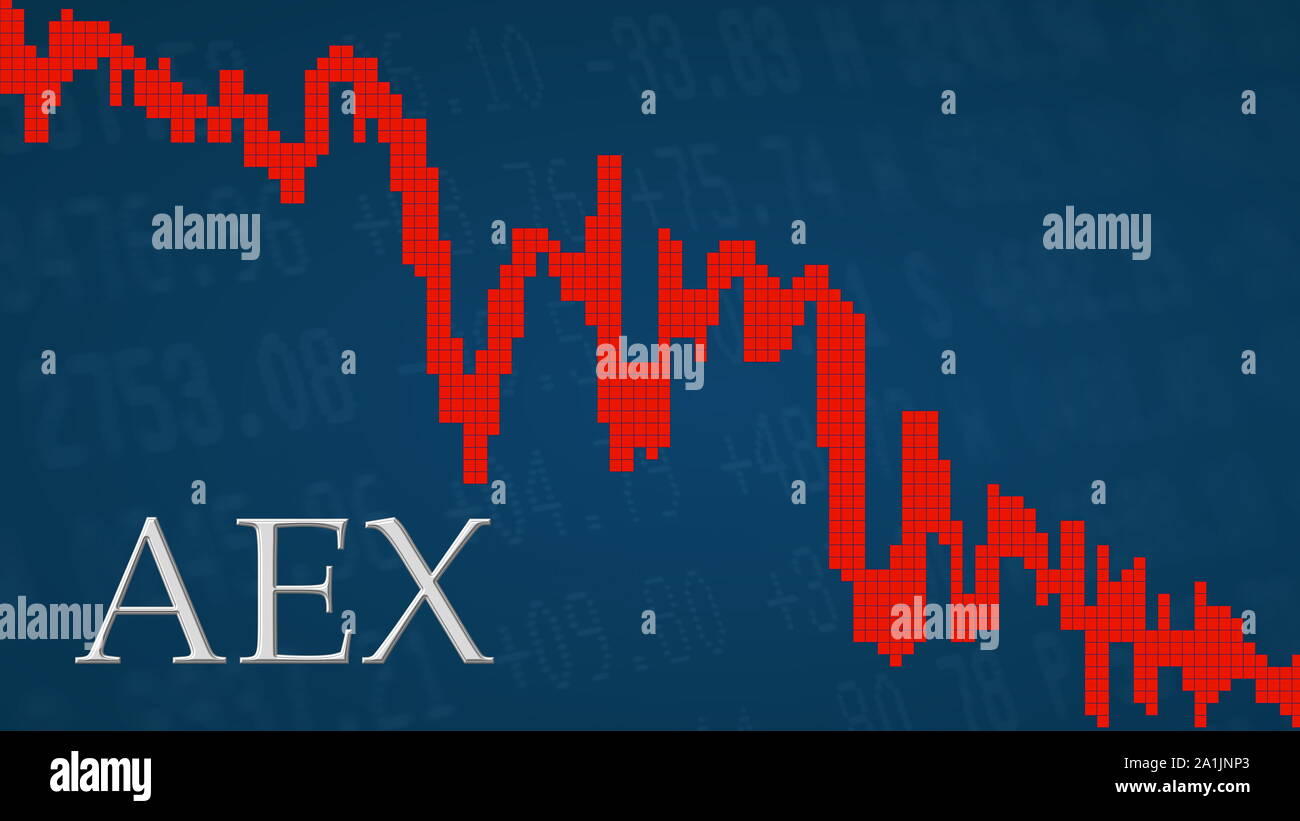

Amsterdam Stock Exchange Plunges 2% After Trump's Tariff Hike

Table of Contents

Immediate Impact of the Tariff Hike on the Amsterdam Stock Exchange (AEX)

The direct correlation between the tariff announcement and the AEX's 2% drop is undeniable. The increased tariffs, targeting specific goods, immediately impacted businesses reliant on international trade, leading to a wave of selling pressure. Sectors most affected included technology, automotive, and agricultural industries – all heavily reliant on global supply chains and vulnerable to trade restrictions.

- Specific percentage drops for key indices within the AEX: The technology index saw a particularly sharp decline of 3.5%, reflecting the sector’s dependence on global supply chains and the potential for reduced consumer demand. The automotive index fell by 2.8%, impacted by disruptions to component sourcing and decreased sales prospects.

- Examples of individual companies experiencing significant losses: ASML Holding, a leading semiconductor equipment manufacturer, experienced a significant share price drop, mirroring the wider tech sector downturn. Similarly, several automotive parts suppliers witnessed considerable losses.

- Initial market reaction (panic selling, decreased trading volume): The initial market reaction was characterized by panic selling as investors reacted to the uncertainty surrounding future trade relations. Trading volume also decreased as investors adopted a wait-and-see approach, further contributing to the market's instability.

Wider Implications for the Dutch Economy

The impact of the tariff hike extends beyond the immediate AEX drop, creating a ripple effect throughout the Dutch economy. Businesses reliant on international trade face reduced export opportunities, impacting revenue and profit margins. This could, in turn, lead to decreased investment and potential job losses.

- Potential impact on specific Dutch export industries: Industries like agriculture (flower exports), logistics, and manufacturing are particularly vulnerable, facing potential decreased demand from their key export markets.

