Euronext Amsterdam Stocks Surge 8% After Trump Tariff Pause

Table of Contents

Understanding the Impact of the Trump Tariff Pause on Euronext Amsterdam

The Trump administration's tariffs imposed significant burdens on European businesses, creating market volatility and uncertainty. These tariffs, targeting various sectors, led to increased production costs, reduced competitiveness, and dampened investor confidence. Companies listed on Euronext Amsterdam, heavily reliant on international trade, felt the pinch acutely. The subsequent pause in these tariffs, however, provided much-needed relief. This sudden shift in trade policy injected a wave of optimism, significantly boosting investor confidence and triggering the observed 8% surge in Amsterdam stocks.

- Specific examples of positively affected sectors: The technology and automotive sectors, particularly those heavily involved in transatlantic trade, experienced substantial gains.

- Quantitative data illustrating pre-pause and post-pause performance: While precise figures require detailed market data analysis, reports indicated a sharp reversal of negative trends across many indices following the tariff pause announcement.

- Analysis of investor sentiment: Pre-pause sentiment was characterized by caution and uncertainty, with many investors adopting a wait-and-see approach. The tariff pause dramatically shifted this sentiment to optimism and renewed investment activity.

Key Sectors Driving the Euronext Amsterdam Stock Surge

The 8% surge wasn't uniform across all sectors listed on Euronext Amsterdam. Certain sectors experienced disproportionately large gains, reflecting the specific impact of the tariffs and the subsequent pause.

- Performance data for each key sector: The technology sector, for example, saw a double-digit percentage increase in some cases, while the automotive sector also experienced significant growth. Detailed sector-specific data would be required for precise figures.

- Factors driving growth in each sector: Reduced production costs due to the tariff pause were a major catalyst. Increased consumer demand, fueled by improved economic sentiment, also played a significant role.

- Companies showing exceptional growth: While identifying specific companies requires further research and analysis, several companies in the technology and automotive sectors reported significantly improved financial forecasts post-pause.

Long-Term Implications and Future Outlook for Euronext Amsterdam Stocks

While the tariff pause brought immediate relief, the long-term implications for Euronext Amsterdam stocks remain uncertain. The current economic climate and future trade negotiations continue to pose significant risks.

- Potential impact of future trade negotiations: The possibility of future trade disputes or renewed tariffs casts a shadow over the long-term outlook. Any escalation of trade tensions could reverse the current positive trend.

- Lingering economic uncertainties in Europe: Brexit's lingering effects and broader European economic challenges add to the uncertainty facing Euronext Amsterdam.

- Expert opinions and predictions: Many analysts suggest a cautious approach, advising investors to closely monitor geopolitical developments and economic indicators before making significant investment decisions.

Investment Strategies Following the Euronext Amsterdam Stock Surge

The 8% surge in Euronext Amsterdam stocks doesn't guarantee continued growth. Investors should employ prudent strategies to navigate the market.

- Strategies for capitalizing on potential future growth: Diversification across different sectors within the Euronext Amsterdam market is crucial. Thorough due diligence on individual companies is essential.

- Importance of diversification: Spreading investments across various sectors minimizes risk and mitigates the impact of sector-specific downturns.

- Considerations for risk-averse and risk-tolerant investors: Risk-averse investors may prefer a more conservative approach, while risk-tolerant investors might consider taking advantage of potential growth opportunities in specific sectors. However, it is imperative to understand that all investment carries inherent risk.

Conclusion

The 8% surge in Euronext Amsterdam stocks following the pause in Trump-era tariffs represents a significant market event, driven by a combination of factors including reduced trade barriers and improved investor confidence. While key sectors like technology and automotive led the charge, long-term implications remain uncertain due to ongoing economic and geopolitical factors. Investors should adopt a diversified and well-researched strategy to navigate this dynamic market. Stay updated on Euronext Amsterdam stocks, monitor the Euronext Amsterdam market carefully, and learn more about investing in Euronext Amsterdam to make informed decisions.

Featured Posts

-

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025 -

Escape To The Country Building A New Life In The Countryside

May 25, 2025

Escape To The Country Building A New Life In The Countryside

May 25, 2025 -

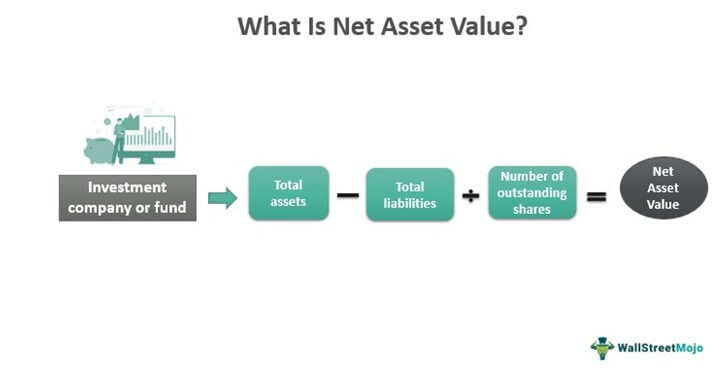

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025 -

Dazi Trump Sul Settore Moda Un Analisi Degli Effetti Su Nike Lululemon E Altri

May 25, 2025

Dazi Trump Sul Settore Moda Un Analisi Degli Effetti Su Nike Lululemon E Altri

May 25, 2025 -

Nanari Upplysingar Um Fyrstu 100 Rafutgafu Porsche Macan

May 25, 2025

Nanari Upplysingar Um Fyrstu 100 Rafutgafu Porsche Macan

May 25, 2025

Latest Posts

-

Trump Administration Greenlights Nippon U S Steel Merger

May 25, 2025

Trump Administration Greenlights Nippon U S Steel Merger

May 25, 2025 -

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025 -

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025 -

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025 -

How 10 New Orleans Inmates Escaped Jail Undetected

May 25, 2025

How 10 New Orleans Inmates Escaped Jail Undetected

May 25, 2025