Amsterdam Exchange Plunges 11% In Three Days: Major Losses Continue

Table of Contents

Causes of the Amsterdam Exchange's Sharp Decline

The sharp decline in the Amsterdam Exchange's performance is attributable to a confluence of factors, both global and specific to the exchange itself.

Impact of Global Market Volatility

The Amsterdam Exchange, like other major global exchanges, is not immune to the impact of global economic uncertainty. Recent downturns in other key markets, such as the Dow Jones and FTSE, have significantly influenced investor sentiment and contributed to the sell-off.

- Examples of global events: Rising inflation rates across the globe, ongoing geopolitical tensions, and the continuing uncertainty surrounding energy prices have all played a significant role in creating a volatile market environment.

- Correlation with other market indices: A strong negative correlation has been observed between the Amsterdam Exchange and major indices like the Dow Jones Industrial Average and the FTSE 100, indicating a shared susceptibility to global market anxieties. Data shows a clear downward trend mirroring similar declines in these other major markets. For instance, a 3% drop in the Dow Jones was closely followed by a 2% drop in the Amsterdam Exchange within the same trading day.

Specific Sectoral Weakness

The downturn isn't evenly distributed across all sectors within the Amsterdam Exchange. Certain sectors have experienced significantly more substantial losses than others.

- Examples of underperforming sectors: The technology, energy, and financial sectors have been particularly hard hit. Technology companies have seen diminished valuations due to increased interest rates, impacting future growth projections. Energy companies, while benefiting from high prices in the short term, face increased uncertainty regarding future demand and government regulations. The financial sector reflects a general tightening of credit conditions.

- Reasons behind underperformance: Regulatory changes impacting specific sectors, coupled with decreased consumer confidence and a tightening of credit conditions, have all contributed to the underperformance of these key sectors. The resulting decline in investor confidence has triggered significant selloffs.

Investor Sentiment and Panic Selling

A significant contributing factor to the speed and depth of the decline has been investor sentiment and the resulting panic selling. Fear and uncertainty have driven investors to liquidate their positions, exacerbating the downward spiral.

- Psychological factors driving sell-offs: The fear of missing out (FOMO) on further declines, coupled with herd behavior – where investors mimic the actions of others – has accelerated the sell-off. The rapid nature of the decline itself further fueled anxiety, prompting more investors to sell.

- Significant news events: While no single event triggered the downturn, a series of negative news reports regarding inflation and future interest rate hikes likely contributed to the erosion of investor confidence, creating the environment for widespread panic selling.

Impact on Investors and the Broader Economy

The decline in the Amsterdam Exchange has significant ramifications for both investors and the Dutch economy as a whole.

Losses for Investors

The 11% drop represents substantial financial losses for investors across the board.

- Losses for different investor types: Institutional investors, managing large portfolios, have experienced significant losses, potentially impacting their overall investment strategies. Individual investors, particularly those with retirement savings heavily invested in the Amsterdam Exchange, are facing substantial reductions in their portfolio values.

- Implications for investors: The losses are impacting retirement savings, investment portfolios, and overall investor confidence. The uncertainty surrounding the market’s future trajectory is leading many investors to adopt a more cautious approach.

Economic Ramifications

The decline in the Amsterdam Exchange has far-reaching implications for the Dutch economy.

- Potential effects on the Dutch economy: A prolonged downturn could negatively impact GDP growth, potentially leading to decreased consumer spending and increased unemployment. The reduced value of companies listed on the exchange also affects their ability to secure funding.

- Potential spillover effects: The Amsterdam Exchange's decline could also have spillover effects on other European markets, given its interconnectedness with the broader European financial system.

Potential Recovery Strategies and Future Outlook

Addressing the situation requires a multi-pronged approach involving government intervention and a careful consideration of market predictions.

Government Intervention and Regulatory Responses

The Dutch government may need to take action to stabilize the market.

- Possible government interventions: Interest rate adjustments, potential bailouts for struggling sectors, or increased regulatory oversight could be considered to restore investor confidence. These measures aim to alleviate anxieties and encourage investment.

- Examples of regulatory changes: Targeted regulations aimed at supporting specific sectors could help to mitigate the impact of the downturn. Government assurances regarding market stability are also crucial.

Market Predictions and Expert Opinions

The outlook for the Amsterdam Exchange is currently uncertain, with expert opinions varying widely.

- Short-term and long-term recovery predictions: Some experts predict a short-term recovery, citing the resilience of the Dutch economy and the potential effectiveness of government interventions. Others remain cautious, pointing to ongoing global uncertainties and the potential for further volatility.

- Optimistic and pessimistic viewpoints: A balanced perspective is crucial. While some believe the current decline is a temporary correction, others suggest a longer period of adjustment may be needed.