- Government response and potential mitigation strategies: The Dutch government is likely to implement support measures for affected businesses, possibly including financial aid packages or tax incentives to boost domestic demand and mitigate the economic fallout.

- Long-term economic outlook for the Netherlands considering this event: The long-term outlook depends on the duration and extent of the trade war. Prolonged trade tensions could significantly hamper economic growth, impacting investment and employment levels in the Netherlands.

Global Market Reactions and the Interconnectedness of Global Finance

The tariff increase triggered a broader global market response, demonstrating the interconnectedness of international stock markets. The Amsterdam Stock Exchange's performance mirrors wider anxieties about escalating trade wars and their potential impact on global economic stability.

- Performance of other major European stock exchanges (e.g., London, Frankfurt, Paris): Other major European stock exchanges also experienced declines, though the magnitude varied depending on the countries' exposure to the affected sectors and their trade relationships with the US.

- Reaction of US and Asian markets: US markets initially reacted negatively, but the response was more muted compared to European markets, highlighting regional disparities in the impact of the tariff hike. Asian markets, particularly those heavily reliant on exports to the US, also experienced significant volatility.

- Expert opinions on the global economic outlook: Economists widely express concerns about the potential for a global slowdown, emphasizing the risk of decreased investment, trade disruption, and potential inflationary pressures due to trade wars.

The Role of Uncertainty in Market Volatility

Uncertainty surrounding future trade policies is a significant driver of market volatility. Unpredictable trade actions erode investor confidence, leading to increased risk aversion and a flight to safety.

- Impact of unpredictable trade policies on investor confidence: Investors react negatively to unpredictability. The lack of clarity about future trade policies makes it difficult to assess long-term risks and opportunities, leading to decreased investment.

- Strategies investors might employ to mitigate risk: Investors may diversify their portfolios, increase their cash holdings, or invest in assets considered less vulnerable to trade tensions to mitigate risk.

- The role of speculation and market psychology: Speculation and market sentiment play a significant role in amplifying market reactions to trade policy announcements, creating a self-reinforcing cycle of volatility.

Conclusion

The 2% plunge in the Amsterdam Stock Exchange following Trump's tariff hike serves as a stark reminder of the interconnectedness of global markets and the sensitivity of economies to protectionist measures. The immediate impact was felt acutely in various sectors, but the long-term consequences for the Dutch economy and the global financial landscape remain uncertain. The event highlights the importance of stable and predictable trade policies for maintaining market stability and fostering economic growth. Understanding the impact of tariff hikes and other global economic events is crucial for making informed investment decisions. Stay informed about developments affecting the Amsterdam Stock Exchange and global trade by regularly checking reputable financial news sources. Follow our website for further analysis on the Amsterdam Stock Exchange and its response to future global events.

Featured Posts

-

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Latest Posts

-

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025 -

La Landlord Price Gouging Following Fires A Stars Accusation

May 24, 2025

La Landlord Price Gouging Following Fires A Stars Accusation

May 24, 2025 -

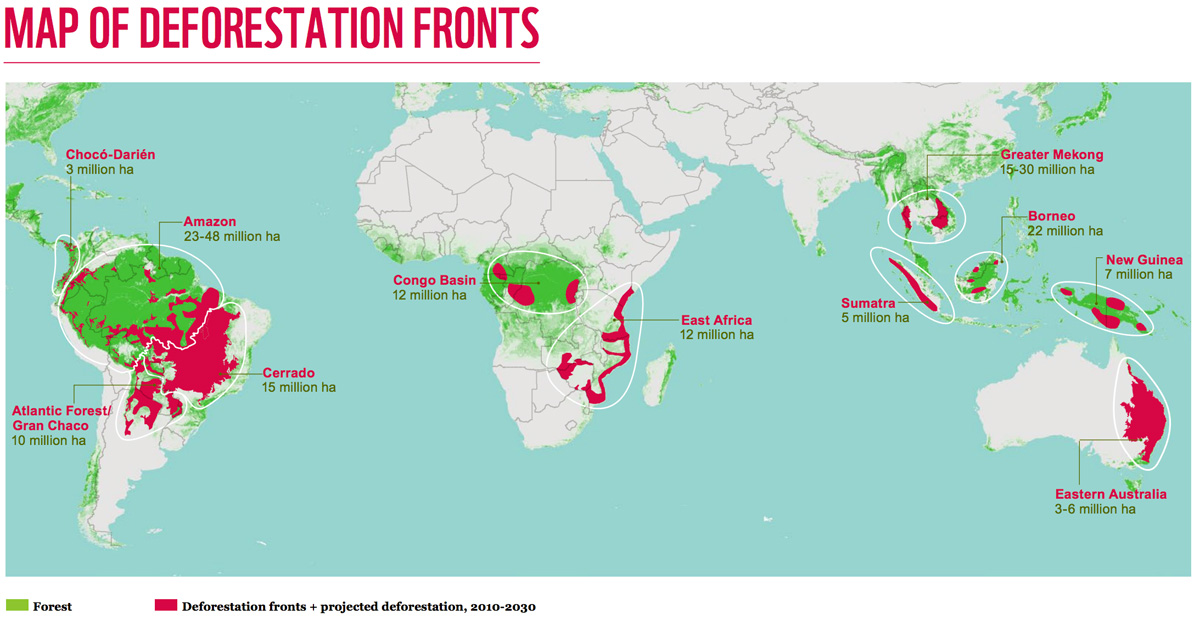

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025