Amsterdam Stock Index Plunges: Over 4% Drop To Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Plunge

The substantial drop in the Amsterdam Stock Index is attributable to a confluence of factors, both global and domestic.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting the AEX. Rising inflation globally, coupled with aggressive interest rate hikes by central banks, is dampening economic growth. This is further exacerbated by geopolitical instability, particularly the ongoing conflict in Ukraine, which disrupts global trade and undermines investor confidence. The slowdown in major global economies, such as the US and China, directly affects Dutch exports, adding pressure to the AEX.

- Weakening Euro: The weakening Euro against major currencies, like the US dollar, increases the cost of imports and reduces the competitiveness of Dutch exports, negatively impacting the AEX.

- Energy Price Volatility: Uncertainty surrounding energy prices, driven by geopolitical factors and supply chain disruptions, adds further pressure to various sectors within the Dutch economy, leading to decreased profitability and impacting stock valuations.

Sector-Specific Weakness

The decline in the AEX is not uniform across all sectors. Certain sectors have experienced disproportionately large drops, contributing significantly to the overall index plunge.

- Technology Sector Decline: The global tech slowdown has significantly impacted the performance of technology companies listed on the AEX, leading to substantial losses.

- Financial Institutions Underperform: Increased regulatory pressures and concerns about potential economic downturns have weighed heavily on the performance of financial institutions, impacting their stock prices.

- Rising Raw Material Costs: The surge in raw material costs, particularly energy, has placed significant strain on industrial companies, affecting their profitability and contributing to the AEX's decline.

Investor Sentiment and Market Volatility

Negative investor sentiment plays a crucial role in exacerbating market downturns. Gloomy economic forecasts and concerns about future growth prospects have fueled increased market volatility, leading to significant sell-offs and panic selling.

- Investment Withdrawal: Investors are withdrawing investments from the Dutch market, further contributing to the downward pressure on the AEX.

- Algorithmic Trading Impact: The use of algorithmic trading can amplify market fluctuations, exacerbating the decline of the Amsterdam Stock Index during periods of heightened uncertainty.

Implications for Investors and the Dutch Economy

The significant drop in the Amsterdam Stock Index has wide-ranging implications for both investors and the Dutch economy.

Impact on Investors

The AEX plunge translates to significant losses for investors holding AEX-related assets. This has increased risk aversion among investors, leading them to adopt more cautious investment strategies.

- Potential for Further Declines: The possibility of further declines in the AEX remains, depending on evolving global and domestic economic conditions.

- Diversification: The need for portfolio diversification is now paramount to mitigate risks associated with the current market volatility.

Economic Consequences for the Netherlands

The decline in the AEX is likely to have a ripple effect on the broader Dutch economy. A decreased stock market valuation can lead to reduced consumer confidence and spending, potentially impacting overall economic growth.

- Economic Slowdown: The current situation suggests a potential slowdown in Dutch economic growth in the near future.

- Government Response: The Dutch government may need to implement policy interventions to mitigate the negative economic consequences of the AEX decline. This might include fiscal stimulus measures or regulatory changes.

Potential Future Trends for the Amsterdam Stock Index

Predicting the future trajectory of the Amsterdam Stock Index requires careful consideration of both short-term and long-term factors.

Short-Term Outlook

In the short term, continued volatility is anticipated for the AEX. Further declines are possible depending on global economic developments and investor sentiment.

- Key Economic Indicators: Close monitoring of key economic indicators, such as inflation rates and unemployment figures, will be crucial for short-term predictions.

- Market Sentiment: Tracking investor sentiment and market reactions to economic news will also help assess the potential short-term movements of the AEX.

Long-Term Prospects

The long-term prospects for the Amsterdam Stock Index depend significantly on the recovery of the global and Dutch economies. Structural reforms and economic diversification will play a crucial role in determining long-term growth potential.

- Long-Term Growth Potential: A thorough assessment of the long-term growth potential of the Dutch economy is necessary for predicting the long-term trajectory of the AEX.

- Government Policies: Government policies and their impact on the business environment will also significantly affect the AEX's long-term performance.

Conclusion

The dramatic plunge of the Amsterdam Stock Index, exceeding 4% and reaching a year-low, highlights substantial challenges facing the Dutch and global economies. Understanding the complex interplay of factors—from global economic uncertainty and sector-specific weakness to volatile investor sentiment—is crucial for navigating this turbulent period. Investors must closely monitor the situation, diversify their portfolios, and remain well-informed about future developments in the Amsterdam Stock Index and the global market. Stay updated on the latest news and analysis regarding the Amsterdam Stock Index to make informed investment decisions.

Featured Posts

-

2026 Porsche Cayenne Ev What The Spy Shots Tell Us

May 24, 2025

2026 Porsche Cayenne Ev What The Spy Shots Tell Us

May 24, 2025 -

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025 -

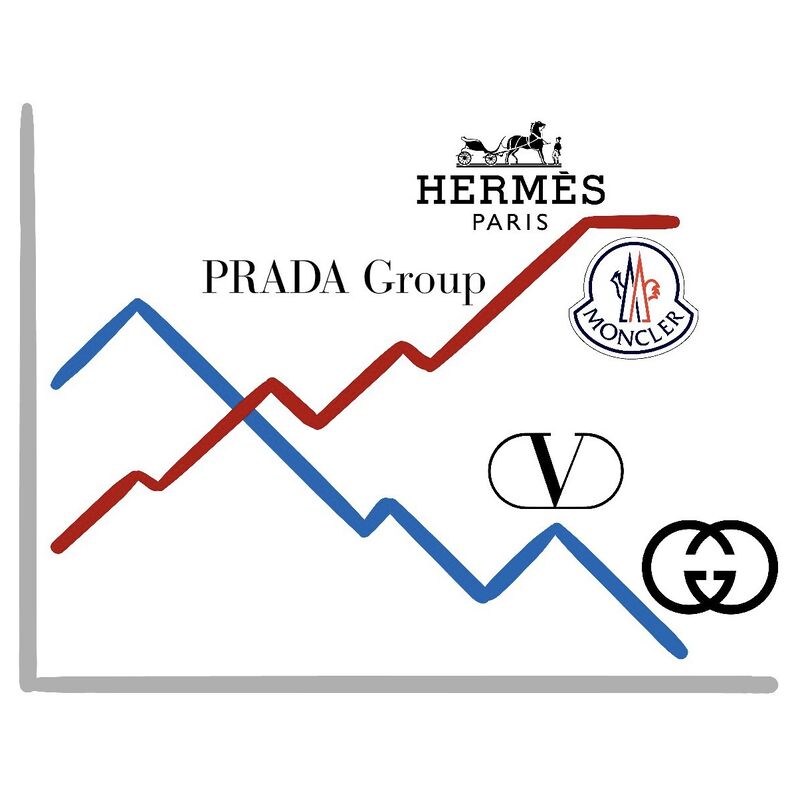

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025 -

Alshrtt Alalmanyt Tetql Mshjeyn Khlal Mdahmat

May 24, 2025

Alshrtt Alalmanyt Tetql Mshjeyn Khlal Mdahmat

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025