A Successful Escape To The Country: Tips For A Smooth Transition

Table of Contents

Financial Planning for Your Country Escape

Moving to the country often involves significant financial adjustments. Thorough budgeting and smart financial planning are paramount for a successful transition.

Budgeting for Rural Living

Rural living comes with unique financial considerations. Your budget needs to account for several factors that may differ significantly from city life:

- Higher property taxes: Rural properties often have higher tax assessments than comparable urban properties.

- Increased reliance on car ownership: Public transportation is often limited in rural areas, making car ownership a necessity. Factor in fuel, maintenance, and insurance costs.

- Higher energy costs: Heating costs, in particular, can be significantly higher in rural areas due to older, less energy-efficient homes and larger spaces to heat.

- Increased home maintenance costs: Larger properties require more upkeep, including landscaping, repairs, and potential renovations.

- Reduced income opportunities: Job markets can be smaller and less diverse in rural areas, potentially impacting your earning potential.

Creating a detailed budget is crucial, including a contingency fund for unexpected repairs or expenses. Consult with a financial advisor specializing in rural relocation for personalized guidance and explore resources like the USDA Rural Development programs for potential assistance.

Securing Financing for Your Rural Property

Securing financing for your rural property requires careful planning and a lender who understands the nuances of rural lending.

- Exploring mortgage options: Research different mortgage types, including USDA rural development loans, which may offer more favorable terms for rural properties.

- Understanding rural lending requirements: Lenders often have specific requirements for rural properties, which may include stricter appraisal processes and higher down payment requirements.

- Potential for government grants or incentives: Explore potential government grants or tax incentives designed to encourage rural development.

- Savings goals: Aim to save a substantial down payment to improve your chances of loan approval and reduce your monthly mortgage payments.

Working with a mortgage lender experienced in rural property transactions is essential. They can guide you through the complexities of rural lending and help you secure the best financing options for your needs.

Finding the Right Rural Property

Finding the perfect rural property is a crucial step in your escape to the country. Careful consideration of several factors will help you make an informed decision.

Location, Location, Location

The location of your rural property significantly impacts your lifestyle and convenience. Consider the following:

- Proximity to essential services: Evaluate the distance to healthcare facilities, schools, grocery stores, and other essential services.

- Commuting distance: If you're not working remotely, consider your commute time and the condition of roads.

- Community involvement opportunities: Explore local clubs, organizations, and community events to gauge the level of community engagement.

- Internet access reliability: Reliable internet access is crucial for work, communication, and entertainment. Research internet availability in your chosen location.

Thorough research is essential. Examine crime rates, local community dynamics, and the overall feel of the area to ensure it aligns with your expectations.

Property Condition and Maintenance

The condition of the property itself is a critical factor to consider beyond the initial purchase price.

- Thorough property inspections: Conduct a comprehensive inspection, including structural, plumbing, electrical, and HVAC assessments, to identify potential problems.

- Understanding potential repair costs: Factor in potential repair and maintenance costs beyond the purchase price. Older properties often require significant renovations.

- Considering the age and condition of existing systems: Assess the age and condition of systems like the roof, heating, and plumbing to estimate future replacement costs.

- Necessary upgrades: Identify any necessary upgrades or renovations to make the property suitable for your needs.

Professional inspections are invaluable. Don't underestimate the potential costs associated with necessary repairs and maintenance, and build these into your budget.

Adjusting to Rural Lifestyle

Successfully transitioning to rural life involves more than just finding the right property. It requires adapting to a new pace of life and engaging with the local community.

Community Engagement

Active community involvement is essential for a fulfilling rural experience.

- Joining local clubs or organizations: Join local clubs or organizations related to your hobbies or interests. This is a great way to meet people and get involved.

- Attending community events: Attend local events and festivals to connect with your neighbors and learn more about the community.

- Building relationships with neighbors: Make an effort to get to know your neighbors; they can be a valuable source of information and support.

- Understanding local customs and traditions: Take the time to learn about the unique customs and traditions of your new community.

Building strong relationships within your rural community will significantly enhance your experience and make your transition smoother.

Access to Services and Amenities

Rural areas often have fewer services and amenities than urban areas. Understanding these limitations and planning accordingly is important.

- Healthcare access: Research healthcare options, including hospitals and clinics, and understand travel times to access necessary care. Consider telehealth options.

- Educational opportunities: If you have children, research local schools and educational options.

- Transportation options: Accept that car ownership is generally necessary in rural areas.

- Internet connectivity: Confirm reliable high-speed internet access before committing to a property.

- Shopping availability: Understand the range of shopping options and consider the frequency of trips to larger towns or cities for specific items.

Proactive planning can mitigate many challenges. Embrace online shopping, telehealth, and other resources to compensate for limited services.

