Tracking The Net Asset Value (NAV) Of Amundi MSCI World Ex-US UCITS ETF

Table of Contents

Where to Find the Official NAV

The primary source for the daily NAV of the Amundi MSCI World ex-US UCITS ETF is the official Amundi website. Finding this information is straightforward:

- Step 1: Navigate to the Amundi website and locate their ETF section. This usually involves a search for "ETFs" or a similar term within their site's search bar.

- Step 2: Search for the "Amundi MSCI World ex-US UCITS ETF" specifically. You might need to use the ETF's ticker symbol (if known) for a faster search.

- Step 3: Once you've located the ETF's information page, look for a section dedicated to "Key Data," "Fund Facts," or a similar heading. The daily NAV should be clearly displayed, often updated at the end of the trading day.

(Note: Screenshots would be included here in a published article to further clarify the process).

While the Amundi website provides the official NAV, you can also find it on various other platforms:

- Financial News Websites: Many reputable financial news sources (e.g., Bloomberg, Yahoo Finance) provide real-time or delayed NAV data for ETFs.

- Brokerage Platforms: If you hold the Amundi MSCI World ex-US UCITS ETF through a brokerage account, the NAV will usually be displayed within your account's portfolio overview.

- Dedicated ETF Data Providers: Services like Bloomberg Terminal or Refinitiv offer comprehensive ETF data, including NAV, but often require subscriptions.

It's important to note that slight discrepancies might exist between different sources due to reporting lags or data processing differences. Always prioritize the official Amundi website for the most accurate information. The NAV is typically updated at the close of the relevant market.

