Amsterdam Stock Market Suffers 2% Drop Due To Trump Tariff Announcement

Table of Contents

The Amsterdam stock market suffered a significant 2% drop today, directly attributed to President Trump's latest announcement regarding new tariffs. This unexpected development sent shockwaves through the European markets, raising concerns about global trade and economic stability. This article delves into the details of this market downturn, exploring its causes, consequences, and potential future implications for investors in the Amsterdam Stock Exchange (AEX). The volatility underscores the interconnectedness of global markets and the sensitivity of the Amsterdam AEX to international trade policies.

The Trump Tariff Announcement and its Immediate Impact

Specific Tariffs Announced

President Trump's announcement detailed new tariffs targeting several key sectors, impacting Dutch businesses significantly. These tariffs specifically affected goods crucial to the Netherlands' economy, leading to immediate market anxieties.

- Agriculture: Increased tariffs on Dutch agricultural exports, such as dairy products and flowers, impacting companies like FrieslandCampina and major flower exporters.

- Technology: Tariffs on certain technology components and finished goods affected Dutch technology companies reliant on global supply chains.

- Manufacturing: Tariffs on manufactured goods, including specific machinery and industrial components, impacting various manufacturing firms across the Netherlands.

Specific companies like ASML Holding (a major semiconductor equipment manufacturer) experienced immediate stock price dips following the announcement, reflecting concerns about future export revenues. The ripple effect through the supply chain caused anxieties for many businesses and negatively impacted the Amsterdam Stock Market.

Market Reaction and Volatility

The immediate market reaction was a sharp decline in the AEX index, with a 2% drop within the first hour of trading. Trading volume surged, indicating heightened investor activity and uncertainty. This volatility mirrored, albeit to a lesser extent, the reactions seen in other major European markets.

- AEX Index Drop: The Amsterdam Exchange Index (AEX) plummeted by 2%, representing a significant loss of market capitalization.

- Increased Trading Volume: Trading volume on the Amsterdam Stock Exchange significantly increased, suggesting heightened anxiety and investor attempts to react to the new information.

- European Market Reaction: While other European markets also experienced declines, the impact was less pronounced in Frankfurt and Paris compared to Amsterdam, suggesting a sector-specific vulnerability in the Netherlands.

- Analyst Quotes: Financial analysts predicted increased market volatility in the short term, citing uncertainty surrounding future trade negotiations and potential retaliatory measures from the European Union.

Long-Term Implications for the Amsterdam Stock Market and Dutch Economy

Potential Economic Slowdown

The new tariffs pose a significant threat to the Netherlands' economy, which is heavily reliant on international trade. A prolonged period of uncertainty could lead to a noticeable economic slowdown.

- GDP Growth Impact: Reduced exports and potential disruptions to supply chains could negatively impact GDP growth, leading to slower economic expansion.

- Employment Concerns: Sectors heavily impacted by the tariffs may experience job losses or reduced hiring, adding further pressure on the Dutch economy.

- Government Response: The Dutch government is likely to implement mitigation strategies, potentially including financial aid packages for affected businesses or efforts to negotiate with the US to lessen the impact of the tariffs.

The long-term implications are complex, with the possibility of knock-on effects across various sectors and potentially affecting consumer spending and investment.

Investor Sentiment and Future Investment

The tariff announcement has undoubtedly damaged investor confidence in the Amsterdam Stock Exchange. Uncertainty about future trade relations casts a shadow over investment decisions.

- Shifting Investment Strategies: Investors may shift their portfolios away from sectors vulnerable to trade disputes, potentially leading to capital outflow from the Dutch market.

- Long-Term Market Recovery: The long-term recovery of the Amsterdam Stock Market will depend on various factors, including the duration of the tariffs, the effectiveness of government mitigation strategies, and the overall global economic outlook. Expert opinion is divided, with some predicting a slow recovery and others anticipating a more rapid rebound.

