Amsterdam Stock Market Plunges: 7% Drop Amidst Trade War Fears

Table of Contents

The 7% Drop: A Detailed Analysis of the Plunge

The sheer magnitude of the 7% drop in the Amsterdam stock market is alarming. This sharp decline, occurring within [Insert timeframe, e.g., a single trading day], represents a significant loss in market capitalization for listed companies. To put this into perspective, [Insert comparison to previous market drops, e.g., this is the largest single-day drop since [Date] ]. The AEX index, a key indicator of the Amsterdam Stock Exchange's performance, bore the brunt of this decline.

Data Visualization: [Insert chart/graph illustrating the 7% drop visually. Clearly label axes and data points.]

- Specific percentage drop for key indices: AEX index dropped by 7%, AMX index dropped by [percentage], [Other relevant index] dropped by [percentage].

- Volume of trading during the plunge: Trading volume surged to [volume figure], indicating heightened activity and potentially panic selling.

- Comparison to previous market drops: Compared to the [Previous event] market drop of [percentage], this represents a [description, e.g., more severe/less severe] decline.

Trade War Fears: The Primary Driver of the Amsterdam Stock Market Decline

The primary catalyst for this significant Amsterdam Stock Market plunge is the escalating global trade war. Growing uncertainty surrounding trade policies and retaliatory tariffs has created a climate of fear and uncertainty, significantly impacting investor sentiment. Specific events, such as [mention specific trade policy or event, e.g., the announcement of new tariffs on [product] by [country]], directly contributed to the sell-off.

- Specific trade policies or events that contributed to the fear: [List specific events with brief explanations.]

- Expert opinions on the link between trade wars and market volatility: [Quote financial analysts or experts on the connection between trade wars and market instability. Cite sources.]

- Impact on specific sectors: Export-oriented industries, particularly those heavily reliant on trade with [mention specific countries], were hit hardest.

Affected Sectors: Which Industries Suffered the Most?

The Amsterdam Stock Market plunge didn't impact all sectors equally. Export-oriented industries, such as [mention specific industry examples, e.g., technology, agriculture], experienced the most significant declines. These sectors are particularly vulnerable to trade wars due to their reliance on international trade and the potential for increased costs from tariffs.

- Percentage drops within individual sectors: [Provide data on percentage drops for specific sectors.]

- Analysis of company-specific performance: [Discuss the performance of specific companies within affected sectors, providing examples.]

- Reasons for vulnerability in each affected sector: [Explain why specific sectors were disproportionately affected.]

Investor Reactions and Market Sentiment

The Amsterdam Stock Market plunge triggered a wave of selling, with some investors engaging in panic selling to limit potential losses. Market sentiment plummeted, reflecting a significant erosion of investor confidence. Many investors adopted a wait-and-see approach, while others shifted their investment strategies towards more conservative assets.

- Data on investor behavior: [If available, include data on selling volume, shifts in investment allocations, etc.]

- Quotes from financial analysts or market experts: [Include quotes from experts summarizing investor sentiment.]

- Analysis of investor sentiment indicators: [Analyze relevant indicators such as VIX index or other sentiment gauges.]

Potential Consequences and Future Outlook for the Amsterdam Stock Market

The consequences of this Amsterdam Stock Market plunge are far-reaching. In the short term, we can expect a slowdown in economic activity, impacting consumer confidence and business investment. The long-term effects depend largely on the resolution of global trade tensions. However, a market recovery is possible, contingent upon factors like a de-escalation of trade disputes and renewed investor confidence.

- Potential economic impacts of the drop: [Discuss potential impacts on GDP growth, employment, etc.]

- Predictions for market recovery timelines: [Offer reasoned estimations for market recovery, considering various scenarios.]

- Factors that could influence future market performance: [Discuss factors like global economic growth, trade policy developments, and investor sentiment.]

Conclusion: Understanding the Amsterdam Stock Market Plunge and its Implications

The 7% drop in the Amsterdam stock market represents a significant event with potentially long-lasting consequences. The primary driver was undeniably the escalating global trade war, creating uncertainty and triggering a wave of selling. Various sectors, especially export-oriented industries, were severely impacted, and investor sentiment plummeted. While a market recovery is possible, the future performance of the Amsterdam Stock Market will hinge on resolving global trade tensions and restoring investor confidence. To stay informed about the Amsterdam Stock Market and its fluctuations, monitor the Amsterdam Stock Market closely by following our updates and analysis. Understanding the Amsterdam Stock Market is crucial for informed investment decisions. Track the Amsterdam Stock Market regularly to make well-informed decisions.

Featured Posts

-

Pobeditel Evrovideniya 2014 Konchita Vurst 13 Let Kaming Aut I Mechty O Bonde

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst 13 Let Kaming Aut I Mechty O Bonde

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Its Net Asset Value

May 24, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025 -

Prezzi Moda Negli Usa Dopo L Introduzione Dei Dazi

May 24, 2025

Prezzi Moda Negli Usa Dopo L Introduzione Dei Dazi

May 24, 2025 -

Is There Reason To Doubt Sean Penns Take On The Woody Allen Allegations

May 24, 2025

Is There Reason To Doubt Sean Penns Take On The Woody Allen Allegations

May 24, 2025

Latest Posts

-

The Nfls Tush Push A Victory For Tradition

May 24, 2025

The Nfls Tush Push A Victory For Tradition

May 24, 2025 -

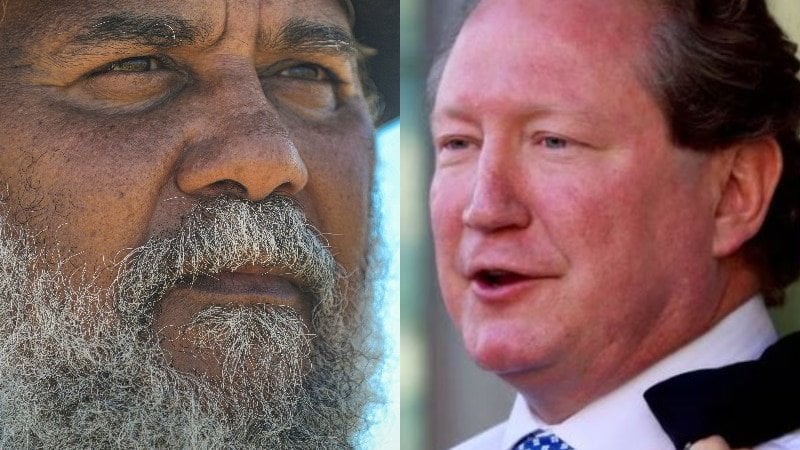

Rio Tinto And The Pilbara A Clash Over Environmental Stewardship

May 24, 2025

Rio Tinto And The Pilbara A Clash Over Environmental Stewardship

May 24, 2025 -

Slowing Growth Forces Sse To Cut 3 Billion From Spending Budget

May 24, 2025

Slowing Growth Forces Sse To Cut 3 Billion From Spending Budget

May 24, 2025 -

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025

Andrew Forrests Pilbara Concerns Rio Tintos Counterarguments

May 24, 2025 -

Analysis Sses 3 Billion Spending Reduction And Its Consequences

May 24, 2025

Analysis Sses 3 Billion Spending Reduction And Its Consequences

May 24, 2025