025

Analyzing The Effectiveness Of Minnesotas Film Tax Credit Program

Apr 29, 2025

Latest Posts

-

Israels Gaza Aid Ban Growing Concerns Over Worsening Humanitarian Situation

Apr 29, 2025

Israels Gaza Aid Ban Growing Concerns Over Worsening Humanitarian Situation

Apr 29, 2025 -

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025 -

Food Fuel And Water Crisis In Gaza Calls To End Israels Aid Ban

Apr 29, 2025

Food Fuel And Water Crisis In Gaza Calls To End Israels Aid Ban

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025