Conclusion

The unprecedented 11% plunge of the Amsterdam Exchange in just three days highlights the fragility of the market and the impact of global economic factors. While the causes are complex, involving global volatility, sectoral weakness, and investor sentiment, understanding these factors is crucial for navigating the current uncertainty. Investors must carefully monitor the situation, consider diversification strategies, and stay informed about potential government interventions and market predictions. Stay updated on the evolving situation of the Amsterdam Exchange and its potential recovery. Keep an eye on news regarding the Amsterdam stock market and any further developments related to this significant decline. By staying informed, investors can make better-informed decisions in relation to the Amsterdam Exchange's future performance.

Featured Posts

-

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Complete Bbc Radio 1 Big Weekend Lineup Jorja Smith Biffy Clyro Blossoms Confirmed

May 25, 2025

Complete Bbc Radio 1 Big Weekend Lineup Jorja Smith Biffy Clyro Blossoms Confirmed

May 25, 2025 -

Avoid Crowds Smart Flight Booking For Memorial Day Weekend 2025

May 25, 2025

Avoid Crowds Smart Flight Booking For Memorial Day Weekend 2025

May 25, 2025 -

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 25, 2025

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 25, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Latest Posts

-

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025 -

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

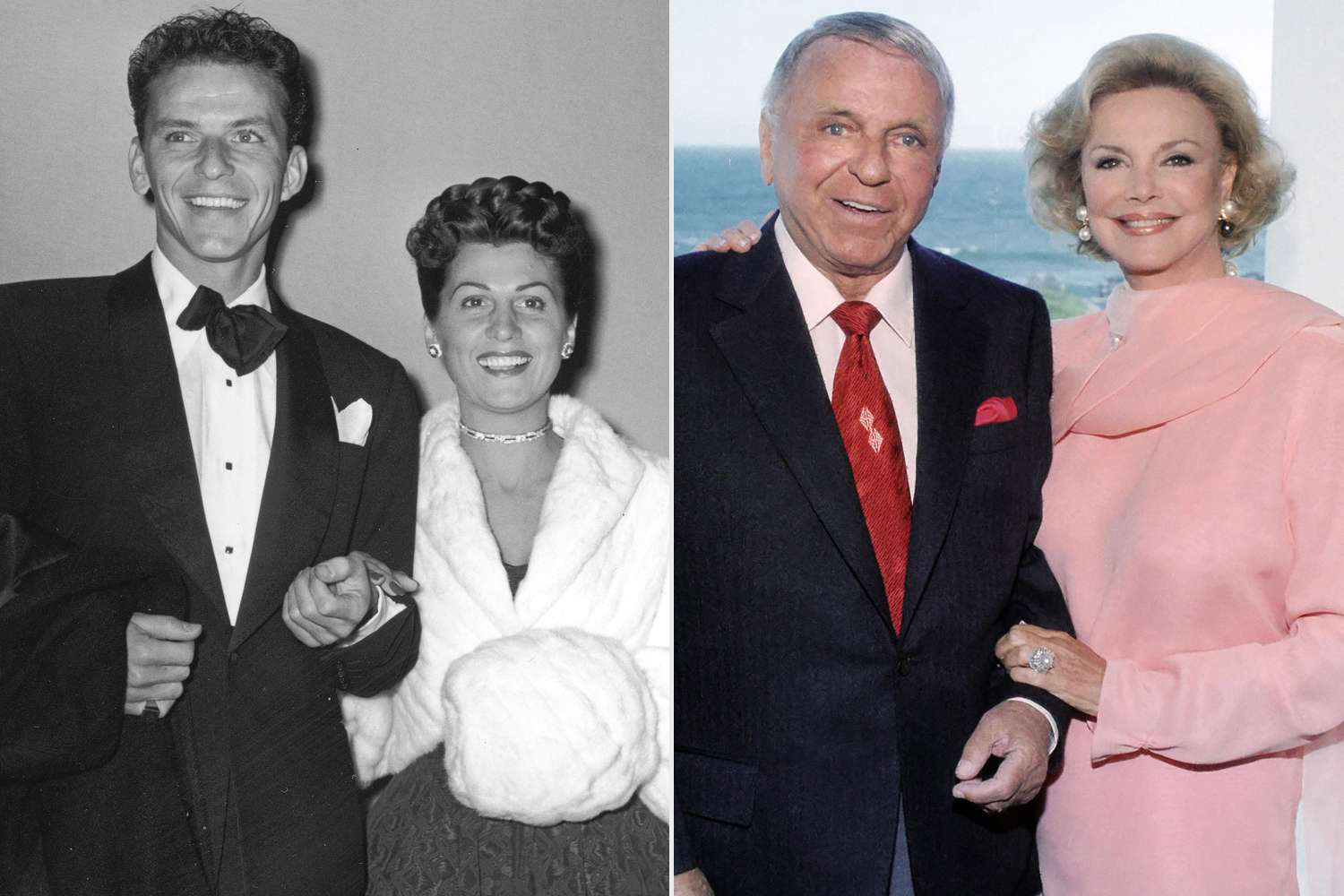

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025