Comparing the Amsterdam Market's Performance to Other European Markets

A Comparative Analysis

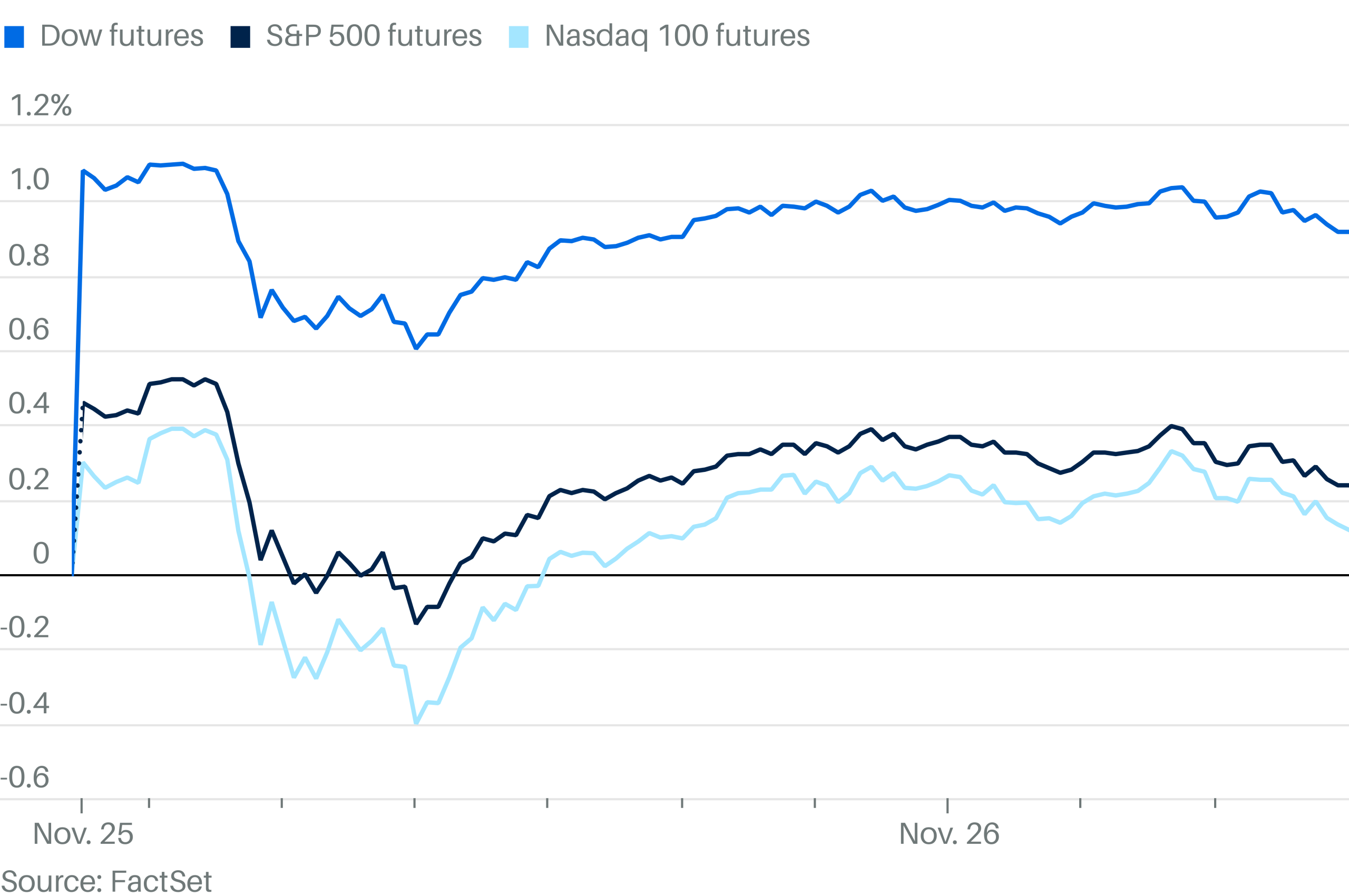

Comparing the Amsterdam Stock Market's performance to other major European markets reveals a greater vulnerability to the Trump tariffs. While other markets experienced declines, the drop in the AEX was proportionally more significant. Charts and graphs displaying the comparative performance of AEX, FTSE 100 (London), DAX (Frankfurt), and CAC 40 (Paris) would visually represent this difference. This divergence can be attributed to the specific structure of the Dutch economy and its reliance on exports to the US.

Sector-Specific Analysis

Analyzing the performance of different sectors within the Amsterdam Stock Market reveals varied vulnerabilities to the tariff announcement. The agricultural and technology sectors, for example, suffered steeper declines than others. A detailed comparison of sector-specific performance would highlight the specific vulnerabilities inherent in the Dutch economy's structure and the unequal impact of international trade policies on different sectors.

Conclusion

The Amsterdam Stock Market experienced a significant 2% drop following President Trump's announcement of new tariffs, highlighting the vulnerability of the Netherlands' export-oriented economy to global trade disputes. The immediate impact was a sharp decline in the AEX index and increased market volatility. Long-term implications include potential economic slowdowns, decreased investor confidence, and sector-specific vulnerabilities. Comparing the AEX performance to other European markets underscores the disproportionate effect of these tariffs on the Netherlands.

Call to Action: Stay updated on the latest developments in the Amsterdam Stock Market and how global trade policies impact your investments. Follow our blog for continuous analysis and insights into the Amsterdam Stock Market's fluctuations and managing investment risks related to global trade issues.

Featured Posts

-

Paradan Tasarruf Eden 3 Burc Kimler

May 24, 2025

Paradan Tasarruf Eden 3 Burc Kimler

May 24, 2025 -

Entdecken Sie Essen Radtouren Entlang Der Spuren Bedeutender Persoenlichkeiten

May 24, 2025

Entdecken Sie Essen Radtouren Entlang Der Spuren Bedeutender Persoenlichkeiten

May 24, 2025 -

Yubiley Sergeya Yurskogo 90 Let Zhizni I Tvorchestva Nezabyvaemogo Artista

May 24, 2025

Yubiley Sergeya Yurskogo 90 Let Zhizni I Tvorchestva Nezabyvaemogo Artista

May 24, 2025 -

Football Match Disrupted By Sexist Chants Against Female Referee Probe Ordered

May 24, 2025

Football Match Disrupted By Sexist Chants Against Female Referee Probe Ordered

May 24, 2025 -

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 24, 2025

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 24, 2025

Latest Posts

-

Today Show Host Dylan Dreyer Announces Difficult News

May 24, 2025

Today Show Host Dylan Dreyer Announces Difficult News

May 24, 2025 -

Celebrating Family Dylan Dreyer And Brian Ficheras Latest Update

May 24, 2025

Celebrating Family Dylan Dreyer And Brian Ficheras Latest Update

May 24, 2025 -

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025 -

Todays Good News Dylan Dreyer And Family Celebrate

May 24, 2025

Todays Good News Dylan Dreyer And Family Celebrate

May 24, 2025 -

Dylan Dreyer And Brian Fichera Share Happy Family News

May 24, 2025

Dylan Dreyer And Brian Fichera Share Happy Family News

May 24, 2025