Amsterdam Stock Market Crash: AEX Index Hits 12-Month Low

Table of Contents

Causes of the AEX Index Decline

Several interconnected factors have contributed to the recent AEX Index decline and the subsequent Amsterdam stock market crash. Understanding these contributing elements is crucial for assessing the current market situation and predicting future trends.

Global Economic Uncertainty

The global economic landscape is currently fraught with uncertainty, significantly impacting the AEX Index. Several key factors are at play:

- Weakening global growth forecasts: Major international organizations like the IMF and World Bank have downgraded their global growth projections for 2023 and beyond, citing persistent inflation and geopolitical instability as major headwinds. This dampens investor confidence and leads to a flight to safety, reducing investment in riskier assets like those listed on the AEX.

- Impact of rising energy prices: The ongoing energy crisis, exacerbated by the war in Ukraine, has driven up energy prices globally. This impacts Dutch businesses directly, increasing their operating costs and squeezing profit margins. Companies heavily reliant on energy, such as those in the industrial sector, are particularly vulnerable. For example, [insert name of a Dutch energy-intensive company] has seen its share price fall significantly.

- Investor sentiment and risk aversion: Negative global news and economic uncertainty fuel investor risk aversion. Investors are moving away from equities and towards safer assets like government bonds, leading to a sell-off in the Amsterdam stock market and pushing the AEX Index down. This is further amplified by algorithmic trading strategies that exacerbate downward trends.

European Union Economic Slowdown

The European Union is facing its own set of economic challenges, directly impacting the Dutch market and contributing to the Amsterdam stock market crash. These include:

- Energy crisis impact on Dutch businesses: The high energy costs disproportionately affect Dutch businesses, many of which are energy-intensive. This leads to reduced profitability, hindering economic growth and negatively impacting stock valuations.

- Supply chain disruptions: The lingering effects of the pandemic, coupled with the war in Ukraine, continue to disrupt global supply chains. This adds to inflationary pressures and hinders the ability of Dutch companies to operate efficiently, affecting their stock performance.

- Potential recession scenarios: Many economists predict a potential recession in the Eurozone, further dampening investor sentiment and increasing the likelihood of further declines in the AEX Index. The possibility of a recession in the Netherlands directly contributes to the Amsterdam stock market crash.

Sector-Specific Challenges

The decline in the AEX Index isn't uniform across all sectors. Some sectors have been hit harder than others:

- Performance of energy companies: Energy companies listed on the AEX have experienced significant volatility, reflecting the uncertainty in the energy market. Price fluctuations and regulatory changes add to the instability.

- Technology sector performance: The tech sector, globally sensitive to interest rate hikes, has also shown weakness. Increased borrowing costs make expansion and innovation more expensive, impacting profitability and investor sentiment.

- Financial sector vulnerability: The financial sector is also vulnerable to global economic headwinds. Increased interest rates and concerns about potential loan defaults can negatively impact bank profitability and lead to reduced valuations. [Include a relevant chart or graph showcasing sector-specific performance].

Impact of the Amsterdam Stock Market Crash

The Amsterdam stock market crash, manifested in the AEX Index decline, has far-reaching consequences.

Investor Confidence and Volatility

The drop in the AEX Index has severely impacted investor confidence:

- Impact on pension funds: Pension funds heavily invested in the Dutch stock market have experienced significant losses, potentially impacting future pension payouts.

- Retail investor losses: Individual investors have also suffered losses, potentially eroding their savings and impacting consumer spending.

- Increased market uncertainty: The volatility in the AEX Index reflects the heightened uncertainty surrounding the Dutch and European economies, making it difficult for investors to make informed decisions. Experts are divided on the short-term outlook for recovery. [Quote a relevant financial analyst's opinion].

Economic Consequences for the Netherlands

The Amsterdam stock market crash has potential ripple effects on the Dutch economy:

- Potential impact on job market: A weakening economy might lead to job losses and increased unemployment, further impacting consumer confidence and spending.

- Consumer spending: Reduced investor confidence and potential job losses may lead to decreased consumer spending, slowing economic growth further.

- Government revenue: Lower economic activity can result in reduced tax revenues for the Dutch government, potentially limiting its ability to fund public services. [Include data on GDP growth forecasts for the Netherlands].

International Implications

The AEX Index decline has implications beyond the Netherlands:

- Impact on European Union financial stability: A significant downturn in the Dutch economy could have wider implications for the stability of the European Union's financial system.

- Potential contagion effects on other markets: The Amsterdam stock market crash could trigger a domino effect, impacting investor sentiment and causing declines in other European stock markets.

Conclusion

The Amsterdam stock market crash, evidenced by the AEX Index hitting a 12-month low, is a complex issue stemming from a combination of global and European economic uncertainties, along with sector-specific challenges. The consequences are far-reaching, impacting investor confidence, the Dutch economy, and potentially broader European financial stability. Understanding the factors contributing to this Amsterdam stock market crash and the AEX Index's current performance is crucial for navigating these challenging times.

Call to Action: Stay informed about the evolving situation of the Amsterdam stock market crash and the AEX index. Regularly monitor financial news from reputable sources and consider consulting with a financial advisor for personalized investment strategies tailored to your risk tolerance. Proactive monitoring and informed decision-making are essential to weathering the challenges of the Amsterdam stock market.