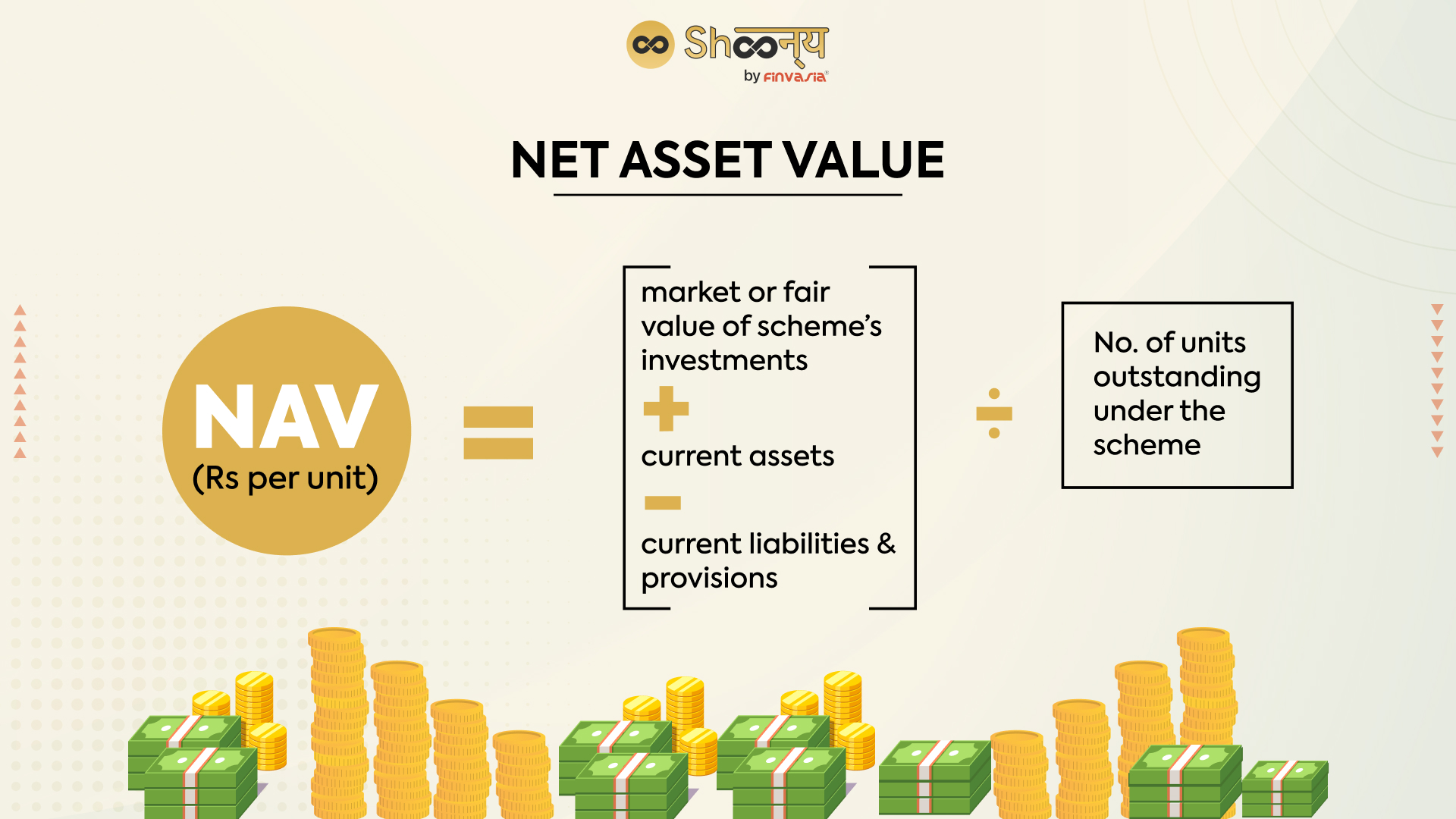

Understanding Factors Affecting Amundi MSCI World ex-US UCITS ETF NAV

Several factors influence the NAV of the Amundi MSCI World ex-US UCITS ETF:

- Currency Fluctuations: As the ETF invests globally, changes in exchange rates between the base currency of the ETF and the currencies of the underlying assets can directly impact the NAV. A strengthening of the US dollar against other currencies, for example, could lower the NAV for US-based investors.

- Underlying Asset Prices: The NAV is fundamentally linked to the performance of the underlying MSCI World ex-US Index. Fluctuations in the index's constituent stocks directly translate to changes in the ETF's NAV. A rise in the index's value typically increases the NAV, and vice-versa.

- Expenses and Management Fees: The ETF's operating expenses and management fees are deducted from the assets under management. These expenses gradually reduce the NAV over time.

- Dividends and Distributions: When the underlying holdings pay dividends, the ETF receives these payments, which are typically passed on to the ETF shareholders. After a dividend distribution, the NAV will usually adjust downwards to reflect the payout.

Tools and Techniques for Tracking NAV

Effectively tracking the NAV of your Amundi MSCI World ex-US UCITS ETF can be achieved through various tools and techniques:

- Spreadsheet Software: Using Excel or Google Sheets, you can manually record the daily NAV obtained from the Amundi website or other sources. This allows you to easily track NAV changes over time and calculate performance metrics.

- Financial Charting Tools: Many financial charting platforms (e.g., TradingView, Yahoo Finance) allow you to add the Amundi MSCI World ex-US UCITS ETF to your watchlist and automatically track its NAV and price movements. Some platforms even offer advanced charting capabilities.

- Portfolio Tracking Software: Several dedicated portfolio tracking applications provide comprehensive tools for monitoring your investments, including the NAV of your ETFs. Many offer automatic data updates and alert functionalities.

Setting up NAV alerts (if available through your chosen tracking method) can be beneficial. This will notify you of significant changes in the NAV, helping you react proactively to potential market shifts. While manual tracking provides a clear understanding of NAV movements, automated tools save time and provide more frequent updates.

Conclusion: Mastering NAV Tracking for the Amundi MSCI World ex-US UCITS ETF

Regularly monitoring the Net Asset Value (NAV) of the Amundi MSCI World ex-US UCITS ETF is essential for informed investment decisions. We've explored multiple methods for accessing the official NAV, understanding the factors that influence it, and employing effective tracking tools. By utilizing the resources and techniques outlined above, you can actively manage your investment in this ETF and make well-informed choices about your portfolio. Stay informed about your investment by regularly tracking the Net Asset Value (NAV) of your Amundi MSCI World ex-US UCITS ETF. Use the resources mentioned above to make well-informed investment decisions!

Featured Posts

-

Artfae Daks Alalmany Ila 24 Alf Nqtt Bfdl Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025

Artfae Daks Alalmany Ila 24 Alf Nqtt Bfdl Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025 -

Faiz Indirimi Avrupa Borsalarinin Yeni Durumu

May 25, 2025

Faiz Indirimi Avrupa Borsalarinin Yeni Durumu

May 25, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 25, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 25, 2025 -

Porsche 911 S T Pts Riviera Blue Find Your Dream Car

May 25, 2025

Porsche 911 S T Pts Riviera Blue Find Your Dream Car

May 25, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Analyzing The Net Asset Value Nav Of The Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Latest Posts

-

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025 -

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025 -

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025 -

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025