Making Your Escape to the Country a Success

Successfully escaping to the country involves careful financial planning, thoughtful property selection, and a willingness to adapt to a different lifestyle. By considering the points discussed above – budgeting carefully, thoroughly researching potential properties, and actively engaging with your new community – you'll be well-prepared for this exciting adventure. Begin your countryside adventure today! Plan your perfect rural retreat and take the first step towards your dream country escape. The rewards of a successful escape to the country, a life filled with tranquility and connection with nature, are immeasurable.

Featured Posts

-

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Purchase Guide

May 24, 2025

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Purchase Guide

May 24, 2025 -

New Matt Maltese Album Her A Deep Dive Into Intimacy And Personal Development

May 24, 2025

New Matt Maltese Album Her A Deep Dive Into Intimacy And Personal Development

May 24, 2025 -

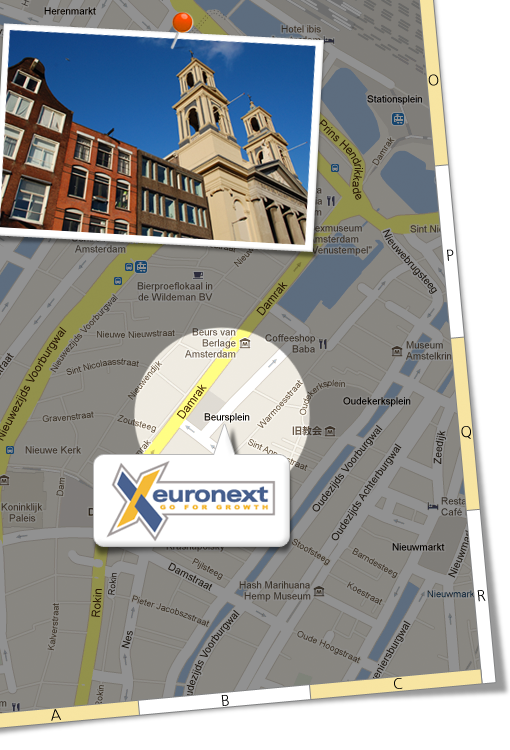

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025 -

Mamma Mia Unveiling The New Ferrari Hot Wheels Collection

May 24, 2025

Mamma Mia Unveiling The New Ferrari Hot Wheels Collection

May 24, 2025 -

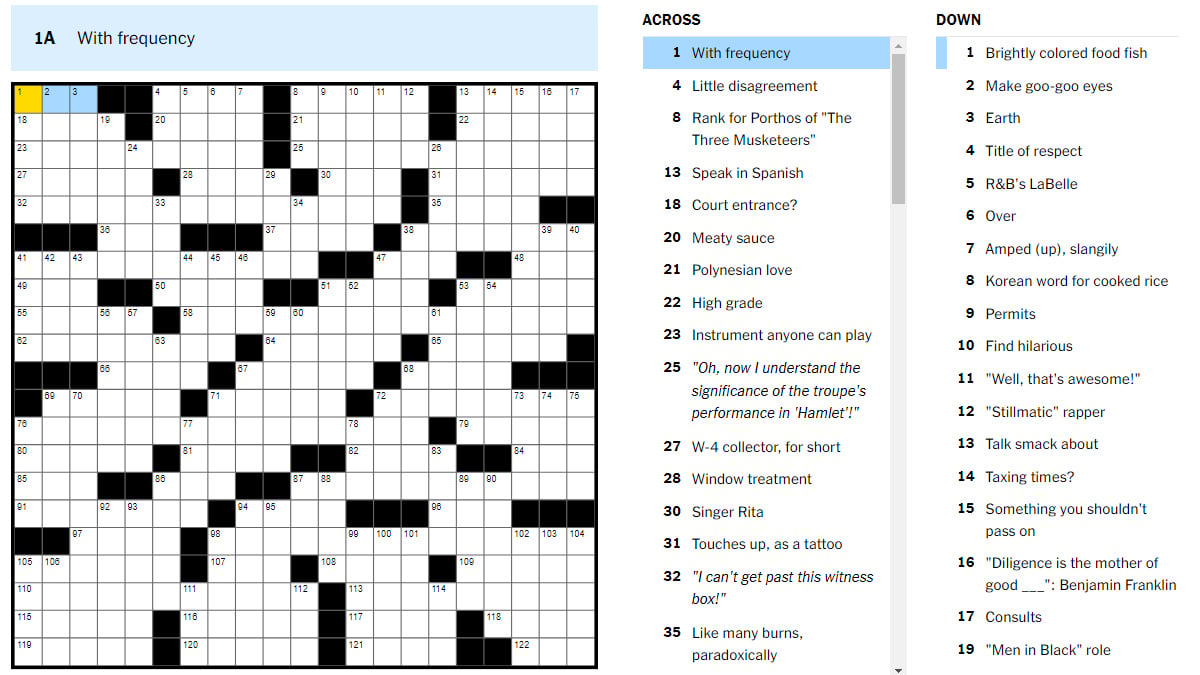

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 24, 2025

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 24, 2025

Latest Posts

-

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025