Featured Posts

-

Everything For Expats Housing Finance Kids And Fun At The Iam Expat Fair

May 25, 2025

Everything For Expats Housing Finance Kids And Fun At The Iam Expat Fair

May 25, 2025 -

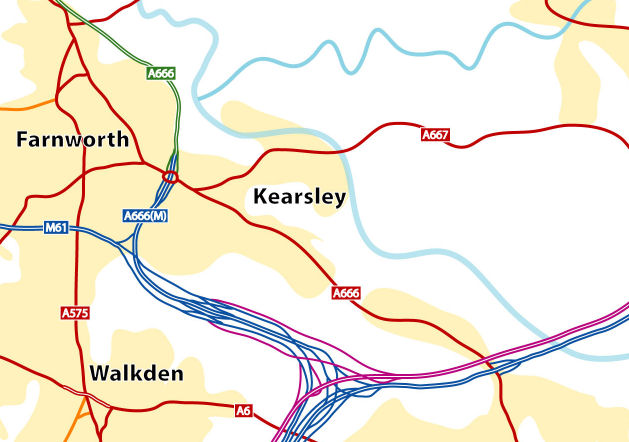

The Unbuilt M62 Relief Road Burys Bypassed History

May 25, 2025

The Unbuilt M62 Relief Road Burys Bypassed History

May 25, 2025 -

Heineken Tops Revenue Projections Confirms Outlook Amidst Trade Tensions

May 25, 2025

Heineken Tops Revenue Projections Confirms Outlook Amidst Trade Tensions

May 25, 2025 -

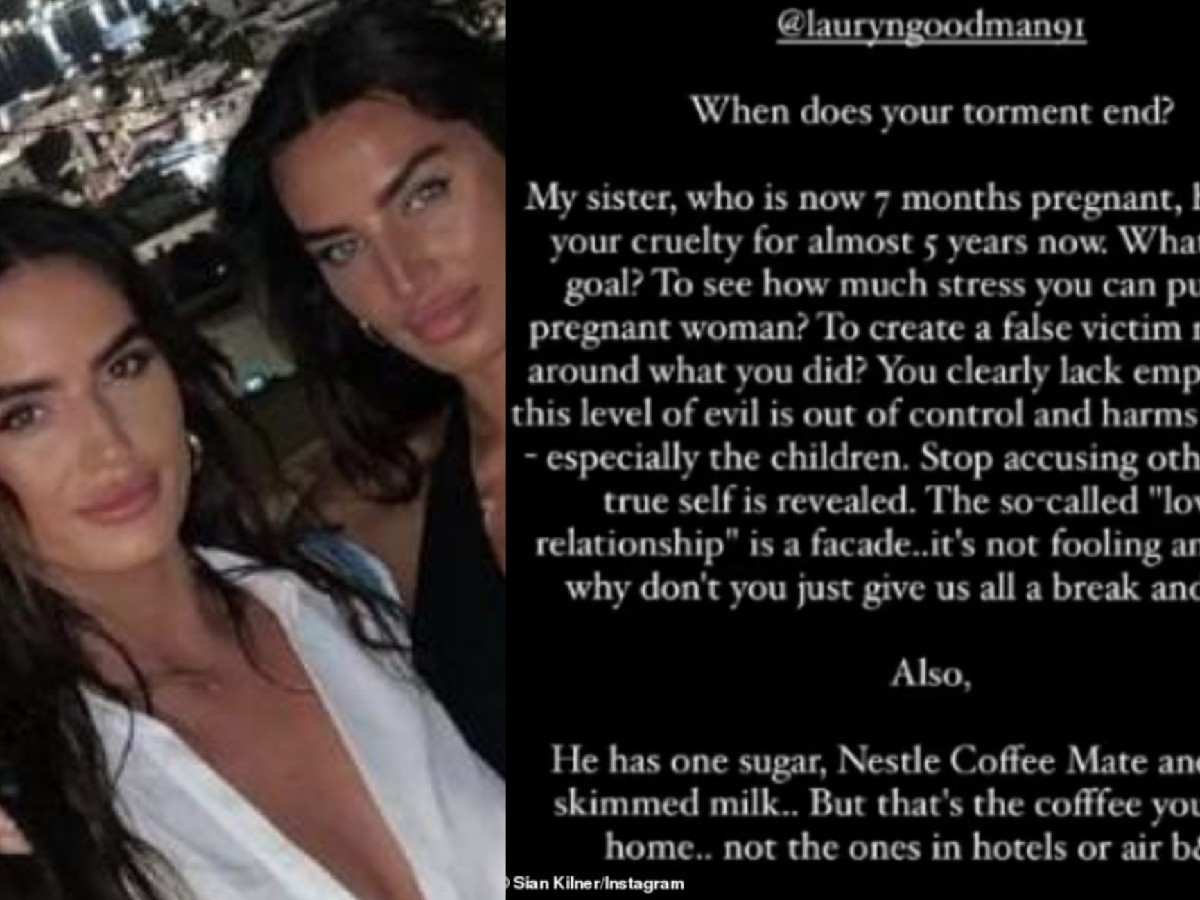

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ex Us Ucits Etf

May 25, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ex Us Ucits Etf

May 25, 2025

Latest Posts

-

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025 -

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025